Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

23 August 2022 - 1:16PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month August, 2022

Commission File Number: 001-15002

ICICI Bank Limited

(Translation of registrant’s name into English)

ICICI Bank Towers,

Bandra-Kurla Complex

Mumbai, India 400 051

(Address of principal executive office)

Indicate by check

mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Indicate by check

mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check

mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check

mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934:

If “Yes”

is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g 3-2(b): Not Applicable

Table of Contents

OTHER NEWS

Subject:

Facts at a glance on proposed ‘ICICI Bank Employees Stock Unit Scheme - 2022’

IBN

ICICI Bank Limited

(the ‘Bank’) Report on Form 6-K

The Bank has made

the below announcement to the Indian stock exchanges:

The Bank has sought

shareholders’ approval at the ensuing Annual General Meeting (“AGM”) scheduled on August 30, 2022 for (a) approval

and adoption of ‘ICICI Bank Employees Stock Unit Scheme - 2022’ (“Scheme 2022”/”Scheme”); and (b)

grant of the Units to eligible employee of select unlisted wholly owned subsidiaries under Scheme 2022 vide item nos. 23 and 24

of the AGM Notice dated June 28, 2022.

The proposed resolutions

as well as explanatory statements forming part of the AGM Notice have already been circulated to the shareholders well in advance. To

enable all our shareholders to view the key highlights and facts in a concise format, we have presented the information in a tabular

format as under for ease of understanding:

| Sr.

No. |

Particulars |

Remarks |

| 1. |

Excluded

Employees from the proposed Scheme |

For ICICI

Bank:

Managing Director

& Chief Executive Officer, Executive Directors, Key Managerial Personnel, Senior Management Personnel and Material Risk Takers,

as on the date of the Grant.

For the Bank’s

select unlisted wholly owned subsidiaries:

Equivalent levels

to Key Management Personnel, Senior Management Personnel, Material Risk Takers and whole time Directors of the Bank, as on the date

of the Grant.

|

| 2. |

Employees

Included |

The key objectives

of the Scheme are to deepen the co-ownership amongst the (i) mid-level and front-line managers, and (ii) employees of Bank’s

select unlisted wholly owned subsidiaries with the following key considerations:

i.

to enable employees’ participation in the business as an active stakeholder to usher in an 'Owner-Manager' culture and to act

as a retention mechanism;

ii.

to enhance motivation of employees; and

iii.

to enable employees to participate in the long term growth and financial success of the Bank.

All employees

of the Bank and select unlisted wholly owned subsidiaries who are exclusively working in India or outside India excluding the categories

of employees listed above.

The coverage

after exclusion of those mentioned as per Sr. No. 1 above of the table, would extend upto eight levels below Managing Director &

Chief Executive Officer.

For the Leadership

Levels, the primary tool for long-term variable pay shall be at market price options (under ESOS 2000), while for grades below Leadership

Levels, the primary tool shall be Units under the Scheme 2022.

|

| 3. |

Total number

of Units to be Granted/Offered/ Issued

|

10 (Ten) Crore

Units, in one or more tranches (approximately 1.44% of the equity share capital as on March 31, 2022).

The potential

incremental dilution on account of the proposed grant of Employee Stock Units would be 0.2% of the paid up capital annually over

the period of seven years.

|

| 4. |

Tenure of the

Scheme

|

7 (Seven)

years from the date of shareholders’ approval. |

| 5. |

Maximum

number of Units to be granted to any Eligible Employee |

·

Schedule I - Part C - Clause (i) of SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021 (“SEBI SBEB &

SE Regulations”) mandates that the explanatory statement include a disclosure on “maximum number of options, SARs,

shares, as the case may be, to be offered and issued per employee and in aggregate, if any“.

The

disclosure made by the Bank is in compliance with the above requirement and it is stipulated that a maximum of 20,000 Units can be

granted to an eligible employee in a financial year, which sets the absolute ceiling limit per grant.

