IDACORP, Inc. (NYSE: IDA) reported third quarter 2024 net income

attributable to IDACORP of $113.6 million, or $2.12 per diluted

share, compared with $105.3 million, or $2.07 per diluted share, in

the third quarter of 2023.

“We had a strong third quarter and benefited from customer

growth, rate changes, and weather conditions that contributed to

higher customer usage,” said IDACORP President and Chief Executive

Officer Lisa Grow. “As expected, higher depreciation and interest

expense partially offset those benefits during the quarter, as we

continued to acquire resources and build infrastructure to respond

to rapidly growing customer needs.”

“We are also excited to announce the results of our request for

proposal process for energy and capacity resource needs in 2026 and

2027. From that process, Idaho Power expects to procure additional

company-owned battery resources and its first-ever company-owned

wind power project in Wyoming, along with several power purchase

arrangements,” Grow added.

IDACORP is increasing the lower-end of its previously reported

full-year 2024 earnings guidance to the range of $5.35 to $5.45 per

diluted share. Idaho Power's expectation of additional tax credits

it will use to support earnings also improved to a range of $25 to

$35 million in 2024. The earnings guidance also assumes normal

weather conditions and normal power supply expenses through the

remainder of the year.

Summary of Financial Results

The following is a summary of net income attributable to IDACORP

and IDACORP's earnings per diluted share for the three and nine

months ended September 30, 2024 and 2023 (in thousands, except

earnings per share amounts):

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

Net income attributable to IDACORP,

Inc.

$

113,605

$

105,264

$

251,298

$

229,936

Weighted average outstanding shares –

diluted

53,485

50,805

52,179

50,762

IDACORP, Inc. earnings per diluted

share

$

2.12

$

2.07

$

4.82

$

4.53

The table below provides a reconciliation of net income

attributable to IDACORP for the three and nine months ended

September 30, 2024, from the same periods in 2023 (items are in

millions and are before related income tax impact unless otherwise

noted):

Three months ended

Nine months ended

Net income attributable to IDACORP,

Inc. - September 30, 2023

$

105.3

$

229.9

Increase (decrease) in Idaho Power net

income:

Retail revenues per megawatt-hour (MWh),

net of associated power supply costs and power cost adjustment and

Idaho Fixed Cost Adjustment (FCA) mechanisms

19.3

44.0

Customer growth, net of associated power

supply costs and power cost adjustment mechanisms

7.4

17.1

Usage per retail customer, net of

associated power supply costs and power cost adjustment

mechanisms

3.1

(0.8

)

Transmission wheeling-related revenues,

net of Idaho-jurisdiction power cost adjustment (PCA) mechanism

impacts

0.5

(3.0

)

Other operations and maintenance (O&M)

expenses

(20.3

)

(47.9

)

Depreciation expense

(5.6

)

(21.8

)

Other changes in operating revenues and

expenses, net

3.3

21.8

Increase in Idaho Power operating

income

7.7

9.4

Non-operating expense, net

2.4

0.2

Additional accumulated deferred investment

tax credits (ADITC) amortization

2.5

15.0

Income tax expense, excluding additional

ADITC amortization

(4.5

)

(4.6

)

Total increase in Idaho Power net

income

8.1

20.0

Other IDACORP changes (net of tax)

0.2

1.4

Net income attributable to IDACORP,

Inc. - September 30, 2024

$

113.6

$

251.3

Net Income - Third Quarter 2024

IDACORP's net income increased $8.3 million for the third

quarter of 2024 compared with the third quarter of 2023, due

primarily to higher net income at Idaho Power.

The net increase in retail revenues per MWh, net of associated

power supply costs and power cost adjustment and FCA mechanisms,

increased operating income by $19.3 million in the third quarter of

2024 compared with the third quarter of 2023. This benefit was due

primarily to an overall increase in Idaho base rates, effective

January 1, 2024, per the terms of the settlement stipulation for

Idaho Power's 2023 Idaho general rate case (2023 Settlement

Stipulation).

