THIRD QUARTER FISCAL 2022 SUMMARY

- Net Sales decreased 30% year-over-year to $245.3 million

- Net Income decreased 54% year-over-year to $23.1 million

- Adjusted EBITDA decreased 39% year-over-year to $60.4

million

- Adjusted diluted EPS decreased 43% year-over-year to $0.14

Hayward Holdings, Inc. (“Hayward”) (NYSE: HAYW), a global

designer, manufacturer and marketer of a broad portfolio of pool

equipment and associated automation systems, today announced

financial results for the third quarter ended October 1, 2022 of

its fiscal year 2022.

CEO COMMENTS

“Our third quarter results were in line with our expectations,”

said Kevin Holleran, Hayward’s President and Chief Executive

Officer. “We continue to leverage our competitive advantages,

increase market share, and capitalize on the sustainable secular

trends in our industry. I am particularly pleased with continued

solid growth and outperformance in channel sell-through in our core

U.S. market for the third quarter, as reported by our primary

channel partners. However, consistent with our expectations, we saw

a meaningful divergence between this channel sell-through and our

net sales into the channel as our partners reduced the level of

inventory on hand in response to normalizing lead times and safety

stock requirements. We are taking proactive steps to streamline the

organization and realign our cost structure to current conditions

while prioritizing our strategic growth investments.”

THIRD QUARTER FISCAL 2022 CONSOLIDATED RESULTS

Net sales decreased by 30% to $245.3 million for the third

quarter of fiscal 2022. The decline in net sales during the quarter

was the result of lower volumes, partially offset by favorable

pricing and acquisitions. The decline in volume was primarily

driven by distribution channel destocking as supply chain pressure

eases, lead times normalize, and the industry starts to return to

the pre-pandemic seasonal trend of lower sales activity in the

third quarter. Additionally, macroeconomic uncertainty and

geopolitical factors in Europe weighed on customer demand and

contributed to the decline in volume.

Gross profit decreased by 34% to $107.8 million for the third

quarter of fiscal 2022. Gross profit margin decreased 239 basis

points to 43.9%. The decrease in gross margin was principally due

to the decline in volume resulting in lower operating leverage.

Gross profit margin was also negatively impacted by the inventory

fair value step-up adjustment recognized as part of purchase

accounting related to the second quarter acquisition of J&J

Electronics and Sollos (the “Specialty Lighting Business”).

Selling, general, and administrative (“SG&A”) expenses

decreased by 27% to $50.5 million for the third quarter of fiscal

2022. The decrease in SG&A was primarily driven by lower

incentive compensation, selling and distribution, and warranty

expenses as well as the absence of a patent infringement litigation

settlement which occurred in the prior year period. As a percentage

of net sales, SG&A increased 96 basis points to 21%, compared

to the prior year period of 20%. Research, development, and

engineering expenses were $6.1 million for the third quarter of

fiscal 2022, or 3% of net sales, as compared to $6.4 million for

the prior year period, or 2% of net sales.

Operating income decreased by 48% to $40.3 million for the third

quarter of fiscal 2022. The decrease in operating income was driven

by lower sales.

Interest expense, net, increased by approximately 26% to $13.9

million for the third quarter of fiscal 2022 primarily as a result

of variable rate increases on the term loan and utilization of the

ABL revolving credit facility.

Income tax expense for the third quarter of fiscal 2022 was $3.5

million for an effective tax rate of 13.3%, compared to $14.3

million at an effective tax rate of 22.2% for the prior-year

period. The decrease was primarily due to discrete items resulting

from certain state legislation changes and the tax benefit

resulting from the exercise of stock options.

Net income decreased by 54% to $23.1 million for the third

quarter of fiscal 2022.

Adjusted EBITDA decreased by 39% to $60.4 million for the third

quarter of fiscal 2022. Adjusted EBITDA margin decreased 341 basis

points to 24.6%.

Diluted GAAP EPS decreased by 52% to $0.10 for the third quarter

of fiscal 2022. Adjusted diluted EPS decreased by 43% to $0.14 for

the third quarter of fiscal 2022.

THIRD QUARTER FISCAL 2022 SEGMENT RESULTS

North America

Net sales decreased by 32% to $203.7 million for the third

quarter of fiscal 2022. The decrease was primarily the result of a

decline in volume, partially offset by increases in price to offset

inflationary pressure and the favorable impact of acquisitions. The

decline in volume was primarily the result of distribution channel

destocking and the seasonal trend of lower sales activity in the

third quarter as discussed above.

Segment income decreased by 47% to $48.7 million for the third

quarter of fiscal 2022. Adjusted segment income decreased by 42% to

$56.9 million.

Europe & Rest of World

Net sales decreased by 21% to $41.6 million for the third

quarter of fiscal 2022. The decrease was primarily due to a decline

in volume as a result of geopolitical factors and macroeconomic

uncertainty, unfavorable impact of foreign currency translation,

and channel inventory reductions, partially offset by price

increases.

Segment income decreased by 17% to $8.8 million for the third

quarter of fiscal 2022. Adjusted segment income decreased by 23% to

$8.6 million.

