Humana Inc. (the “company”) (NYSE: HUM) announced today the

completion of its public offering of $1.25 billion in aggregate

principal amount of senior notes. These senior notes are comprised

of $500 million of the company’s 5.700 percent senior notes, due

2026, at 99.984 percent of the principal amount and $750 million of

the company’s 5.500 percent senior notes, due 2053, at 96.431

percent of the principal amount (collectively, the “Senior Notes

Offerings”).

The company expects net proceeds from the Senior Notes Offerings

will be approximately $1.211 billion after deducting underwriters’

discounts and estimated offering expenses. The company intends to

use the net proceeds from the Senior Notes Offerings to repay

outstanding amounts under its $500 million Delayed Draw Term Loan.

Net proceeds from the Senior Notes Offerings in excess of the

amount required to repay outstanding borrowings under its Delayed

Draw Term Loan at the time the Senior Notes Offerings are completed

will be used for general corporate purposes, which may include the

repayment of borrowings under its commercial paper program. As of

December 31, 2022, the outstanding balance under the company’s

Delayed Draw Term Loan was $500 million and the interest rate in

effect on that outstanding balance was LIBOR plus 125 basis

points.

Barclays Capital Inc., Citigroup Global Markets Inc., Morgan

Stanley & Co. LLC, U.S. Bancorp Investments, Inc. and Wells

Fargo Securities, LLC acted as active joint book-running managers

for the Senior Notes Offerings.

The Senior Notes Offerings were made pursuant to an effective

shelf registration statement (including a base prospectus) filed

with the Securities and Exchange Commission (the “SEC”). The Senior

Notes Offerings were made by means of a prospectus and related

prospectus supplement, copies of which may be obtained by calling

Barclays Capital Inc. toll-free at 1-888-603-5847, Citigroup Global

Markets Inc. toll-free at 1-800-831-9146, Morgan Stanley & Co.

LLC at 1-866-718-1649, U.S. Bancorp Investments, Inc. toll-free at

(877) 558-2607 or Wells Fargo Securities, LLC toll-free at

1-800-645-3751. An electronic copy of the registration statement

and prospectus supplement, together with the base prospectus, is

available on the SEC’s website at www.sec.gov.

This news release does not constitute an offer to sell or a

solicitation of an offer to buy the securities described herein,

nor shall there be any sale of these securities in any state or

jurisdiction in which such an offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

Cautionary Statement

This news release includes forward-looking statements regarding

Humana within the meaning of the Private Securities Litigation

Reform Act of 1995. When used in investor presentations, press

releases, SEC filings, and in oral statements made by or with the

approval of one of Humana’s executive officers, the words or

phrases like “expects,” “believes,” “anticipates,” “intends,”

“likely will result,” “estimates,” “projects” or variations of such

words and similar expressions are intended to identify such

forward-looking statements.

These forward-looking statements are not guarantees of future

performance and are subject to risks, uncertainties, and

assumptions, including, among other things, information set forth

in the “Risk Factors” section of the company’s SEC filings, a

summary of which includes but is not limited to the following:

- If Humana does not design and price its products properly and

competitively, if the premiums Humana receives are insufficient to

cover the cost of healthcare services delivered to its members, if

the company is unable to implement clinical initiatives to provide

a better healthcare experience for its members, lower costs and

appropriately document the risk profile of its members, or if its

estimates of benefits expense are inadequate, Humana’s

profitability could be materially adversely affected. Humana

estimates the costs of its benefit expense payments, and designs

and prices its products accordingly, using actuarial methods and

assumptions based upon, among other relevant factors, claim payment

patterns, medical cost inflation, and historical developments such

as claim inventory levels and claim receipt patterns. The company

continually reviews estimates of future payments relating to

benefit expenses for services incurred in the current and prior

periods and makes necessary adjustments to its reserves, including

premium deficiency reserves, where appropriate. These estimates

involve extensive judgment, and have considerable inherent

variability because they are extremely sensitive to changes in

claim payment patterns and medical cost trends. Accordingly,

Humana's reserves may be insufficient.

- If Humana fails to effectively implement its operational and

strategic initiatives, including its Medicare initiatives, which

are of particular importance given the concentration of the

company's revenues in these products, state-based contract

strategy, the growth of its CenterWell business, and its integrated

care delivery model, the company’s business may be materially

adversely affected. In addition, there can be no assurances that

the company will be successful in maintaining or improving its Star

ratings in future years.

