As filed with the Securities and Exchange Commission on August 11, 2022

Registration Statement No. 333-258075

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 3

TO FORM S-1

ON FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HOLLEY INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

87-1727560

(I.R.S. Employer Identification Number)

1801 Russellville Road

Bowling Green, Kentucky 42101

(270) 782-2900

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Thomas W. Tomlinson

Chief Executive Officer

1801 Russellville Road

Bowling Green, Kentucky 42101

(270) 782-2900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Jay H. Knight

Taylor K. Wirth

Bass, Berry & Sims PLC

150 Third Avenue South, Suite 2800

Nashville, Tennessee 37201

(615) 742-7756

|

|

Dominic Bardos

Carly Kennedy

Holley Inc.

1801 Russellville Road

Bowling Green, Kentucky 42101

(270) 782-2900

|

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

| |

|

Emerging growth company

|

☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

On July 21, 2021, Holley Inc., a Delaware corporation (the “Company,” “Holley,” “we,” “us” or “our”), f/k/a Empower Ltd. (“Empower”), filed a registration statement with the Securities and Exchange Commission (the “SEC”), on Form S-1 (File No. 333-258075) (the “Registration Statement”), to initially register for resale by the selling securityholders named therein or their permitted transferees (i) up to 109,257,218 shares of common stock, par value $0.0001 per share, of the Company (“Common Stock”), and (ii) up to 6,333,333 warrants to purchase Common Stock. In addition, the Registration Statement registered the issuance by us of up to an aggregate of 6,333,333 shares of our Common Stock issuable upon the exercise of the warrants offered thereby. The Registration Statement was declared effective by the SEC on July 28, 2021.

On February 4, 2022, we filed Post-Effective Amendment No. 1 to the Registration Statement (“POSAM 1”). POSAM 1 included updated information related to the restatement of the (i) audited financial statements included in Amendment No. 1 to Empower’s Annual Report on Form 10-K/A, originally filed with the SEC on May 19, 2021; (ii) unaudited interim financial statements included in Empower’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2021, originally filed with the SEC on May 19, 2021; and (iii) unaudited interim financial statements included in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2021, originally filed with the SEC on August 12, 2021, which amendments were filed with the SEC on February 4, 2022, and in each case as a result of management’s determination that all outstanding Class A ordinary shares, par value $0.0001 per share, should be classified as temporary equity regardless of the net tangible assets redemption limitation contained in the governing documents of Empower. POSAM 1 was declared effective by the SEC on February 8, 2022.

On March 15, 2022, we filed Post-Effective Amendment No. 2 to the Registration Statement (“POSAM 2”). POSAM 2 included updated disclosures related to, among other things, the information contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, which was filed substantially concurrently with POSAM 2. POSAM 2 was declared effective by the SEC on March 17, 2022.

We are filing this Post-Effective Amendment No. 3 to the Registration Statement (“POSAM 3”) to convert the registration statement on Form S-1 into a registration statement on Form S-3.

No additional securities are being registered under this POSAM 3. All applicable registration and filing fees payable in connection with the securities covered by this POSAM 3 were paid at the time of the original filing of the Registration Statement.

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling securityholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 11, 2022

PROSPECTUS

91,102,264 Shares of Common Stock

Up to 6,333,333 Shares of Common Stock Issuable Upon Exercise of the Warrants

Up to 6,333,333 Warrants

This prospectus relates to the offer and sale from time to time by the selling securityholders named in this prospectus (the “Selling Securityholders”), or any of their pledgees, donees, assignees and successors-in-interest (collectively, the “permitted transferees”), of: (i) up to 91,102,264 shares of our Common Stock, and (ii) up to 6,333,333 warrants to purchase Common Stock. We will not receive any proceeds from the sale of shares of Common Stock or warrants by the Selling Securityholders pursuant to this prospectus.

In addition, this prospectus relates to the issuance by us of up to an aggregate of 6,333,333 shares of our Common Stock issuable upon the exercise of the warrants offered hereby. We will receive the proceeds from any exercise of any warrants for cash. We will bear the costs, fees and expenses incurred in effecting the registration of the securities covered by this prospectus, including all registration and filing fees, New York Stock Exchange (“NYSE”) listing fees and fees and expenses of our counsel and our independent registered public accounting firm. The Selling Securityholders will pay any underwriting discounts and commissions and expenses incurred by the Selling Securityholders for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Securityholders in disposing of the securities.

We are registering the securities for resale pursuant to the Selling Securityholders’ registration rights under certain agreements between us and the Selling Securityholders. Our registration of the securities covered by this prospectus does not mean that either we or the Selling Securityholders will offer or sell any of the shares of Common Stock or warrants. The Selling Securityholders or their permitted transferees may offer, sell or distribute all or a portion of their shares of Common Stock or warrants publicly or through private transactions at prevailing market prices or at negotiated prices. We provide more information about how the Selling Securityholders may sell the Common Stock or warrants in the section entitled “Plan of Distribution.”

You should read this prospectus and any prospectus supplement or amendment carefully before you invest in our securities.

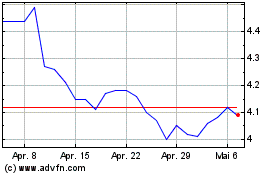

Our Common Stock and our public warrants are listed on the NYSE under the symbols “HLLY” and “HLLY WS,” respectively. On August 9, 2022, the closing price of our Common Stock was $6.19 and the closing price of our public warrants was $1.13.

We are an “emerging growth company” and a “smaller reporting company” under federal securities laws and are subject to reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 8 of this prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022.