BALANCE SHEET AND CASH FLOW

As of October 1, 2022, Hayward had cash and cash equivalents of

$72.9 million and approximately $55.2 million available for future

borrowings under its ABL Facility. Cash flow from operations for

the nine months ended October 1, 2022, of approximately $144

million was a decrease of approximately $55 million from the prior

year comparative period as a result of the increase in cash used

for working capital, partially offset by an increase in net

income.

COST OPTIMIZATION PROGRAM

During the three months ended October 1, 2022, the Company

initiated an enterprise cost reduction program to address the

current market dynamics and maintain the Company’s strong financial

metrics. The initial focus was on a reduction of variable costs

with specific attention to eliminating cost inefficiencies in our

supply chain and reducing labor in our production cost base. In

addition to these variable cost reductions, the Company identified

structural selling, general and administrative cost reduction

opportunities totaling $25 million to $30 million in 2023, with

initial savings of approximately $8 million to be realized in

2022.

OUTLOOK

Hayward is refining its full fiscal year 2022 guidance to

reflect higher than expected inflation impacting the fourth

quarter, normalizing channel inventory levels and geopolitical

events in Europe. Hayward continues to see increasing consumer

demand for pool equipment products in the U.S., specifically, for

our suite of SmartPadTM products into the aftermarket. Hayward is

confident in the long-term outlook for profitable growth and robust

cash flow generation, driven by new product innovation, growing

commercial relationships with prominent pool dealers and builders,

and agile manufacturing capabilities.

For fiscal year 2022, Hayward now expects net sales to decrease

approximately 6% from prior year, and Adjusted EBITDA of $365

million to $370 million.

Please see the Forward-Looking Statements section of this

release for a discussion of certain risks relevant to Hayward’s

outlook.

SHARE REPURCHASE PROGRAM

For the three and nine months ended October 1, 2022, Hayward

repurchased approximately $50.0 million and $343.1 million,

respectively, in common stock under its previously approved share

repurchase program, leaving approximately $400.0 million remaining

under the renewed authorization, which occurred on July 26, 2022.

Hayward's Board of Directors renewed the initial authorization of

the existing repurchase program and authorized Hayward to

repurchase up to an aggregate of $450 million of its common stock

over the next three years. The repurchase program will continue to

be funded by cash on hand and cash generated from operations.

CONFERENCE CALL INFORMATION

Hayward will hold a conference call to discuss the results

today, November 1, 2022 at 9:00 a.m. (ET).

To access the live conference call, please register for the call

in advance by visiting

https://www.netroadshow.com/events/login?show=c0ffcc93&confId=42857.

Registration will also be available during the call. After

registering, a confirmation e-mail will be sent including dial-in

details and a unique access code for entry. To ensure you are

connected for the full call please register at least 10 minutes

before the start of the call.

Interested investors and other parties can also listen to a

webcast of the live conference call by logging onto the Investor

Relations section of the company's website at

https://investor.hayward.com/events-and-presentations/default.aspx.

An earnings presentation will be posted to the Investor Relations

section of the company’s website prior to the conference call.

For those unable to listen to the live conference call, a replay

will be available approximately two hours after the call through

the archived webcast on the Hayward website or by dialing (866)

813-9403 or (44) 204-525-0658. The access code for the replay is

480626. The replay will be available until 11:59 p.m. Eastern Time

on November 15, 2022.

ABOUT HAYWARD HOLDINGS, INC.

Hayward Holdings, Inc. (NYSE: HAYW) is a leading global designer

and manufacturer of pool equipment and technology all key to the

SmartPad™ conversion strategy designed to provide superior outdoor

living experience. Hayward offers a full line of innovative,

energy-efficient and sustainable residential and commercial pool

equipment, including a complete line of advanced pumps, filters,

heaters, automatic pool cleaners, LED lighting, internet of things

(IoT) enabled controls, alternate sanitizers and water

features.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains certain statements that are

“forward-looking statements” as that term is defined under the

Private Securities Litigation Reform Act of 1995 (the “Act”) and

releases issued by the Securities and Exchange Commission (the

“SEC”). Such forward-looking statements relating to Hayward are

based on the beliefs of Hayward’s management as well as assumptions

made by, and information currently available to it. These

forward-looking statements include, but are not limited to,

statements about Hayward’s strategies, plans, objectives,

expectations, intentions, expenditures and assumptions and other

statements contained in or incorporated by reference in this

earnings release that are not historical facts. When used in this

document, words such as “guidance,” “may,” “will,” “should,”

“could,” “intend,” “potential,” “continue,” “anticipate,”

“believe,” “estimate,” “expect,” “plan,” “target,” “predict,”

“project,” “seek” and similar expressions as they relate to Hayward

are intended to identify forward-looking statements. Hayward

believes that it is important to communicate its future

expectations to its stockholders, and it therefore makes

forward-looking statements in reliance upon the safe harbor

provisions of the Act. However, there may be events in the future

that Hayward is not able to accurately predict or control, and

actual results may differ materially from the expectations it

describes in its forward-looking statements.

