Amended Statement of Beneficial Ownership (sc 13d/a)

22 Juli 2022 - 10:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of

1934

(Amendment No. 3)*

JinkoSolar Holding Co., Ltd.

(Name of Issuer)

Ordinary Shares, Par Value US$0.00002 Per Share

(“Ordinary Shares”)

(Title of Class of Securities)

47759T100 (1)

(CUSIP Number)

Xiande Li

1 Jingke Road, Shangrao

Economic Development Zone

Jiangxi Province, 334100

People’s Republic of China

Telephone: (86-793) 846-9699

With a copy to:

Shuang Zhao, Esq.

Cleary Gottlieb Steen & Hamilton LLP

c/o 37th Floor, Hysan Place

500 Hennessy Road

Causeway Bay, Hong Kong

Telephone: +852 2532 3783

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

July 1, 2022

(Date of Event Which Requires Filing of

this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall include a

signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to

be sent.

* The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter the disclosures provided in a prior cover page.

The information required in the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

(1) This CUSIP number applies to the Issuer’s

American Depositary Shares, each representing four Ordinary Shares.

CUSIP No: 47759T100

| 1. |

Names of reporting persons

Xiande Li |

| 2. |

Check the appropriate box if a member of a group (see instructions)

(a) ¨ (b)

x |

| 3. |

SEC use only |

| 4. |

Source of funds (see instructions)

SC |

| 5. |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

Citizenship or place of organization

People’s Republic of China |

Number of

shares

beneficially

owned by

each

reporting

person with |

7. |

Sole voting power

20,439,5241 |

| 8. |

Shared voting power

0 |

| 9. |

Sole dispositive power

20,439,5241 |

| 10. |

Shared dispositive power

0 |

| 11. |

Aggregate amount beneficially owned by each reporting person

20,439,524 |

| 12. |

Check if the aggregate amount in Row (11) excludes certain shares (see instructions) ¨ |

| 13. |

Percent of class represented by amount in Row (11)

10.2%2 |

| 14. |

Type of reporting person (see instructions)

IN |

| |

|

|

|

| 1. | These securities include 20,439,524 Ordinary Shares of the Issuer

(including certain Ordinary Shares in the form of American depositary shares and restricted American depositary shares) held by Brilliant

Win Holdings Limited (“Brilliant Win”). Brilliant Win is wholly owned by Cypress Hope Limited, a British Virgin Islands company

wholly owned by Xiande Li. Xiande Li is the sole director of Brilliant Win and as such has the power to vote and dispose of the ordinary

shares held by Brilliant Win. Therefore, Xiande Li is the beneficial owner of all Issuer’s ordinary shares held by Brilliant Win. |

| 2. | Based on 200,494,033 Ordinary Shares outstanding as of July

1, 2022. |

CUSIP No: 47759T100

| 1. |

Names of reporting persons

Brilliant Win Holdings Limited |

| 2. |

Check the appropriate box if a member of a group (see instructions)

(a) ¨ (b)

x |

| 3. |

SEC use only |

| 4. |

Source of funds (see instructions)

Not Applicable |

| 5. |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨ |

| 6. |

Citizenship or place of organization

British Virgin Islands |

Number of

shares

beneficially

owned by

each

reporting

person with |

7. |

Sole voting power

20,439,5241 |

| 8. |

Shared voting power

0 |

| 9. |

Sole dispositive power

20,439,5241 |

| 10. |

Shared dispositive power

0 |

| 11. |

Aggregate amount beneficially owned by each reporting person

20,439,524 |

| 12. |

Check if the aggregate amount in Row (11) excludes certain shares (see instructions) ¨ |

| 13. |

Percent of class represented by amount in Row (11)

10.2%2 |

| 14. |

Type of reporting person (see instructions)

CO |

| |

|

|

|

| 1. | These securities include 20,439,524 Ordinary Shares (including

certain Ordinary Shares in the form of American depositary shares and restricted American depositary shares). |

| 2. | Based on 200,494,033 Ordinary Shares outstanding as of July

1, 2022. |

This Amendment No. 3 to Schedule 13D amends and

supplements the statement on Schedule 13D originally filed with the Securities and Exchange Commission (the “SEC”)

on January 31, 2019 (the “Original Schedule 13D”), as amended by the Amendment No.1 to Schedule 13D on February 18,

2020 and the Amendment No.2 to Schedule 13D on December 14, 2020 (together with the Original Schedule 13D, the “Schedule 13D”),

relating to the ordinary shares, par value US$0.00002 per share (“Ordinary Shares”), of JinkoSolar Holding Co., Ltd.

(the “Issuer”) filed jointly by Xiande Li and Brilliant Win (collectively, the “Reporting Persons”)

and Tanka International Limited. Except as amended and supplemented herein, the information set forth in the Schedule 13D remains unchanged.

Capitalized terms used herein without definition have meanings assigned thereto in the Schedule 13D.

| ITEM 1. | SECURITY AND ISSUER |

No modification.

| ITEM 2. | IDENTITY AND BACKGROUND |

Item 2 of the Schedule 13D is hereby amended and supplemented

to include the following information:

The registered address of Brilliant Win is Commerce House,

Wickhams Cay 1, P. O. Box 3140, Road Town, Tortola, British Virgin Islands VG1110.

