HSBC, Temasek Launch Sustainable Infrastructure Financing Firm

30 August 2022 - 9:58AM

Dow Jones News

By Fabiana Negrin Ochoa

HSBC Holdings PLC and Singapore state-investment firm Temasek

Holdings Pte. are contributing a combined $150 million as equity

capital to establish a company focused on financing sustainable

infrastructure in Asia.

The company, called Pentagreen Capital, aims to provide more

than $1 billion in loans for sustainable infrastructure

construction in the next five years, HSBC and Temasek said in a

joint statement Tuesday.

Pentagreen will operate independently from HSBC and Temasek,

which will be represented on its board, according to the statement.

Marat Zapparov, previously of International Finance Corporation,

will serve as chief executive. The board will be chaired by Kai

Nargolwala, who holds the same role at Singapore Pools Pte.

Pentagreen, which will initially focus on opportunities in

Southeast Asia, aims to serve as an alternative source of capital

for projects that could otherwise struggle to secure funding. Its

main target areas will be clean transport, renewable energy and

energy storage, and water and waste management, though areas such

as climate adaptation and land use will be considered in

future.

"We aim to fill the gap between traditional financing options

from banks and development financiers," Mr. Zapparov said.

The Asian Development Bank, one of Pentagreen's strategic

partners, has estimated that Asia will need to invest about $26

trillion between 2016 and 2030 on infrastructure to maintain growth

momentum, address poverty and respond to climate change.

Write to Fabiana Negrin Ochoa at fabiana.negrinochoa@wsj.com

(END) Dow Jones Newswires

August 30, 2022 03:43 ET (07:43 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

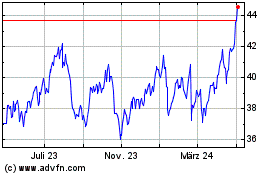

HSBC (NYSE:HSBC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

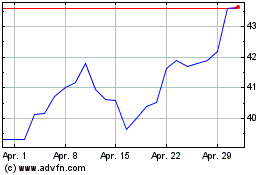

HSBC (NYSE:HSBC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024