Examples of forward-looking statements include, among others,

statements Hayward makes regarding: Hayward’s outlook, financial

position; business plans and objectives; general economic and

industry trends; business prospects; future product development and

acquisition strategies; growth and expansion opportunities;

operating results; and working capital and liquidity. The

forward-looking statements in this earnings release are only

predictions. Hayward may not achieve the plans, intentions or

expectations disclosed in Hayward’s forward-looking statements, and

you should not place significant reliance on its forward-looking

statements. Hayward has based these forward-looking statements

largely on its current expectations and projections about future

events and financial trends that it believes may affect its

business, financial condition and results of operations. Moreover,

neither Hayward nor any other person assumes responsibility for the

accuracy and completeness of forward-looking statements taken from

third-party industry and market reports.

Important factors that could affect Hayward’s future results and

could cause those results or other outcomes to differ materially

from those indicated in its forward-looking statements include the

following: its ability to execute on its growth strategies and

expansion opportunities; uncertainties affecting the pace of

distribution channel destocking and its impact on sales volumes;

its ability to maintain favorable relationships with suppliers and

manage disruptions to its global supply chain and the availability

of raw materials, including as a result of the COVID-19 pandemic;

its relationships with and the performance of distributors,

builders, buying groups, retailers and servicers who sell Hayward’s

products to pool owners; competition from national and global

companies, as well as lower-cost manufacturers; impacts on

Hayward’s business from the sensitivity of its business to

seasonality and unfavorable economic business and weather

conditions; Hayward’s ability to identify emerging technological

and other trends in its target end markets; Hayward’s ability to

develop, manufacture and effectively and profitably market and sell

its new planned and future products; failure of markets to accept

new product introductions and enhancements; the ability to

successfully identify, finance, complete and integrate

acquisitions; Hayward’s ability to attract and retain senior

management and other qualified personnel; regulatory changes and

developments affecting Hayward’s current and future products;

volatility in currency exchange rates; Hayward's ability to realize

cost savings from restructuring activities; Hayward’s ability to

service its existing indebtedness and obtain additional capital to

finance operations and its growth opportunities; impacts on

Hayward’s business from political, regulatory, economic, trade, and

other risks associated with operating foreign businesses, including

risks associated with geopolitical conflict; Hayward’s ability to

establish and maintain intellectual property protection for its

products, as well as its ability to operate its business without

infringing, misappropriating or otherwise violating the

intellectual property rights of others; the impact of material cost

and other inflation; the impact of changes in laws, regulations and

administrative policy, including those that limit U.S. tax

benefits, impact trade agreements and tariffs, or address the

impacts of climate change; the outcome of litigation and

governmental proceedings; impacts on Hayward’s business from the

COVID-19 pandemic; and other factors set forth in “Risk Factors” in

Hayward’s Annual Report on Form 10-K for the year ended December

31, 2021 and its Quarterly Report on Form 10-Q for the period ended

July 2, 2022.

Many of these factors are macroeconomic in nature and are,

therefore, beyond Hayward’s control. Should one or more of these

risks or uncertainties materialize, or should underlying

assumptions prove incorrect, Hayward’s actual results, performance

or achievements may vary materially from those described in this

earnings release as anticipated, believed, estimated, expected,

intended, planned or projected. The forward-looking statements

included in this earnings release are made only as of the date of

this earnings release. Unless required by United States federal

securities laws, Hayward neither intends nor assumes any obligation

to update these forward-looking statements for any reason after the

date of this earnings release to conform these statements to actual

results or to changes in Hayward’s expectations.

NON-GAAP FINANCIAL MEASURES

This earnings release includes certain financial measures not

presented in accordance with the generally accepted accounting

principles in the United States (“GAAP”) including adjusted net

income, adjusted basic EPS, adjusted diluted EPS, EBITDA, adjusted

EBITDA, adjusted EBITDA margin, adjusted gross profit margin,

adjusted segment income, adjusted segment income margin, net debt

and free cash flow. These financial measures are not measures of

financial performance in accordance with GAAP and may exclude items

that are significant in understanding and assessing the Company’s

financial results. Therefore, these measures should not be

considered in isolation or as an alternative to net income (loss),

segment income or other measures of profitability or performance

under GAAP. You should be aware that the Company’s presentation of

these measures may not be comparable to similarly titled measures

used by other companies, which may be defined and calculated

differently. See the appendix for a reconciliation of historical

non-GAAP measures to the most directly comparable GAAP

measures.

Reconciliation for the forward-looking full year fiscal 2022 net

sales and adjusted EBITDA outlook is not being provided, as Hayward

does not currently have sufficient data to accurately estimate the

variables and individual adjustments for such reconciliation.

