HubSpot, Inc. (NYSE: HUBS), the customer relationship management

(CRM) platform for scaling companies, today announced financial

results for the fourth quarter and full year ended December 31,

2022.

Financial Highlights:

Revenue Fourth Quarter 2022:

- Total revenue was $469.7 million, up 27% compared to Q4'21.

- Subscription revenue was $458.2 million, up 28% compared to

Q4'21.

- Professional services and other revenue was $11.5 million, up

8% compared to Q4'21.

Full Year 2022:

- Total revenue was $1.731 billion, up 33% compared to 2021.

- Subscription revenue was $1.691 billion, up 34% compared to

2021.

- Professional services and other revenue was $40.4 million, down

5% compared to 2021.

Operating Income (Loss) Fourth Quarter 2022:

- GAAP operating margin was (2.9%), compared to (2.2%) in

Q4'21.

- Non-GAAP operating margin was 13.6%, compared to 10.3% in

Q4'21.

- GAAP operating loss was ($13.5) million, compared to ($8.2)

million in Q4'21.

- Non-GAAP operating income was $64.0 million, compared to $38.2

million in Q4'21.

Full Year 2022:

- GAAP operating margin was (6.3%), compared to (4.2%) in

2021.

- Non-GAAP operating margin was 9.8%, compared to 9.0% in

2021.

- GAAP operating loss was ($109.1) million, compared to ($54.8)

million in 2021.

- Non-GAAP operating income was $169.1 million, compared to

$117.6 million in 2021.

Net Income (Loss) Fourth Quarter 2022:

- GAAP net loss was ($15.6) million, or ($0.32) per basic and

diluted share, compared to ($16.4) million, or ($0.35) per basic

and diluted share in Q4'21.

- Non-GAAP net income was $56.8 million, or $1.17 per basic and

$1.11 per diluted share, compared to $29.6 million, or $0.63 per

basic and $0.58 per diluted share in Q4'21.

- Weighted average basic and diluted shares outstanding for GAAP

net loss per share was 48.8 million, compared to 47.3 million basic

and diluted shares in Q4'21.

- Weighted average basic and diluted shares outstanding for

non-GAAP net income per share was 48.8 million and 51.1 million

respectively, compared to 47.3 million and 50.9 million,

respectively in Q4'21.

Full Year 2022:

- GAAP net loss was ($112.7) million, or ($2.35) per basic and

diluted share, compared to ($77.8) million, or ($1.66) per basic

and diluted share in 2021.

- Non-GAAP net income was $141.8 million, or $2.95 per basic and

$2.78 per diluted share, compared to $92.5 million, or $1.97 per

basic and $1.82 per diluted share in 2021.

- Weighted average basic and diluted shares outstanding for GAAP

net loss per share was 48.1 million, compared to 46.9 million basic

and diluted shares in 2021.

- Weighted average basic and diluted shares outstanding for

non-GAAP net income per share was 48.1 million and 51.1 million

respectively, compared to 46.9 million and 50.7 million,

respectively in 2021.

Balance Sheet and Cash Flow

- The company’s cash, cash equivalents, and short-term and

long-term investments balance was $1.5 billion as of December 31,

2022.

- During the fourth quarter, the company generated $90.0 million

of cash from operating activities and operating cash flow, compared

to $95.2 million of cash from operating activities and $97.2

million of operating cash flow, which excluded the $2.0 million

used for the repayment of its convertible notes, during Q4'21.

- During the fourth quarter, the company generated $70.9 million

of free cash flow, compared to $78.3 million during Q4'21.

- During 2022, the company generated $273.2 million of cash from

operating activities and operating cash flow, compared to $238.7

million of cash from operating activities and $265.2 million of

operating cash flow, which excluded the $26.4 million used for the

repayment of its convertible notes, during 2021.

- The company generated $191.4 million of free cash flow during

2022, compared to $203.3 million during 2021.

Additional Recent Business Highlights

- Grew Customers to 167,386 at December 31, 2022, up 24% from

December 31, 2021.

- Average Subscription Revenue Per Customer was $11,231 during

the fourth quarter of 2022, up 3% compared to the fourth quarter of

2021.

