Current Report Filing (8-k)

04 Januar 2023 - 11:03PM

Edgar (US Regulatory)

false 0000860730 0000860730 2023-01-04 2023-01-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 4, 2023 (January 4, 2023)

HCA Healthcare, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-11239 |

|

27-3865930 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| One Park Plaza, Nashville, Tennessee |

|

37203 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(615) 344-9551

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each Class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $.01 par value per share |

|

HCA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On January 4, 2023, HCA Inc. (the “Borrower”), a direct, wholly-owned subsidiary of HCA Healthcare, Inc., amended and restated its senior secured credit facility (the “Cash Flow Credit Facility”) to, among other things, replace the existing revolving credit commitments of $2.0 billion with a new tranche of revolving credit commitments of $3.5 billion maturing on June 30, 2026, and replace the London Inter-Bank Offered Rate (“LIBOR”) with the term secured overnight financing rate (“Term SOFR”) as the reference rate available for outstanding and future loans made under the Cash Flow Credit Facility. On the same date, the Borrower also amended and restated its $4.5 billion senior secured asset-based revolving credit facility (the “ABL Credit Facility”) to, among other things, replace LIBOR with Term SOFR as the reference rate available for outstanding and future loans made under the ABL Credit Facility. The credit spread adjustment applicable to loans bearing interest at a rate based on Term SOFR will be 0.10% per annum. The replacement of LIBOR with Term SOFR with respect to outstanding LIBOR-based loans under the Cash Flow Credit Facility and ABL Credit Facility will occur at the end of the current interest periods for such outstanding loans. On the same date, the Borrower incurred additional revolving loans under the ABL Credit Facility and applied the proceeds, together with cash on hand, to pay off in full the $492.5 million of outstanding Tranche B term loans under the Cash Flow Credit Facility. The Borrower did not otherwise incur additional indebtedness in connection with the foregoing amendments.

The foregoing descriptions of amendments to the Cash Flow Credit Facility and ABL Credit Facility are qualified in their entirety by the terms of the applicable agreements. Please refer to such agreements, which are incorporated herein by reference and attached hereto as Exhibits 4.1 and 4.2.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits:

|

|

|

| Exhibit No. |

|

Description |

|

|

| 4.1* |

|

Restatement Agreement dated as of January 4, 2023, by and among HCA Inc., as borrower, the guarantors party thereto, Bank of America, N.A., as administrative agent and collateral agent, and the lenders party thereto |

|

|

| 4.2* |

|

Amendment No. 1 to Credit Agreement dated as of January 4, 2023, by and among HCA Inc., as parent borrower, the subsidiary borrowers party thereto, Bank of America, N.A., as administrative agent and collateral agent, and the lenders party thereto |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| * |

Certain schedules and exhibits have been omitted. The Registrant agrees to furnish supplementally a copy of any omitted schedule or exhibit to the SEC upon request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| HCA HEALTHCARE, INC. (Registrant) |

|

|

| By: |

|

/s/ John M. Franck II |

|

|

John M. Franck II |

|

|

Vice President - Legal and Corporate Secretary |

Date: January 4, 2023

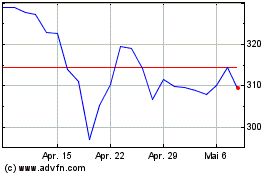

HCA Healthcare (NYSE:HCA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

HCA Healthcare (NYSE:HCA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024