Hayward Holdings, Inc. Unaudited Condensed

Consolidated Balance Sheets (Dollars in thousands, except per

share data)

October 1, 2022

December 31, 2021

Assets

Current assets

Cash and cash equivalents

$

72,907

$

265,796

Accounts receivable, net of allowances of

$2,872 and $2,003, respectively

108,543

208,112

Inventories, net

313,379

233,449

Prepaid expenses

16,051

12,459

Other current assets

51,368

30,705

Total current assets

562,248

750,521

Property, plant, and equipment, net of

accumulated depreciation of $76,600 and $67,366, respectively

148,428

146,754

Goodwill

927,055

924,264

Trademark

736,000

736,000

Customer relationships, net

236,321

242,854

Other intangibles, net

108,983

103,192

Other non-current assets

111,363

74,885

Total assets

$

2,830,398

$

2,978,470

Liabilities and Stockholders'

Equity

Current liabilities

Current portion of the long-term debt

$

11,957

$

12,155

Accounts payable

65,354

87,445

Accrued expenses and other liabilities

152,011

190,378

Income taxes payable

—

13,886

Total current liabilities

229,322

303,864

Long-term debt, net

1,067,002

973,124

Deferred tax liabilities, net

266,290

262,378

Other non-current liabilities

71,523

69,591

Total liabilities

1,634,137

1,608,957

Stockholders' equity

Preferred stock, $0.001 par value,

100,000,000 authorized, no shares issued or outstanding as of

October 1, 2022 and December 31, 2021

—

—

Common stock $0.001 par value, 750,000,000

authorized; 239,942,927 issued and 211,276,558 outstanding at

October 1, 2022; 238,432,216 issued and 233,056,799 outstanding at

December 31, 2021

240

238

Additional paid-in capital

1,067,148

1,058,724

Common stock in treasury; 28,666,369 and

5,375,417 at October 1, 2022 and December 31, 2021,

respectively

(357,408

)

(14,066

)

Retained earnings

484,254

320,875

Accumulated other comprehensive income

2,027

3,742

Total stockholders' equity

1,196,261

1,369,513

Total liabilities, redeemable stock, and

stockholders' equity

$

2,830,398

$

2,978,470

Hayward Holdings, Inc. Unaudited Condensed

Consolidated Statements of Operations (Dollars in thousands,

except per share data)

Three Months Ended

Nine Months Ended

October 1, 2022

October 2, 2021

October 1, 2022

October 2, 2021

Net sales

$

245,267

$

350,624

$

1,055,169

$

1,049,409

Cost of sales

137,483

188,170

567,626

559,033

Gross profit

107,784

162,454

487,543

490,376

Selling, general, and administrative

expense

50,493

68,807

188,297

207,129

Research, development, and engineering

expense

6,142

6,370

16,411

16,187

Acquisition and restructuring related

expense

2,288

783

9,499

2,452

Amortization of intangible assets

8,521

8,700

23,828

26,162

Operating income

40,340

77,794

249,508

238,446

Interest expense, net

13,938

11,050

35,105

42,297

Loss on debt extinguishment

—

—

—

9,418

Other (income) expense, net

(234

)

2,087

3,056

4,655

Total other expense

13,704

13,137

38,161

56,370

Income from operations before income

taxes

26,636

64,657

211,347

182,076

Provision for income taxes

3,549

14,336

47,968

42,072

Net income

$

23,087

$

50,321

$

163,379

$

140,004

Earnings per share

Basic

$

0.11

$

0.22

$

0.74

$

0.24

Diluted

$

0.10

$

0.21

$

0.70

$

0.23

Weighted average common shares

outstanding

Basic

212,905,429

231,339,007

222,009,824

172,820,430

Diluted

222,006,615

243,783,501

232,131,395

185,673,814

Hayward Holdings, Inc.

Unaudited Condensed Consolidated

Statements of Cash Flows

(In thousands)

Nine Months Ended

October 1, 2022

October 2, 2021

Cash flows from operating

activities

Net income

$

163,379

$

140,004

Adjustments to reconcile net income to net

cash provided by operating activities

Depreciation

13,931

14,096

Amortization of intangible assets

28,437

30,903

Amortization of deferred debt issuance

fees

2,312

2,771

Stock-based compensation

5,787

13,308

Deferred income taxes

(4,221

)

(3,014

)

Allowance for bad debts

869

584

Loss on debt extinguishment

—

9,418

Loss on disposal of property, plant and

equipment

5,550

3,743

Changes in operating assets and

liabilities

Accounts receivable

96,874

(9,115

)

Inventories

(70,469

)

(66,027

)

Other current and non-current assets

(16,902

)

(10,699

)

Accounts payable

(24,472

)

9,671

Accrued expenses and other liabilities

(57,411

)

63,520

Net cash provided by operating

activities

143,664

199,163

Cash flows from investing

activities

Purchases of property, plant, and

equipment

(23,533

)

(19,098

)

Purchases of intangibles

—

(818

)

Acquisitions, net of cash acquired

(61,337

)

—

Proceeds from sale of property, plant, and

equipment

4

25

Proceeds from settlements of investment

currency hedge

—

719

Net cash used in investing activities

(84,866

)

(19,172

)

Cash flows from financing

activities

Proceeds from issuance of common stock -

Initial Public Offering

—

377,400

Costs associated with Initial Public

Offering

—

(26,124

)

Purchase of common stock for treasury

(343,319

)

(10,530

)

Cash paid for taxes from share

withholdings

(871

)

(10,174

)

Proceeds from issuance of long-term

debt

—

51,659

Debt issuance costs

—

(12,422

)

Payments of long-term debt

(7,500

)

