UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company

Act file number 811-21982

Guggenheim

Strategic Opportunities Fund

(Exact name of registrant as specified in charter)

227 West

Monroe Street, Chicago, 60606

(Address of principal executive offices) (Zip code)

Amy J. Lee

227 West

Monroe Street, Chicago, 60606

(Name and address of agent for service)

Registrant's

telephone number, including area code: (312) 827-0100

Date of fiscal

year end: May 31

Date of reporting

period: June 1, 2023 - May 31, 2024

Item 1. Reports to Stockholders.

The registrant's annual report transmitted

to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”),

is as follows:

Guggenheim Funds Annual Report

Guggenheim Strategic Opportunities Fund

| |

|

| GuggenheimInvestments.com |

CEF-GOF-AR-0524 |

GUGGENHEIMINVESTMENTS.COM/GOF

... YOUR WINDOW TO THE LATEST, MOST UP-TO-DATE

INFORMATION ABOUT GUGGENHEIM STRATEGIC

OPPORTUNITIES FUND

The shareholder report you are reading right now is just the beginning

of the story.

Online at guggenheiminvestments.com/gof, you will find:

• Daily, weekly and monthly data on share prices, net asset

values, distributions and more

• Portfolio overviews and performance analyses

• Announcements, press releases and special notices

• Fund and adviser contact information

Guggenheim Partners Investment Management, LLC and Guggenheim Funds

Investment Advisors, LLC are continually updating and expanding shareholder information services on the Fund’s website in an ongoing

effort to provide you with the most current information about how your Fund’s assets are managed and the results of our efforts. It

is just one more small way we are working to keep you better informed about your investment in the Fund.

| |

|

| DEAR SHAREHOLDER (Unaudited) |

May 31, 2024 |

We thank you for your investment in the Guggenheim Strategic Opportunities

Fund (the “Fund”). This report covers the Fund’s performance for the 12-month period ended May 31, 2024 (the “Reporting

Period”).

To learn more about the Fund’s performance and investment

strategy, we encourage you to read the Economic and Market Overview and the Management’s Discussion of Fund Performance, which begin

on page 5. There you will find information on Guggenheim’s investment philosophy, views on the economy and market environment, and

information about the factors that impacted the Fund’s performance during the Reporting Period.

The Fund’s investment objective is to maximize total return

through a combination of current income and capital appreciation. The Fund pursues a relative value-based investment philosophy. The Fund’s

sub-adviser seeks to combine a credit-managed fixed-income portfolio with access to a diversified pool of alternative investments and

equity strategies.

All Fund returns cited—whether based on net asset value (“NAV”)

or market price—assume the reinvestment of all distributions. For the Reporting Period, the Fund provided a total return based on

market price of 9.77% and a total return based on NAV of 15.72%. At the end of the Reporting Period, the Fund’s market price of

$14.68 per share represented a premium of 22.85% to its NAV of $11.95 per share.

Past performance is not a guarantee of future results. All NAV

returns include the deduction of management fees, operating expenses, and all other Fund expenses. The market price of the Fund’s

shares fluctuates from time to time, and it may be higher or lower than the Fund’s NAV.

During the Reporting Period, the Fund paid a monthly distribution

of $0.1821 per share. The most recent distribution represents an annualized distribution rate of 14.89% based on the Fund’s closing

market price of $14.68 per share at the end of the Reporting Period.

The Fund’s distribution rate is not constant and the amount

of distributions, when declared by the Fund’s Board of Trustees, is subject to change. There is no guarantee of any future distribution

or that the current returns and distribution rate will be maintained. Please see the Distributions to Shareholders & Annualized Distribution

Rate table on page 15, and Note 2(f) on page 87 for more information on distributions for the period.

We encourage shareholders to consider the opportunity to reinvest

their distributions from the Fund through the Dividend Reinvestment Plan (“DRIP”), which is described on page 130 of this

report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly dividend distribution

in common shares of the Fund purchased in the market at a price less than NAV.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND ANNUAL REPORT l 3

| |

|

| DEAR SHAREHOLDER (Unaudited) continued |

May 31, 2024 |

Conversely, when the market price of the Fund’s common shares

is at a premium above NAV, the DRIP reinvests participants’ dividends in newly issued common shares at the greater of NAV per share

or 95% of the market price per share. The DRIP provides a cost-effective means to accumulate additional shares and enjoy the benefits of

compounding returns over time. The DRIP effectively provides an income averaging technique for shareholders to accumulate a larger number

of Fund shares when the market price is depressed than when the price is higher.

We appreciate your investment and look forward to serving your

investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at guggenheiminvestments.com/gof.

Sincerely,

Guggenheim

Funds Investment Advisors, LLC

Guggenheim Strategic Opportunities Fund

June 30, 2024

4 l GOF l GUGGENHEIM STRATEGIC

OPPORTUNITIES FUND ANNUAL REPORT

| |

|

| ECONOMIC AND MARKET OVERVIEW |

May 31, 2024 |

In recent quarters, the U.S. economy has demonstrated continued

strength as fiscal spending helped defy predictions of a U.S. Federal Reserve (the “Fed”) induced recession. Inflation continues

to gradually recede, albeit in fits and starts, leaving the Fed on hold to preserve its monetary policy optionality for now. Our economic

outlook has continued to improve as the aggregate economy has not responded to rate hikes in the usual ways, even as higher rates weighed

on some sectors and reinforced our outlook for increasing bifurcation across the economy and markets. While factors like fiscal stimulus

and immigration have helped prop up the economy, we do not believe they will support the economic cycle indefinitely. Our base case is

for a benign slowdown in real gross domestic product (“GDP”) growth although we view risks to this forecast as tilted to the

downside, particularly relative to the improved expectations of the market.

Optimistic expectations built into market pricing are the driving

force behind the recent easing in financial conditions. The Fed’s own financial conditions gauge suggests little headwind to growth

from broad financial conditions. But most of the easing has been driven by narrow gains in equity valuations, leaving the economy vulnerable

to a pullback in risk sentiment.

Optimism can also be seen in forecasts of accelerating corporate

earnings growth, with the S&P 500 earnings per share expected to grow 12% this year after just 2% growth in 2023. While our baseline

view is also relatively constructive on the economy, and anticipated Fed easing later this year is expected to help support the growth

outlook, we still view risks as skewed to the downside. Signs of economic bifurcation and more cautious consumers may weigh on growth

more than currently anticipated, particularly if softening in labor market indicators continues.

However, even as slower growth or shifts in sentiment create some

potential for spread widening, all-in yields remain attractive on a historical basis and are still near decade plus highs. In addition,

the Fed’s attention to downside risks suggests to us that any substantial shift in conditions could be met with expectations of

greater monetary policy easing and could create a favorable environment for active fixed-income investors.