“I’m proud of the way our team stepped up to the challenging

macroeconomic conditions that emerged in 2022. We executed well and

helped our customers navigate choppy waters,” said Yamini Rangan,

Chief Executive Officer at HubSpot. “We focused on product

innovation and showing the value HubSpot can deliver. As a result,

we increasingly see HubSpot becoming the platform of choice for

SMBs. Looking ahead, we have a tremendous opportunity in 2023 to

help our customers grow and make progress on our vision of becoming

the #1 CRM platform for scaling companies. We’ve taken the hard but

necessary steps to restructure our business so we’re better

positioned to navigate the current environment and emerge stronger

long-term. Our mission of helping millions of organizations grow

better is as exciting as ever.”

Business Outlook

Based on information available as of February 16, 2023, HubSpot

is issuing guidance for the first quarter of 2023 and full year

2023 as indicated below.

First Quarter 2023:

- Total revenue is expected to be in the range of $473.0 million

to $475.0 million.

- Unfavorable foreign exchange rates are expected to be a 4 point

headwind to first quarter 2023 revenue growth(1).

- Non-GAAP operating income is expected to be in the range of

$45.0 million to $47.0 million(2).

- Non-GAAP net income per common share is expected to be in the

range of $0.82 to $0.84(2). This assumes approximately 51.5 million

weighted average diluted shares outstanding.

Full Year 2023:

- Total revenue is expected to be in the range of $2.050 billion

to $2.060 billion.

- Unfavorable foreign exchange rates are expected to be a one

point headwind to full year 2023 revenue growth(1).

- Non-GAAP operating income is expected to be in the range of

$248.0 million to $252.0 million(2).

- Non-GAAP net income per common share is expected to be in the

range of $4.24 to $4.32(2). This assumes approximately 52.2 million

weighted average diluted shares outstanding.

(1) Foreign exchange rates impact on revenue is calculated by

comparing current period rates with prior period average rates.

(2)The impact of restructuring charges, which include employee

severance and lease consolidation costs, are excluded from our

non-GAAP operating income and non-GAAP net income per common share

business outlook.

Use of Non-GAAP Financial Measures

In our earnings press releases, conference calls, slide

presentations, and webcasts, we may use or discuss non-GAAP

financial measures, as defined by Regulation G. The GAAP financial

measure most directly comparable to each non-GAAP financial measure

used or discussed, and a reconciliation of the differences between

each non-GAAP financial measure and the comparable GAAP financial

measure, are included in this press release after the consolidated

financial statements. Our earnings press releases containing such

non-GAAP reconciliations can be found in the Investors section of

our website ir.hubspot.com.

Conference Call Information

HubSpot will host a conference call on Thursday February 16,

2023 at 4:30 p.m. Eastern Time (ET) to discuss the company’s fourth

quarter and full year 2022 financial results and its business

outlook. To register for this conference call, please use this dial

in registration link or visit HubSpot's Investor Relations website

at ir.hubspot.com. After registering, a confirmation email will be

sent, including dial-in details and a unique code for entry.

Participants who wish to register for the conference call webcast

please use this link.

Following the conference call, a replay will be available at

(866) 813-9403 (domestic) or +44 204-525-0658 (international). The

replay passcode is 434716. An archived webcast of this conference

call will also be available on HubSpot's Investor Relations website

at ir.hubspot.com.

The company has used, and intends to continue to use, the

investor relations portion of its website as a means of disclosing

material non-public information and for complying with disclosure

obligations under Regulation FD.

About HubSpot

HubSpot is a leading CRM platform that provides software and

support to help companies grow better. The platform includes

marketing, sales, service, operations, and website management

products that start free and scale to meet our customers' needs at

any stage of growth. Today, over 167,000 customers across more than

120 countries use HubSpot's powerful and easy-to-use tools and

integrations to attract, engage, and delight customers. Learn more

at www.hubspot.com.

Cautionary Language Concerning Forward-Looking

Statements

This press release includes certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements regarding management’s expectations

of future financial and operational performance and operational

expenditures, expected growth, foreign currency movement, and

business outlook, including our financial guidance for the first

fiscal quarter of and full year 2023; statements regarding our

positioning for future growth and market leadership; statements

regarding the economic environment; and statements regarding

expected market trends, future priorities and related investments,

and market opportunities. These forward-looking statements include,

but are not limited to, plans, objectives, expectations and

intentions and other statements contained in this press release

that are not historical facts and statements identified by words

such as “expects,” “anticipates,” “intends,” “plans,” “believes,”