(367,144

)

Proceeds from revolving credit

facility

150,000

68,000

Payments on revolving credit facility

(50,000

)

(68,000

)

Proceeds from issuance of short term

debt

8,119

—

Payments of short term debt

(2,849

)

—

Other, net

473

522

Net cash (used in) provided by financing

activities

(245,947

)

3,187

Effect of exchange rate changes on cash

and cash equivalents and restricted cash

(5,740

)

(1,505

)

Change in cash and cash equivalents and

restricted cash

(192,889

)

181,673

Cash and cash equivalents and restricted

cash, beginning of period

265,796

115,294

Cash and cash equivalents and restricted

cash, end of period

$

72,907

$

296,967

Supplemental disclosures of cash flow

information

Cash paid-interest

32,725

53,686

Cash paid-income taxes

93,503

39,242

Equipment financed under finance

leases

1,603

—

Reconciliations

Consolidated

Reconciliations

Adjusted EBITDA and Adjusted EBITDA Margin Reconciliations

(Non-GAAP)

Following is a reconciliation from net income to adjusted

EBITDA:

(Dollars in thousands)

Three Months Ended

Nine Months Ended

October 1, 2022

October 2, 2021

October 1, 2022

October 2, 2021

Net income

$

23,087

$

50,321

$

163,379

$

140,004

Depreciation

4,333

4,847

13,931

14,096

Amortization

10,249

10,405

28,437

30,903

Interest expense

13,938

11,050

35,105

42,297

Income taxes

3,549

14,336

47,968

42,072

Loss on extinguishment of debt

—

—

—

9,418

EBITDA

55,156

90,959

288,820

278,790

Stock-based compensation (a)

(4

)

484

1,248

16,383

Sponsor management fees (b)

—

—

—

90

Currency exchange items (c)

52

1,149

2,776

4,379

Acquisition and restructuring related

expense, net (d)

2,288

783

9,499

2,452

Other (e)

2,935

4,954

11,970

13,941

Total Adjustments

5,271

7,370

25,493

37,245

Adjusted EBITDA

$

60,427

$

98,329

$

314,313

$

316,035

Adjusted EBITDA margin

24.6

%

28.0

%

29.8

%

30.1

%

(a)

Represents non-cash stock-based

compensation expense related to equity awards issued to management,

employees, and directors. Beginning in the three months ended July

2, 2022, the adjustment includes only expense related to awards

issued under the 2017 Equity Incentive Plan, which were awards

granted prior to the effective date of Hayward’s initial public

offering (the “IPO”), whereas in prior periods, the adjustment

included stock-based compensation expense for all equity awards.

Under the historical presentation, the stock-based compensation

adjustment for the three and nine months ended October 1, 2022

would have been an expense of $1.8 million and $4.7 million,

respectively.

(b)

Represents fees paid to certain of the

Company’s controlling stockholders for services rendered pursuant

to a 2017 management services agreement. This agreement and the

corresponding payment obligation ceased on March 16, 2021, the

effective date of the IPO.

(c)

Represents unrealized non-cash losses

(gains) on foreign denominated monetary assets and liabilities and

foreign currency contracts.

(d)

Adjustments in the three months ended

October 1, 2022 are primarily driven by separation costs associated

with a reduction-in-force as well as costs associated with the

relocation of the corporate headquarters. Adjustments in the nine

months ended October 1, 2022 are primarily driven by transaction

costs associated with the acquisition of the Specialty Lighting

Business, costs associated with the relocation of the corporate

headquarters, and separation costs associated with a

reduction-in-force. Adjustments in the three and nine months ended

October 2, 2021 are primarily driven by restructuring related costs

associated with the exit of a redundant manufacturing and

distribution facility and costs associated with the relocation of

the corporate headquarters.

(e)

Adjustments in the three months ended

October 1, 2022 primarily includes the non-cash increase in cost of

goods sold resulting from the fair value inventory step-up

adjustment recognized as part of the purchase accounting for the

Specialty Lighting Business. Adjustments in the three months ended

October 2, 2021 include a legal settlement and fees, costs related

to a fire at our manufacturing and administrative facilities in

Yuncos, Spain, and operating losses related to an early-stage

product business acquired in 2018 that was phased out.

Adjustments in the nine months ended

October 1, 2022 include expenses associated with the

discontinuation of a product joint development agreement, a

non-cash increase in cost of goods sold resulting from the fair

value inventory step-up adjustment recognized as part of the

purchase accounting for the Specialty Lighting Business, and costs

incurred related to the selling stockholder offering of shares in

May 2022, which are reported in SG&A in our unaudited condensed

consolidated statements of operations, partially offset by gains

resulting from an insurance policy reimbursement related to the

fire incident in Yuncos, Spain. Adjustments in the nine months

ended October 2, 2021 include a write-off related to the

aforementioned fire in Yuncos, Spain, a legal settlement and fees

related to patent infringement litigation, expenses incurred in

preparation for the IPO and transaction related bonuses, costs

related to our debt refinancing, and operating losses related to an

early stage product business acquired in 2018 that was phased

out.