TABLE OF CONTENTS

|

INTRODUCTORY NOTE REGARDING THE BUSINESS COMBINATION

|

1 |

|

ABOUT THIS PROSPECTUS

|

3 |

|

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

|

3 |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

4 |

|

THE COMPANY

|

6 |

|

THE OFFERING

|

7 |

|

RISK FACTORS

|

8 |

|

USE OF PROCEEDS

|

9 |

|

SELLING SECURITYHOLDERS

|

10 |

|

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

|

14 |

|

PLAN OF DISTRIBUTION

|

19 |

|

DESCRIPTION OF SECURITIES

|

22 |

|

LEGAL MATTERS

|

32 |

|

EXPERTS

|

32 |

|

WHERE YOU CAN FIND MORE INFORMATION

|

32 |

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

32 |

INTRODUCTORY NOTE REGARDING THE BUSINESS COMBINATION

On July 16, 2021 (the “Closing” and such date the “Closing Date”), we consummated the business combination pursuant to that certain Agreement and Plan of Merger, dated March 11, 2021, (the “Merger Agreement”), by and among Empower, Empower Merger Sub I Inc., a Delaware corporation and a direct wholly owned subsidiary of Empower (“Merger Sub I”), Empower Merger Sub II LLC, a Delaware limited liability company and a direct wholly owned subsidiary of Empower (“Merger Sub II”), and Holley Intermediate Holdings, Inc., a Delaware corporation (“Holley Intermediate”).

The Merger Agreement provided for, among other things, the following transactions: (i) Empower changed its jurisdiction of incorporation by deregistering as a Cayman Islands exempted company and continuing and domesticating as a corporation incorporated under the laws of the State of Delaware (the “Domestication”), and, in connection with the Domestication, (A) each outstanding Class A ordinary share of Empower, par value $0.0001 per share, converted automatically into one share of our Common Stock, and (B) each outstanding Class B ordinary share of Empower, par value $0.0001 per share (the “Founder Shares”), converted automatically into one share of our Common Stock; and (ii) following the Domestication, (A) Merger Sub I merged with and into Holley Intermediate, with Holley Intermediate surviving as a wholly owned subsidiary of Empower (“Merger I”), (B) immediately following Merger I, Holley Intermediate merged with and into Merger Sub II, with Merger Sub II surviving as a limited liability company and a wholly owned subsidiary of Empower (“Merger II” and, together with Merger I, the “Mergers”). The transactions set forth in the Merger Agreement, including the Mergers, constituted a “Business Combination” as contemplated by Empower’s amended and restated memorandum and articles of association. Pursuant to the Merger Agreement, at the Closing, all outstanding shares of Holley Intermediate common stock as of immediately prior to the effective time of Merger I were cancelled and Holley Parent Holdings, LLC, the sole stockholder of Holley Intermediate (the “Holley Stockholder”), received $264,717,627.49 in cash and 67,673,884 shares of Common Stock (at a deemed value of $10.00 per share). Upon the Closing, Empower changed its name to “Holley Inc.” and its trading symbol of its Common Stock on the NYSE from “EMPW” to “HLLY.”

Concurrent with the execution of the Merger Agreement, Empower entered into certain Subscription Agreements, dated as of March 11, 2021, by and between Empower, on the one hand, and certain investors (“PIPE Investors”) on the other hand (collectively, the “PIPE Subscription Agreements”), pursuant to which, among other things, the PIPE Investors agreed to subscribe for and purchase, and Empower agreed to issue and sell to the PIPE Investors an aggregate of 24,000,000 shares of Common Stock, at a per share price of $10.00 for an aggregate purchase price of $240,000,000, concurrent with the Closing, on the terms and subject to the conditions set forth therein.

Concurrent with the execution of the Merger Agreement, Empower entered into that certain Sponsor Agreement (the “Sponsor Agreement”) with Empower Sponsor Holdings LLC, a Delaware limited liability company (the “Sponsor”), and the Holley Stockholder, whereby the Sponsor agreed to (i) waive certain of its anti-dilution and conversion rights with respect to the Founder Shares and (ii) an earn-out in respect of 2,187,500 Founder Shares (the “Earn-Out Shares”) vesting in two equal tranches upon the achievement of specified conditions. The Earn-Out Shares will be forfeited by the Sponsor if the applicable conditions are not satisfied before July 16, 2028 (seven years after the Closing Date).

Concurrent with the execution of the Merger Agreement, Empower and Empower Funding, LLC, a Delaware limited liability company and an affiliate of the Sponsor (the “A&R FPA Investor”) entered into that certain Amended and Restated Forward Purchase Agreement (the “A&R FPA”), pursuant to which the A&R FPA Investor agreed to purchase an aggregate of 5,000,000 units of Empower (the “Empower Units”), each Empower unit representing a right to acquire one share of Common Stock and one-third of one warrant to purchase Common Stock at an exercise price of $11.50 per share (each a “Public Warrant”), for $50,000,000 in the aggregate. On July 9, 2021, Empower and the A&R FPA Investor entered into that certain Assignment and Assumption Agreement with the New FPA Purchasers, pursuant to which the A&R FPA Investor assigned its right to purchase 4,975,000 Empower Units to MidOcean Partners V, L.P. and 25,000 Empower Units to MidOcean Partners V Executive, L.P. (collectively, the “New FPA Purchasers”), in each case pursuant to the A&R FPA. Immediately prior to the Domestication, the New FPA Purchasers were issued 5,000,000 Empower Units for an aggregate purchase price of $50,000,000. Following the Domestication, each Empower Unit was subsequently separated into one share of Common Stock and one-third of one Public Warrant. Pursuant to the A&R FPA, the New FPA Purchasers agreed to not exercise the underlying Public Warrants until October 9, 2021 (the one year anniversary of Empower’s initial public offering).