“seeks,” “estimates” or words of similar meaning. These

forward-looking statements reflect our current views about our

plans, intentions, expectations, strategies and prospects, which

are based on the information currently available to us and on

assumptions we have made. Although we believe that our plans,

intentions, expectations, strategies and prospects as reflected in

or suggested by those forward-looking statements are reasonable, we

can give no assurance that the plans, intentions, expectations or

strategies will be attained or achieved. Furthermore, actual

results may differ materially from those described in the

forward-looking statements and will be affected by a variety of

risks and factors that are beyond our control including, without

limitation, risks associated with our history of losses; our recent

reduction in force, including risks that the related costs and

charges may be greater than anticipated and that the restructuring

efforts may not generate their intended benefits, may adversely

affect the Company’s internal programs and the Company’s ability to

recruit and retain skilled and motivated personnel, and may be

distracting to employees and management; our ability to retain

existing customers and add new customers; the continued growth of

the market for a CRM platform; our ability to differentiate our

platform from competing products and technologies; our ability to

manage our growth effectively over the long-term to maintain our

high level of service; our ability to maintain and expand

relationships with our solutions partners; the price volatility of

our common stock; the impact of geopolitical conflicts, inflation,

foreign currency movement, macroeconomic instability, and the

COVID-19 pandemic on our business, the broader economy, our

workforce and operations, the markets in which we and our partners

and customers operate, and our ability to forecast our future

financial performance; and other risks set forth under the caption

“Risk Factors” in our SEC filings. We assume no obligation to

update any forward-looking statements contained in this document as

a result of new information, future events or otherwise.

Consolidated Balance Sheets

(in thousands)

December 31,

December 31,

2022

2021

Assets

Current assets:

Cash and cash equivalents

$

331,022

$

377,013

Short-term investments

1,081,662

820,962

Accounts receivable

226,849

157,362

Deferred commission expense

70,992

59,849

Prepaid expenses and other current

assets

44,074

38,388

Total current assets

1,754,599

1,453,574

Long-term investments

112,791

174,895

Property and equipment, net

105,227

96,134

Capitalized software development costs,

net

63,790

39,858

Right-of-use assets

319,304

280,828

Deferred commission expense, net of

current portion

66,559

42,681

Other assets

58,795

29,244

Intangible assets, net

17,446

10,565

Goodwill

46,227

47,075

Total assets

$

2,544,738

$

2,174,854

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable

$

20,883

$

2,773

Accrued compensation costs

62,846

63,836

Accrued expenses and other current

liabilities

102,122

74,457

Convertible senior notes

—

19,630

Operating lease liabilities

35,928

26,364

Deferred revenue

539,874

430,414

Total current liabilities

761,653

617,474

Operating lease liabilities, net of

current portion

316,184

283,873

Deferred revenue, net of current

portion

5,904

4,473

Other long-term liabilities

14,546

12,134

Convertible senior notes, net of current

portion

454,227

383,101

Total liabilities

1,552,514

1,301,055

Stockholders’ equity:

Common stock

49

47

Additional paid-in capital

1,647,446

1,436,089

Accumulated other comprehensive loss

(12,890

)

(1,339

)

Accumulated deficit

(642,381

)

(560,998

)

Total stockholders’ equity

992,224

873,799

Total liabilities and stockholders’

equity

$

2,544,738

$

2,174,854

Consolidated Statements of

Operations

(in thousands, except per share data)

For the Three Months Ended

December 31,

For the Year Ended December

31,

2022

2021

2022

2021

Revenues:

Subscription

$

458,152

$

358,657

$

1,690,538

$

1,258,319

Professional services and other

11,506

10,652

40,431

42,339

Total revenue

469,658

369,309

1,730,969

1,300,658

Cost of revenues:

Subscription

66,051

58,599

257,513

211,132

Professional services and other

14,214

13,040

56,746

47,725

Total cost of revenues

80,265

71,639

314,259

258,857

Gross profit

389,393

297,670

1,416,710

1,041,801

Operating expenses:

Research and development

116,334

82,997

442,022

301,970

Sales and marketing

235,132

180,845

886,069

649,681

General and administrative

51,413

42,065

197,720

144,949

Total operating expenses

402,879

305,907

1,525,811

1,096,600

Loss from operations

(13,486

)

(8,237

)

(109,101

)

(54,799

)

Other expense:

Interest income

7,777

126

15,000

1,173

Interest expense

(941

)

(5,905

)

(3,762

)

(30,282

)