Following is a reconciliation from net income to adjusted EBITDA

for the last twelve months:

(Dollars in thousands)

Last Twelve Months(f)

Fiscal Year

October 1, 2022

December 31, 2021

Net income

$

227,100

$

203,725

Depreciation

18,661

18,826

Amortization

36,524

38,990

Interest expense

43,662

50,854

Income taxes

62,312

56,416

Loss on extinguishment of debt

—

9,418

EBITDA

388,259

378,229

Stock-based compensation (a)

3,884

19,019

Sponsor management fees (b)

—

90

Currency exchange items (c)

2,882

4,485

Acquisition and restructuring related

expense, net (d)

22,077

15,030

Other (e)

2,914

4,884

Total Adjustments

31,757

43,508

Adjusted EBITDA

$

420,016

$

421,737

Adjusted EBITDA margin

29.8

%

30.1

%

(a)

Represents non-cash stock-based

compensation expense related to equity awards issued to management,

employees, and directors. Beginning in the three months ended July

2, 2022, the adjustment includes only expense related to awards

issued under the 2017 Equity Incentive Plan, which were awards

granted prior to the effective date of Hayward’s initial public

offering (the “IPO”), whereas in prior periods, the adjustment

included stock-based compensation expense for all equity awards.

Under the historical presentation, the stock-based compensation

adjustment for the three and nine months ended October 1, 2022

would have been an expense of $1.8 million and $4.7 million,

respectively.

(b)

Represents fees paid to certain of the

Company’s controlling stockholders for services rendered pursuant

to a 2017 management services agreement. This agreement and the

corresponding payment obligation ceased on March 16, 2021, the

effective date of the IPO.

(c)

Represents unrealized non-cash losses

(gains) on foreign denominated monetary assets and liabilities and

foreign currency contracts.

(d)

Adjustments in the last twelve months

ended October 1, 2022 include business restructuring related costs

associated with the exit of an early-stage product business

acquired in 2018, transaction costs associated with the acquisition

of the Specialty Lighting Business, costs associated with the

relocation of the corporate headquarters, and separation costs

associated with a reduction-in-force. Adjustments in the last

twelve months ended December 31, 2021 include business

restructuring related costs associated with the exit of an

early-stage product business acquired in 2018, severance and

relocation costs associated with the relocation of our corporate

headquarters, and business restructuring related costs associated

with the exit of redundant manufacturing and distribution

facilities.

(e)

Adjustments in the last twelve months

ended October 1, 2022 include expenses associated with the

discontinuation of a product joint development agreement, a

non-cash increase in cost of goods sold resulting from the fair

value inventory step-up adjustment recognized as part of the

purchase accounting for the Specialty Lighting Business, and costs

incurred related to the selling stockholder offering of shares in

May 2022, which are reported in SG&A in our unaudited condensed

consolidated statements of operations, partially offset by gains

resulting from an insurance policy reimbursement related to the

fire incident in Yuncos, Spain.

Adjustments in the twelve months ended

December 31, 2021 include net insurance settlement proceeds for

property damage loss as well as the consequential business

interruption loss amount caused by the fire incident in Yuncos

Spain, a legal settlement and related fees, operating losses

related to the early stage product business acquired in 2018, debt

refinancing expenses, and expenses incurred in preparation with the

IPO.

(f)

Items for the last twelve months ended

October 1, 2022 are calculated by adding the item for the nine

months ended October 1, 2022 plus Fiscal Year ended December 31,

2021 and subtracting the item for the nine months ended October 2,

2021.

Adjusted Net Income and Adjusted EPS Reconciliation

(Non-GAAP)

Following is a reconciliation of net income to adjusted net

income and earnings per share to adjusted earnings per share:

(Dollars in thousands)

Three Months Ended

Nine Months Ended

October 1, 2022

October 2, 2021

October 1, 2022

October 2, 2021

Net income

$

23,087

$

50,321

$

163,379

$

140,004

Tax adjustments (a)

(2,897

)

(2,410

)

(3,128

)

(5,255

)

Other adjustments and amortization:

Stock-based compensation (b)

(4

)

484

1,248

16,383

Sponsor management fees (c)

—

—

—

90

Currency exchange items (d)

52

1,149

2,776

4,379

Acquisition and restructuring related

expense, net (e)

2,288

783

9,499

2,452

Other (f)

2,935

4,954

11,970

13,941

EBITDA adjustments

5,271

7,370

25,493

37,245

Loss on extinguishment of debt

—

—

—

9,418

Amortization

10,249

10,405

28,437

30,903

Tax effect(a)

(3,756

)

(4,604

)

(13,066

)

(20,492

)

Pro forma adjustments (g):

Interest savings

—

—

—

6,443

Acquisitions

—

875

2,761

3,079

Tax effect(a)

—

(227

)

(667

)

(2,623

)

Adjusted net income

$

31,954

$

61,730

$

203,209

$

198,722

Weighted average number of common shares

outstanding, basic

212,905,429

231,339,007

222,009,824

172,820,430

Weighted average number of common shares

outstanding, diluted

222,006,615

243,783,501

232,131,395

185,673,814

Adjusted basic EPS(h)