This

maximum cap per employee is further subject to compliance with RBI circular on Guidelines on Compensation of Whole Time Directors/

Chief Executive Officers/ Material Risk Takers and Control Function staff dated November 4, 2019 (“RBI Compensation Guidelines”)

which provides that the total variable pay shall be limited to a maximum of 300% of the fixed pay (for the relative performance

measurement period). This forms part of the Board approved Compensation Policy of the Bank as well.

The

Bank is subject to supervision by RBI including on parameters relating to compliance on Compensation Policy adherence and with regard

to SEBI SBEB & SE Regulations, the secretarial auditor certificate is placed before the shareholders annually in order to provide

assurance on compliance with the said Regulations.

Hence,

in addition to supervision by the Board Governance, Remuneration & Nomination Committee (“BGRNC”) & the Board,

the Bank would be subject to supervision by its regulator to ensure orderly conduct in the grant and administration of the proposed

Scheme.

·

The grant shall be made only to those employees who fulfil the prescribed grant conditions and the maximum cap would be applicable

in exceedingly limited instances subject to adherence to limits as mentioned in the RBI Compensation Guidelines.

|

| 6. |

Performance

based Grant conditions |

Factors

such as length of service, grade, performance, conduct, present contribution, potential contribution

of the Eligible Employee or such other factors as the BGRNC may decide relevant.

|

| 7. |

Vesting

Period |

The

vesting of Units shall be essentially based on continuation of employment or service subject

to minimum vesting period of 1 (one) year from the date of grant of Units and the vesting

period would be spread over a minimum period of three (3) years from the date of grant of

the Units.

In accordance

with the RBI Compensation Guidelines, the vesting is spread over a minimum period of 3 (three) years.

|

| 8. |

Maximum

period within which Units shall vest |

Units

granted under this Scheme shall vest not later than the maximum vesting period of 4 (four)

years.

|

| 9. |

Performance

parameters for Vesting |

In

addition to continuity of employment, vesting shall also be dependent on achievement of certain

corporate performance parameter(s) such as:

i

Risk Calibrated Core Operating profit;

ii

Provision/asset quality;

iii

Other parameters, if any, as the Committee may determine.

The performance

parameters for Control Functions of the Bank (which include Internal Audit, Risk & Compliance functions) would be governed by

the regulatory guidelines.

|

| 10. |

Entities

covered |

·

ICICI Bank Limited; and

·

Select unlisted wholly owned subsidiaries of ICICI Bank Limited which are aligned as a key delivery engine of the Bank’s core

operating franchise and in essence complement the business delivery of the Bank, including but not limited to:

o

ICICI Bank UK PLC

o

ICICI Bank Canada

o

ICICI Investment Management Company Limited

|

| 11. |

Exercise

Price and period |

Face

value of equity shares of the Bank i.e. Rs. 2 for each unit (as adjusted for any changes in capital structure of the Bank) shall

be the exercise price. Exercise period shall be 5 (five) years from the date of the respective vesting of the Units. |

This is for your reference

and records.

ICICI Bank Limited

ICICI Bank Towers

Bandra-Kurla Complex

Mumbai 400 051, India. |

Tel.: (91-22) 2653 1414

Fax: (91-22) 2653 1122

Website www.icicibank.com

CIN.: L65190GJ1994PLC021012 |

Regd. Office: ICICI Bank Tower,

Near Chakli Circle,

Old Padra Road

Vadodara 390007. India |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorised.

| |

|

|

|

For ICICI

Bank Limited |

| |

|

|

|

|

| |

|

|

|

|

| Date: |

August 23, 2022 |

|

By: |

/s/ Vivek Ranjan |

| |

|

|

|

Name: |

Vivek Ranjan |

| |

|

|

|

Title: |

Chief Manager |

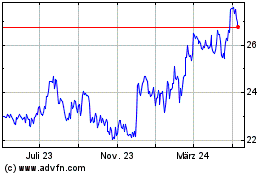

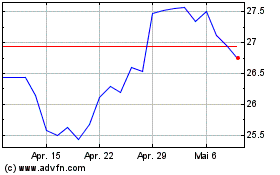

Icici Bank (NYSE:IBN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Icici Bank (NYSE:IBN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024