Statement of Changes in Beneficial Ownership (4)

16 März 2023 - 9:12PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Buck Michele |

2. Issuer Name and Ticker or Trading Symbol

HERSHEY CO

[

HSY

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chairman, President and CEO |

|

(Last)

(First)

(Middle)

19 E. CHOCOLATE AVENUE |

3. Date of Earliest Transaction

(MM/DD/YYYY)

3/14/2023 |

|

(Street)

HERSHEY, PA 17033

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 3/14/2023 | | M | | 4251 | A | $105.96 | 167694 | D | |

| Common Stock | 3/14/2023 | | S(1) | | 1877 | D | $240.425 (2) | 165817 | D | |

| Common Stock | 3/14/2023 | | S(1) | | 2220 | D | $241.367 (3) | 163597 | D | |

| Common Stock | 3/14/2023 | | S(1) | | 154 | D | $242.031 (4) | 163443 | D | |

| Common Stock | 3/14/2023 | | S(1) | | 2900 | D | $240.451 (5) | 160543 | D | |

| Common Stock | 3/14/2023 | | S(1) | | 2007 | D | $241.468 (6) | 158536 | D | |

| Common Stock | 3/14/2023 | | S(1) | | 93 | D | $242.14 | 158443 | D | |

| Common Stock | 3/14/2023 | | S(1) | | 1991 | D | $240.40 (7) | 156452 | D | |

| Common Stock | 3/14/2023 | | S(1) | | 2802 | D | $241.338 (8) | 153650 | D | |

| Common Stock | 3/14/2023 | | S(1) | | 207 | D | $242.019 (9) | 153443 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Non-qualified Stock Option (Right to Buy) | $105.96 | 3/14/2023 | | M | | | 4251 | (10) | 2/17/2024 | Common Stock | 4251 | $0 | 17004 | D | |

| Explanation of Responses: |

| (1) | The sale reported in this Form 4 was effected pursuant to a Rule 10b5-1 trading plan adopted by the reporting person on August 16, 2022. |

| (2) | This reflects the weighted average price for the shares, which were sold in multiple transactions at prices that ranged from $239.860 to $240.840. Upon the request of the SEC staff, the issuer or a security holder of the issuer, the reporting person undertakes to provide information regarding the number of shares sold at each separate price. |

| (3) | This reflects the weighted average price for the shares, which were sold in multiple transactions at prices that ranged from $240.870 to $241.850. Upon the request of the SEC staff, the issuer or a security holder of the issuer, the reporting person undertakes to provide information regarding the number of shares sold at each separate price. |

| (4) | This reflects the weighted average price for the shares, which were sold in multiple transactions at prices that ranged from $242.010 to $242.080.

Upon the request of the SEC staff, the issuer or a security holder of the issuer, the reporting person undertakes to provide information regarding the number of shares sold at each separate price. |

| (5) | This reflects the weighted average price for the shares, which were sold in multiple transactions at prices that ranged from $239.960 to $240.895. Upon the request of the SEC staff, the issuer or a security holder of the issuer, the reporting person undertakes to provide information regarding the number of shares sold at each separate price. |

| (6) | This reflects the weighted average price for the shares, which were sold in multiple transactions at prices that ranged from $241.000 to $241.980. Upon the request of the SEC staff, the issuer or a security holder of the issuer, the reporting person undertakes to provide information regarding the number of shares sold at each separate price. |

| (7) | This reflects the weighted average price for the shares, which were sold in multiple transactions at prices that ranged from $239.860 to $240.840. Upon the request of the SEC staff, the issuer or a security holder of the issuer, the reporting person undertakes to provide information regarding the number of shares sold at each separate price. |

| (8) | This reflects the weighted average price for the shares, which were sold in multiple transactions at prices that ranged from $240.870 to $241.810. Upon the request of the SEC staff, the issuer or a security holder of the issuer, the reporting person undertakes to provide information regarding the number of shares sold at each separate price. |

| (9) | This reflects the weighted average price for the shares, which were sold in multiple transactions at prices that ranged from $242.010 to $242.140. Upon the request of the SEC staff, the issuer or a security holder of the issuer, the reporting person undertakes to provide information regarding the number of shares sold at each separate price. |

| (10) | The options vested according to the following schedule: 25% vested on February 18, 2015, 25% vested on February 18, 2016, 25% vested on February 18, 2017 and 25% vested on February 18, 2018. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Buck Michele

19 E. CHOCOLATE AVENUE

HERSHEY, PA 17033 | X |

| Chairman, President and CEO |

|

Signatures

|

| /s/ Lauren H. Lacey, Agent for Michele G. Buck | | 3/16/2023 |

| **Signature of Reporting Person | Date |

| Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. |

| * | If the form is filed by more than one reporting person, see Instruction 4(b)(v). |

| ** | Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a). |

| Note: | File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. |

| Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

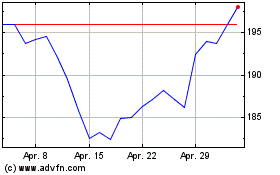

Hershey (NYSE:HSY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Hershey (NYSE:HSY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024