Hilltop Holdings Inc. (NYSE: HTH) (“Hilltop”) today announced

financial results for the fourth quarter and full year 2022.

Hilltop produced income to common stockholders of $25.6 million, or

$0.39 per diluted share, for the fourth quarter of 2022, compared

to $62.2 million, or $0.78 per diluted share, for the fourth

quarter of 2021. Income to common stockholders for the full year

2022 was $113.1 million, or $1.60 per diluted share, compared to

$374.5 million, or $4.61 per diluted share, for the full year 2021.

Hilltop’s financial results for the fourth quarter and full year of

2022 included significant decreases in year-over-year mortgage

origination segment net gains from sales of loans and other

mortgage production income, while the banking segment recorded a

provision for credit losses as opposed to a reversal of credit

losses in respective prior year periods.

Hilltop also announced that its Board of Directors declared a

quarterly cash dividend of $0.16 per common share, a 7% increase

from the prior quarter, payable on February 24, 2023, to all common

stockholders of record as of the close of business on February 10,

2023. Additionally, the Hilltop Board of Directors authorized,

subject to regulatory approvals or non-objections, a new stock

repurchase program through January 2024, under which Hilltop may

repurchase, in the aggregate, up to $75.0 million of its

outstanding common stock. During 2022, Hilltop paid $442.3 million

to repurchase approximately 14.87 million shares of its common

stock at a price of $29.75 per share pursuant to the tender offer

completed in May 2022. These shares were returned to the pool of

authorized but unissued shares of common stock.

Headwinds during 2022, including the impact of tight housing

inventories on mortgage volumes, declining deposit balances, rapid

increases in market interest rates and a declining economic

forecast, are expected to continue to have an adverse impact on our

operating results during 2023. The impacts of such headwinds in

2023 remain uncertain and will depend on developments outside of

our control, including, among others, timing and significance of

further changes in U.S. treasury yields and mortgage interest

rates, exposure to increasing funding costs, inflationary pressures

associated with compensation, occupancy and software costs and

labor market conditions, the Russian-Ukraine conflict and its

impact on supply chains, and the impact of the pandemic.

Jeremy B. Ford, President and CEO of Hilltop, said “Although we

experienced a challenging operating environment in 2022, Hilltop

still generated consolidated profitability and finished the year a

more resilient company. The abrupt market shifts in the mortgage

and fixed income businesses had a negative impact across our

company, particularly at PrimeLending and HilltopSecurities, while

PlainsCapital Bank delivered across all of its key priorities,

including prudent loan growth, sound credit quality and efficiency.

I am proud of our teams’ accomplishments during the year, as they

continued to deliver high-quality products and services for our

clients, while also making tough, yet prudent, expense decisions to

right-size our franchise.

“Additionally, our focus on maintaining a strong balance sheet

with significant capital and liquidity has positioned Hilltop for

long-term success regardless of interest rate and economic

volatility. Finally, I am very pleased that Hilltop returned a

record amount of capital to stockholders during 2022, primarily

through our successful tender offer share repurchase completed in

May.”

Fourth Quarter 2022 Highlights for Hilltop:

- The provision for credit losses was $3.6 million during the

fourth quarter of 2022, compared to a reversal of credit losses of

$0.8 million in the third quarter of 2022 and a reversal of credit

losses of $18.6 million in the fourth quarter of 2021;

- The provision for credit losses during the fourth quarter of

2022 reflected a deteriorating U.S. economic outlook since the

prior quarter.

- For the fourth quarter of 2022, net gains from sale of loans

and other mortgage production income and mortgage loan origination

fees within our mortgage origination segment was $71.1 million,

compared to $192.0 million in the fourth quarter of 2021, a 63.0%

decrease;

- Mortgage loan origination production volume was $2.0 billion

during the fourth quarter of 2022, compared to $5.0 billion in the

fourth quarter of 2021;

- Net gains from mortgage loans sold to third parties decreased

to 211 basis points during the fourth quarter of 2022, compared to

227 basis points in the third quarter of 2022.

