Grindr Inc. Reports 2022 Q4 and Full Year 2022

Earnings Results

2022 Full Year Operating Income of $13 Million

and Adjusted EBITDA Margin of 44%

111 Billion Chats Sent and 999 Million Album

Shares in 2022, with Revenue from Paying Users Up 41%

Inaugural Shareholder Letter Details Plans to

Drive Monetization, with Guidance of 25% or Greater Revenue Growth

and 38%+ EBITDA Margin in 2023

Grindr Inc. (NYSE: GRND), the world’s largest social network for

the LGBTQ community, today posted its financial results for the

fourth quarter and fiscal year ended December 31, 2022 in a Letter

to Shareholders. The Letter to Shareholders can be accessed on

Grindr’s Investor Relations website.

“Grindr is off to a great start as a newly public company,

delivering strong growth in revenue and Adjusted EBITDA,” said

George Arison, Chief Executive Officer of Grindr. “We grew revenue

from our paying users by 41% in 2022. We have put the foundation in

place to drive sustainable long-term growth and value creation as

we enhance our user experience, better monetize our core business,

build out our international business and, longer-term, add new

adjacent, community-focused businesses.”

Earnings Webcast Information

Grindr will host a live webcast today at 2:00 p.m. Pacific Time

to discuss the company’s fourth quarter and fiscal year financial

results. The webcast of the conference call can be accessed as

follows:

Event: Grindr Fourth Quarter and Fiscal Year 2022 Earnings

Conference Call

Date: Monday, March 6, 2023

Time: 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time)

Live Webcast Site: https://investors.grindr.com/

An archived webcast of the conference call will also be

accessible on Grindr’s Investor Relations page,

https://investors.grindr.com/.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995 regarding Grindr’s

current views with respect to its industry, operations and future

business plans and performance. These forward-looking statements

can generally be identified by the use of forward-looking

terminology, including the terms “believes,” “estimates,”

“anticipates,” “expects,” “seeks,” “projects,” “intends,” “plans,”

“may,” “will” or “should” or, in each case, their negative or other

variations or comparable terminology, but the absence of these

words does not mean that a statement is not forward-looking. These

forward-looking statements include, among others, statements about

our growth opportunities, our 2023 strategic priorities, our plan

to generate sustainable double-digit revenue growth and strong

profitability and our full year 2023 guidance. Forward-looking

statements, including guidance related to Revenue Growth and

Adjusted EBITDA Margin, are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are not guarantees

of future performance and are subject to risks and uncertainties

that may cause actual results to differ materially from our

expectations discussed in the forward-looking statements. Many

factors could cause actual future events to differ materially from

the forward-looking statements in this press release, including but

not limited to: (i) our reliance on historical data, which may be

of limited reliability, in providing revenue guidance; (ii) the

impact of the regulatory environment and complexities with

compliance related to such environment; (iii) our ability to

respond to general economic conditions; (iv) factors relating to

the business, operations and financial performance of Grindr and

its subsidiaries, including: (a) competition in the dating and

social networking products and services industry; (b) the ability

to maintain and attract users; and (c) fluctuation in quarterly and

yearly results; (v) natural disasters, outbreaks and pandemics,

including the COVID-19 pandemic and MPox; (vi) our ability to adapt

to changes in technology and user preferences in a timely and

cost-effective manner; (vii) our ability to maintain compliance

with privacy and data protection laws and regulations; (viii) our

ability to protect systems and infrastructures from cyber-attacks

and prevent unauthorized data access; (ix) our dependence on the

integrity of third-party systems and infrastructure; and (x) our

ability to protect our intellectual property rights from

unauthorized use by third parties. The foregoing list of factors is

not exhaustive. Further information on these and additional risks,

uncertainties and other factors that could cause actual outcomes

and results to differ materially from those included in or

contemplated by the forward-looking statements contained in this

press release are included under the caption “Risk Factors” in our

Registration Statement filed on Form S-1/A filed by Grindr with the

SEC on February 9, 2023 as well as other filings that we make with

the SEC from time to time. Forward-looking statements speak only as

of the date they are made. Readers are cautioned not to put undue

reliance on forward-looking statements, and the Company assumes no

obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise.