The opinions and forecasts expressed may not actually come to

pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation

of any specific security or strategy.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND ANNUAL REPORT l 5

| MANAGEMENT’S DISCUSSION OF |

|

| FUND PERFORMANCE (Unaudited) |

May 31, 2024 |

MANAGEMENT TEAM

Guggenheim Funds Investment Advisors, LLC serves as the investment

adviser to Guggenheim Strategic Opportunities Fund (the “Fund”). The Fund is managed by a team of seasoned professionals at

Guggenheim Partners Investment Management, LLC (“GPIM”).

This team includes Anne B. Walsh, CFA, JD, Managing Partner, Chief

Investment Officer of GPIM and Portfolio Manager; Steven H. Brown, CFA, Chief Investment Officer - Fixed Income, Senior Managing Director,

and Portfolio Manager; Adam J. Bloch, Managing Director and Portfolio Manager; and Evan L. Serdensky, Managing Director and Portfolio

Manager.

Discuss the Fund’s return and return of comparative indices

All Fund returns cited—whether based on net asset value (“NAV”)

or market price—assume the reinvestment of all distributions. For the Reporting Period, the Fund provided a total return based on

market price of 9.77% and a total return based on NAV of 15.72%. At the end of the Reporting Period, the Fund’s market price of

$14.68 per share represented a premium of 22.85% to its NAV of $11.95 per share. At the beginning of the Reporting Period, the Fund’s

market price of $15.69 per share represented a premium of 27.15% to its NAV of $12.34 per share.

Past performance is not a guarantee of future results. All NAV

returns include the deduction of management fees, operating expenses, and all other Fund expenses. The market price of the Fund’s

shares fluctuates from time to time and may be higher or lower than the Fund’s NAV.

Please refer to the graphs and tables included within the Fund

Summary beginning on page 12 for additional information about the Fund’s performance.

The returns for the Reporting Period of indices tracking performance

of the asset classes to which the Fund allocates the largest of its investments were:

| Index* |

Total Return |

| Bloomberg U.S. Aggregate Bond Index |

1.31% |

| Bloomberg U.S. Corporate Bond Index |

4.40% |

| Bloomberg U.S. Corporate High Yield Index |

11.24% |

| Credit Suisse Leveraged Loan Index |

13.22% |

| ICE Bank of America (“BofA”) Asset Backed Security Master BBB-AA Index |

7.07% |

| NASDAQ - 100 Index |

31.12% |

| Russell 2000 Index |

20.12% |

| Standard & Poor’s 500 (“S&P 500”) Index |

28.19% |

* See page 10 for Index definitions

6 l GOF l GUGGENHEIM STRATEGIC

OPPORTUNITIES FUND ANNUAL REPORT

| MANAGEMENT’S DISCUSSION OF |

|

| FUND PERFORMANCE (Unaudited) continued |

May 31, 2024 |

Discuss the Fund’s distributions

During the Reporting Period, the Fund paid a monthly distribution

of $0.1821 per share. The most recent distribution represents an annualized distribution rate of 14.89% based on the Fund’s closing

market price of $14.68 per share at the end of the Reporting Period.

The distributions paid consisted of (i) investment company taxable

income taxed as ordinary income, which includes, among other things, short-term capital gain and income from certain hedging and interest

rate transactions, (ii) long-term capital gain and (iii) return of capital.

There is no guarantee of any future distribution or that the current

returns and distribution rate will be maintained. The Fund’s distribution rate is not constant and the amount of distributions,

when declared by the Fund’s Board of Trustees, is subject to change.

Please see the Distributions to Shareholders & Annualized Distribution

Rate table on page 15, and Note 2(f) on page 87 for more information on distributions for the period.

| Payable Date |

Amount |

| June 30, 2023 |

$0.1821 |

| July 31, 2023 |

$0.1821 |

| August 31, 2023 |

$0.1821 |

| September 29, 2023 |

$0.1821 |

| October 31, 2023 |

$0.1821 |

| November 30, 2023 |

$0.1821 |

| December 29, 2023 |

$0.1821 |

| January 31, 2024 |

$0.1821 |

| February 29, 2024 |

$0.1821 |

| March 29, 2024 |

$0.1821 |

| April 30, 2024 |

$0.1821 |

| May 31, 2024 |

$0.1821 |

| Total |

$2.1852 |

What factors contributed or detracted from the Fund’s

Performance during the Reporting Period?

During the Reporting Period, the Fund saw positive performance

from income, credit spread tightening, and equities. Earned income contributed the most to performance as the Fund continued to prioritize

higher-quality credits with attractive income/yield profiles. Credit spreads also added to overall performance, particularly below-investment-grade

corporate credit, as bank loans and high yield corporates saw spreads tighten. Additionally, the Fund’s equity exposure contributed

to overall performance given the strong performance of the equity market over the Reporting Period. Duration was the sole thematic detractor

to the Fund. Duration detracted from performance as the yield

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND ANNUAL REPORT l 7

| MANAGEMENT’S DISCUSSION OF |

|

| FUND PERFORMANCE (Unaudited) continued |

May 31, 2024 |

curve bear steepened, meaning yields at the long end of the curve

rose more than those at the front end, with yields on 2-year and 10-year Treasurys finishing 47 basis points and 86 basis points higher,

respectively, at the end of the Reporting Period.

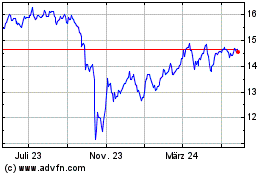

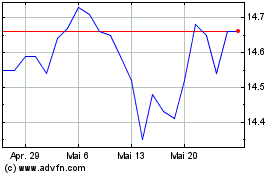

During the period, the Fund’s market price experienced elevated

volatility and trading volume, along with a decline in the Fund’s market price premium to NAV, particularly during the first half

of the period. The market price volatility was not related to any news or fundamental changes to the Fund’s investment objectives

or strategies, which remained consistent. As of the end of the period, the Fund’s market price premium to NAV returned to a level

more in line with its longer-term average.

The market price of a closed-end fund may trade at a premium or

discount to NAV. Whereas the NAV performance is indicative of investment performance, the market price performance may be influenced by

non-fundamental factors, such as seasonality, investor sentiment and overall supply and demand in the closed-end fund market, among other

factors. Whether investors will realize gains or losses upon the sale of Fund shares will depend upon whether the market price of Fund

shares at the time of sale is above or below the investor’s purchase price. The Fund’s investment performance during the period,

as indicated by NAV total return, outperformed its market price along with several fixed-income indices.

Discuss the Fund’s Use of Leverage

At the end of the Reporting Period, the Fund’s leverage was

approximately 18% of Managed Assets, compared with approximately 19% at the beginning of the Reporting Period.

The Fund currently employs financial leverage through reverse repurchase

agreements and a credit facility with a major bank.

One purpose of leverage is to fund the purchase of additional securities

that may provide increased income and potentially greater appreciation to common shareholders than could be achieved from an unlevered

portfolio. Leverage may result in greater NAV volatility and entails more downside risk than an unleveraged portfolio.

The Fund’s use of leverage during the Reporting Period benefited

performance.