- Hilltop’s consolidated annualized return on average assets and

return on average stockholders’ equity for the fourth quarter of

2022 were 0.63% and 4.99%, respectively, compared to 1.41% and

9.93%, respectively, for the fourth quarter of 2021;

- Hilltop’s book value per common share increased to $31.62 at

December 31, 2022, compared to $31.46 at September 30, 2022;

- Hilltop’s total assets were $16.3 billion and $16.6 billion at

December 31, 2022 and September 30, 2022, respectively;

- Loans1, net of allowance for credit losses, were $7.6 billion

and $7.4 billion at December 31, 2022 and September 30, 2022;

- Non-performing loans were $30.3 million, or 0.33% of total

loans, at December 31, 2022, compared to $34.6 million, or 0.39% of

total loans, at September 30, 2022;

- Loans held for sale decreased by 2.1% from September 30, 2022

to $1.0 billion at December 31, 2022;

- Total deposits were $11.3 billion and $11.4 billion at December

31, 2022 and September 30, 2022, respectively;

- Hilltop maintained strong capital levels2 with a Tier 1

Leverage Ratio3 of 11.47% and a Common Equity Tier 1 Capital Ratio

of 18.22% at December 31, 2022;

- Hilltop’s consolidated net interest margin4 increased to 3.23%

for the fourth quarter of 2022, compared to 3.19% in the third

quarter of 2022;

- For the fourth quarter of 2022, noninterest income was $169.8

million, compared to $284.8 million in the fourth quarter of 2021,

a 40.4% decrease;

- For the fourth quarter 2022, noninterest expense was $253.4

million, compared to $322.2 million in the fourth quarter of 2021,

a 21.4% decrease; and

- Hilltop’s effective tax rate was 26.6% during the fourth

quarter of 2022, compared to 24.2% during the same period in 2021.

- The effective tax rate for the fourth quarter of 2022 was

higher than the applicable statutory rate primarily due to the

impact of non-deductible compensation expense and other permanent

adjustments.

___________________

1

“Loans” reflect loans held for investment

excluding broker-dealer margin loans, net of allowance for credit

losses, of $431.0 million and $402.0 million at December 31, 2022

and September 30, 2022, respectively.

2

Capital ratios reflect Hilltop’s decision

to elect the transition option as issued by the federal banking

regulatory agencies in March 2020 that permits banking institutions

to mitigate the estimated cumulative regulatory capital effects

from CECL over a five-year transitionary period.

3

Based on the end of period Tier 1 capital

divided by total average assets during the quarter, excluding

goodwill and intangible assets.

4

Net interest margin is defined as net

interest income divided by average interest-earning assets.

Consolidated Financial and Other

Information

Consolidated Balance Sheets

December 31,

September 30,

June 30,

March 31,

December 31,

(in 000's)

2022

2022

2022

2022

2021

Cash and due from banks

$

1,579,512

$

1,777,584

$

1,783,554

$

2,886,812

$

2,823,138

Federal funds sold

650

663

381

383

385

Assets segregated for regulatory

purposes

67,737

109,358

120,816

128,408

221,740

Securities purchased under agreements to

resell

118,070

145,365

139,929

256,991

118,262

Securities:

Trading, at fair value

755,032

641,864

593,273

471,763

647,998

Available for sale, at fair value, net

1,658,766

1,584,724

1,562,222

1,462,340

2,130,568

Held to maturity, at amortized cost,

net

875,532

889,452

920,583

953,107

267,684

Equity, at fair value

200

209

197

225

250

3,289,530

3,116,249

3,076,275

2,887,435

3,046,500

Loans held for sale

982,616

1,003,605

1,491,579

1,643,994

1,878,190

Loans held for investment, net of unearned

income

8,092,673

7,944,246

7,930,619

7,797,903

7,879,904

Allowance for credit losses

(95,442

)

(91,783

)

(95,298

)

(91,185

)

(91,352

)