Other (expense) income

(6,244

)

(974

)

(6,829

)

10,090

Total other income (expense)

592

(6,753

)

4,409

(19,019

)

Loss before income tax expense

(12,894

)

(14,990

)

(104,692

)

(73,818

)

Income tax expense

(2,744

)

(1,380

)

(8,057

)

(4,019

)

Net loss

$

(15,638

)

$

(16,370

)

$

(112,749

)

$

(77,837

)

Net loss per share, basic and diluted

$

(0.32

)

$

(0.35

)

$

(2.35

)

$

(1.66

)

Weighted average common shares used in

computing basic and diluted net loss per share:

48,787

47,304

48,065

46,891

Consolidated Statements of Cash

Flows

(in thousands)

For the Three Months Ended

December 31,

For the Year Ended December

31,

2022

2021

2022

2021

Operating Activities:

Net loss

$

(15,638

)

$

(16,370

)

$

(112,749

)

$

(77,837

)

Adjustments to reconcile net loss to net

cash and cash equivalents provided by operating activities

Depreciation and amortization

15,525

11,970

58,150

45,159

Stock-based compensation

76,768

45,914

275,849

166,761

Loss on early extinguishment of 2022

Convertible Notes

—

68

—

4,892

Repayment of 2022 Convertible Notes

attributable to the debt discount

—

(1,971

)

—

(26,428

)

Gain on strategic investments

—

(2

)

(4,201

)

(11,741

)

Impairment of strategic investments

5,863

—

5,863

—

Gain on termination of operating

leases

—

—

—

(4,276

)

Loss on disposal of fixed assets

—

—

—

6,468

Benefit from deferred income taxes

(1,533

)

(1,548

)

(2,122

)

(2,869

)

Amortization of debt discount and issuance

costs

504

5,393

2,013

23,507

(Accretion) amortization of bond

discount

(5,851

)

1,332

(9,118

)

4,275

Unrealized currency translation

530

701

1,010

1,304

Changes in assets and liabilities

Accounts receivable

(53,850

)

(31,859

)

(73,985

)

(34,107

)

Prepaid expenses and other assets

2,878

6,072

(5,987

)

(1,077

)

Deferred commission expense

(15,373

)

(8,189

)

(37,583

)

(32,560

)

Right-of-use assets

9,909

4,470

29,531

31,418

Accounts payable

7,617

1,343

18,277

(10,608

)

Accrued expenses and other liabilities

15,920

20,025

32,375

58,209

Operating lease liabilities

(6,529

)

(3,056

)

(21,118

)

(29,478

)

Deferred revenue

53,226

60,891

116,969

127,716

Net cash and cash equivalents provided by

operating activities

89,966

95,184

273,174

238,728

Investing Activities:

Purchases of investments

(248,951

)

(447,431

)

(1,507,870

)

(1,484,762

)

Maturities of investments

167,200

446,722

1,184,506

1,387,498

Sale of investments

—

—

124,998

—

Purchases of property and equipment

(6,042

)

(11,327

)

(37,426

)

(28,726

)

Purchases of intangible assets

—

—

(10,000

)

—

Acquisition of a business, net of cash

acquired

—

—

—

(16,810

)

Purchases of strategic investments

(6,499

)

(2,887

)

(26,371

)

(13,089

)

Proceeds from sale of strategic

investments

—

12,620

—

12,620

Payments for equity method investments

(1,250

)

—

(3,150

)

(3,100

)

Capitalization of software development

costs

(12,995

)

(7,501

)

(44,345

)

(33,139

)

Net cash and cash equivalents used in

investing activities

(108,537

)

(9,804

)

(319,658

)

(179,508

)

Financing Activities:

Proceeds from settlement of Convertible

Note Hedges related to the 2022 Convertible Notes

—

8,256

60,483

8,985

Payments for settlement of Warrants

related to the 2022 Convertible Notes

(34

)

—

(34

)

—

Payment for settlement of 2022 Convertible

Notes

—

(9,097

)

(79,807

)

(89,525

)

Repayment of 2025 Convertible Notes

attributable to the principal

—

—

(1,619

)

—

Employee taxes paid related to the net

share settlement of stock-based awards

(1,572

)

(5,711

)

(11,526

)

(17,439

)

Proceeds related to the issuance of common

stock under stock plans

10,213

12,386

39,931

46,510

Net cash and cash equivalents provided by

(used in) financing activities

8,607

5,834

7,428

(51,469

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

9,451

(2,535

)