Investments in Investment Funds (as defined in the Additional Information

Regarding the Fund section which begins on Page 132) frequently expose the Fund to an additional layer of financial leverage and the associated

risks, such as the magnified effect of any losses.

8 l GOF l GUGGENHEIM STRATEGIC

OPPORTUNITIES FUND ANNUAL REPORT

| MANAGEMENT’S DISCUSSION OF |

|

| FUND PERFORMANCE (Unaudited) continued |

May 31, 2024 |

How did the Fund use derivatives during the Reporting Period?

The Fund used a variety of derivatives during the Reporting Period,

both to gain market exposure, as well as to hedge certain exposures. Derivatives used for hedging mostly detracted from performance. Derivatives

used for hedging include call writing, which detracted from performance as equities rose over the period. Foreign currency forwards, used

to hedge non-USD exposures, detracted from overall performance. The Fund continued to utilize credit default swaps to hedge broader credit

markets, which also detracted from performance given the strong credit market performance during the Reporting Period. On the rates front,

the Fund continued to hold curve caps and interest rate swaps to hedge against moves lower in the yield curve; those positions were slight

detractors during the Reporting Period. During the Reporting Period, the Fund increased its utilization of S&P 500 Index Mini futures

to gain long U.S. equity exposure. Derivatives used to obtain general index exposure, such as futures and total return swaps to gain long

equity exposure, exhibited positive performance.

How was the Fund positioned at the end of the Reporting Period?

The Reporting Period exhibited a period of unprecedented volatility

that has left a wide range of possible outcomes going forward. We believe the next major policy moves are likely to provide strong tailwinds

for fixed income. We continue to expect elevated volatility in the economy and markets, as well as a policy response to these conditions.

This argues for the importance of diversification in asset allocation and within portfolios. The heightened probability of an economic

slowdown over the next 6-12 months, as indicated by our models, continues to guide our more defensive and conservative positioning within

the Fund, prioritizing quality (which takes multiple forms, including focusing on industry market leaders, more conservatively positioned

balance sheets, stronger credit stipulations, and more creditor-friendly structures) and industries that may be more resilient to economic

downturns.

Though the recent tightening of credit spreads has likely pulled

forward some of the expected future total return potential of parts of fixed income, we still view the go-forward valuation proposition

of fixed income as attractive at current levels and sourceable income levels in high-quality credit as historically high relative to recent

history. High-quality issuers in both the high yield and bank loan markets remain areas of focus within the Fund as well as certain subsectors

of structured credit like commercial asset-backed securities that continue to present opportunities to source loss-remote assets at attractive

valuations.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND ANNUAL REPORT l 9

| MANAGEMENT’S DISCUSSION OF |

|

| FUND PERFORMANCE (Unaudited) continued |

May 31, 2024 |

Index Definitions

Indices are unmanaged and reflect no expenses. It is not possible

to invest directly in an index.

The Bloomberg U.S. Aggregate Bond Index is a broad-based

flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries,

government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate

mortgage, or “ARM”, pass-throughs), asset-backed securities (“ABS”), and commercial mortgage-backed securities

(“CMBS”) (agency and non-agency).

The Bloomberg U.S. Corporate Bond Index is a broad-based

benchmark that measures the investment grade, fixed-rate, taxable corporate bond market. It includes U.S. dollar-denominated securities

publicly issued by U.S. and non-U.S. industrial, utility and financial issuers that meet specified maturity, liquidity, and quality requirements.

The Bloomberg U.S. Corporate High Yield Index measures the

U.S. dollar-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of

Moody’s, Fitch, and S&P is Ba1/BB +/BB + or below.

The Credit Suisse Leveraged Loan Index is an index designed

to mirror the investable universe of the U.S.-dollar-denominated leveraged loan market.

The ICE Bank of America Asset Backed Security Master BBB-AA

Index is a subset of the ICE Bank of America U.S. Fixed Rate Asset Backed Securities Index including all securities rated AA1 through

BBB3, inclusive.

The NASDAQ-100 Index includes 100 of the largest domestic

and international non-financial securities listed on The Nasdaq Stock Market based on market capitalization. The Index reflects companies

across major industry groups including computer hardware and software, telecommunications, retail/ wholesale trade and biotechnology.

It does not contain securities of financial companies including investment companies.

The Russell 2000 Index measures the performance of the small-cap

segment of the U.S. equity universe.

The Standard & Poor’s 500 (“S&P 500”)

Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad economy, representing all

major industries and is considered a representation of the U.S. stock market.

10 l GOF l GUGGENHEIM STRATEGIC

OPPORTUNITIES FUND ANNUAL REPORT

| MANAGEMENT’S DISCUSSION OF |

|

| FUND PERFORMANCE (Unaudited) continued |

May 31, 2024 |

The views expressed in this report reflect those of the portfolio

managers only through the report period as stated on the cover. These views are subject to change at any time, based on market and other

conditions and should not be construed as a recommendation of any kind. The material may also include forward looking statements that

involve risk and uncertainty, and there is no guarantee that any predictions will come to pass.

There can be no assurance that the Fund will achieve its investment

objectives. The value of the Fund will fluctuate with the value of the underlying securities. Risk is inherent in all investing, including

the loss of your entire principal. Therefore, before investing you should consider the risks carefully. The Fund is subject to various

risk factors. Certain of these risk factors are described in the Additional Information Regarding the Fund section, which begins on page

132. Please see the Fund’s Prospectus and Statement of Additional Information (SAI) and guggenheiminvestments.com/gof for a more

detailed description of the risks of investing in the Fund. Shareholders may access the Fund’s Prospectus and SAI on the EDGAR Database

on the Securities and Exchange Commission’s website at www.sec.gov.

This material is not intended as a recommendation or as investment

advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary

capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation

of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended

to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional

regarding your specific situation.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND ANNUAL REPORT l 11

| FUND SUMMARY (Unaudited) |

May 31, 2024 |

| Fund Statistics |

|

| Market Price |

$14.68 |

| Net Asset Value |

$11.95 |

| Premium to NAV |

22.85% |

| Net Assets ($000) |

$1,703,619 |

CUMULATIVE FUND PERFORMANCE*

*The performance data above represents past performance that is

not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s

shares, when sold, may be worth more of less than their original cost. Returns are historical and include changes in principal and reinvested

dividends and capital gains and do not reflect the effect of taxes. The Bloomberg U.S. Aggregate Bond Index is an unmanaged index and,

unlike the Fund, has no management fees or operating expenses to reduce its reported return. The Fund does not seek to achieve performance

that is comparative to an index.

| AVERAGE ANNUAL TOTAL RETURNS FOR |

|

|

|

| THE PERIOD ENDED MAY 31, 2024 |

|

|

|

| |

One |

Three |

Five |

Ten |

| |

Year |

Year |

Year |

Year |

| Guggenheim Strategic Opportunities Fund |

|

|

|

|

| NAV |

15.72% |

4.29% |

7.00% |

8.06% |

| Market |

9.77% |

2.22% |

7.43% |

8.70% |

| Bloomberg U.S. Aggregate |

|

|

|

|

| Bond Index |

1.31% |

(3.10%) |

(0.17%) |

1.26% |

Performance data quoted represents past performance, which is

no guarantee of future results and current performance may be lower or higher than the figures shown. All NAV returns include the deduction

of management fees, operating expenses and all other Fund expenses. The deduction of taxes that a shareholder would pay on Fund distributions

or the sale of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com/gof.