Loans held for investment, net

7,997,231

7,852,463

7,835,321

7,706,718

7,788,552

Broker-dealer and clearing organization

receivables

1,038,055

1,255,052

1,049,830

1,610,352

1,672,946

Premises and equipment, net

184,950

191,423

195,361

198,906

204,438

Operating lease right-of-use assets

102,443

103,099

106,806

108,180

112,328

Mortgage servicing assets

100,825

156,539

121,688

100,475

86,990

Other assets

527,469

624,235

513,570

546,622

452,880

Goodwill

267,447

267,447

267,447

267,447

267,447

Other intangible assets, net

11,317

12,209

13,182

14,233

15,284

Total assets

$

16,267,852

$

16,615,291

$

16,715,739

$

18,356,956

$

18,689,080

Deposits:

Noninterest-bearing

$

3,968,862

$

4,546,816

$

4,601,643

$

4,694,592

$

4,577,183

Interest-bearing

7,346,887

6,805,198

7,319,143

7,972,110

8,240,894

Total deposits

11,315,749

11,352,014

11,920,786

12,666,702

12,818,077

Broker-dealer and clearing organization

payables

966,470

1,176,156

934,818

1,397,836

1,477,300

Short-term borrowings

970,056

942,309

822,649

835,054

859,444

Securities sold, not yet purchased, at

fair value

53,023

99,515

135,968

97,629

96,586

Notes payable

346,654

390,354

389,722

395,479

387,904

Operating lease liabilities

126,759

120,635

124,406

125,919

130,960

Other liabilities

417,042

475,425

329,987

347,742

369,606

Total liabilities

14,195,753

14,556,408

14,658,336

15,866,361

16,139,877

Common stock

647

646

646

794

790

Additional paid-in capital

1,046,331

1,043,605

1,039,261

1,275,649

1,274,446

Accumulated other comprehensive loss

(124,961

)

(119,864

)

(95,279

)

(80,565

)

(10,219

)

Retained earnings

1,123,636

1,107,586

1,085,208

1,267,415

1,257,014

Deferred compensation employee stock

trust, net

481

479

695

744

752

Employee stock trust

(640

)

(641

)

(954

)

(104

)

(115

)

Total Hilltop stockholders' equity

2,045,494

2,031,811

2,029,577

2,463,933

2,522,668

Noncontrolling interests

26,605

27,072

27,826

26,662

26,535

Total stockholders' equity

2,072,099

2,058,883

2,057,403

2,490,595

2,549,203

Total liabilities & stockholders'

equity

$

16,267,852

$

16,615,291

$

16,715,739

$

18,356,956

$

18,689,080

Three Months Ended

Year Ended

Consolidated Income Statements

December 31,

September 30,

December 31,

December 31,

December 31,

(in 000's, except per share

data)

2022

2022

2021

2022

2021

Interest income:

Loans, including fees

$

117,906

$

109,165

$

96,104

$

416,207

$

404,312

Securities borrowed

14,162

10,938

8,524

44,414

61,667

Securities:

Taxable

23,293

19,642

13,916

75,805

47,633

Tax-exempt

3,002

2,451

2,639

10,013

9,766

Other

21,611

14,276

1,872

44,677

6,595

Total interest income

179,974

156,472

123,055

591,116

529,973

Interest expense:

Deposits

28,238

12,525

4,404

50,412

23,624

Securities loaned

13,179

9,407

6,624

38,570

50,974

Short-term borrowings

10,278

5,550

2,279

20,893

9,065

Notes payable

3,988

3,907

5,871

16,141

21,386

Junior subordinated debentures

—

—

—

—

1,558

Other

849

1,597

(417

)

6,125

384

Total interest expense

56,532

32,986

18,761

132,141

106,991

Net interest income

123,442

123,486

104,294

458,975

422,982

Provision for (reversal of) credit

losses

3,638

(780

)

(18,565

)

8,309

(58,213

)

Net interest income after provision for

(reversal of) credit losses

119,804

124,266

122,859

450,666

481,195

Noninterest income:

Net gains from sale of loans and other

mortgage production income

35,949

57,998

156,103

302,384

825,960

Mortgage loan origination fees

35,198

39,960

35,930

149,598

160,011

Securities commissions and fees

33,143

34,076

32,801

139,122

143,827

Investment and securities advisory fees

and commissions

30,661

35,031

42,834

127,399

152,443

Other

34,833

39,910

17,178

113,957

128,034

Total noninterest income

169,784

206,975

284,846

832,460

1,410,275

Noninterest expense:

Employees' compensation and benefits

167,892

200,450

229,717

773,688

1,007,235

Occupancy and equipment, net

23,077

25,041

25,741

97,115

100,602

Professional services

11,555

10,631

9,904

48,495

54,270

Other

50,844

52,616

56,832

207,701

225,291

Total noninterest expense

253,368

288,738

322,194

1,126,999

1,387,398

Income before income taxes

36,220

42,503

85,511

156,127

504,072

Income tax expense

9,642

9,249

20,715

36,833

117,976

Net income

26,578

33,254

64,796

119,294

386,096

Less: Net income attributable to

noncontrolling interest

1,022

1,186

2,611

6,160

11,601

Income attributable to Hilltop

$

25,556

$

32,068

$

62,185

$

113,134

$

374,495

Earnings per common share:

Basic:

$

0.40

$

0.50

$

0.79

$

1.61

$

4.64

Diluted:

$

0.39

$

0.50

$

0.78

$

1.60

$

4.61

Cash dividends declared per common

share

$

0.15

$

0.15

$

0.12

$

0.60

$

0.48

Weighted average shares outstanding:

Basic

64,602

64,552

78,933

70,434

80,708

Diluted

64,779

64,669

79,427

70,626

81,173

Three Months Ended December

31, 2022

Segment Results

Mortgage

All Other and

Hilltop

(in 000's)

Banking

Broker-Dealer

Origination

Corporate

Eliminations

Consolidated

Net interest income (expense)

$

109,335

$

14,116

$

(4,464

)

$

(3,279

)

$

7,734

$

123,442

Provision for (reversal of) credit

losses

3,925

(287

)

—

—

—

3,638

Noninterest income

11,869

92,803

71,439

1,870

(8,197

)

169,784

Noninterest expense

59,269

87,406

92,532

14,642

(481

)

253,368

Income (loss) before taxes

$

58,010

$

19,800

$

(25,557

)

$

(16,051

)

$

18

$

36,220

Year Ended December 31,

2022

Segment Results

Mortgage

All Other and

Hilltop

(in 000's)

Banking

Broker-Dealer

Origination

Corporate

Eliminations

Consolidated

Net interest income (expense)

$

413,603

$

51,597

$

(10,529

)

$

(13,135

)

$

17,439

$

458,975

Provision for (reversal of) credit

losses

8,250

59

—

—

—

8,309

Noninterest income

49,307

341,943

452,915

7,525

(19,230

)

832,460

Noninterest expense

235,190

355,713

478,904

59,030

(1,838

)

1,126,999

Income (loss) before taxes

$

219,470

$

37,768

$

(36,518

)

$

(64,640

)

$

47

$

156,127

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

December 31,

Selected Financial Data

2022

2022

2021

2022

2021

Hilltop

Consolidated:

Return on average stockholders' equity

4.99

%

6.26

%

9.93

%

5.11

%

15.38

%

Return on average assets

0.63

%

0.79

%

1.41

%

0.69

%

2.17

%

Net interest margin (1)

3.23

%

3.19

%

2.44

%

2.87

%

2.57

%

Net interest margin (taxable equivalent)

(2):

As reported

3.24

%

3.20

%

2.45

%

2.88

%

2.58

%

Impact of purchase accounting

7 bps

8 bps

12 bps

7 bps

12 bps

Book value per common share ($)

31.62

31.46

31.95

31.62

31.95

Shares outstanding, end of period

(000's)

64,685

64,591

78,965

64,685

78,965

Dividend payout ratio (3)

37.92

%

30.19

%

15.19

%

37.36

%

10.34

%

Banking

Segment:

Net interest margin (1)

3.42

%

3.42

%

2.81

%

3.11

%

3.07

%

Net interest margin (taxable equivalent)

(2):