At Idaho Power, customer growth increased operating income by

$7.4 million in the third quarter of 2024 compared with the third

quarter of 2023, as the number of Idaho Power customers grew by

approximately 16,500, or 2.6 percent, during the twelve months

ended September 30, 2024. Usage per retail customer increased

operating income by $3.1 million in the third quarter of 2024

compared with the third quarter of 2023. While there was an

increase in usage per customer for most retail customer classes,

usage per residential and irrigation customers were the primary

contributors. Higher temperatures and lower precipitation compared

with the third quarter of 2023 led residential customers to use

more energy for cooling purposes and irrigation customers to run

irrigation pumps more frequently.

Total other O&M expenses in the third quarter of 2024 were

$20.3 million higher than the third quarter of 2023, partially

related to approximately $4 million of increased pension-related

expenses and an approximate $6 million increase in wildfire

mitigation program and related insurance expenses. Both of these

increases in expenses were partially offset by increases in retail

revenues, as more costs are now recovered in base rates pursuant to

the 2023 Settlement Stipulation. However, revenues related to these

increased costs are not collected at the same rate that the

expenses are incurred in the interim periods throughout the year

due to the impact of volume-based rates and associated revenues.

Inflationary pressures on labor-related costs also contributed to

the increase in other O&M expenses. These increases in other

O&M expenses were partially offset by a $2.9 million deferral

of other O&M expenses related to the conversion from coal to

natural gas for two units at the Jim Bridger power plant.

Depreciation expense increased $5.6 million in the third quarter

of 2024 compared with the third quarter of 2023 due primarily to an

increase in plant-in-service.

Other changes in operating revenues and expenses, net, increased

operating income by $3.3 million in the third quarter of 2024

compared with the third quarter of 2023, due primarily to a

decrease in net power supply expenses that were not deferred for

future recovery in rates through Idaho Power's power cost

adjustment mechanisms, which increased other changes in operating

revenues and expenses, net, compared with the same period in 2023.

More moderate and less volatile wholesale natural gas and power

market prices in the western United States and increased wholesale

energy sales decreased Idaho Power's net power supply expenses in

the third quarter of 2024 compared with the third quarter of

2023.

Non-operating expense, net, decreased $2.4 million in the third

quarter of 2024 compared with the third quarter of 2023. Allowance

for funds used during construction (AFUDC) increased in the third

quarter of 2024 compared with the third quarter of 2023, as the

average construction work in progress balance was higher, and

interest income increased due to higher average cash balances and

interest rates. These increases were partially offset by an

increase in interest expense on long-term debt in the third quarter

of 2024 compared with the third quarter of 2023, due primarily to

an increase in long-term debt balances. Also offsetting the

increases, Idaho Power's earnings from its investment in Bridger

Coal Company (BCC) decreased $2.2 million in the third quarter of

2024 compared with the third quarter of 2023, due to a decrease in

the amount included and recovered in base rates pursuant to the

2023 Settlement Stipulation.

The increase in income tax expense was principally the result of

higher income before income taxes, partially offset by an increase

in additional ADITC amortization. Based on Idaho Power's current

expectations of full-year 2024 results, Idaho Power recorded $2.5

million of additional ADITC amortization under its Idaho regulatory

settlement stipulation during the third quarter of 2024, but

recorded no additional ADITC amortization during the same period in

2023.

Net Income - Year-To-Date 2024

IDACORP's net income increased $21.4 million for the first nine

months of 2024 compared with the first nine months of 2023, due

primarily to higher net income at Idaho Power.

The net increase in retail revenues per MWh, net of associated

power supply costs and power cost adjustment and FCA mechanisms,

increased operating income by $44 million in the first nine months

of 2024 compared with the first nine months of 2023. This benefit

was due primarily to an overall increase in Idaho base rates,

effective January 1, 2024, per the terms of the 2023 Settlement

Stipulation.