(6,811

)

(8,861

)

Net (decrease) increase in cash, cash

equivalents and restricted cash

(513

)

88,679

(45,867

)

(1,110

)

Cash, cash equivalents and restricted

cash, beginning of period

334,688

291,363

380,042

381,152

Cash, cash equivalents and restricted

cash, end of period

$

334,175

$

380,042

$

334,175

$

380,042

Reconciliation of non-GAAP operating

income and operating margin

(in thousands, except percentages)

Three Months Ended December

31,

For the Year Ended December

31,

2022

2021

2022

2021

GAAP operating loss

$

(13,486

)

$

(8,237

)

$

(109,101

)

$

(54,799

)

Stock-based compensation

76,768

45,914

275,849

166,761

Amortization of acquired intangible

assets

729

318

2,629

1,326

Acquisition/disposition related expenses

(income)

—

170

(305

)

2,087

Gain on termination of operating

leases

—

—

—

(4,276

)

Loss on disposal of fixed assets

—

—

—

6,468

Non-GAAP operating income

$

64,011

$

38,165

$

169,072

$

117,567

GAAP operating margin

(2.9

%)

(2.2

%)

(6.3

%)

(4.2

%)

Non-GAAP operating margin

13.6

%

10.3

%

9.8

%

9.0

%

Reconciliation of non-GAAP net

income

(in thousands, except per share

amounts)

Three Months Ended December

31,

For the Year Ended December

31,

2022

2021

2022

2021

GAAP net loss

$

(15,638

)

(16,370

)

$

(112,749

)

$

(77,837

)

Stock-based compensation

76,768

45,914

275,849

166,761

Amortization of acquired intangibles

assets

729

318

2,629

1,326

Acquisition/disposition related expenses

(income)

—

170

(305

)

2,087

Gain on termination of operating

leases

—

—

—

(4,276

)

Loss on disposal of fixed assets

—

—

—

6,468

Non-cash interest expense for amortization

of debt discount and debt issuance costs

504

5,393

2,013

23,507

Impairment of (gain on) strategic

investments

5,863

(2

)

1,662

(11,741

)

Loss on early extinguishment of 2022

Convertible Notes

—

68

—

4,892

Loss on equity method investment

87

150

125

371

Income tax effects of non-GAAP items

(11,467

)

(6,024

)

(27,399

)

(19,096

)

Non-GAAP net income

$

56,846

29,617

$

141,825

$

92,462

Non-GAAP net income per share:

Basic

$

1.17

$

0.63

$

2.95

$

1.97

Diluted

$

1.11

$

0.58

$

2.78

$

1.82

Shares used in non-GAAP per share

calculations

Basic

48,787

47,304

48,065

46,891

Diluted

51,094

50,888

51,099

50,694

Reconciliation of non-GAAP expense and

expense as a percentage of revenue

(in thousands, except percentages)

Three Months Ended December

31,

2022

2021

COS, Subs- cription

COS, Prof. services &

other

R&D

S&M

G&A

COS, Subs- cription

COS, Prof. services &

other

R&D

S&M

G&A

GAAP expense

$

66,051

$

14,214

$

116,334

$

235,132

$

51,413

$

58,599

$

13,040

$

82,997

$

180,845

$

42,065

Stock -based compensation

(2,560

)

(1,113

)

(30,248

)

(30,557

)

(12,290

)

(1,742

)

(821

)

(16,600

)

(17,511

)

(9,240

)

Amortization of acquired intangible

assets

(283

)

—

—

(446

)

—

(228

)

—

—

(90

)

—

Acquisition/disposition related

expense

—

—

—

—

—

—

—

(131

)

—

(39

)

Non-GAAP expense

$

63,208

$

13,101

$

86,086

$

204,129

$

39,123

$

56,629

$

12,219

$

66,266

$

163,244

$

32,786

GAAP expense as a percentage of

revenue

14.1

%

3.0

%

24.8

%

50.1

%

10.9

%

15.9

%

3.5

%

22.5

%

49.0

%

11.4

%

Non-GAAP expense as a percentage of

revenue

13.5

%

2.8

%

18.3

%

43.5

%

8.3

%

15.3

%

3.3

%

17.9

%

44.2

%

8.9

%

For the Year Ended December

31,

2022

2021

COS, Subs- cription

COS, Prof. services &

other

R&D

S&M

G&A

COS, Subs- cription

COS, Prof. services &

other

R&D

S&M

G&A

GAAP expense

$

257,513

$

56,746

$

442,022

$

886,069

$

197,720

$

211,132

$

47,725

$

301,970

$

649,681

$

144,949

Stock -based compensation

(9,076

)