The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that

an investor’s shares, when sold, may be worth more or less than their original cost.

The referenced index is an unmanaged and not available for direct

investment. Index performance does not reflect transaction costs, fees or expenses.

12 l GOF l GUGGENHEIM STRATEGIC

OPPORTUNITIES FUND ANNUAL REPORT

| |

|

| FUND SUMMARY (Unaudited) continued |

May 31, 2024 |

| |

| Portfolio Breakdown |

% of Net Assets |

| Investments |

|

| Corporate Bonds |

44.2% |

| Senior Floating Rate Interests |

37.9% |

| Asset-Backed Securities |

19.2% |

| Preferred Stocks |

6.0% |

| Collateralized Mortgage Obligations |

5.8% |

| U.S. Government Securities |

3.3% |

| Money Market Funds |

2.3% |

| Closed-End Mutual Funds |

1.3% |

| Other |

1.5% |

| Total Investments |

121.5% |

| Other Assets & Liabilities, net |

(21.5%) |

| Net Assets |

100.0% |

| Ten Largest Holdings1 |

% of Net Assets |

| Madison Park Funding LIII Ltd., 11.33% |

1.1% |

| Guggenheim Active Allocation Fund |

0.9% |

| Lightning A, 5.50% |

0.7% |

| Thunderbird A, 5.50% |

0.7% |

| CIFC Funding Ltd., 12.58% |

0.7% |

| Morgan Stanley Finance LLC, 0.50% |

0.6% |

| Hotwire Funding LLC, 8.84% |

0.6% |

| Delta Air Lines, Inc., 7.00% |

0.6% |

| Boyce Park CLO Ltd., 11.58% |

0.6% |

| AT&T Mobility II LLC, 6.80% |

0.6% |

| Top Ten Total |

7.1% |

1 “Ten Largest Holdings” excludes any temporary

cash or derivative investments.

Portfolio breakdown and holdings are subject to change daily. For

more information, please visit guggenheiminvestments.com/gof. The above summaries are provided for informational purposes only and should

not be viewed as recommendations. Past performance does not guarantee future results.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND ANNUAL REPORT l 13

| |

|

| FUND SUMMARY (Unaudited) continued |

May 31, 2024 |

| |

| Portfolio Composition by Quality Rating1 |

| |

| |

% of Total |

| Rating |

Investments |

| Fixed Income Investments |

|

| AAA |

1.0% |

| AA |

2.5% |

| A |

5.6% |

| BBB |

11.0% |

| BB |

22.8% |

| B |

32.1% |

| CCC |

3.8% |

| CC |

0.1% |

| C |

0.1% |

| D |

0.1% |

| NR2 |

10.2% |

| Other Investments |

10.7% |

| Total Investments |

100.0% |

| 1 | | Source: BlackRock Solutions. Credit quality ratings are measured on a scale that generally

ranges from AAA (highest) to D (lowest). All securities except for those labeled “NR” have been rated by Moody’s, Standard

& Poor’s (“S&P”), or Fitch, each of which is a Nationally Recognized Statistical Rating Organization (“NRSRO”).

For purposes of this presentation, when ratings are available from more than one agency, the highest rating is used. Guggenheim Investments

has converted Moody’s and Fitch ratings to the equivalent S&P rating. Security ratings are determined at the time of purchase

and may change thereafter. |

| 2 | | NR (not rated) securities do not necessarily indicate low credit quality. |

14 l GOF l GUGGENHEIM STRATEGIC

OPPORTUNITIES FUND ANNUAL REPORT

| |

|

| FUND SUMMARY (Unaudited) continued |

May 31, 2024 |

During the period, the Fund’s market price experienced elevated

volatility and trading volume, along with a decline in the Fund’s market price premium to NAV, particularly during the first half

of the period. The market price volatility was not related to any news or fundamental changes to the Fund’s investment objectives

or strategies, which remained consistent.

All or a portion of the above distributions is characterized

as a return of capital. For the year ended May 31, 2024, 36.9% of the distributions were characterized as ordinary income, 7.0% of the

distributions were characterized as long-term capital gains and 56.1% of the distributions were characterized as return of capital. The

final determination of the tax character of the distributions paid by the Fund in 2024 will be reported to shareholders in January 2025.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND ANNUAL REPORT l 15

| SCHEDULE OF INVESTMENTS |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| COMMON STOCKS† – 0.7% |

|

|

| Consumer, Non-cyclical – 0.2% |

|

|

| Endo, Inc.*,†† |

67,403 |

$ 1,881,690 |

| Cengage Learning Holdings II, Inc.*,†† |

11,126 |

185,437 |

| Endo, Inc.*,††,1 |

1,167 |

32,579 |

| Moderna, Inc.*,2 |

146 |

20,812 |

| Keurig Dr Pepper, Inc.2 |

515 |

17,639 |

| Bunge Global S.A.2 |

163 |

17,537 |

| Archer-Daniels-Midland Co.2 |

274 |

17,109 |

| Quanta Services, Inc.2 |

62 |

17,108 |

| Amgen, Inc.2 |

55 |

16,822 |

| Boston Scientific Corp.*,2 |

222 |

16,776 |

| Quest Diagnostics, Inc.2 |

118 |

16,753 |

| Kellanova2 |

277 |

16,714 |

| Altria Group, Inc.2 |

358 |

16,557 |

| ResMed, Inc.2 |

80 |

16,506 |

| Philip Morris International, Inc.2 |

162 |

16,424 |

| Eli Lilly & Co.2 |

20 |

16,407 |

| Vertex Pharmaceuticals, Inc.*,2 |

36 |

16,392 |

| DaVita, Inc.*,2 |

111 |

16,330 |

| Cintas Corp.2 |

24 |

16,271 |

| Elevance Health, Inc.2 |

30 |

16,154 |

| Universal Health Services, Inc. — Class B2 |

85 |

16,133 |

| PayPal Holdings, Inc.*,2 |

254 |

16,000 |

| McKesson Corp.2 |

28 |

15,949 |

| Avery Dennison Corp.2 |

70 |

15,931 |

| Conagra Brands, Inc.2 |

533 |

15,926 |

| Verisk Analytics, Inc. — Class A2 |

63 |

15,925 |

| PepsiCo, Inc.2 |

92 |

15,907 |

| Kimberly-Clark Corp.2 |

119 |

15,863 |

| Coca-Cola Co.2 |

252 |

15,858 |

| Tyson Foods, Inc. — Class A2 |

277 |

15,858 |

| McCormick & Company, Inc.2 |

219 |

15,816 |

| General Mills, Inc.2 |

230 |

15,813 |

| Colgate-Palmolive Co.2 |

170 |

15,803 |

| Pfizer, Inc.2 |

551 |

15,792 |

| Humana, Inc.2 |

44 |

15,757 |

| Campbell Soup Co.2 |

355 |

15,755 |

| HCA Healthcare, Inc.2 |

46 |

15,629 |

| Moody’s Corp.2 |

39 |

15,483 |

| Procter & Gamble Co.2 |

94 |

15,467 |

| Church & Dwight Company, Inc.2 |

144 |

15,409 |

See notes to financial statements.