As reported

3.43

%

3.43

%

2.82

%

3.11

%

3.08

%

Impact of purchase accounting

8 bps

10 bps

15 bps

9 bps

16 bps

Accretion of discount on loans

($000's)

2,173

2,858

4,716

10,552

18,789

Net recoveries (charge-offs) ($000's)

21

(2,735

)

405

(4,219

)

521

Return on average assets

1.31

%

1.41

%

1.44

%

1.19

%

1.55

%

Fee income ratio

9.8

%

9.9

%

10.8

%

10.7

%

10.0

%

Efficiency ratio

48.9

%

48.9

%

54.2

%

50.8

%

50.3

%

Employees' compensation and benefits

($000's)

34,526

35,934

34,415

137,531

130,276

Broker-Dealer

Segment:

Net revenue ($000's) (4)

106,919

114,184

94,569

393,540

424,421

Employees' compensation and benefits

($000's)

60,552

70,274

65,301

251,145

276,176

Variable compensation expense ($000's)

32,042

42,567

35,939

138,705

161,264

Compensation as a % of net revenue

56.6

%

61.5

%

69.1

%

63.8

%

65.1

%

Pre-tax margin (5)

18.5

%

15.3

%

1.8

%

9.6

%

10.3

%

Mortgage

Origination Segment:

Mortgage loan originations - volume

($000's):

Home purchases

1,895,731

2,832,136

3,559,137

10,823,002

14,429,190

Refinancings

147,511

211,075

1,430,369

1,837,154

8,239,093

Total mortgage loan originations -

volume

2,043,242

3,043,211

4,989,506

12,660,156

22,668,283

Mortgage loan sales - volume ($000's)

2,038,990

3,419,950

4,988,538

13,200,471

23,059,160

Net gains from mortgage loan sales (basis

points):

Loans sold to third parties

211

227

362

263

375

Impact of loans retained by banking

segment

(19

)

(9

)

(15

)

(11

)

(13

)

As reported

192

218

347

252

362

Mortgage servicing rights asset ($000's)

(6)

100,825

156,539

86,990

100,825

86,990

Employees' compensation and benefits

($000's)

64,940

86,079

121,758

353,973

568,221

Variable compensation expense ($000's)

26,724

44,312

73,208

183,804

373,929

___________________

(1)

Net interest margin is defined as net

interest income divided by average interest-earning assets.

(2)

Net interest margin (taxable equivalent),

a non-GAAP measure, is defined as taxable equivalent net interest

income divided by average interest-earning assets. Taxable

equivalent adjustments are based on the applicable 21% federal

income tax rate for all periods presented. The interest income

earned on certain earning assets is completely or partially exempt

from federal income tax. As such, these tax-exempt instruments

typically yield lower returns than taxable investments. To provide

more meaningful comparisons of net interest margins for all earning

assets, we use net interest income on a taxable-equivalent basis in

calculating net interest margin by increasing the interest income

earned on tax-exempt assets to make it fully equivalent to interest

income earned on taxable investments. The taxable equivalent

adjustments to interest income for Hilltop (consolidated) were $0.3

million, $0.4 million, $0.5 million, $1.6 million and $1.7 million,

respectively, for the periods presented and for the banking segment

were $0.2 million for each of the periods presented.

(3)

Dividend payout ratio is defined as cash

dividends declared per common share divided by basic earnings per

common share.

(4)

Net revenue is defined as the sum of total

broker-dealer net interest income and total broker-dealer

noninterest income.

(5)

Pre-tax margin is defined as income before

income taxes divided by net revenue.

(6)

Reported on a consolidated basis and

therefore does not include mortgage servicing rights assets related

to loans serviced for the banking segment, which are eliminated in

consolidation.