Except for the above, no modification to other information

in Item 2.

| ITEM 3. | SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

Item 3 of the Schedule 13D is hereby amended and supplemented

to include the following information:

As of July 1, 2022, 3,866,772 restricted shares of the Issuer

which were granted to the Reporting Persons under the Issuer’s 2014 Equity Incentive Plan, 2021 Equity Incentive Plan and 2022 Equity

Incentive Plan have been vested.

| ITEM 4. | PURPOSE OF TRANSACTION |

The information set forth in Items 3 and 6 is hereby incorporated

by reference in this Item 4.

| ITEM 5. | INTEREST IN SECURITIES OF THE ISSUER |

Item 5 of the Schedule 13D is hereby amended and restated

as follows:

(a)

Each of the Reporting Persons’ current ownership in the securities of the Issuer is set forth on the cover pages to this Statement

on Schedule 13D and is incorporated by reference herein. The ownership percentage appearing on such pages has been calculated based on

200,494,033 Ordinary Shares outstanding as of July 1, 2022. The Reporting Persons disclaim membership in any “group” with

any person other than the Reporting Persons.

(b)

The following table sets forth the beneficial ownership of the class of securities reported on for each of the Reporting Persons.

| | |

| | |

| | |

Sole Power | | |

| | |

| | |

Shared Power | |

| | |

| | |

Percentage | | |

to | | |

Shared Power | | |

Sole Power to | | |

to | |

| | |

Number of Shares | | |

of | | |

Vote/Direct | | |

to Vote/Direct | | |

Dispose/Direct | | |

Dispose/Direct | |

| Reporting Person | |

Beneficially Owned | | |

Securities | | |

Vote | | |

Vote | | |

Disposition | | |

Disposition | |

| Xiande Li | |

| 20,439,524 | | |

| 10.2 | % | |

| 20,439,524 | | |

| 0 | | |

| 20,439,524 | | |

| 0 | |

| Brilliant Win | |

| 20,439,524 | | |

| 10.2 | % | |

| 20,439,524 | | |

| 0 | | |

| 20,439,524 | | |

| 0 | |

(c)

Other than as described in Items 3 and 4 above, there have been no transactions in the class of securities reported on that were

effected during the past sixty days by any of the Reporting Persons.

(d)

Not applicable.

(e)

Not applicable.

| ITEM 6. | CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER |

2014 Equity Incentive Plan

The Issuer adopted the 2014 Equity Incentive Plan

in August 2014 (the “2014 Equity Incentive Plan”). The 2014 Equity Incentive Plan provides for the grant of options,

restricted shares and other share-based awards, referred to as “Awards,” to the Issuer’s directors, key employees or

consultants up to 12,796,745 of the Ordinary Shares. The purpose of the 2014 Equity Incentive Plan is to aid the Issuer in recruiting

and retaining key employees, directors or consultants of outstanding ability and to motivate such employees, directors or consultants

to exert their best efforts on behalf of the Issuer by providing incentives through the granting of awards. The Issuer’s board of

directors expects that the Issuer will benefit from the added interest which such key employees, directors or consultants will have in

the Issuer’s welfare as a result of their proprietary interest in the Issuer’s success. The 2014 Equity Incentive Plan is

filed as an exhibit hereto and is incorporated herein by reference.

2021 Equity Incentive Plan

The Issuer adopted the 2021 Equity Incentive Plan

in March 2021 (the “2021 Equity Incentive Plan”). The 2021 Equity Incentive Plan provides for the grant of options,

restricted shares and other share-based awards, referred to as “Awards,” to the Issuer’s directors, key employees or

consultants up to 2,600,000 of the Ordinary Shares. The purpose of the 2021 Equity Incentive Plan is to aid the Issuer in recruiting and

retaining key employees, directors or consultants of outstanding ability and to motivate such employees, directors or consultants to exert

their best efforts on behalf of the Issuer by providing incentives through the granting of awards. The Issuer’s board of directors

expects that the Issuer will benefit from the added interest which such key employees, directors or consultants will have in the Issuer’s

welfare as a result of their proprietary interest in the Issuer’s success. The 2021 Equity Incentive Plan is filed as an exhibit

hereto and is incorporated herein by reference.

2022 Equity Incentive Plan

The

Issuer adopted the 2022 Equity Incentive Plan in March 2022 (the “2022 Equity Incentive Plan”). The 2022 Equity Incentive

Plan provides for the grant of options, restricted shares and other share-based awards, referred to as “Awards,” to the Issuer’s

directors, key employees or consultants up to 12,000,000 of the Ordinary Shares. The purpose of the 2022 Equity Incentive Plan is to

aid the Issuer in recruiting and retaining directors, consultants or key employees of outstanding ability and to motivate such directors,

consultants or key employees to exert their best efforts on behalf of the Issuer by providing incentives through the granting of Awards

in recognition of their past and future services. The Issuer’s board of directors expects that the Issuer will benefit from the

added interest which such key employees, directors or consultants will have in the Issuer’s welfare as a result of their proprietary

interest in the Issuer’s success. The 2022 Equity Incentive Plan is filed as an exhibit hereto and is incorporated herein

by reference.

| ITEM 7. | MATERIAL

TO BE FILED AS EXHIBITS |

Item 7 of the Schedule 13D is hereby amended and restated as follows:

The following documents are filed as exhibits:

EXHIBIT INDEX

SIGNATURE

After reasonable inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this Statement is true, complete and correct.

Dated: July 22, 2022

| |

Xiande Li |

| |

|

| |

By: |

/s/ Xiande Li |

|

| |

Name: Xiande Li |

| |

BRILLIANT WIN HOLDINGS LIMITED |

| |

|

| |

By: |

/s/ Xiande Li |

|

| |

Name: Xiande Li |

| |

Title: Sole Director |

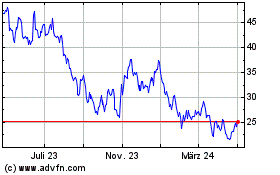

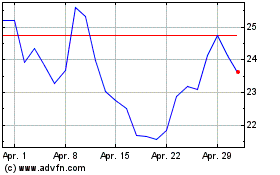

Jinkosolar (NYSE:JKS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Jinkosolar (NYSE:JKS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024