16 l GOF l GUGGENHEIM STRATEGIC

OPPORTUNITIES FUND ANNUAL REPORT

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| COMMON STOCKS† – 0.7% (continued) |

|

|

| Consumer, Non-cyclical – 0.2% (continued) |

|

|

| UnitedHealth Group, Inc.2 |

31 |

$ 15,357 |

| Corteva, Inc.2 |

274 |

15,328 |

| Intuitive Surgical, Inc.*,2 |

38 |

15,281 |

| Kraft Heinz Co.2 |

431 |

15,244 |

| S&P Global, Inc.2 |

36 |

15,244 |

| Hershey Co.2 |

77 |

15,233 |

| Merck & Company, Inc.2 |

121 |

15,190 |

| Automatic Data Processing, Inc.2 |

62 |

15,185 |

| Cigna Group2 |

44 |

15,163 |

| Danaher Corp.2 |

59 |

15,151 |

| Rollins, Inc.2 |

330 |

15,078 |

| Biogen, Inc.*,2 |

67 |

15,071 |

| Bio-Techne Corp.2 |

195 |

15,052 |

| Revvity, Inc.2 |

137 |

14,969 |

| Insulet Corp.*,2 |

84 |

14,884 |

| United Rentals, Inc.2 |

22 |

14,727 |

| Regeneron Pharmaceuticals, Inc.*,2 |

15 |

14,702 |

| Becton Dickinson & Co.2 |

63 |

14,614 |

| Constellation Brands, Inc. — Class A2 |

58 |

14,513 |

| Kenvue, Inc.2 |

749 |

14,456 |

| Incyte Corp.*,2 |

250 |

14,448 |

| Hologic, Inc.*,2 |

195 |

14,387 |

| Stryker Corp.2 |

42 |

14,326 |

| Mondelez International, Inc. — Class A2 |

209 |

14,323 |

| Medtronic plc2 |

176 |

14,321 |

| Cencora, Inc. — Class A2 |

63 |

14,274 |

| STERIS plc2 |

64 |

14,264 |

| Catalent, Inc.*,2 |

265 |

14,254 |

| Thermo Fisher Scientific, Inc.2 |

25 |

14,199 |

| Edwards Lifesciences Corp.*,2 |

163 |

14,163 |

| Kroger Co.2 |

268 |

14,035 |

| Teleflex, Inc.2 |

67 |

14,008 |

| Cooper Companies, Inc.*,2 |

148 |

13,958 |

| J M Smucker Co.2 |

125 |

13,955 |

| Henry Schein, Inc.*,2 |

201 |

13,937 |

| MarketAxess Holdings, Inc.2 |

70 |

13,925 |

| West Pharmaceutical Services, Inc.2 |

42 |

13,919 |

| Zoetis, Inc.2 |

82 |

13,904 |

| Johnson & Johnson2 |

94 |

13,787 |

| Save-A-Lot*,††† |

1,871,199 |

13,753 |

| Centene Corp.*,2 |

192 |

13,745 |

See notes to financial statements.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND ANNUAL REPORT l 17

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| COMMON STOCKS† – 0.7% (continued) |

|

|

| Consumer, Non-cyclical – 0.2% (continued) |

|

|

| Corpay, Inc.*,2 |

51 |

$ 13,651 |

| Hormel Foods Corp.2 |

440 |

13,631 |

| CoStar Group, Inc.*,2 |

174 |

13,602 |

| Zimmer Biomet Holdings, Inc.2 |

118 |

13,588 |

| Sysco Corp.2 |

186 |

13,545 |

| AbbVie, Inc.2 |

84 |

13,544 |

| Labcorp Holdings, Inc.2 |

69 |

13,449 |

| Gartner, Inc.*,2 |

32 |

13,429 |

| IDEXX Laboratories, Inc.*,2 |

27 |

13,418 |

| Dexcom, Inc.*,2 |

111 |

13,184 |

| Agilent Technologies, Inc.2 |

101 |

13,171 |

| Monster Beverage Corp.*,2 |

253 |

13,136 |

| Lamb Weston Holdings, Inc.2 |

148 |

13,067 |

| Viatris, Inc.2 |

1,224 |

12,974 |

| Waters Corp.*,2 |

42 |

12,974 |

| Equifax, Inc.2 |

56 |

12,958 |

| Cardinal Health, Inc.2 |

130 |

12,905 |

| Gilead Sciences, Inc.2 |

200 |

12,854 |

| Molson Coors Beverage Co. — Class B2 |

232 |

12,716 |

| IQVIA Holdings, Inc.*,2 |

58 |

12,707 |

| Abbott Laboratories2 |

124 |

12,672 |

| Brown-Forman Corp. — Class B2 |

276 |

12,657 |

| Clorox Co.2 |

96 |

12,630 |

| Bio-Rad Laboratories, Inc. — Class A*,2 |

44 |

12,622 |

| GE HealthCare Technologies, Inc.2 |

160 |

12,480 |

| Align Technology, Inc.*,2 |

48 |

12,346 |

| Estee Lauder Companies, Inc. — Class A2 |

100 |

12,336 |

| Molina Healthcare, Inc.*,2 |

38 |

11,954 |

| CVS Health Corp.2 |

200 |

11,920 |

| Solventum Corp.*,2 |

199 |

11,823 |

| Robert Half, Inc.2 |

184 |

11,818 |

| Global Payments, Inc.2 |

116 |

11,815 |

| Baxter International, Inc.2 |

343 |

11,693 |

| Charles River Laboratories International, Inc.*,2 |

56 |

11,673 |

| Illumina, Inc.*,2 |

111 |

11,575 |

| Bristol-Myers Squibb Co.2 |

279 |

11,464 |

| Total Consumer, Non-cyclical |

|

3,758,399 |

| Industrial – 0.1% |

|

|

| Carrier Global Corp.2 |

4,174 |

263,755 |

| BP Holdco LLC*,†††,3 |

121,041 |

146,719 |

| Schur Flexibles GesmbH*,†† |

660 |

136,855 |

See notes to financial statements.