$

0.15

$

0.27

0.92

1.15

Adjusted diluted EPS(h)

$

0.14

$

0.25

0.88

1.07

(a)

Tax adjustments for the three and nine

months ended October 1, 2022 reflect a normalized tax rate of 24.2%

and 24.5% compared to our effective tax rate of 13.3% and 22.7%,

respectively. Our effective tax rate for the three and nine months

ended October 1, 2022 includes the impact of the revaluation of

deferred tax liabilities as a result of state tax law changes and

the tax benefit resulting from the exercise of stock options. Tax

adjustments for the three and nine months ended October 2, 2021

reflect a normalized tax rate of 25.9% and 25.1% compared to our

effective tax rate of 22.2% and 23.1%, respectively. Our effective

tax rate for the three and nine months ended October 1, 2022

includes the impact of the release of a valuation allowance on the

deferred tax assets and the tax benefit resulting from the exercise

of stock options. All non-tax adjustments are effected at the

normalized rate.

(b)

Represents non-cash stock-based

compensation expense related to equity awards issued to management,

employees, and directors. Beginning in the three months ended July

2, 2022, the adjustment includes only expense related to awards

issued under the 2017 Equity Incentive Plan, which were awards

granted prior to the effective date of Hayward’s initial public

offering (the “IPO”), whereas in prior periods, the adjustment

included stock-based compensation expense for all equity awards.

Under the historical presentation, the stock-based compensation

adjustment for the three and nine months ended October 1, 2022

would have been an expense of $1.8 million and $4.7 million,

respectively.

(c)

Represents fees paid to certain of the

Company’s controlling stockholders for services rendered pursuant

to a 2017 management services agreement. This agreement and the

corresponding payment obligation ceased on March 16, 2021, the

effective date of the IPO.

(d)

Represents unrealized non-cash losses

(gains) on foreign denominated monetary assets and liabilities and

foreign currency contracts.

(e)

Adjustments in the three months ended

October 1, 2022 are primarily driven by separation costs associated

with a reduction-in-force as well as costs associated with the

relocation of the corporate headquarters. Adjustments in the nine

months ended October 1, 2022 are primarily driven by transaction

costs associated with the acquisition of the Specialty Lighting

Business, costs associated with the relocation of the corporate

headquarters, and separation costs associated with a

reduction-in-force. Adjustments in the three and nine months ended

October 2, 2021 are primarily driven by restructuring related costs

associated with the exit of a redundant manufacturing and

distribution facility and costs associated with the relocation of

the corporate headquarters.

(f)

Adjustments in the three months ended

October 1, 2022 primarily includes the non-cash increase in cost of

goods sold resulting from the fair value inventory step-up

adjustment recognized as part of the purchase accounting for the

Specialty Lighting Business. Adjustments in the three months ended

October 2, 2021 include a legal settlement and fees, costs related

to a fire at our manufacturing and administrative facilities in

Yuncos, Spain, and operating losses related to an early-stage

product business acquired in 2018 that was phased out.

Adjustments in the nine months ended

October 1, 2022 include expenses associated with the

discontinuation of a product joint development agreement, a

non-cash increase in cost of goods sold resulting from the fair

value inventory step-up adjustment recognized as part of the

purchase accounting for the Specialty Lighting Business, and costs

incurred related to the selling stockholder offering of shares in

May 2022, which are reported in SG&A in our unaudited condensed

consolidated statements of operations, partially offset by gains

resulting from an insurance policy reimbursement related to the

fire incident in Yuncos, Spain. Adjustments in the nine months

ended October 2, 2021 include a write-off related to the

aforementioned fire in Yuncos, Spain, a legal settlement and fees

related to patent infringement litigation, expenses incurred in

preparation for the IPO and transaction related bonuses, costs

related to our debt refinancing, and operating losses related to an

early stage product business acquired in 2018 that was phased

out.

(g)

The adjustments for the nine months ended

October 1, 2022 represent pro-forma adjustments related to the

acquisition of the Specialty Lighting Business and the adjustments

for the three and nine months ended October 2, 2021 represent

pro-forma adjustments related to interest savings from repayment in

full of our Second Lien Term Facility and partial repayment of our

First Lien Credit Agreement as if such payments had occurred at the

beginning of the period.

(h)

For the nine months ended October 2, 2021,

adjusted net income used in the computation of adjusted basic and

diluted EPS does not include certain IPO related items impacting

net income attributable to common stockholders used as the

numerator of the US GAAP basic and diluted EPS computations,

including a deemed dividend to Class A shareholders of $85.5

million and dividends to Class C shareholders of $41 thousand.

Including these items in the calculation of adjusted EPS would

result in adjusted basic and diluted EPS of $0.58 and $0.54 per

share, respectively.