(4,393

)

(107,517

)

(107,640

)

(47,223

)

(6,297

)

(3,092

)

(61,614

)

(67,413

)

(28,345

)

Amortization of acquired intangible

assets

(1,203

)

—

—

(1,426

)

—

(937

)

—

—

(389

)

—

Acquisition/disposition related income

(expenses)

—

—

300

—

5

—

—

(1,152

)

(367

)

(568

)

Gain on termination of operating

leases

—

—

—

—

—

395

275

1,346

1,839

421

Loss on disposal of fixed assets

—

—

—

—

—

(600

)

(415

)

(2,036

)

(2,781

)

(636

)

Non-GAAP expense

$

247,234

$

52,353

$

334,805

$

777,003

$

150,502

$

203,693

$

44,493

$

238,514

$

580,570

$

115,821

GAAP expense as a percentage of

revenue

14.9

%

3.3

%

25.5

%

51.2

%

11.4

%

16.2

%

3.7

%

23.2

%

50.0

%

11.1

%

Non-GAAP expense as a percentage of

revenue

14.3

%

3.0

%

19.3

%

44.9

%

8.7

%

15.7

%

3.4

%

18.3

%

44.6

%

8.9

%

Reconciliation of non-GAAP subscription

margin

(in thousands, except percentages)

Three Months Ended December

31,

For the Year Ended December

31,

2022

2021

2022

2021

GAAP subscription margin

$

392,101

$

300,058

$

1,433,025

$

1,047,187

Stock -based compensation

2,560

1,742

9,076

6,297

Amortization of acquired intangible

assets

283

228

1,203

937

Gain on termination of operating

leases

—

—

—

(395

)

Loss on disposal of fixed assets

—

—

—

600

Non-GAAP subscription margin

$

394,944

$

302,028

$

1,443,304

$

1,054,626

GAAP subscription margin percentage

85.6

%

83.7

%

84.8

%

83.2

%

Non-GAAP subscription margin

percentage

86.2

%

84.2

%

85.4

%

83.8

%

Reconciliation of free cash

flow

(in thousands)

Three Months Ended December

31,

For the Year Ended December

31,

2022

2021

2022

2021

GAAP net cash and cash equivalents

provided by operating activities

$

89,966

$

95,184

$

273,174

$

238,728

Purchases of property and equipment

(6,042

)

(11,327

)

(37,426

)

(28,726

)

Capitalization of software development

costs

(12,995

)

(7,501

)

(44,345

)

(33,139

)

Repayment of 2022 Convertible Notes

attributable to the debt discount

—

1,971

—

26,428

Free cash flow

$

70,929

$

78,327

$

191,403

$

203,291

Reconciliation of operating cash

flow

(in thousands)

Three Months Ended December

31,

For the Year Ended December

31,

2022

2021

2022

2021

GAAP net cash and cash equivalents

provided by operating activities

$

89,966

$

95,184

$

273,174

$

238,728

Repayment of 2022 Convertible Notes

attributable to the debt discount

—

1,971

—

26,428

Operating cash flow, excluding repayment

of convertible debt

$

89,966

$

97,155

$

273,174

$

265,156

Reconciliation of forecasted non-GAAP

operating income

(in thousands, except percentages)

Three Months Ended March 31,

2023

Year Ended December 31,

2023

GAAP operating income range

($64,045)-($110,045)

($287,972)-($316,972)

Stock-based compensation

84,199

460,589

Amortization of acquired intangible

assets

846

3,383

Restructuring charges

24,000-72,000

72,000-105,000

Non-GAAP operating income range

$45,000-$47,000

$248,000-$252,000

Reconciliation of forecasted non-GAAP

net income and non-GAAP net income per share

(in thousands, except per share

amounts)

Three Months Ended March 31,

2023

Year Ended December 31,

2023

GAAP net loss range

($61,846)-($108,596)

($275,688)-($303,688)

Stock-based compensation

84,199

460,589

Amortization of acquired intangible

assets

846

3,383

Restructuring charges

24,000-72,000

72,000-105,000

Non-cash interest expense for amortization

of debt issuance costs

484

1,985

Income tax effects of non-GAAP items

(5,383)-(5,633)