At Idaho Power, customer growth increased operating income by

$17.1 million in the first nine months of 2024 compared with the

first nine months of 2023. The benefit from customer growth was

partially offset by a decrease in usage per retail customer of $0.8

million, as higher usage per customer in the second and third

quarters of 2024 was more than offset by lower usage per customer

in the first quarter of 2024. Overall, usage per customer was

relatively flat for most customer classes.

Transmission wheeling-related revenues, net of PCA impacts,

decreased $3.0 million during the first nine months of 2024

compared with the first nine months of 2023. Effective January 1,

2024, financial settlement of transmission line losses are subject

to the PCA mechanism, as approved in the 2023 Settlement

Stipulation, resulting in a smaller contribution of those revenues

to net income compared with the first nine months of 2023 when the

financial settlement of transmission line losses was not subject to

the PCA mechanism.

Total other O&M expenses in the first nine months of 2024

were $47.9 million higher than the first nine months of 2023,

partially related to approximately $13 million of increased

pension-related expenses and an approximate $22 million increase in

wildfire mitigation program and related insurance expenses. Both of

these increases in expenses were partially offset by increases in

retail revenues, as more costs are now recovered in base rates

pursuant to the 2023 Settlement Stipulation; however, revenues

related to these increased costs are not collected at the same rate

that the expenses are incurred in the interim periods throughout

the year. On a full-year basis for 2024, Idaho Power expects other

O&M expenses related to its employee pension plans and its

wildfire mitigation program and related insurance to increase

approximately $18 million and $30 million, respectively, compared

with 2023. Inflationary pressures on labor-related costs also

contributed to the increase in other O&M expenses. These

increases were partially offset by a $9.1 million increase in

deferral of other O&M expenses related to the conversion from

coal to natural gas for two units at the Jim Bridger power

plant.

Depreciation expense increased $21.8 million for the first nine

months of 2024 compared with the first nine months of 2023 due

primarily to an increase in plant-in-service.

Other changes in operating revenues and expenses, net, increased

operating income by $21.8 million in the first nine months of 2024

compared with the first nine months of 2023, due partially to a

decrease in net power supply expenses that were not deferred for

future recovery in rates through Idaho Power's power cost

adjustment mechanisms, which increased other changes in operating

revenues and expenses, net, compared with the same period in 2023.

More moderate wholesale natural gas and power market prices in the

western United States and increased wholesale energy sales

decreased Idaho Power's net power supply expenses in the first nine

months of 2024 compared with the first nine months of 2023. The

change was also partially due to the timing of recording and

adjusting regulatory accruals and deferrals.

Non-operating expense, net, decreased $0.2 million in the first

nine months of 2024 compared with the first nine months of 2023.

AFUDC increased in the first nine months of 2024 compared with the

first nine months of 2023, as the average construction work in

progress balance was higher. In addition, interest income increased

due to higher average cash balances and interest rates compared

with the same period in 2023. These increases were partially offset

by an increase in interest expense on long-term debt in the first

nine months of 2024 compared with the first nine months of 2023,

due primarily to an increase in long-term debt balances. Also

offsetting the increases, Idaho Power's earnings from its

investment in BCC decreased $5.5 million in the first nine months

of 2024 compared with the first nine months of 2023, due to a

decrease in the amount included and recovered in base rates

pursuant to the 2023 Settlement Stipulation.

The increase in income tax expense was primarily the result of

higher income before income taxes, partially offset by an increase

in additional ADITC amortization. Based on Idaho Power's current

expectations of full-year 2024 results, Idaho Power recorded $22.5

million of additional ADITC amortization under its Idaho regulatory

settlement stipulation during the first nine months of 2024, but

recorded $7.5 million of additional ADITC amortization during the

same period in 2023.