In connection with the Business Combination, certain parties entered into agreements imposing certain transfer restrictions on their ownership of Common Stock and Warrants (as defined below). Pursuant to the terms of a letter agreement entered into with Empower, dated October 6, 2020, the Sponsor and Empower’s officers and directors agreed not to transfer, assign or sell their Founder Shares until the earliest of (A) July 16, 2022 (one year after the Closing Date), (B) the closing price of the Common Stock equals or exceeds $12.00 per share for a specified post-Closing time period, or (C) the date on which the Company completes a liquidation, merger, share exchange or other similar transaction. These parties also agreed, subject to limited exceptions, not to transfer, assign or sell any of the warrants to purchase Common Stock issued to the Sponsor in a private placement in connection with Empower’s initial public offering (the “Private Warrants” and together with the Public Warrants, the “Warrants”) until August 15, 2021, the date that was 30 days after the Closing Date. Concurrent with the execution of the Merger Agreement, the Holley Stockholder entered into a lock-up agreement with Empower, pursuant to which the Holley Stockholder agreed, among other things, to certain transfer restrictions on its shares of Common Stock as follows, subject to certain exceptions: (i) 50,750,000 shares of Common Stock may not be transferred until the earlier to occur of: (A) July 16, 2022, (B) if the closing price of Common Stock equals or exceeds $12.00 per share for a specified post-Closing time period, or (C) the date on which the Company completes a liquidation, merger, share exchange or other similar transaction and (ii) 16,923,884 shares of Common Stock may not be transferred before January 16, 2022 (six months following the Closing Date).

At the Closing, the Sponsor, the Company and the Holley Stockholder entered into that certain Amended and Restated Registration Rights Agreement, pursuant to which the Company agreed to register for resale certain shares of Common Stock and other equity securities of the Company that are held by the Sponsor and the Holley Stockholder from time to time.

At the Closing, the Company, the Sponsor, certain affiliates of the Sponsor, the Holley Stockholder and Sentinel Capital Partners V, L.P., Sentinel Capital Partners V-A, L.P. and Sentinel Capital Investors V, L.P., controlling affiliates of the Holley Stockholder, entered into a Stockholders’ Agreement, pursuant to which the Holley Stockholder and the Sponsor have the right to designate nominees for election to the Company’s board of directors subject to certain beneficial ownership requirements.

This prospectus relates to the offer and sale from time to time by the Selling Securityholders named in this prospectus of the following:

| |

●

|

up to 91,102,264 shares of Common Stock, consisting of: (i) 6,250,000 shares of Common Stock issued to holders of the Founder Shares in connection with the Domestication; (ii) 4,666,667 shares of Common Stock issuable upon the exercise of the Private Warrants; (iii) 18,845,047 shares of Common Stock issued to the PIPE Investors pursuant to the PIPE Subscription Agreements; (iv) 5,000,000 shares of Common Stock issued to the New FPA Purchasers pursuant to the A&R FPA, as assigned by the A&R FPA Investor; (v) 1,666,666 shares of Common Stock issuable upon exercise of Public Warrants issued to the New FPA Purchasers pursuant to the A&R FPA, as assigned by the A&R FPA Investor; and (vi) 54,673,884 shares of Common Stock issued to the Holley Stockholder in connection with the Business Combination; and

|

| |

●

|

up to 6,333,333 Warrants, consisting of (i) 1,666,666 Public Warrants issued to the New FPA Purchasers pursuant to the A&R FPA, as assigned by the A&R FPA Investor, and (ii) 4,666,667 Private Warrants issued to the Sponsor.

|

In addition, this prospectus relates to the issuance by us of up to an aggregate of 6,333,333 shares of Common Stock issuable upon the exercise of the Warrants offered hereby.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, we and the Selling Securityholders may, from time to time, issue, offer and sell, as applicable, any combination of the securities described in this prospectus in one or more offerings from time to time through any means described in the section entitled “Plan of Distribution.” More specific terms of any securities that the Selling Securityholders offer and sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the Common Stock and/or Warrants being offered and the terms of the offering.

A prospectus supplement may also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should rely only on the information contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. See “Where You Can Find More Information.”

Neither we nor the Selling Securityholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus, any accompanying prospectus supplement or any free writing prospectus we have prepared or authorized. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate only as of the date on the front of those documents only, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

For investors outside the United States: neither we nor the Selling Securityholders have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution of this prospectus outside the United States.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

Unless the context indicates otherwise, as used in this prospectus, the terms “us,” “our,” “Holley,” “we,” the “company” and similar designations refer to Holley Inc. and its consolidated subsidiaries.

TRADEMARKS, SERVICE MARKS AND TRADE NAMES

This prospectus contains references to trademarks, trade names or service marks of Holley and other entities. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus are presented without the TM, SM and ® symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our respective rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things, the plans, strategies and prospects, both business and financial of the Company. These statements are based on the beliefs and assumptions of our management. Although the Company believes that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, the Company cannot assure you that it will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates,” “intends” or similar expressions. Forward-looking statements contained in this prospectus include, but are not limited to, statements about the ability of the Company to:

| |

● |

anticipate and manage through disruptions and higher costs in manufacturing, supply chain, logistical operations, and shortages of certain company products in distribution channels; |

| |

●

|

access, collect and use personal data about consumers;

|

| |

●

|

execute its business strategy, including monetization of services provided and expansions in and into existing and new lines of business;

|

| |

●

|

anticipate the impact of the coronavirus disease 2019 (“COVID-19”) pandemic and its effect on business and financial conditions;

|

| |

●

|

manage risks associated with operational changes in response to the COVID-19 pandemic;

|

| |

●

|

recognize the anticipated benefits of and successfully deploy the proceeds from the Business Combination (as defined herein), which may be affected by, among other things, competition, the ability to integrate the combined businesses and the ability of the combined business to grow and manage growth profitably;

|

| |

●

|

anticipate the uncertainties inherent in the development of new business lines and business strategies;

|

| |

●

|

retain and hire necessary employees;

|

| |

●

|

increase brand awareness;

|

| |

●

|

attract, train and retain effective officers, key employees or directors;

|

| |

●

|

upgrade and maintain information technology systems;

|

| |

●

|

respond to cyber-attacks, security breaches, or computer viruses;

|

| |

●

|

comply with privacy and data protection laws, and respond to privacy or data breaches, or the loss of data;

|

| |

●

|

acquire and protect intellectual property;

|

| |

●

|

meet future liquidity requirements and comply with restrictive covenants related to long-term indebtedness;

|

| |

●

|

effectively respond to general economic and business conditions;

|

| |

●

|

maintain proper and effective internal controls;

|

| |

●

|

maintain the listing on, or the delisting of the Company’s securities from, the NYSE or an inability to have our securities listed on another national securities exchange;