18 l GOF l GUGGENHEIM STRATEGIC

OPPORTUNITIES FUND ANNUAL REPORT

| |

|

|

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| COMMON STOCKS† – 0.7% (continued) |

|

|

| Industrial – 0.1% (continued) |

|

|

| YAK BLOCKER 2 LLC SRS C-1*,††† |

34,136 |

$ 64,277 |

| YAK BLOCKER 2 LLC SRS C-2*,††† |

31,551 |

59,410 |

| 3M Co.2 |

189 |

18,926 |

| Generac Holdings, Inc.*,2 |

128 |

18,843 |

| Howmet Aerospace, Inc.2 |

221 |

18,708 |

| General Electric Co.2 |

112 |

18,496 |

| Amphenol Corp. — Class A2 |

136 |

18,002 |

| GE Vernova, Inc.*,2 |

102 |

17,898 |

| CH Robinson Worldwide, Inc.2 |

207 |

17,879 |

| RTX Corp.2 |

165 |

17,789 |

| Westinghouse Air Brake Technologies Corp.2 |

105 |

17,769 |

| Westrock Co.2 |

329 |

17,648 |

| Johnson Controls International plc2 |

243 |

17,474 |

| TransDigm Group, Inc.2 |

13 |

17,462 |

| Garmin Ltd.2 |

106 |

17,368 |

| Trane Technologies plc2 |

53 |

17,355 |

| Eaton Corporation plc2 |

50 |

16,642 |

| Xylem, Inc.2 |

118 |

16,640 |

| Veralto Corp.2 |

169 |

16,624 |

| General Dynamics Corp.2 |

55 |

16,487 |

| Lockheed Martin Corp.2 |

35 |

16,462 |

| Amcor plc2 |

1,603 |

16,302 |

| Dover Corp.2 |

88 |

16,176 |

| TE Connectivity Ltd.2 |

107 |

16,018 |

| Ball Corp.2 |

230 |

15,969 |

| L3Harris Technologies, Inc.2 |

70 |

15,738 |

| FedEx Corp.2 |

61 |

15,492 |

| Ingersoll Rand, Inc.2 |

166 |

15,446 |

| Mettler-Toledo International, Inc.*,2 |

11 |

15,445 |

| Otis Worldwide Corp.2 |

154 |

15,277 |

| Emerson Electric Co.2 |

136 |

15,254 |

| Waste Management, Inc.2 |

72 |

15,173 |

| Honeywell International, Inc.2 |

75 |

15,164 |

| Pentair plc2 |

185 |

15,055 |

| Republic Services, Inc. — Class A2 |

81 |

15,000 |

| Mohawk Industries, Inc.*,2 |

123 |

14,998 |

| Expeditors International of Washington, Inc.2 |

124 |

14,992 |

| Deere & Co.2 |

40 |

14,991 |

| Caterpillar, Inc.2 |

44 |

14,895 |

| Parker-Hannifin Corp.2 |

28 |

14,883 |

| Northrop Grumman Corp.2 |

33 |

14,875 |

See notes to financial statements.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND ANNUAL REPORT l 19

| |

|

|

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| COMMON STOCKS† – 0.7% (continued) |

|

|

| Industrial – 0.1% (continued) |

|

|

| Packaging Corporation of America2 |

81 |

$ 14,863 |

| Hubbell, Inc.2 |

38 |

14,778 |

| A O Smith Corp.2 |

175 |

14,637 |

| Vulcan Materials Co.2 |

56 |

14,323 |

| Martin Marietta Materials, Inc.2 |

25 |

14,302 |

| Stanley Black & Decker, Inc.2 |

164 |

14,296 |

| Textron, Inc.2 |

163 |

14,280 |

| Jacobs Solutions, Inc.2 |

102 |

14,213 |

| AMETEK, Inc.2 |

83 |

14,075 |

| Allegion plc2 |

115 |

14,009 |

| Union Pacific Corp.2 |

60 |

13,969 |

| Snap-on, Inc.2 |

51 |

13,916 |

| Teledyne Technologies, Inc.*,2 |

35 |

13,893 |

| Illinois Tool Works, Inc.2 |

57 |

13,837 |

| Masco Corp.2 |

195 |

13,635 |

| Axon Enterprise, Inc.*,2 |

48 |

13,520 |

| Boeing Co.*,2 |

76 |

13,498 |

| United Parcel Service, Inc. — Class B2 |

97 |

13,476 |

| Keysight Technologies, Inc.*,2 |

97 |

13,433 |

| Nordson Corp.2 |

57 |

13,379 |

| CSX Corp.2 |

393 |

13,264 |

| Trimble, Inc.*,2 |

238 |

13,252 |

| IDEX Corp.2 |

63 |

13,144 |

| Rockwell Automation, Inc.2 |

51 |

13,134 |

| Fortive Corp.2 |

176 |

13,102 |

| Norfolk Southern Corp.2 |

58 |

13,038 |

| Huntington Ingalls Industries, Inc.2 |

51 |

12,908 |

| Old Dominion Freight Line, Inc.2 |

70 |

12,267 |

| Builders FirstSource, Inc.*,2 |

75 |

12,059 |

| J.B. Hunt Transport Services, Inc.2 |

75 |

12,056 |

| Jabil, Inc.2 |

99 |

11,771 |

| Vector Phoenix Holdings Cayman, LP*,††† |

121,040 |

2,561 |

| Targus, Inc.*,††† |

45,049 |

1,903 |

| Targus, Inc.*,††† |

45,049 |

1,594 |

| Targus, Inc.*,††† |

45,049 |

512 |

| Targus, Inc.*,††† |

45,049 |

5 |

| Total Industrial |

|

1,739,533 |

| Financial – 0.1% |

|

|

| Checkers Holdings, Inc.*,††† |

84,343 |

335,685 |

| Endo Luxembourg Finance Co I SARL / Endo US, Inc.*,†††,1 |

3,345,000 |

25,656 |

| Endo Luxembourg Finance Co I SARL / Endo US, Inc.*,†††,1 |

1,900,000 |

14,573 |

See notes to financial statements.

20 l GOF l GUGGENHEIM STRATEGIC

OPPORTUNITIES FUND ANNUAL REPORT

| |

|

|

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| COMMON STOCKS† – 0.7% (continued) |