- If Humana fails to properly maintain the integrity of its data,

to strategically maintain existing or implement new information

systems, to protect Humana’s proprietary rights to its systems, or

to defend against cyber-security attacks or prevent other privacy

or data security incidents that result in security breaches that

disrupt the company's operations or in the unintentional

dissemination of sensitive personal information or proprietary or

confidential information, the company’s business may be materially

adversely affected.

- Humana is involved in various legal actions, or disputes that

could lead to legal actions (such as, among other things, provider

contract disputes and qui tam litigation brought by individuals on

behalf of the government), governmental and internal

investigations, and routine internal review of business processes

any of which, if resolved unfavorably to the company, could result

in substantial monetary damages or changes in its business

practices. Increased litigation and negative publicity could also

increase the company’s cost of doing business.

- As a government contractor, Humana is exposed to risks that may

materially adversely affect its business or its willingness or

ability to participate in government healthcare programs including,

among other things, loss of material government contracts;

governmental audits and investigations; potential inadequacy of

government determined payment rates; potential restrictions on

profitability, including by comparison of profitability of the

company’s Medicare Advantage business to non-Medicare Advantage

business; or other changes in the governmental programs in which

Humana participates. Changes to the risk-adjustment model utilized

by CMS to adjust premiums paid to Medicare Advantage plans or

retrospective recovery by CMS of previously paid premiums as a

result of the final rule related to the risk adjustment data

validation audit methodology published by CMS on January 30, 2023

(Final RADV Rule), which Humana believes fails to address

adequately the statutory requirement of actuarial equivalence due

to its failure to include a “Fee For Service Adjuster (FFS

Adjuster)”, could have a material adverse effect on the company's

operating results, financial position and cash flows.

- Humana's business activities are subject to substantial

government regulation. New laws or regulations, or legislative,

judicial, or regulatory changes in existing laws or regulations or

their manner of application could increase the company's cost of

doing business and have a material adverse effect on Humana’s

results of operations (including restricting revenue, enrollment

and premium growth in certain products and market segments,

restricting the company’s ability to expand into new markets,

increasing the company’s medical and operating costs by, among

other things, requiring a minimum benefit ratio on insured

products, lowering the company’s Medicare payment rates and

increasing the company’s expenses associated with a non-deductible

health insurance industry fee and other assessments); the company’s

financial position (including the company’s ability to maintain the

value of its goodwill); and the company’s cash flows.

- Humana’s failure to manage acquisitions, divestitures and other

significant transactions successfully may have a material adverse

effect on the company’s results of operations, financial position,

and cash flows.

- If Humana fails to develop and maintain satisfactory

relationships with the providers of care to its members, the

company’s business may be adversely affected.

- Humana faces significant competition in attracting and

retaining talented employees. Further, managing succession for, and

retention of, key executives is critical to the company’s success,

and its failure to do so could adversely affect the company’s

businesses, operating results and/or future performance.

- Humana’s pharmacy business is highly competitive and subjects

it to regulations and supply chain risks in addition to those the

company faces with its core health benefits businesses.

- Changes in the prescription drug industry pricing benchmarks

may adversely affect Humana’s financial performance.

- Humana’s ability to obtain funds from certain of its licensed

subsidiaries is restricted by state insurance regulations.

- Downgrades in Humana’s debt ratings, should they occur, may

adversely affect its business, results of operations, and financial

condition.

- The securities and credit markets may experience volatility and

disruption, which may adversely affect Humana’s business.

- The spread of, and response to, the novel coronavirus, or

COVID-19, underscores certain risks Humana faces, including those

discussed above, and the ongoing, heightened uncertainty created by

the pandemic precludes any prediction as to the ultimate adverse

impact to Humana of COVID-19.