|

| |

●

|

obtain additional capital, including use of the debt market;

|

| |

●

|

enhance future operating and financial results;

|

| |

●

|

anticipate rapid technological changes;

|

| |

●

|

comply with laws and regulations applicable to its business and industry, including laws and regulations related to environmental health and safety;

|

| |

●

|

stay abreast of modified or new laws and regulations;

|

| |

●

|

anticipate the impact of, and response to, new accounting standards;

|

| |

●

|

respond to fluctuations in foreign currency exchange rates and political unrest and regulatory changes in international markets from various events;

|

| |

●

|

anticipate the rise in interest rates which would increase the cost of capital, as well as responding to inflationary pressures;

|

| |

●

|

anticipate the significance and timing of contractual obligations;

|

| |

●

|

maintain key strategic relationships with partners and resellers;

|

| |

●

|

respond to uncertainties associated with product and service development and market acceptance;

|

| |

●

|

manage to finance operations on an economically viable basis;

|

| |

●

|

anticipate the impact of new U.S. federal income tax law, including the impact on deferred tax assets;

|

| |

●

|

respond to litigation, investigations, complaints, product liability claims and/or adverse publicity;

|

| |

●

|

anticipate the time during which we will be an emerging growth company under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”);

|

| |

●

|

anticipate the impact of changes in consumer spending patterns, consumer preferences, local, regional and national economic conditions, crime, weather, demographic trends and employee availability; and

|

| |

●

|

other risks and factors, listed under the caption “Risk Factors” included in our Annual Report on 10-K for the year ended December 31, 2021, as filed with the SEC on March 15, 2022, and in any subsequent filings with the SEC.

|

These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this prospectus are more fully described under the heading “Risk Factors” and elsewhere in this prospectus. The risks described under the heading “Risk Factors” are not exhaustive. Other sections of this prospectus describe additional factors that could adversely affect the business, financial condition or results of operations of the Company. New risk factors emerge from time to time and it is not possible to predict all such risk factors, nor can the Company assess the impact of all such risk factors on the business of the Company, or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements attributable to the Company or persons acting on their behalf are expressly qualified in their entirety by the foregoing cautionary statements. The Company undertakes no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

In addition, statements of belief and similar statements reflect the beliefs and opinions of the Company on the relevant subject. These statements are based upon information available to the Company as of the date of this prospectus, and while the Company believes such information forms a reasonable basis for such statements, such information may be limited or incomplete, and statements should not be read to indicate that the Company has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon these statements.

THE COMPANY

Overview

Founded in 1903, we have been a part of the automotive industry for well over a century. We are a leading designer, marketer, and manufacturer of high-performance automotive aftermarket products for car and truck enthusiasts. Our products span a number of automotive platforms and are sold across multiple channels. We attribute a major component of our success to our brands, including “Holley”, “APR”, “MSD” and “Flowmaster”, among others. In addition, we have recently added to our brand lineup through a series of strategic acquisitions, including our 2020 acquisitions of Simpson Racing Products, Inc., Drake Automotive Group LLC and Detroit Speed, Inc., and our 2021 acquisitions of substantially all the assets of AEM Performance Electronics, Finspeed, LLC, Classic Instruments LLC, ADS Precision Machining, Inc., d.b.a. Arizona Desert Shocks, Baer, Inc., d.b.a. Baer Brakes, Brothers Mail Order Industries, Inc., d.b.a. Brothers Trucks, Rocket Performance Machine, Inc., d.b.a. Rocket Racing Wheels, and Speartech Fuel Injections Systems, Inc. Since December 31, 2021, we have completed an additional three acquisitions, including the acquisition of substantially all of the assets of John’s Ind., Inc., Southern Kentucky Classics, and Vesta Motorsports USA, Inc. d.b.a. RaceQuip. Through these strategic acquisitions, we have increased our market position in the otherwise highly fragmented performance automotive aftermarket industry.

We operate in the performance automotive aftermarket parts industry. We believe there is ample opportunity to continue our expansion into new products and markets, such as exterior accessories and mobile electronics, representing a natural progression for us to grow market share as these adjacencies are driven by passionate enthusiasts, consistent with our core categories.

Emerging Growth Company and Smaller Reporting Company Status

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, as modified by the JOBS Act. As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period.

We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of our initial public offering, (b) in which we have total annual gross revenue of at least $1.07 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our Common Stock that are held by non-affiliates exceeds $700 million as of the prior June 30, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period. References herein to “emerging growth company” have the meaning associated with it in the JOBS Act.

Additionally, we are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of the fiscal year in which (1) the market value of our Common Stock held by non-affiliates exceeds $250 million as of the prior June 30, or (2) our annual revenues exceeded $100 million during such completed fiscal year and the market value of our Common Stock held by non-affiliates exceeds $700 million as of the prior June 30.

Corporate Information

The mailing address for our principal executive office is 1801 Russellville Road, Bowling Green, Kentucky 42101, and our telephone number is (270) 782-2900. Our website address is www.holley.com. The information contained in or accessible from our website is not incorporated into this prospectus, and you should not consider it part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

THE OFFERING

|

Issuer

|

Holley Inc.

|

| |

|

|

Shares of Common Stock offered by us

|

Up to 6,333,333 shares of Common Stock issuable upon exercise of the Warrants.

|

| |

|

|

Shares of Common Stock offered by the Selling Securityholders

|

Up to 91,102,264 shares of Common Stock.

|

| |

|

|

Warrants offered by the Selling Securityholders

|

Up to 6,333,333 Warrants.

|

| |

|

|

Exercise Price of Warrants

|

$11.50, subject to adjustment as described herein.

|

| |

|

|

Shares of Common Stock outstanding prior to exercise of all Warrants

|

118,241,747 shares of Common Stock (as of August 6, 2022).

|

| |

|

|

Shares of Common Stock outstanding assuming exercise of all Warrants

|

132,875,058 (based on total shares outstanding as of August 6, 2022 plus 14,633,311 Warrants).