|

|

| Financial – 0.1% (continued) |

|

|

| Endo Luxembourg Finance Co I SARL / Endo US, Inc.*,††† |

181,000 |

$ 18 |

| Goldman Sachs Group, Inc.2 |

39 |

17,804 |

| Arch Capital Group Ltd.*,2 |

171 |

17,550 |

| Ventas, Inc. REIT2 |

338 |

16,988 |

| Welltower, Inc. REIT2 |

163 |

16,898 |

| Bank of America Corp.2 |

421 |

16,836 |

| Healthpeak Properties, Inc. REIT2 |

846 |

16,835 |

| Morgan Stanley2 |

172 |

16,828 |

| Aflac, Inc.2 |

183 |

16,446 |

| Charles Schwab Corp.2 |

223 |

16,341 |

| Citigroup, Inc.2 |

261 |

16,263 |

| Chubb Ltd.2 |

60 |

16,249 |

| Prudential Financial, Inc.2 |

135 |

16,247 |

| JPMorgan Chase & Co.2 |

80 |

16,210 |

| Bank of New York Mellon Corp.2 |

270 |

16,095 |

| Allstate Corp.2 |

96 |

16,082 |

| American Express Co.2 |

67 |

16,080 |

| Progressive Corp.2 |

76 |

16,050 |

| Hartford Financial Services Group, Inc.2 |

155 |

16,035 |

| Everest Group Ltd.2 |

41 |

16,028 |

| American International Group, Inc.2 |

202 |

15,922 |

| M&T Bank Corp.2 |

105 |

15,918 |

| Essex Property Trust, Inc. REIT2 |

61 |

15,847 |

| Wells Fargo & Co.2 |

263 |

15,759 |

| Brown & Brown, Inc.2 |

176 |

15,754 |

| PNC Financial Services Group, Inc.2 |

100 |

15,739 |

| Ameriprise Financial, Inc.2 |

36 |

15,718 |

| State Street Corp.2 |

207 |

15,647 |

| Synchrony Financial2 |

356 |

15,593 |

| Huntington Bancshares, Inc.2 |

1,111 |

15,465 |

| Principal Financial Group, Inc.2 |

188 |

15,424 |

| Citizens Financial Group, Inc.2 |

437 |

15,422 |

| Fifth Third Bancorp2 |

412 |

15,417 |

| Northern Trust Corp.2 |

183 |

15,416 |

| AvalonBay Communities, Inc. REIT2 |

80 |

15,414 |

| Equity Residential REIT2 |

237 |

15,412 |

| Loews Corp.2 |

200 |

15,360 |

| Raymond James Financial, Inc.2 |

125 |

15,344 |

| MetLife, Inc.2 |

212 |

15,342 |

| Berkshire Hathaway, Inc. — Class B*,2 |

37 |

15,333 |

| UDR, Inc. REIT2 |

394 |

15,216 |

See notes to financial statements.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND ANNUAL REPORT l 21

| |

|

|

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| COMMON STOCKS† – 0.7% (continued) |

|

|

| Financial – 0.1% (continued) |

|

|

| Discover Financial Services2 |

124 |

$ 15,210 |

| Arthur J Gallagher & Co.2 |

60 |

15,200 |

| Camden Property Trust REIT2 |

148 |

15,192 |

| Marsh & McLennan Companies, Inc.2 |

73 |

15,153 |

| Truist Financial Corp.2 |

401 |

15,138 |

| Realty Income Corp. REIT2 |

284 |

15,069 |

| Cincinnati Financial Corp.2 |

128 |

15,050 |

| Capital One Financial Corp.2 |

109 |

15,002 |

| Simon Property Group, Inc. REIT2 |

99 |

14,980 |

| T. Rowe Price Group, Inc.2 |

127 |

14,964 |

| Kimco Realty Corp. REIT2 |

770 |

14,907 |

| Travelers Companies, Inc.2 |

69 |

14,883 |

| Regency Centers Corp. REIT2 |

242 |

14,859 |

| Invitation Homes, Inc. REIT2 |

427 |

14,855 |

| Iron Mountain, Inc. REIT2 |

184 |

14,847 |

| Invesco Ltd.2 |

945 |

14,846 |

| Mid-America Apartment Communities, Inc. REIT2 |

111 |

14,842 |

| Federal Realty Investment Trust REIT2 |

147 |

14,840 |

| VICI Properties, Inc. REIT2 |

515 |

14,786 |

| Nasdaq, Inc.2 |

250 |

14,757 |

| Regions Financial Corp.2 |

762 |

14,745 |

| Visa, Inc. — Class A2 |

54 |

14,713 |

| Comerica, Inc.2 |

285 |

14,603 |

| Assurant, Inc.2 |

84 |

14,572 |

| Digital Realty Trust, Inc. REIT2 |

100 |

14,534 |

| Extra Space Storage, Inc. REIT2 |

100 |

14,477 |

| Intercontinental Exchange, Inc.2 |

108 |

14,461 |

| KeyCorp2 |

1,005 |

14,442 |

| W R Berkley Corp.2 |

178 |

14,423 |

| Blackstone, Inc. — Class A2 |

119 |

14,339 |

| Mastercard, Inc. — Class A2 |

32 |

14,306 |

| Boston Properties, Inc. REIT2 |

235 |

14,258 |

| CME Group, Inc. — Class A2 |

70 |

14,209 |

| American Tower Corp. — Class A REIT2 |

72 |

14,093 |

| U.S. Bancorp2 |

347 |

14,071 |

| Alexandria Real Estate Equities, Inc. REIT2 |

118 |

14,042 |

| Willis Towers Watson plc2 |

55 |

14,041 |

| CBRE Group, Inc. — Class A*,2 |

159 |

14,003 |

| Public Storage REIT2 |

51 |

13,965 |

| BlackRock, Inc. — Class A2 |

18 |

13,897 |

| Cboe Global Markets, Inc.2 |

80 |

13,839 |

See notes to financial statements.

22 l GOF l GUGGENHEIM STRATEGIC

OPPORTUNITIES FUND ANNUAL REPORT

| |

|

|

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| COMMON STOCKS† – 0.7% (continued) |

|

|

| Financial – 0.1% (continued) |

|

|

| Crown Castle, Inc. REIT2 |

133 |

$ 13,633 |

| Aon plc — Class A2 |

47 |

13,237 |

| SBA Communications Corp. REIT2 |

67 |

13,178 |

| Weyerhaeuser Co. REIT2 |

431 |

12,943 |

| Host Hotels & Resorts, Inc. REIT2 |

718 |

12,881 |

| Franklin Resources, Inc.2 |

535 |

12,626 |

| Prologis, Inc. REIT2 |

111 |

12,264 |

| Equinix, Inc. REIT2 |

16 |

12,208 |

| Globe Life, Inc.2 |

121 |

10,014 |

| Avison Young (Canada), Inc.*,†† |

579 |

579 |

| Pershing Square Tontine Holdings, Ltd. — Class A*,†††,4 |

1,042,740 |

105 |

| Sparta Systems*,††† |

1,922 |

– |

| Total Financial |

|

1,729,340 |

| Consumer, Cyclical – 0.1% |

|

|

| ATD New Holdings, Inc.*,†† |

23,593 |

412,877 |

| Exide Technologies*,††† |

343 |

341,743 |

| Chipotle Mexican Grill, Inc. — Class A*,2 |

6 |

18,777 |

| United Airlines Holdings, Inc.*,2 |

346 |

18,335 |

| Delta Air Lines, Inc.2 |

355 |

18,112 |

| Deckers Outdoor Corp.*,2 |

16 |

17,503 |

| Royal Caribbean Cruises Ltd.*,2 |

118 |

17,426 |

| Bath & Body Works, Inc.2 |

335 |

17,400 |

| Hasbro, Inc.2 |

290 |

17,336 |

| Domino’s Pizza, Inc.2 |

34 |

17,292 |

| Tractor Supply Co.2 |

60 |

17,117 |

| General Motors Co.2 |

380 |

17,096 |

| Costco Wholesale Corp.2 |

21 |

17,008 |

| BorgWarner, Inc.2 |

468 |

16,689 |

| Walmart, Inc.2 |

250 |

16,440 |

| Best Buy Company, Inc.2 |

191 |

16,201 |

| TJX Companies, Inc.2 |

156 |

16,084 |

| Aptiv plc*,2 |

192 |

15,986 |

| Ralph Lauren Corp. — Class A2 |

85 |

15,885 |

| Cummins, Inc.2 |

56 |

15,777 |

| PulteGroup, Inc.2 |

133 |

15,604 |

| NVR, Inc.*,2 |

2 |

15,361 |

| Tesla, Inc.*,2 |

86 |

15,315 |

| Ford Motor Co.2 |

1,232 |

14,944 |

| Yum! Brands, Inc.2 |

107 |

14,705 |

| Hilton Worldwide Holdings, Inc.2 |

73 |

14,644 |

| Lennar Corp. — Class A2 |

91 |

14,592 |

See notes to financial statements.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND ANNUAL REPORT l 23