December 31,

September 30,

June 30,

March 31,

December 31,

Capital Ratios

2022

2022

2022

2022

2021

Tier 1 capital (to average assets):

PlainsCapital

10.26

%

10.29

%

9.67

%

9.74

%

10.20

%

Hilltop

11.47

%

11.41

%

10.53

%

12.46

%

12.58

%

Common equity Tier 1 capital (to

risk-weighted assets):

PlainsCapital

14.97

%

14.68

%

14.65

%

15.37

%

16.00

%

Hilltop

18.22

%

17.45

%

17.24

%

21.27

%

21.22

%

Tier 1 capital (to risk-weighted

assets):

PlainsCapital

14.97

%

14.68

%

14.65

%

15.37

%

16.00

%

Hilltop

18.22

%

17.45

%

17.24

%

21.27

%

21.22

%

Total capital (to risk-weighted

assets):

PlainsCapital

15.90

%

15.54

%

15.55

%

16.18

%

16.77

%

Hilltop

20.97

%

20.07

%

19.90

%

23.85

%

23.75

%

December 31,

September 30,

June 30,

March 31,

December 31,

Non-Performing Assets Portfolio

Data

2022

2022

2022

2022

2021

Loans accounted for on a non-accrual basis

($000's) (1):

Commercial real estate

4,269

4,735

4,947

6,153

6,601

Commercial and industrial

9,095

12,078

13,315

18,486

22,478

Construction and land development

1

1

1

1

2

1-4 family residential

16,138

16,968

16,542

18,723

21,123

Consumer

14

16

19

21

23

Broker-dealer

—

—

—

—

—

29,517

33,798

34,824

43,384

50,227

Troubled debt restructurings included in

accruing loans held for investment ($000's)

803

825

857

890

922

Non-performing loans ($000's)

30,320

34,623

35,681

44,274

51,149

Non-performing loans as a % of total

loans

0.33

%

0.39

%

0.38

%

0.47

%

0.52

%

Other real estate owned ($000's)

2,325

1,637

1,516

2,175

2,833

Other repossessed assets ($000's)

—

—

—

—

—

Non-performing assets ($000's)

32,645

36,260

37,197

46,449

53,982

Non-performing assets as a % of total

assets

0.20

%

0.22

%

0.22

%

0.25

%

0.29

%

Loans past due 90 days or more and still

accruing ($000's) (2):

92,099

96,532

82,410

87,489

60,775

___________________

(1)

Loans accounted for on a non-accrual basis

do not include COVID-19 related loan modifications through January

1, 2022. The banking segment’s COVID-19 payment deferment programs

since the second quarter of 2020 allowed for a deferral of

principal and/or interest payments with such deferred principal

payments due and payable on the maturity date of the existing loan.

For the periods presented, the banking segment’s actions through

December 31, 2021 included approval of COVID-19 related loan

modifications, resulting in active loan modifications of

approximately $4 million as of December 31, 2021.

(2)

Loans past due 90 days or more and still

accruing were primarily comprised of loans held for sale and

guaranteed by U.S. government agencies, including loans that are

subject to repurchase, or have been repurchased, by

PrimeLending.

Three Months Ended December

31,

2022

2021

Average

Interest

Annualized

Average

Interest

Annualized

Outstanding

Earned

Yield or

Outstanding

Earned

Yield or

Net Interest Margin (Taxable

Equivalent) Details (1)

Balance

or Paid

Rate

Balance

or Paid

Rate

Assets

Interest-earning assets

Loans held for sale

$

882,322

$

11,634

5.27

%

$

1,852,140

$

13,708

2.96

%

Loans held for investment, gross (2)

7,774,350

106,271

5.42

%

7,695,090

82,396

4.25

%

Investment securities - taxable

2,843,881

23,293

3.28

%

2,677,894

13,916

2.08

%

Investment securities - non-taxable

(3)

354,207

3,286

3.71

%

331,959

3,188

3.84

%

Federal funds sold and securities

purchased under agreements to resell

161,632

2,173

5.33

%

194,351

164

0.33

%

Interest-bearing deposits in other

financial institutions

1,749,902

15,751

3.57

%

2,683,656

943

0.14

%

Securities borrowed

1,350,873

14,162

4.10

%

1,474,421

8,524

2.26

%

Other

56,196

3,686

26.02

%

52,848

765

5.74

%

Interest-earning assets, gross (3)