|

| |

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale of shares of Common Stock or Warrants by the Selling Securityholders. We will receive up to an aggregate of approximately $72.8 million from the exercise of the Warrants, assuming the exercise in full of all of the Warrants for cash. We expect to use the net proceeds from the exercise of the Warrants for general corporate purposes. See “Use of Proceeds.”

|

| |

|

|

Redemption

|

The Warrants are redeemable in certain circumstances. See “Description of Securities — Warrants” for further discussion.

|

| |

|

|

Market for Common Stock and Warrants

|

Our Common Stock and Public Warrants are currently traded on the NYSE under the symbols “HLLY” and “HLLY WS,” respectively.

|

| |

|

|

Risk Factors

|

Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” elsewhere in this prospectus.

|

RISK FACTORS

An investment in our securities involves risks and uncertainties. You should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K, any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in any applicable prospectus supplement before making an investment decision. The risks described in these documents are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be materially adversely affected. This could cause the trading price of our securities to decline, resulting in a loss of all or part of your investment. Please also carefully read the section titled “Cautionary Note Regarding Forward-Looking Statements.”

USE OF PROCEEDS

All of the Common Stock and Warrants offered by the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective accounts. The Company will not receive any of the proceeds from these sales.

The Company will receive up to an aggregate of approximately $72.8 million from the exercise of the Warrants offered by the Selling Securityholders pursuant to this prospectus, assuming the exercise in full of all of the Warrants for cash. Unless we inform you otherwise in a prospectus supplement or free writing prospectus, the Company intends to use the net proceeds from the exercise of such Warrants for general corporate purposes, which may include acquisitions or other strategic investments or repayment of outstanding indebtedness. The Company will have broad discretion over the use of proceeds from the exercise of the Warrants. There is no assurance that the holders of the Warrants will elect to exercise any or all of such Warrants.

The Selling Securityholders will pay any underwriting discounts and commissions and expenses incurred by the Selling Securityholders for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Securityholders in disposing of the securities. We will bear the costs, fees and expenses incurred in effecting the registration of the securities covered by this prospectus, including all registration and filing fees, NYSE listing fees and fees and expenses of our counsel and our independent registered public accounting firm.

SELLING SECURITYHOLDERS

The following table sets forth information known to us regarding ownership of shares of Common Stock and Warrants as of August 6, 2022 that may be offered from time to time by the Selling Securityholders. When we refer to the “Selling Securityholders” in this prospectus, we refer to the persons listed in the table below, and the pledgees, donees, transferees, assignees, successors and other permitted transferees that hold any of the Selling Securityholders’ interest in the shares of Common Stock or the Warrants after the date of this prospectus.

The Selling Securityholders listed in the table below may from time to time offer and sell any or all of the shares of Common Stock and Warrants set forth below pursuant to this prospectus. We cannot advise you as to whether the Selling Securityholders will in fact sell any or all of such shares of Common Stock or Warrants. In particular, the Selling Securityholders identified below may have sold, transferred or otherwise disposed of all or a portion of their securities after the date on which they provided us with information regarding their securities. Any changed or new information given to us by the Selling Securityholders, including regarding the identity of, and the securities held by, each Selling Securityholder, will be set forth in a prospectus supplement or amendments to the registration statement of which this prospectus is a part, if and when necessary.

Our registration of the shares of Common Stock and Warrants does not necessarily mean that the Selling Securityholders will sell all or any of such Common Stock or Warrants. The following table sets forth certain information provided by or on behalf of the Selling Securityholders concerning the Common Stock and Warrants that may be offered from time to time by each Selling Securityholder with this prospectus and the beneficial ownership of the Selling Securityholders both before and after the offering of the securities covered by this prospectus. A Selling Securityholder may sell all, some or none of such securities in this offering. See “Plan of Distribution.”

|

|

|

|

Common Stock |

|

|

Warrants |

|

| |

|

|

Beneficial

Ownership

Before the

Offering

|

|

|

Shares to

be

Sold in the

Offering

|

|

|

Beneficial

Ownership After

the Offering

|

|

|

Beneficial

Ownership

Before the

Offering

|

|

|

Warrants

to be Sold

in the

Offering

|

Beneficial

Ownership After

the Offering

|

|

Name of Selling

Securityholder |

|

|

Number of

Shares

|

|

|

Number of

Shares

|

|

|

Number of

Shares

|

|

|

%

**

|

|

|

Number of

Warrants

|

|

|

Number of

Warrants

|

Number of

Warrants

|

% |

|

|

Holley Parent Holdings, LLC

|

(1) |

|

|

54,673,884 |

|

|

|

54,673,884 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MidOcean Partners Executive V, LP

|

(2) |

|

|

51,456 |

|

|

|

51,456 |

|

|

|

— |

|

|

|

— |

|

|

|

28,333 |

|

|

|

28,333 |

|

|

|

|

MidOcean Partners V, LP

|

(2) |

|

|

10,239,794 |

|

|

|

10,239,794 |

|

|

|

— |

|

|

|

— |

|

|

|

5,638,334 |

|

|

|

5,638,334 |

|

|

|

|

Allspring Special Small Cap Value Fund, A series of Allspring Funds Trust (f/k/a Wells Fargo Special Small Cap Value Fund, A series of Wells Fargo Funds Trust)

|

(3) |

|

|

5,600,786 |

|

|

|

5,500,000 |

|

|

|

100,786 |

|

|

|

* |

% |

|

|

|

|

|

|

|

|

|

|

|

Wasatch Microcap Fund

|

(4) |

|

|

2,648,974 |

|

|

|

1,600,000 |

|

|

|

1,048,974 |

|

|

|

* |

% |

|

|

|

|

|

|

|

|

|

|

|

Wasatch Core Growth Fund

|

(4) |

|

|

4,380,265 |

|

|

|

3,500,000 |

|

|

|

880,265 |

|

|

|

* |

% |

|

|

|

|

|

|

|

|

|

|

|

Clearlake Flagship Plus Partners Master Fund, L.P.