2024 Annual Earnings Guidance and Key Operating and Financial

Metrics

IDACORP is increasing the lower-end of its earnings guidance

estimate for 2024 and its expectation for the use of additional

ADITCs also improved. The 2024 guidance incorporates all of the key

operating and financial assumptions listed in the table that

follows (in millions, except per share amounts):

Current(1)

Previous(2)

IDACORP Earnings Guidance (per diluted

share)

$ 5.35 – $ 5.45

$ 5.30 – $ 5.45

Idaho Power Additional ADITCs

$ 25 – $ 35

$ 35 – $ 50

Idaho Power O&M Expense(3)

No change

$ 440 – $ 450

Idaho Power Capital Expenditures,

Excluding AFUDC

No change

$ 925 – $ 975

Idaho Power Hydropower Generation

(MWh)

7.0 – 7.5

7.0 – 8.0

(1)

As of October 31, 2024. Assumes normal

weather conditions and normal power supply expenses through the

remainder of 2024.

(2)

As of August 1, 2024, the date of filing

IDACORP's and Idaho Power's Quarterly Report on Form 10-Q for the

quarter ended June 30, 2024.

(3)

Approximately $48 million of the expected

increase in other O&M expense, compared with 2023, relates to

pension and wildfire mitigation plan expenses, approved for

recovery in the 2023 Settlement Stipulation effective January 1,

2024. The increased other O&M expense is expected to be offset

by collection through tariff-based retail revenues.

More detailed financial and operational information is provided

in IDACORP’s Quarterly Report on Form 10-Q filed today with the

U.S. Securities and Exchange Commission, which is also available

for review on IDACORP’s website at www.idacorpinc.com.

Web Cast / Conference Call

IDACORP will hold an analyst conference call today at 2:30 p.m.

Mountain Time (4:30 p.m. Eastern Time). All parties interested in

listening may do so through a live webcast on IDACORP's website

(www.idacorpinc.com), or by calling (855) 761-5600 for listen-only

mode. The passcode for the call is 9290150. The conference call

logistics are also posted on IDACORP's website. Slides will be

included during the conference call. To access the slide deck,

please visit www.idacorpinc.com/investor-relations. A replay of the

conference call will be available on the company's website for 12

months and will be available shortly after the call.

Background Information

IDACORP, Inc. (NYSE: IDA), Boise, Idaho-based and formed in

1998, is a holding company comprised of Idaho Power, a regulated

electric utility; IDACORP Financial, an investor in affordable

housing and other real estate tax credit investments; and Ida-West

Energy, an operator of small hydroelectric generation projects that

satisfy the requirements of the Public Utility Regulatory Policies

Act of 1978. Idaho Power, headquartered in vibrant and fast-growing

Boise, Idaho, has been a locally operated energy company since

1916. Today, it serves a 24,000-square-mile service area in Idaho

and Oregon. Idaho Power’s goal to provide 100% clean energy by 2045

builds on its long history as a clean-energy leader that provides

reliable service at affordable prices. With 17 low-cost hydropower

projects at the core of its diverse energy mix, Idaho Power’s

residential, business, and agricultural customers pay among the

nation's lowest prices for electricity. Its 2,100 employees proudly

serve more than 640,000 customers with a culture of safety first,

integrity always, and respect for all. To learn more about IDACORP

or Idaho Power, visit www.idacorpinc.com or www.idahopower.com.

Forward-Looking Statements

In addition to the historical information contained in this

press release, this press release contains (and oral communications

made by IDACORP, Inc. (IDACORP) and Idaho Power Company (Idaho

Power) may contain) statements that relate to future events and

expectations, such as statements regarding projected or future

financial performance, power generation, cash flows, capital

expenditures, regulatory filings, dividends, capital structure or

ratios, load forecasts, strategic goals, challenges, objectives,

and plans for future operations. Such statements constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Any statements that

express, or involve discussions as to, expectations, beliefs,

plans, objectives, assumptions, or future events or performance,

often, but not always, through the use of words or phrases such as

"anticipates," "believes," "could," "estimates," "expects,"

"intends," "potential," "plans," "predicts," "preliminary,"

"projects," "targets," "may," "may result," or similar expressions,

are not statements of historical facts and may be forward-looking.