15,173,363

180,256

4.71

%

16,962,359

123,604

2.89

%

Allowance for credit losses

(92,344

)

(109,555

)

Interest-earning assets, net

15,081,019

16,852,804

Noninterest-earning assets

1,637,295

1,402,216

Total assets

$

16,718,314

$

18,255,020

Liabilities and Stockholders'

Equity

Interest-bearing liabilities

Interest-bearing deposits

$

7,154,802

$

28,238

1.57

%

$

7,901,704

$

4,404

0.22

%

Securities loaned

1,274,038

13,179

4.10

%

1,422,303

6,624

1.85

%

Notes payable and other borrowings

1,355,809

15,114

4.42

%

1,233,924

7,733

2.49

%

Total interest-bearing liabilities

9,784,649

56,531

2.29

%

10,557,931

18,761

0.70

%

Noninterest-bearing liabilities

Noninterest-bearing deposits

4,222,143

4,509,891

Other liabilities

652,900

677,433

Total liabilities

14,659,692

15,745,255

Stockholders’ equity

2,032,287

2,484,301

Noncontrolling interest

26,335

25,464

Total liabilities and stockholders'

equity

$

16,718,314

$

18,255,020

Net interest income (3)

$

123,725

$

104,843

Net interest spread (3)

2.42

%

2.19

%

Net interest margin (3)

3.24

%

2.45

%

Year Ended December

31,

2022

2021

Average

Interest

Annualized

Average

Interest

Annualized

Outstanding

Earned

Yield or

Outstanding

Earned

Yield or

Net Interest Margin (Taxable

Equivalent) Details (1)

Balance

or Paid

Rate

Balance

or Paid

Rate

Assets

Interest-earning assets

Loans held for sale

$

1,221,235

$

52,315

4.28

%

$

2,293,543

$

64,767

2.82

%

Loans held for investment, gross (2)

7,840,848

363,892

4.71

%

7,645,292

339,548

4.44

%

Investment securities - taxable

2,819,282

75,805

2.69

%

2,493,848

47,582

1.91

%

Investment securities - non-taxable

(3)

310,315

11,608

3.74

%

313,703

11,448

3.65

%

Federal funds sold and securities

purchased under agreements to resell

162,575

4,098

2.52

%

152,273

372

0.24

%

Interest-bearing deposits in other

financial institutions

2,306,960

31,705

1.37

%

2,078,666

2,942

0.14

%

Securities borrowed

1,298,276

44,414

3.37

%

1,445,464

61,667

4.21

%

Other

55,280

8,873

16.05

%

50,929

3,332

6.54

%

Interest-earning assets, gross (3)

16,014,771

592,710

3.70

%

16,473,718

531,658

3.23

%

Allowance for credit losses

(92,828

)

(129,689

)

Interest-earning assets, net

15,921,943

16,344,029

Noninterest-earning assets

1,488,994

1,451,928

Total assets

$

17,410,937

$

17,795,957

Liabilities and Stockholders'

Equity

Interest-bearing liabilities

Interest-bearing deposits

$

7,561,501

$

50,412

0.67

%

$

7,722,584

$

23,624

0.31

%

Securities loaned

1,184,498

38,570

3.26

%

1,374,142

50,974

3.71

%

Notes payable and other borrowings

1,293,133

43,158

3.34

%

1,216,381

32,393

2.66

%

Total interest-bearing liabilities

10,039,132

132,140

1.32

%

10,313,107

106,991

1.04

%

Noninterest-bearing liabilities

Noninterest-bearing deposits

4,455,779

4,157,962

Other liabilities

675,629

863,976

Total liabilities

15,170,540

15,335,045

Stockholders’ equity

2,213,756

2,435,185

Noncontrolling interest

26,641

25,727

Total liabilities and stockholders'

equity

$

17,410,937

$

17,795,957

Net interest income (3)

$

460,570

$

424,667

Net interest spread (3)

2.38

%

2.19

%

Net interest margin (3)

2.88

%

2.58

%

___________________

(1)

Information presented on a

consolidated basis.

(2)

Average balance includes

non-accrual loans.