(40,869)-(41,869)

Non-GAAP net income range

$42,300-$43,300

$221,400-$225,400

GAAP net income per basic and diluted

share

($1.25)-($2.20)

($5.68)-($6.29)

Non-GAAP net income per diluted share

$0.82-$0.84

$4.24-$4.32

Weighted average common shares used in

computing GAAP basic and diluted net loss per share:

49,403

50,000

Weighted average common shares used in

computing non-GAAP diluted net loss per share:

51,507

52,199

HubSpot’s estimates of stock-based compensation, amortization of

acquired intangible assets, restructuring charges, non-cash

interest expense for amortization of debt issuance costs, and

income tax effects of non-GAAP items assume, among other things,

the occurrence of no additional acquisitions, and no further

revisions to stock-based compensation and related expenses.

Non-GAAP Financial Measures

We report our financial results in accordance with accounting

principles generally accepted in the United States of America, or

GAAP. However, management believes that, in order to properly

understand our short-term and long-term financial and operational

trends, investors may wish to consider the impact of certain

non-cash or non-recurring items when used as a supplement to

financial performance measures in accordance with GAAP. These items

result from facts and circumstances that vary in frequency and

impact on continuing operations. In this release, HubSpot’s

non-GAAP operating income, operating margin, subscription margin,

expense, expense as a percentage of revenue, net income, operating

and free cash flow are not presented in accordance with GAAP and

are not intended to be used in lieu of GAAP presentations of

results of operations. Free cash flow is defined as cash and cash

equivalents provided by or used in operating activities less

purchases of property and equipment and capitalization of software

development costs, plus repayments of convertible notes

attributable to debt discount. We believe information regarding

free cash flow provides useful information to investors in

understanding and evaluating the strength of liquidity and

available cash and the exclusion of repayments of convertible notes

attributable to debt discount from operating cash flow provides a

comparable framework for assessing how our business performed when

compared to prior periods and also aligns the non-GAAP treatment of

our debt discount that is amortized as non-cash interest

expense.

Management believes that these non-GAAP financial measures

provide additional means of evaluating period-over-period operating

performance. Specifically, these non-GAAP financial measures

provide management with additional means to understand and evaluate

the operating results and trends in our ongoing business by

eliminating certain non-cash expenses and other items that

management believes might otherwise make comparisons of our ongoing

business with prior periods more difficult, obscure trends in

ongoing operations, or reduce management’s ability to make useful

forecasts. In addition, management understands that some investors

and financial analysts find this information helpful in analyzing

our financial and operational performance and comparing this

performance to our peers and competitors. However, these non-GAAP

financial measures have limitations as an analytical tool and are

not intended to be an alternative to financial measures prepared in

accordance with GAAP. In addition, it should be noted that these

non-GAAP financial measures may be different from non-GAAP measures

used by other companies. We intend to provide these non-GAAP

financial measures as part of our future earnings discussions and,

therefore, the inclusion of these non-GAAP financial measures will

provide consistency in our financial reporting. Management may,

however, utilize other measures to illustrate performance in the

future. Investors are encouraged to review the reconciliation of

these non-GAAP measures to their most directly comparable GAAP

financial measures. A reconciliation of our non-GAAP financial

measures to their most directly comparable GAAP measures has been

provided in the financial statement tables included above in this

press release.

These non-GAAP measures exclude stock-based compensation,

amortization of acquired intangible assets, acquisition related

expenses, disposition related income, non-cash interest expense for

the amortization of debt issuance costs, gain on termination of

operating leases, loss on disposal of fixed assets, loss on early

extinguishment of 2022 Convertible Notes, gain or impairment losses

on strategic investments, gain or loss on equity method investment,

and account for the income tax effects of the exclusion of these

non-GAAP items. We believe investors may want to incorporate the

effects of these items in order to compare our financial

performance with that of other companies and between time

periods:

- Stock-based compensation is a non-cash expense accounted for in

accordance with FASB ASC Topic 718. We believe that the exclusion

of stock-based compensation expense allows for financial results

that are more indicative of our operational performance and provide

for a useful comparison of our operating results to prior periods

and to our peer companies because stock-based compensation expense

varies from period to period and company to company due to such

things as differing valuation methodologies and changes in stock

price.

