Statement of Changes in Beneficial Ownership (4)

23 Juni 2022 - 11:35PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Sienko David C |

2. Issuer Name and Ticker or Trading Symbol

HECLA MINING CO/DE/

[

HL

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

VP & General Counsel |

|

(Last)

(First)

(Middle)

6500 N. MINERAL DRIVE, SUITE 200 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

6/21/2022 |

|

(Street)

COEUR D'ALENE, ID 83815

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 6/21/2022 | | F | | 22976 (1) | D | $0 | 821165 (2) | D | |

| Common Stock | 6/21/2022 | | A | | 38374 (3) | A | $4.43 | 821165 (4) | D | |

| Common Stock | 6/21/2022 | | J | | 4191 (5) | A | $0 | 4191 | I | By 401(k) Plan |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Performance rights | $0 | 6/21/2022 | | A | | 25959 (6) | | 1/1/2025 | 1/1/2026 | Common Stock | 25959 | $0 | 821165 (7) | D | |

| Explanation of Responses: |

| (1) | Mr. Sienko was awarded (i) 81,522 restricted stock units on June 21, 2019; (ii) 49,505 restricted stock units on June 22, 2020; and (iii) 19,036 restricted stock units on June 21, 2021. The restrictions lapsed on 1/3 of those vesting units (50,022 shares). Mr. Sienko elected to have Hecla Mining Company withhold 2,976 shares to cover his tax liability. |

| (2) | Consists of 681,948 shares held directly, 67,565 unvested restricted stock units, and 71,652 performance-based shares. |

| (3) | Award of restricted stock units that vest as follows: 12,791 shares on June 21, 2023; 12,791 shares on June 21, 2024; and 12,792 shares on June 21, 2025. |

| (4) | See footnote 2. |

| (5) | Held as 348.942 units in Mr. Sienko's 401(k) account under the Hecla Mining Company Capital Accumulation Plan, and estimated to be 4,191 shares. |

| (6) | Mr. Sienko was awarded performance rights representing the contingent right to receive between $57,500 and $230,000 worth of Hecla Mining Company common stock based on Hecla Mining Company's Total Shareholder Return performance over the 3-year period (January 1, 2022 to December 31, 2024) relative to our peers. Examples of the potential grant of shares to Mr. Sienko under this plan are as follows: 100th percentile rank among peers = maximum award at 200% of target ($230,000 in stock); 60th percentile rank among peers = target award at grant value ($115,000 in stock); and 50th percentile rank among peers = threshold award at 50% of target ($57,500 in stock). |

| (7) | See footnote 2. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Sienko David C

6500 N. MINERAL DRIVE, SUITE 200

COEUR D'ALENE, ID 83815 |

|

| VP & General Counsel |

|

Signatures

|

| Tami D. Whitman, Attorney-in-Fact for David C. Sienko | | 6/23/2022 |

| **Signature of Reporting Person | Date |

| Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. |

| * | If the form is filed by more than one reporting person, see Instruction 4(b)(v). |

| ** | Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a). |

| Note: | File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. |

| Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

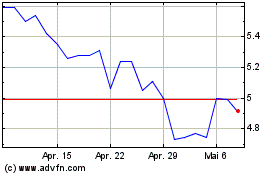

Hecla Mining (NYSE:HL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

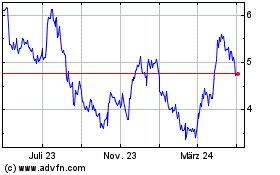

Hecla Mining (NYSE:HL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024