(3)

Presented on a taxable-equivalent

basis with annualized taxable equivalent adjustments based on the

applicable 21% federal income tax rate for the periods presented.

The adjustment to interest income was $0.3 million and $0.5 million

for the three months ended December 31, 2022 and 2021,

respectively, and $1.6 million and $1.7 million for the year ended

December 31, 2022 and 2021, respectively.

Conference Call Information

Hilltop will host a live webcast and conference call at 8:00 AM

Central (9:00 AM Eastern) on Friday, January 27, 2023. Hilltop

President and CEO Jeremy B. Ford and Hilltop CFO William B. Furr

will review fourth quarter and full year 2022 financial results.

Interested parties can access the conference call by dialing

1-844-200-6205 (United States), 1-833-950-0062 (Canada) or

1-929-526-1599 (all other locations) and then using the access code

429656. The conference call also will be webcast simultaneously on

Hilltop’s Investor Relations website

(http://ir.hilltop-holdings.com).

About Hilltop

Hilltop Holdings is a Dallas-based financial holding company.

Its primary line of business is to provide business and consumer

banking services from offices located throughout Texas through

PlainsCapital Bank. PlainsCapital Bank’s wholly owned subsidiary,

PrimeLending, provides residential mortgage lending throughout the

United States. Hilltop Holdings’ broker-dealer subsidiaries,

Hilltop Securities Inc. and Momentum Independent Network Inc.,

provide a full complement of securities brokerage, institutional

and investment banking services in addition to clearing services

and retail financial advisory. At December 31, 2022, Hilltop

employed approximately 4,140 people and operated approximately 360

locations in 47 states. Hilltop Holdings’ common stock is listed on

the New York Stock Exchange under the symbol “HTH.” Find more

information at Hilltop-Holdings.com, PlainsCapital.com,

PrimeLending.com and HilltopSecurities.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements anticipated in

such statements. Forward-looking statements speak only as of the

date they are made and, except as required by law, we do not assume

any duty to update forward-looking statements. Such forward-looking

statements include, but are not limited to, statements concerning

such things as our plans, objectives, strategies, expectations,

intentions and other statements that are not statements of

historical fact, and may be identified by words such as

“anticipates,” “believes,” “building,” “continue,” “could,”

“drive,” “estimates,” “expects,” “extent,” “focus,” “forecasts,”

“goal,” “guidance,” “intends,” “may,” “might,” “outlook,” “plan,”

“position,” “probable,” “progressing,” “projects,” “prudent,”

“seeks,” “should,” “target,” “view,” “will” or “would” or the

negative of these words and phrases or similar words or phrases.

The following factors, among others, could cause actual results to

differ materially from those set forth in the forward-looking

statements: (i) the credit risks of lending activities, including

our ability to estimate credit losses and the allowance for credit

losses, as well as the effects of changes in the level of, and

trends in, loan delinquencies and write-offs; (ii) effectiveness of

our data security controls in the face of cyber attacks; (iii)

changes in general economic, market and business conditions in

areas or markets where we compete, including changes in the price

of crude oil; (iv) changes in the interest rate environment; and

(v) risks associated with concentration in real estate related

loans. For further discussion of such factors, see the risk factors

described in our most recent Annual Report on Form 10-K and

subsequent Quarterly Reports on Form 10-Q and other reports that

are filed with the Securities and Exchange Commission. All

forward-looking statements are qualified in their entirety by this

cautionary statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230126005878/en/

Investor Relations Contact: Erik Yohe 214-525-4634

eyohe@hilltop-holdings.com

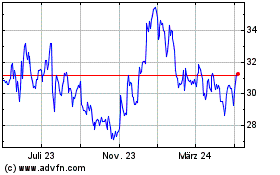

Hilltop (NYSE:HTH)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

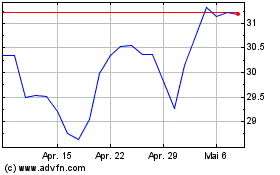

Hilltop (NYSE:HTH)

Historical Stock Chart

Von Apr 2023 bis Apr 2024