As the COVID-19 pandemic continues, the premiums the company

charges may prove to be insufficient to cover the cost of health

care services delivered to its members, each of which could be

impacted by many factors, including the impacts that Humana has

experienced, and may continue to experience, to its revenues due to

limitations on its ability to implement clinical initiatives to

manage health care costs and chronic conditions of its members, and

appropriately document their risk profiles, as a result of the

company’s members being unable or unwilling to see their providers

due to actions taken to mitigate the spread of COVID-19; increased

costs that may result from higher utilization rates of medical

facilities and services and other increases in associated hospital

and pharmaceutical costs; and shifts in the company’s premium and

medical claims cost trends to reflect the demographic impact of

higher mortality during the COVID-19 pandemic. In addition, Humana

is offering, and has been mandated by legislative and regulatory

action (including the Families First Act and CARES Act) to provide,

certain expanded benefit coverage to its members, such as waiving,

or reimbursing, certain costs for COVID-19 testing, vaccinations

and treatment. These measures taken by Humana, or governmental

action, to respond to the ongoing impact of COVID-19 (including

further expansion or modification of the services delivered to its

members, the adoption or modification of regulatory requirements

associated with those services and the costs and challenges

associated with ensuring timely compliance with such requirements),

and the potential for widespread testing, treatments and the

distribution and administration of COVID-19 vaccines, could

adversely impact the company’s profitability.

The spread and impact of COVID-19 and additional variants, or

actions taken to mitigate this spread, could have material and

adverse effects on Humana’s ability to operate effectively,

including as a result of the complete or partial closure of

facilities or labor shortages. Disruptions in public and private

infrastructure, including communications, availability of in-person

sales and marketing channels, financial services and supply chains,

could materially and adversely disrupt the company’s normal

business operations. A significant subset of the company's and the

company's third party providers' employee population are in a

remote work environment in an effort to mitigate the spread of

COVID-19, which may exacerbate certain risks to Humana’s business,

including an increased demand for information technology resources,

increased risk of phishing and other cybersecurity attacks, and

increased risk of unauthorized dissemination of sensitive personal,

proprietary, or confidential information. The continued COVID-19

pandemic has severely impacted global economic activity, including

the businesses of some of Humana’s commercial customers, and caused

significant volatility and negative pressure in the financial

markets. In addition to disrupting Humana’s operations, these

developments may adversely affect the timing of commercial customer

premium collections and corresponding claim payments, the value of

the company’s investment portfolio, or future liquidity needs.

The ongoing, heightened uncertainty created by the pandemic

precludes any prediction as to the ultimate adverse impact to

Humana of COVID-19. Humana is continuing to monitor the spread of

COVID-19, changes to the company’s benefit coverages, and the

ongoing costs and business impacts of dealing with COVID-19,

including the potential costs and impacts associated with lifting

or reimposing restrictions on movement and economic activity, the

timing and degree in resumption of demand for deferred healthcare

services, the pace of administration of COVID-19 vaccines and the

effectiveness of those vaccines, and related risks. The magnitude

and duration of the pandemic remain uncertain, and its impact on

Humana’s business, results of operations, financial position, and

cash flows could be material.

In making forward-looking statements, Humana is not undertaking

to address or update them in future filings or communications

regarding its business or results. In light of these risks,

uncertainties, and assumptions, the forward-looking events

discussed herein may or may not occur. There also may be other

risks that the company is unable to predict at this time. Any of

these risks and uncertainties may cause actual results to differ

materially from the results discussed in the forward-looking

statements.

Humana advises investors to read the following documents as

filed by the company with the SEC for further discussion both of

the risks it faces and its historical performance:

- Form 10-K for the year ended December 31, 2022; and

- Form 8-Ks filed during 2023.

About Humana

Humana Inc. (NYSE: HUM) is committed to helping our millions of

medical and specialty members achieve their best health. Our

successful history in care delivery and health plan administration

is helping us create a new kind of integrated care with the power

to improve health and well-being and lower costs. Our efforts are

leading to a better quality of life for people with Medicare,

families, individuals, military service personnel, and communities

at large.

To accomplish that, we support physicians and other health care

professionals as they work to deliver the right care in the right

place for their patients, our members. Our range of clinical

capabilities, resources and tools – such as in-home care,

behavioral health, pharmacy services, data analytics and wellness

solutions – combine to produce a simplified experience that makes

health care easier to navigate and more effective.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230313005699/en/

Lisa Stoner Investor Relations Humana Inc. 502-580-2652 e-mail:

lstamper@humana.com

Mark Taylor Corporate Communications Humana Inc. 317-753-0345

e-mail: mtaylor108@humana.com

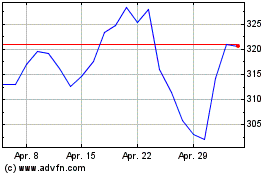

Humana (NYSE:HUM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Humana (NYSE:HUM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024