|

(5) |

|

|

2,750,000 |

|

|

|

2,750,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Baron Small Cap Fund

|

(6) |

|

|

4,557,910 |

|

|

|

2,500,000 |

|

|

|

2,057,910 |

|

|

|

1.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

Polar Long/Short Master Fund

|

(7) |

|

|

193,981 |

|

|

|

193,981 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Polar Multi-Strategy Master Fund

|

(7) |

|

|

191,066 |

|

|

|

191,066 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Glenn J. Krevlin Revocable Trust dated July 25, 2007

|

(8) |

|

|

558,333 |

|

|

|

450,000 |

|

|

|

108,333 |

|

|

|

* |

% |

|

|

|

|

|

|

|

|

|

|

|

Nina P. Krevlin Irrevocable Trust FBO

Michael Krevlin dated October 22, 2007

|

(8) |

|

|

50,000 |

|

|

|

50,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stewart J. Rahr Revocable Trust

|

(9) |

|

|

200,000 |

|

|

|

200,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kornitzer Capital Management, Inc. FBO Buffalo Funds

|

(10) |

|

|

110,000 |

|

|

|

110,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John R. Muse

|

|

|

|

50,000 |

|

|

|

50,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FMAB Partners, LP

|

(11) |

|

|

50,000 |

|

|

|

50,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Americo Life, Inc.

|

(12) |

|

|

300,000 |

|

|

|

300,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Maddox Family Trust

|

(13) |

|

|

100,000 |

|

|

|

100,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Staysail 16 LLC

|

(14) |

|

|

200,000 |

|

|

|

200,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Graham Clempson

|

(15) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

433,333 |

|

|

|

433,333 |

|

|

|

|

Sam Clempson

|

(16) |

|

|

449,063 |

|

|

|

449,063 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lily Clempson

|

(17) |

|

|

449,062 |

|

|

|

449,062 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rubel Family Management Trust U/A Dated 10/8/2018

|

(18) |

|

|

493,632 |

|

|

|

493,632 |

|

|

|

— |

|

|

|

— |

|

|

|

233,333 |

|

|

|

233,333 |

|

|

|

|

Matthew Rubel Family Annual Exclusion Trust FBO Joshua Rubel

|

(19) |

|

|

134,831 |

|

|

|

134,831 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Matthew Rubel Family Annual Exclusion Trust FBO Jeffrey Rubel

|

(20) |

|

|

134,831 |

|

|

|

134,831 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Matthew Rubel Family Annual Exclusion Trust FBO Michael Rubel

|

(21) |

|

|

134,831 |

|

|

|

134,831 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Krishnan Anand

|

(22) |

|

|

30,000 |

|

|

|

30,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gina Bianchini

|

(23) |

|

|

47,000 |

|

|

|

30,000 |

|

|

|

17,000 |

|

|

|

* |

% |

|

|

|

|

|

|

|

|

|

|

|

Jeffrey W. Jones

|

(24) |

|

|

35,000 |

|

|

|

35,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beth J. Kaplan

|

(25) |

|

|

32,500 |

|

|

|

32,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

William B. Cyr

|

(26) |

|

|

25,000 |

|

|

|

25,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mindy Grossman

|

(27) |

|

|

19,000 |

|

|

|

19,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The NG 2013 Grantor Trust u/a/d March 25, 2013

|

(28) |

|

|

3,000 |

|

|

|

3,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Grossman Grandchildren's Trust u/a/d December 8, 2017

|

(29) |

|

|

3,000 |

|

|

|

3,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Matt Maddox

|

(30) |

|

|

25,000 |

|

|

|

25,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Matthew Shay

|

(31) |

|

|

25,000 |

|

|

|

25,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Andrew Spring

|

(32) |

|

|

10,000 |

|

|

|

10,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jonathan Marlow

|

(33) |

|

|

20,000 |

|

|

|

20,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sam Selinger

|

(34) |

|

|

5,000 |

|

|

|

5,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Less than 1%

** Based upon 118,241,747 shares of Common Stock outstanding as of August 6, 2022.

|

(1)

|

The Holley Stockholder is governed by the amended and restated limited liability company agreement of the Holley Stockholder (the “Holley Stockholder LLCA”) among the Holley Stockholder and Sentinel Capital Partners V, L.P., Sentinel Capital Partners V-A, L.P., Sentinel Capital Investors V, L.P., controlling affiliates of the Holley Stockholder (collectively, the “Sentinel Investors”), and the other members party thereto. By virtue of (a) the ability of the Sentinel Investors under the Holley Stockholder LLCA to appoint and remove a majority of the members of the board of directors of the Holley Stockholder and (b) the ability of a majority of the board of directors of the Holley Stockholder to control investment and voting power over the shares of our Common Stock held by the Holley Stockholder, the Sentinel Investors may be deemed to have beneficial ownership over the shares of Common Stock held of record by the Holley Stockholder. The Sentinel Investors are controlled by Sentinel Partners V, L.P. (“Sentinel Partners V”), their general partner, which is controlled by Sentinel Managing Company V, Inc. (“Sentinel Managing Company”), its general partner, which is controlled by David S. Lobel, its president and controlling shareholder. Accordingly, each of Sentinel Partners V, Sentinel Managing Company and Mr. Lobel may be deemed to have beneficial ownership over the shares of Common Stock held by the Holley Stockholder. Each of the Sentinel Investors, Sentinel Partners V, Sentinel Managing Company and Mr. Lobel disclaims beneficial ownership of the shares of Common Stock held by the Holley Stockholder other than to the extent of their pecuniary interest therein. The address for each of the foregoing is c/o Sentinel Capital Partners, L.L.C., One Vanderbilt Avenue, 53rd Floor, New York, NY 10017.

