Current Report Filing (8-k)

17 Mai 2023 - 10:07PM

Edgar (US Regulatory)

false0001820144NYSENYSE00018201442023-05-122023-05-120001820144us-gaap:CommonStockMember2023-05-122023-05-120001820144tinv:WarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShareMember2023-05-122023-05-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 12, 2023

GRINDR INC.

(Exact name of Registrant as Specified in its Charter)

|

Delaware

|

001-39714

|

92-1079067

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

750 N. San Vicente Blvd., Suite RE 1400

West Hollywood, CA 90069

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (310) 776-6680

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on

which registered

|

|

Common Stock, par value $0.0001 per share

|

|

GRND

|

|

The New York Stock Exchange

|

|

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share

|

|

GRND.WS

|

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry Into a Material Definitive Agreement.

|

Fortress Credit Corp. Loan

On May 12, 2023, Grindr Inc. (the “Company”), Grindr

Group LLC (“Legacy Grindr”), Grindr Capital LLC (f/k/a San Vicente Capital LLC) (the “Borrower”),

Fortress Credit Corp. (“Fortress”) and the other credit parties and lenders party to the June 10, 2020 credit agreement (the “Credit Agreement”) between Grindr Gap LLC (f/k/a San Vicente Gap LLC) (“Grindr Gap”), the Borrower, Fortress and the other credit parties and

lenders party thereto, entered into an Amendment No. 4 to the Credit Agreement and related agreements (the “Amendment No. 4”). Pursuant to Amendment No. 4, the Company and Legacy Grindr have become guarantors of the borrowings under the Credit Agreement and have pledged

certain of their assets as collateral. The Company and Legacy Grindr have also become subject to the covenants under the Credit Agreement. In addition, the Company has replaced Grindr Gap as the reporting entity under the Credit Agreement and is

required to furnish financial information to the lenders based on the Company’s consolidated financial information, including the liquidity calculation and financial covenant certification.

The Credit Agreement permitted the Borrower to borrow up to $192.0 million through a senior secured credit facility. The

Borrower, Fortress and the other credit parties and lenders entered into Amendment No. 2 to the Credit Agreement on June 13, 2022, which permitted the Borrower to borrow an additional $60.0 million through several supplemental term loans. The

Borrower, Fortress and the other credit parties and lenders entered into Amendment No. 3 to the Credit Agreement on November 14, 2022, which permitted the Borrower to borrow an additional $170.8 million through several supplemental term loans.

The Borrower is a direct subsidiary of Grindr Gap, which is a direct subsidiary of Legacy Grindr. Legacy Grindr is a direct

subsidiary of the Company. Borrowings under the Credit Agreement are guaranteed by all of the subsidiaries of Legacy Grindr (other than the Borrower and Grindr Canada Inc.) and are collateralized by the capital stock and/or certain assets of all

of the subsidiaries of Legacy Grindr.

| Item 9.01 |

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

Amendment No. 4 to the Credit Agreement, dated as of May 12, 2023, among Grindr Gap LLC, Grindr Capital LLC, Fortress Credit Corp., Grindr Inc., Grindr Group

LLC and the other parties thereto.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

GRINDR INC.

|

| |

|

|

|

Date: May 17, 2023

|

By:

|

/s/ Vandana Mehta-Krantz

|

| |

Name:

|

Vandana Mehta-Krantz

|

| |

Title:

|

Chief Financial Officer

|

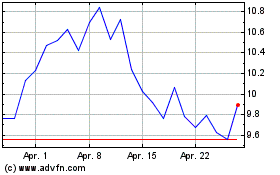

Grindr (NYSE:GRND)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Grindr (NYSE:GRND)

Historical Stock Chart

Von Apr 2023 bis Apr 2024