Current Report Filing (8-k)

02 September 2022 - 10:07PM

Edgar (US Regulatory)

0001672013false00016720132022-08-302022-08-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 30, 2022

| | |

| Acushnet Holdings Corp. |

(Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Delaware | 001-37935 | 45-2644353 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

| 333 Bridge Street | Fairhaven, | Massachusetts | 02719 |

| (Address of principal executive offices) | | | (Zip Code) |

(800) 225‑8500

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock - $0.001 par value per share | | GOLF | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On August 30, 2022, in connection with its existing $450.0 million share repurchase authorization, Acushnet Holdings Corp. (the “Company”) amended and restated its existing stock repurchase agreement, dated as of June 16, 2022 (the “Original Agreement”), with Magnus Holdings Co., Ltd. (“Magnus”) to increase the aggregate dollar amount of shares of its common stock that it will repurchase from Magnus on a share-for-share basis as the Company repurchases shares in the open market from $75.0 million to $100.0 million (the “Amended and Restated Agreement”). The terms of the Amended and Restated Agreement are otherwise identical to the terms of the Original Agreement. The price payable to Magnus for the Company’s shares will be the average price of the shares purchased in the open market over the period of time from July 1, 2022 (in the case of the first such pricing period) to the first “determination date” and, in the case of any subsequent such pricing period, from the most recent preceding determination date to the next determination date. The “determination date” will be (i) commencing July 1, 2022, the date on which the Company purchases an aggregate of $100.0 million of shares, (ii) any date otherwise mutually agreed between the Company and Magnus, and (iii) January 13, 2023, if the Company has not already purchased the $100.0 million shares of common stock. The obligations of the Company to purchase the shares and Magnus to sell the shares following each determination date are conditioned upon no event occurring since the date of the agreement that, either individually or in the aggregate, has had a material adverse effect on the business or financial condition of the Company as of each closing. The foregoing summary does not purport to be complete and is qualified in its entirety by reference to the copy of the Amended and Restated Agreement filed as Exhibit 10.1 to this Current Report on Form 8-K. For more information on Magnus’ relationship to the Company, please refer to the Company’s Definitive Proxy Statement filed on April 14, 2022.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ACUSHNET HOLDINGS CORP. |

| |

| By: | /s/ Thomas Pacheco |

| Name: | Thomas Pacheco |

| Title: | Executive Vice President, Chief Financial Officer and Chief Accounting Officer |

Date: September 2, 2022

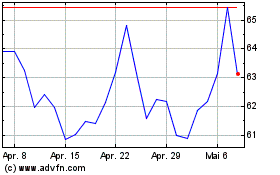

Acushnet (NYSE:GOLF)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

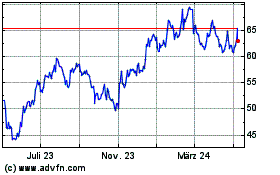

Acushnet (NYSE:GOLF)

Historical Stock Chart

Von Apr 2023 bis Apr 2024