About Non-GAAP

Grindr uses Adjusted EBITDA and Adjusted EBITDA margin, which

are non-GAAP measures, to understand and evaluate its core

operating performance. These non-GAAP financial measures, which may

differ from similarly titled measures used by other companies, are

presented to enhance investors’ overall understanding of Grindr’s

financial performance and should not be considered as a substitute

for, or superior to, the financial information prepared and

presented in accordance with GAAP. Grindr defines Adjusted EBITDA

as net income (loss) excluding income tax provision, interest

expense, depreciation and amortization, stock-based compensation

expense, non-core expenses/losses (gains), including purchase

accounting adjustments related to deferred revenue,

transaction-related costs, management fees, and interest income

from the related party loan to Catapult GP II. Adjusted EBITDA

Margin represents Adjusted EBITDA as a percentage of revenue.

Grindr’s management uses Adjusted EBITDA and Adjusted EBITDA margin

internally to evaluate the performance of our business and this

measure is one of the primary metrics by which our internal budgets

are based and by which management is compensated. Grindr believes

Adjusted EBITDA and Adjusted EBITDA Margin are also helpful to

investors, analysts, and other interested parties because they can

assist in providing a more consistent and comparable overview of

our operations across our historical financial periods. Grindr

excludes the above items as some are non-cash in nature, and others

are non-recurring that they may not be representative of normal

operating results. Adjusted EBITDA and Adjusted EBITDA margin

adjust for the impact of items that Grindr does not consider

indicative of the operational performance of our business. While

Grindr believes that these non-GAAP financial measures are useful

in evaluating our business, this information should be considered

as supplemental in nature and is not meant as a substitute for the

related financial information prepared and presented in accordance

with GAAP.

Unaudited Reconciliation of Net Income to

Adjusted EBITDA

$ in thousands Q4 2022 Q4 2021

FY 2022 FY 2021

Net income

$5,195

$6,497

$852

$5,064

Interest expense, net (1)

20,540

3,835

31,538

18,698

Income tax (benefit) expense

(4,586

)

1,450

(859

)

1,236

Depreciation and amortization

10,291

10,700

37,506

43,234

Transaction-related costs (2)

4,288

876

6,499

3,854

Litigation related costs (3)

201

535

1,722

1,913

Stock-based compensation expense

5,233

679

28,586

2,485

Management fees (4)

100

185

644

728

Purchase accounting adjustment

-

8

-

900

Other income (5)

(552

)

(1,409

)

-

(1,058

)

Change in fair value of warrant liability (6)

(21,295

)

-

(21,295

)

-

Adjusted EBITDA

$19,415

$23,356

$85,193

$77,054

_______________

1)

Interest expense, net for the year ended

December 31, 2022 included the loss on extinguishment of Deferred

Payment (as defined in our public filings).

2)

Transaction-related costs consist of

legal, tax, accounting, consulting, and other professional fees

related to the Business Combination with Tiga Acquisition Corp. (as

defined in our public filings), that are non-recurring in

nature.

3)

Litigation related costs primarily

represent external legal fees associated with the outstanding

litigation or regulatory matters such as the potential Datatilsynet

fine or the CFIUS review of the Business Combination, which are

unrelated to Grindr’s core ongoing business operations.

4)

Management fees represent administrative

costs associated with SVH’s administrative role in managing

financial relationships and providing directive on strategic and

operational decisions, which ceased to continue after the closing

of the Business Combination.

5)

For the year ended December 31, 2021,

other income primarily represents costs incurred from

reorganization events that are unrelated to Grindr’s core ongoing

business operations, including severance and employment related

costs of $0.5 million, offset by PPP Loan forgiveness income of

$1.5 million.

6)

Change in fair value of warrant liability

relates to our warrants that were remeasured to fair value of $17.9

million as of December 31, 2022, resulting in a gain of $21.3

million for the year ended December 31, 2022.

About Grindr Inc.

With roughly 12 million monthly active users in virtually every

country in the world, Grindr has grown to become a fundamental part

of the queer community since its launch in 2009. The company

continues to expand its ecosystem to enable gay, bi, trans and

queer people to connect, express themselves, and discover the world

around them. Grindr is headquartered in West Hollywood, California.

The Grindr app is available on the App Store and Google Play.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230306005746/en/

Investors: IR@grindr.com

Media: Press@grindr.com

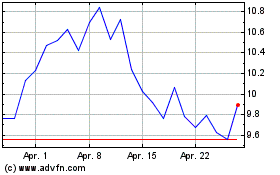

Grindr (NYSE:GRND)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Grindr (NYSE:GRND)

Historical Stock Chart

Von Apr 2023 bis Apr 2024