Forward-looking statements are not guarantees of future

performance, involve estimates, assumptions, risks, and

uncertainties, and may differ materially from actual results,

performance, or outcomes. In addition to any assumptions and other

factors and matters referred to specifically in connection with

such forward-looking statements, factors that could cause actual

results or outcomes to differ materially from those contained in

forward-looking statements include those factors set forth in this

press release, IDACORP's and Idaho Power's most recent Annual

Report on Form 10-K, particularly Part I, Item 1A - "Risk Factors"

and Part II, Item 7 - "Management’s Discussion and Analysis of

Financial Condition and Results of Operations" of that report,

subsequent reports filed by IDACORP and Idaho Power with the U.S.

Securities and Exchange Commission (SEC), and the following

important factors: (a) decisions or actions by the Idaho and Oregon

public utilities commissions and the Federal Energy Regulatory

Commission that impact Idaho Power's ability to recover costs and

earn a return on investment; (b) changes to or the elimination of

Idaho Power's regulatory cost recovery mechanisms; (c) expenses and

risks associated with capital expenditures for, and the permitting

and construction of, utility infrastructure projects that Idaho

Power may be unable to complete, are delayed, or that may not be

deemed prudent by regulators for cost recovery or return on

investment; (d) expenses and risks associated with supplier and

contractor delays and failure to satisfy project quality and

performance standards on utility infrastructure projects, and the

potential impacts of those delays and failures on Idaho Power's

ability to serve customers; (e) the rapid addition of new

industrial and commercial customer load and the volatility of such

new load demand, resulting in increased risks and costs of power

demand potentially exceeding supply and of purchasing energy and

capacity in the market or acquiring or constructing additional

capacity and energy resources, and the potential financial impacts

of industrial customers not meeting forecasted power usage ramp

rates or amounts; (f) impacts of economic conditions, including an

inflationary or recessionary environment and increased interest

rates, on items such as operations and capital investments, supply

costs and delivery delays, supply scarcity and shortages,

population growth or decline in Idaho Power's service area, changes

in customer demand for electricity, revenue from sales of excess

power, credit quality of counterparties and suppliers and their

ability to meet financial and operational commitments and on the

timing and extent of their power usage, and collection of

receivables; (g) changes in residential, commercial, and industrial

growth and demographic patterns within Idaho Power's service area,

and the associated impacts on loads and load growth; (h) employee

workforce factors, including the operational and financial costs of

unionization or the attempt to unionize all or part of the

companies' workforce, the cost and ability to attract and retain

skilled workers and third-party contractors and suppliers, the cost

of living and the related impact on recruiting employees, and the

ability to adjust to fluctuations in labor costs; (i) changes in,

failure to comply with, and costs of compliance with laws,

regulations, policies, orders, and licenses, which may result in

penalties and fines, increase compliance and operational costs, and

impact recovery associated with increased costs through rates; (j)

abnormal or severe weather conditions (including conditions and

events associated with climate change), wildfires, droughts,

earthquakes, and other natural phenomena and natural disasters,

which affect customer sales, hydropower generation, repair costs,

service interruptions, public safety power shutoffs and

de-energization, liability for damage caused by utility property,

and the availability and cost of fuel for generation plants or

purchased power to serve customers; (k) advancement and adoption of

self-generation, energy storage, energy efficiency, alternative

energy sources, and other technologies that may reduce Idaho

Power's sale or delivery of electric power or introduce operational

vulnerabilities to the power grid; (l) variable hydrological

conditions and over-appropriation of surface and groundwater in the

Snake River Basin, which may impact the amount of power generated

by Idaho Power's hydropower facilities and power supply costs; (m)

ability to acquire equipment, materials, fuel, power, and

transmission capacity on reasonable terms and prices, particularly

in the event of unanticipated or abnormally high resource demands,

price volatility, lack of physical availability, transportation

constraints, outages due to maintenance or repairs to generation or

transmission facilities, disruptions in the supply chain, or

reduced credit quality or lack of counterparty and supplier credit;