Segment Reconciliations

Following is a reconciliation from segment income to adjusted

segment income for the North America (“NAM”) and Europe & Rest

of World (“E&RW”) segments:

(Dollars in thousands)

Three Months Ended

Three Months Ended

October 1, 2022

October 2, 2021

Total

NAM

E&RW

Total

NAM

E&RW

Net sales

$

245,267

$

203,674

$

41,593

$

350,624

$

298,236

$

52,388

Gross profit

$

107,784

$

91,850

$

15,934

$

162,454

$

141,655

$

20,799

Gross profit margin % (a)

43.9

%

45.1

%

38.3

%

46.3

%

47.5

%

39.7

%

Segment income

$

57,493

$

48,704

$

8,789

$

102,502

$

91,920

$

10,582

Segment income margin %

23.4

%

23.9

%

21.1

%

29.2

%

30.8

%

20.2

%

Depreciation

4,049

3,853

196

4,428

4,253

175

Amortization

1,728

1,728

—

1,705

1,705

—

Stock-based compensation

(276

)

(284

)

8

(92

)

(126

)

34

Other (b)

2,516

2,878

(362

)

957

568

389

Total adjustments

8,017

8,175

(158

)

6,998

6,400

598

Adjusted segment income

$

65,510

$

56,879

$

8,631

$

109,500

$

98,320

$

11,180

Adjusted segment income margin %

26.7

%

27.9

%

20.8

%

31.2

%

33.0

%

21.3

%

Expenses not allocated to segments

Corporate expense, net

$

6,344

$

15,225

Acquisition and restructuring related

expense

2,288

783

Amortization of intangible assets

8,521

8,700

Operating income

$

40,340

$

77,794

(a)

Excluding the non-cash increase in cost of

goods sold resulting from the fair value inventory step-up

adjustment recognized as part of the purchase accounting for the

Specialty Lighting Business, adjusted gross profit margin was

45.0%, an increase of 108 basis points, for the three months ended

October 1, 2022. For NAM, excluding the impact of the purchase

accounting adjustment, adjusted gross profit margin was 46.4%, an

increase of 128 basis points, for the three months ended October 1,

2022

(b)

The three months ended October 1, 2022 for

NAM includes a non-cash increase in cost of goods sold resulting

from the fair value inventory step-up adjustment recognized as part

of the purchase accounting for the Specialty Lighting Business. The

three months ended October 2, 2021 includes operating losses which

relate to an early stage product business acquired in 2018 that was

phased out in 2021.

The three months ended October 1, 2022 for

E&RW includes collections of previously reserved bad debt

expense related to certain customers impacted by the conflict in

Russia and Ukraine. The three months ended October 2, 2021

represents the impact of a fire at our manufacturing and

administrative facilities in Yuncos, Spain.

(Dollars in thousands)

Nine Months Ended

Nine Months Ended

October 1, 2022

October 2, 2021

Total

NAM

E&RW

Total

NAM

E&RW

Net sales

$

1,055,169

$

892,050

$

163,119

$

1,049,409

$

863,276

$

186,133

Gross profit

$

487,543

$

421,725

$

65,818

$

490,376

$

416,753

$

73,623

Gross profit margin %

46.2

%

47.3

%

40.3

%

46.7

%

48.3

%

39.6

%

Segment income

$

306,844

$

267,854

$

38,990

$

304,848

$

267,020

$

37,828

Segment income margin %

29.1

%

30.0

%

23.9

%

29.0

%

30.9

%

20.3

%

Depreciation

13,006

12,435

571

13,496

12,653

843

Amortization

4,609

4,609

—

4,740

4,740

—

Stock-based compensation

183

72

111

7,904

7,318

586

Other (a)

8,966

8,616

350

6,991

1,551

5,440

Total adjustments

26,764

25,732

1,032

33,131

26,262

6,869

Adjusted segment income (a)

$

333,608

$

293,586

$

40,022

$

337,979

$

293,282

$

44,697

Adjusted segment income margin % (a)

31.6

%

32.9

%

24.5

%

32.2

%

34.0

%

24.0

%

Expenses not allocated to segments

Corporate expense, net

$

24,009

$

37,788

Acquisition and restructuring related

expense

9,499

2,452

Amortization of intangible assets

23,828

26,162

Operating income

$

249,508

$

238,446

(a)

The nine months ended October 1, 2022 for

NAM includes expenses associated with the discontinuation of a

product joint development agreement and a non-cash increase in cost

of goods sold resulting from the fair value inventory step-up

adjustment recognized as part of the purchase accounting for the

Specialty Lighting Business. The nine months ended October 2, 2021

include operating losses which relate to an early stage product

business acquired in 2018 that was phased out in 2021.

The nine months ended October 1, 2022 for

E&RW includes bad debt reserves related to certain customers

impacted by the conflict in Russia and Ukraine partially offset by

subsequent collections. The nine months ended October 2, 2021

represents the impact of a fire at our manufacturing and

administrative facilities in Yuncos, Spain.

Source: Hayward Holdings, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221101005299/en/

Investor Relations: Kevin Maczka

investor.relations@hayward.com

Media Relations: Tanya McNabb tmcnabb@hayward.com

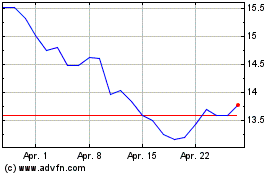

Hayward (NYSE:HAYW)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Hayward (NYSE:HAYW)

Historical Stock Chart

Von Apr 2023 bis Apr 2024