- Expense for the amortization of acquired intangible assets,

excluding backlog acquired intangible assets amortized as contra

revenue, is excluded from non-GAAP expense and income measures as

HubSpot views amortization of these assets as arising from

pre-acquisition activities determined at the time of an

acquisition. While these intangible assets are evaluated for

impairment regularly, amortization of the cost of purchased

intangibles is a non-cash expense that is not typically affected by

operations during any particular period. Valuation and subsequent

amortization of intangible assets can also be inconsistent in

amount and frequency because they can significantly vary based on

the timing and size of acquisitions and the inherently subjective

nature of the degree to which a purchase price is allocated to

intangible assets. We believe that the exclusion of this

amortization expense provides for a useful comparison of our

operating results to prior periods, for which we have historically

excluded amortization expense, and to our peer companies, which

commonly exclude acquired intangible asset amortization. It is

important to note that although we exclude amortization of acquired

intangible assets from our non-GAAP expense and income measures,

revenue generated from such intangibles is included within our

non-GAAP income measures. The use of these intangible assets

contributed to our revenues earned during the periods presented and

will contribute to future periods as well.

- Acquisition related expenses, such as transaction costs and

retention payments, and disposition related income, such as

proceeds from sale of assets, are transactions that are not

necessarily reflective of our operational performance during a

period. We believe that the exclusion of these expenses and income

provides for a useful comparison of our operating results to prior

periods and to our peer companies, which commonly exclude these

expenses and income.

- In June 2020, the Company issued $460 million of convertible

notes due in 2025 with a coupon interest rate of 0.375%. In August

2020, the FASB published ASU 2020-06, which was adopted on January

1, 2022. ASU 2020-06 simplifies the accounting for convertible debt

and other equity-linked instruments and eliminates requirements to

separately account for liability and equity components of such

convertible debt instruments. Consequently, our convertible notes

are accounted for as a single liability and the discount created by

the recognition of a component of the convertible debt in equity is

eliminated. The issuance cost of the debt is amortized as interest

expense over the remaining term of the debt. We believe the

exclusion of this non-cash interest expense provides for a useful

comparison of our operating results to prior periods and to our

peer companies. Prior to January 1, 2022, the difference between

the fair value and carrying value of debt conversion settlements

was recorded as a loss on early extinguishment of debt within

interest expense. Upon the adoption of ASU 2020-06, no loss is

recognized.

- Strategic investments consist of non-controlling equity

investments in privately held companies. The recognition of gains

or impairment losses can vary significantly across periods and we

do not view them to be indicative of our fundamental operating

activities and believe the exclusion of gains or impairment losses

provides for a useful comparison of our operating results to prior

periods and to our peer companies.

- We made a contribution to the Black Economic Development Fund

(the “investee”) managed by the Local Initiatives Support

Corporation and have committed to make additional capital

contributions. We account for this investment under the equity

method of accounting. The proportionate share of our equity method

investee's net earnings have been excluded in order to provide a

comparable view of our operating results to prior periods and to

our peer companies. We believe this activity is not reflective of

our recurring core business operating results.

- Gain on termination of operating leases results from early

lease terminations and related improvement reimbursements from

landlords being recorded as income. Loss on fixed assets result

from the disposal of property and equipment associated with early

lease terminations. As we generally fulfill our obligations for the

full lease term and use these assets for their full useful lives,

we believe these activities are not considered reflective of our

recurring core business operating results. As such, we believe the

exclusion of these transactions provides for a useful comparison of

our operating results to prior periods and to our peer

companies.

- The effects of income taxes on non-GAAP items reflect a fixed

long-term projected tax rate of 20% to provide better consistency

across reporting periods. To determine this long-term non-GAAP tax

rate, we exclude the impact of other non-GAAP adjustments and take

into account other factors such as our current operating structure

and existing tax positions in various jurisdictions. We will

periodically reevaluate this tax rate, as necessary, for

significant events such as relevant tax law changes and material

changes in our forecasted geographic earnings mix.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230216005523/en/

Investor Relations Contact: Charles MacGlashing

investors@hubspot.com

Media Contact: media@hubspot.com

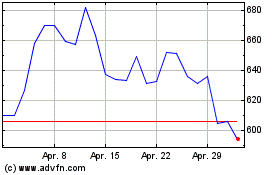

HubSpot (NYSE:HUBS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

HubSpot (NYSE:HUBS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024