|

|

(2)

|

On August 5, 2022, Sponsor distributed an aggregate of 6,250,000 shares of our Common Stock and 4,666,667 Private Warrants to its members and interest holders (the “Sponsor Distribution”). In connection with the Sponsor Distribution, Partners received 4,170,294 shares of Common Stock and 3,980,001 Private Warrants and Executive received 20,956 shares of Common Stock and 20,000 Private Warrants. On August 5, 2022, MidOcean Partners V, L.P., a Delaware limited partnership (“Partners”), transferred 5,500 shares of Common Stock to MidOcean Partners Executive V, L.P., a Delaware limited partnership (“Executive”). Figures include shares of Common Stock issuable upon exercise of Private Warrants and Public Warrants. The general partner of Partners and Executive is MidOcean Associates V, L.P., a Delaware limited partnership (“Associates”). The general partner of Associates is Ultramar Capital, Ltd, a Cayman Islands company (“Ultramar”), which is controlled by James Edward Virtue (“Virtue”). Accordingly, each of Associates, Ultramar, and Virtue may be deemed to have beneficial ownership of the securities held by Partners and Executive, and in each case, each of Partners, Executive, Associates, Ultramar and Virtue disclaims beneficial ownership of such securities except to the extent of their pecuniary interest therein. The business address of each of Executive, Partners, Associates, Ultramar and Virtue is 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(3)

|

Allspring Special Small Cap Value Fund, A series of Allspring Funds Trust (f/k/a Wells Fargo Special Small Cap Value Fund, A series of Wells Fargo Funds Trust), is a registered investment company under the Investment Company Act of 1940.

|

|

(4)

|

Each of Wasatch Micro Cap Fund and Wasatch Core Growth Fund is a registered investment company under the Investment Company Act of 1940 (the “Wasatch Funds”). Each of the Wasatch Funds is advised by Wasatch Advisors, Inc. (“Wasatch”), a registered investment advisor, which, according to a Schedule 13D filed by Wasatch on February 11, 2022, has voting power over an additional 1,080,704 shares of Common Stock not reflected in the above table. The business address of Wasatch and the Wasatch Funds is 505 Wakara Way, Salt Lake City, UT 84108.

|

|

(5)

|

Clearlake Flagship Plus Partners Master Fund, L.P. is a registered investment company under the Investment Company Act of 1940.

|

|

(6)

|

Baron Small Cap Fund is a registered investment company under the Investment Company Act of 1940. BAMCO, Inc., a registered investor advisor, is the investment advisor of Baron Small Cap Fund. Mr. Ronald Baron has voting and/or investment control over the shares of our Common Stock held by Baron Small Cap Fund and, accordingly, may be deemed to have beneficial ownership of such shares. Mr. Baron disclaims beneficial ownership of the shares held by Baron Small Cap Fund.

|

|

(7)

|

Consists of (i) 401,279 shares of Common Stock held by Polar Multi-Strategy Master Fund and (ii) 102,777 shares of Common Stock held by Polar Long/Short Master Fund (collectively, the “Polar Funds”). The Polar Funds are under management by Polar Asset Management Partners Inc. (“PAMPI”). PAMPI serves as investment advisor of the Polar Funds and has control and discretion over the shares held by the Polar Funds. As such, PAMPI may be deemed the beneficial owner of the shares held by the Polar Funds. PAMPI disclaims any beneficial ownership of the reported shares other than to the extent of any pecuniary interest therein. The business address of the Funds is c/o Polar Asset Management Partners Inc., 16 York Street, Suite 2900, Toronto, Ontario M5J 0E6.

|

|

(8)

|

Each of the Glenn J Krevlin Revocable Trust dated July 25, 2007 (“G. Krevlin Trust”) and Nina P. Krevlin Irrevocable Trust FBO Michael Krevlin (“N. Krevlin Trust”) is managed by Glenn J. Krevlin, as trustee. Mr. Krevlin has voting and investment control over the shares of our Common Stock held by the G. Krevlin Trust and N. Krevlin Trust and, accordingly, may be deemed to have beneficial ownership of such shares.

|

|

(9)

|

The Stewart J. Rahr Revocable Trust (“S. Rahr Trust”) is managed by Stewart Rahr, as grantor and trustee and Steven Burns, as trustee. Each of Mr. Rahr and Mr. Burns has voting and investment control over the shares of our Common Stock held by the S. Rahr Trust and, accordingly, may be deemed to have beneficial ownership of such shares.

|

|

(10)

|

Kornitzer Capital Management, Inc. (“KCM”) is the investment adviser to and acting for the benefit of the Buffalo Funds. KCM may be deemed to have voting and dispositive power with respect to the shares of our Common Stock and, accordingly, may be deemed to have beneficial ownership of such shares. Craig Richard and Doug Cartwright are employees of KCM and manage the Buffalo Early Stage Growth Fund. Mr. Richard and Mr. Cartwright may be deemed to have voting and dispositive power with respect to the shares; however, Mr. Richard and Mr. Cartwright disclaim beneficial ownership of the shares held by the Buffalo Funds.

|

|

(11)

|

FMAB Partners LP (“FMAB”) is managed by JAJO, LLC (“JAJO”). Each of Jack D. Furst, John S. Furst and Robert S. Furst have voting and investment control over the shares of our Common Stock held by FMAB and, accordingly, may be deemed to have beneficial ownership of such shares.

|

|

(12)

|

Michael A Merriman and Mary Beth Sotos each have voting or investment control over the shares of our Common Stock held by Americo Life, Inc. and, accordingly, may be deemed to have beneficial ownership of such shares.

|

|

(13)

|

Matthew Maddox and Katherine Maddox each have voting or investment control over the shares of our Common Stock held by The Maddox Family Trust (“Maddox Trust”) and, accordingly, may be deemed to have beneficial ownership of such shares.

|

|

(14)

|

Staysail 16 LLC (“Staysail”) is managed by Spinnaker Capital 2018 GP LLC. Anastasios Parafestas has voting and investment control over the shares of our Common Stock held by Staysail and, accordingly, may be deemed to have beneficial ownership of such shares.