(n) disruptions or outages of Idaho Power's generation or

transmission systems or of any interconnected transmission systems,

which can result in liability for Idaho Power, increased power

supply costs and repair expenses, and reduced revenues; (o)

accidents, electrical contacts, fires (either affecting or caused

by Idaho Power facilities or infrastructure), explosions,

infrastructure failures, general system damage or dysfunction, and

other unplanned events that may occur while operating and

maintaining assets, which can cause unplanned outages; reduce

generating output; damage company assets, operations, or

reputation; subject Idaho Power to third-party claims for property

damage, personal injury, or loss of life; or result in the

imposition of fines and penalties; (p) acts or threats of

terrorism, acts of war, social unrest, cyber or physical security

attacks, and other malicious acts of individuals or groups seeking

to disrupt Idaho Power's operations or the electric power grid or

compromise data, or the disruption or damage to the companies’

business, operations, or reputation resulting from such events; (q)

increased costs associated with purchases of power mandated by the

Public Utility Regulatory Policies Act of 1978 from renewable

energy sources; (r) Idaho Power's concentration in one industry and

one region, and the resulting exposure to regional economic

conditions and regional legislation and regulation; (s) unaligned

goals and positions with co-owners of Idaho Power’s generation and

transmission assets; (t) changes in tax laws or related regulations

or interpretations of applicable laws or regulations by federal,

state, or local taxing jurisdictions, and the availability of tax

credits; (u) inability to timely obtain and the cost of obtaining

and complying with required governmental permits and approvals,

licenses, rights-of-way, and siting for transmission and generation

projects and hydropower facilities; (v) ability to obtain debt and

equity financing or refinance existing debt when necessary and on

satisfactory terms, which can be affected by factors such as credit

ratings, reputational harm, volatility or disruptions in the

financial markets, interest rates, decisions by the Idaho, Oregon,

or Wyoming public utility commissions, and the companies' past or

projected financial performance; (w) ability to enter into

financial and physical commodity hedges with creditworthy

counterparties to manage price and commodity risk for fuel, power,

and transmission, and the failure of any such risk management and

hedging strategies to work as intended, and the potential losses

the companies may incur on those hedges, which can be affected by

factors such as the volume of hedging transactions and degree of

price volatility; (x) changes in actuarial assumptions, changes in

interest rates, increasing health care costs, and the actual and

projected return on plan assets for pension and other

postretirement plans, which can affect future pension and other

postretirement plan funding obligations, costs, and liabilities and

the companies' cash flows; (y) remediation costs associated with

planned cessation of coal-fired operations at Idaho Power's

co-owned coal plants and conversion of the plants to natural gas;

(z) ability to continue to pay dividends and achieve target

dividend payout ratios based on financial performance and capital

requirements, and in light of credit rating considerations,

contractual covenants and restrictions, and regulatory limitations;

(aa) adoption of or changes in accounting policies and principles,

changes in accounting estimates, and new SEC or New York Stock

Exchange requirements or new interpretations of existing

requirements; and (ab) changing market dynamics due to the

emergence of day ahead or other energy and transmission markets in

the western United States. Any forward-looking statement speaks

only as of the date on which such statement is made. New factors

emerge from time to time and it is not possible for the companies

to predict all such factors, nor can they assess the impact of any

such factor on the business or the extent to which any factor, or

combination of factors, may cause results to differ materially from

those contained in any forward-looking statement. IDACORP and Idaho

Power disclaim any obligation to update publicly any

forward-looking information, whether in response to new

information, future events, or otherwise, except as required by

applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031193254/en/

Investor and Analyst Contact Amy I.

Shaw VP of Finance, Compliance & Risk Phone: (208) 388-5611

AShaw@idahopower.com

Media Contact Jordan Rodriguez

Corporate Communications Phone: (208) 388-2460

JRodriguez@idahopower.com

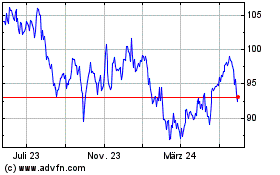

IDACORP (NYSE:IDA)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

IDACORP (NYSE:IDA)

Historical Stock Chart

Von Nov 2023 bis Nov 2024