|

|

(15)

|

Represents 433,333 Private Warrants received pursuant to the Sponsor Distribution, and the 433,333 shares of Common Stock issuable upon exercise of such Private Warrants. The business address of the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(16)

|

Represents 449,063 shares of Common Stock received pursuant to the Sponsor Distribution. The business address of the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(17)

|

Represents 449,062 shares of Common Stock received pursuant to the Sponsor Distribution. The business address of the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(18)

|

Represents (a) 493,632 shares of Common Stock, (b) 233,333 Private Warrants, and (c) 233,333 shares of Common Stock issuable upon exercise of the Private Warrants received pursuant to the Sponsor Distribution. Matthew E. Rubel and Melissa Rubel are the trustees of the Selling Securityholder and have shared voting and investment control over the securities held by the Selling Securityholder, and may be deemed to have beneficial ownership of such securities. The business address of Matthew E. Rubel, Melissa Rubel and the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(19)

|

Represents 134,831 shares of Common Stock received pursuant to the Sponsor Distribution. Matthew E. Rubel is the trustee of the Selling Securityholder and has voting and investment control over the securities held by the Selling Securityholder, and may be deemed to have beneficial ownership of such securities. The business address of Matthew E. Rubel and the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(20)

|

Represents 134,831 shares of Common Stock received pursuant to the Sponsor Distribution. Matthew E. Rubel is the trustee of the Selling Securityholder and has voting and investment control over the securities held by the Selling Securityholder, and may be deemed to have beneficial ownership of such securities. The business address of Matthew E. Rubel and the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(21)

|

Represents 134,831 shares of Common Stock received pursuant to the Sponsor Distribution. Matthew E. Rubel is the trustee of the Selling Securityholder and has voting and investment control over the securities held by the Selling Securityholder, and may be deemed to have beneficial ownership of such securities. The business address of Matthew E. Rubel and the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(22)

|

Represents 30,000 shares of Common Stock received pursuant to the Sponsor Distribution. The business address of the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(23)

|

Represents (a) 17,000 vested restricted stock units and (b) 30,000 shares of Common Stock received pursuant to the Sponsor Distribution. The business address of the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(24)

|

Represents 35,000 shares of Common Stock received pursuant to the Sponsor Distribution. The business address of the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(25)

|

Represents 32,500 shares of Common Stock received pursuant to the Sponsor Distribution. The business address of the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(26)

|

Represents 25,000 shares of Common Stock received pursuant to the Sponsor Distribution. The business address of the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(27)

|

Represents 19,000 shares of Common Stock received pursuant to the Sponsor Distribution. The business address of the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(28)

|

Represents 3,000 shares of Common Stock received pursuant to the Sponsor Distribution. Mindy Grossman is the trustee of the Selling Securityholder and has voting and investment control over the securities held by the Selling Securityholder, and may be deemed to have a beneficial ownership of such securities. The business address of the Selling Securityholder and Mindy Grossman is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(29)

|

Represents 3,000 shares of Common Stock received pursuant to the Sponsor Distribution. Mindy Grossman is the trustee of the Selling Securityholder and has voting and investment control over the securities held by the Selling Securityholder, and may be deemed to have a beneficial ownership of such securities. The business address of Mindy Grossman and the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(30)

|

Represents 25,000 shares of Common Stock received pursuant to the Sponsor Distribution. The business address of the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(31)

|

Represents 25,000 shares of Common Stock received pursuant to the Sponsor Distribution. The business address of the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(32)

|

Represents 10,000 shares of Common Stock received pursuant to the Sponsor Distribution. The business address of the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(33)

|

Represents 20,000 shares of Common Stock received pursuant to the Sponsor Distribution. The business address of the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

|

(34)

|

Represents 5,000 shares of Common Stock received pursuant to the Sponsor Distribution. The business address of the Selling Securityholder is c/o MidOcean Partners, 245 Park Avenue, 38th Floor, New York, NY 10167.

|

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

The following is a discussion of material U.S. federal income tax consequences of the ownership and disposition of our Common Stock and Warrants, which we refer to collectively as our securities. This discussion applies only to securities that are held as capital assets for U.S. federal income tax purposes and is applicable only to holders who are purchasing our securities in this offering.

This discussion is a summary only and does not describe all of the tax consequences that may be relevant to you in light of your particular circumstances, including but not limited to the alternative minimum tax, the Medicare tax on certain investment income and the different consequences that may apply if you are subject to special rules that apply to certain types of investors (such as the effects of Section 451 of the Internal Code of 1986, as amended (the “Code”)), including but not limited to:

| |

●

|

financial institutions or financial services entities;

|

| |

●

|

governments or agencies or instrumentalities thereof;

|

| |

●

|

regulated investment companies;

|

| |

●

|

real estate investment trusts;

|

| |

●

|

expatriates or former long-term residents of the U.S.;

|

| |

●

|

persons that actually or constructively own five percent or more of our voting shares;

|

| |

●

|

dealers or traders subject to a mark-to-market method of accounting with respect to the securities;

|

| |

●

|

persons holding the securities as part of a “straddle,” hedge, integrated transaction or similar transaction;

|

| |

●

|

U.S. holders (as defined below) whose functional currency is not the U.S. dollar;

|

| |

●

|

partnerships or other pass-through entities for U.S. federal income tax purposes and any beneficial owners of such entities;

|

| |

●

|

controlled foreign corporations and passive foreign investment companies; and

|

This discussion is based on the Code and administrative pronouncements, judicial decisions and final, temporary and proposed Treasury regulations as of the date hereof, all of which are subject to change, possibly with retroactive effect, and changes to any of which subsequent to the date of this prospectus may affect the tax consequences described herein. This discussion does not address any aspect of state, local or non-U.S. taxation, or any U.S. federal taxes other than income taxes (such as gift and estate taxes).

We have not sought, and will not seek, a ruling from the United States Internal Revenue Service (the “IRS”) as to any U.S. federal income tax consequence described herein. The IRS may disagree with the discussion herein, and its position may be upheld by a court. Moreover, there can be no assurance that future legislation, regulations, administrative rulings or court decisions will not adversely affect the accuracy of the statements in this discussion. You are urged to consult your tax advisor with respect to the application of U.S. federal tax laws to your particular situation, as well as any tax consequences arising under the laws of any state, local or foreign jurisdiction.