| |

|

|

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| COMMON STOCKS† – 0.7% (continued) |

|

|

| Consumer, Cyclical – 0.1% (continued) |

|

|

| Copart, Inc.*,2 |

273 |

$ 14,485 |

| DR Horton, Inc.2 |

98 |

14,484 |

| Ross Stores, Inc.2 |

103 |

14,395 |

| NIKE, Inc. — Class B2 |

151 |

14,352 |

| Genuine Parts Co.2 |

99 |

14,270 |

| MGM Resorts International*,2 |

353 |

14,180 |

| Wynn Resorts Ltd.2 |

149 |

14,137 |

| PACCAR, Inc.2 |

131 |

14,083 |

| Live Nation Entertainment, Inc.*,2 |

150 |

14,061 |

| Tapestry, Inc.2 |

319 |

13,873 |

| Marriott International, Inc. — Class A2 |

60 |

13,870 |

| AutoZone, Inc.*,2 |

5 |

13,850 |

| WW Grainger, Inc.2 |

15 |

13,822 |

| Carnival Corp.*,2 |

916 |

13,814 |

| Target Corp.2 |

88 |

13,742 |

| Lowe’s Companies, Inc.2 |

62 |

13,720 |

| O’Reilly Automotive, Inc.*,2 |

14 |

13,486 |

| Home Depot, Inc.2 |

40 |

13,395 |

| Starbucks Corp.2 |

165 |

13,236 |

| McDonald’s Corp.2 |

51 |

13,203 |

| Las Vegas Sands Corp.2 |

291 |

13,104 |

| Pool Corp.2 |

36 |

13,088 |

| Darden Restaurants, Inc.2 |

87 |

13,084 |

| Fastenal Co.2 |

198 |

13,064 |

| Dollar General Corp.2 |

95 |

13,006 |

| CarMax, Inc.*,2 |

183 |

12,857 |

| Caesars Entertainment, Inc.*,2 |

356 |

12,659 |

| LKQ Corp.2 |

292 |

12,565 |

| Norwegian Cruise Line Holdings Ltd.*,2 |

750 |

12,450 |

| Dollar Tree, Inc.*,2 |

101 |

11,913 |

| Southwest Airlines Co.2 |

438 |

11,756 |

| American Airlines Group, Inc.*,2 |

1,022 |

11,753 |

| Walgreens Boots Alliance, Inc.2 |

709 |

11,500 |

| Ulta Beauty, Inc.*,2 |

28 |

11,062 |

| Lululemon Athletica, Inc.*,2 |

33 |

10,296 |

| Total Consumer, Cyclical |

|

1,628,864 |

| Technology – 0.1% |

|

|

| Qlik Technologies, Inc. – Class A*,††† |

112 |

182,647 |

| Teradyne, Inc.2 |

141 |

19,872 |

| Micron Technology, Inc.2 |

154 |

19,250 |

| NVIDIA Corp.2 |

17 |

18,638 |

See notes to financial statements.

24 l GOF l GUGGENHEIM STRATEGIC

OPPORTUNITIES FUND ANNUAL REPORT

| |

|

|

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| COMMON STOCKS† – 0.7% (continued) |

|

|

| Technology – 0.1% (continued) |

|

|

| Analog Devices, Inc.2 |

77 |

$ 18,056 |

| QUALCOMM, Inc.2 |

88 |

17,956 |

| Western Digital Corp.*,2 |

238 |

17,919 |

| HP, Inc.2 |

488 |

17,812 |

| NetApp, Inc.2 |

145 |

17,462 |

| Tyler Technologies, Inc.*,2 |

36 |

17,293 |

| Leidos Holdings, Inc.2 |

117 |

17,205 |

| Texas Instruments, Inc.2 |

87 |

16,966 |

| Apple, Inc.2 |

88 |

16,918 |

| Take-Two Interactive Software, Inc.*,2 |

104 |

16,677 |

| Zebra Technologies Corp. — Class A*,2 |

53 |

16,554 |

| Microchip Technology, Inc.2 |

169 |

16,432 |

| NXP Semiconductor N.V.2 |

60 |

16,326 |

| Fidelity National Information Services, Inc.2 |

215 |

16,314 |

| KLA Corp.2 |

21 |

15,950 |

| Applied Materials, Inc.2 |

73 |

15,701 |

| Oracle Corp.2 |

133 |

15,586 |

| Fair Isaac Corp.*,2 |

12 |

15,479 |

| Microsoft Corp.2 |

37 |

15,360 |

| Seagate Technology Holdings plc2 |

162 |

15,105 |

| Lam Research Corp.2 |

16 |

14,919 |

| Paychex, Inc.2 |

124 |

14,900 |

| Broadridge Financial Solutions, Inc.2 |

74 |

14,857 |

| Fiserv, Inc.*,2 |

99 |

14,826 |

| Electronic Arts, Inc.2 |

111 |

14,750 |

| Hewlett Packard Enterprise Co.2 |

834 |

14,720 |

| Monolithic Power Systems, Inc.2 |

20 |

14,713 |

| Broadcom, Inc.2 |

11 |

14,614 |

| Synopsys, Inc.*,2 |

26 |

14,581 |

| Roper Technologies, Inc.2 |

27 |

14,385 |

| ANSYS, Inc.*,2 |

45 |

14,285 |

| PTC, Inc.*,2 |

81 |

14,275 |

| Jack Henry & Associates, Inc.2 |

86 |

14,162 |

| Cadence Design Systems, Inc.*,2 |

49 |

14,029 |

| ON Semiconductor Corp.*,2 |

190 |

13,878 |

| MSCI, Inc. — Class A2 |

27 |

13,370 |

| Intuit, Inc.2 |

23 |

13,258 |

| ServiceNow, Inc.*,2 |

20 |

13,139 |

| Skyworks Solutions, Inc.2 |

141 |

13,065 |

| Cognizant Technology Solutions Corp. — Class A2 |

195 |

12,899 |

| International Business Machines Corp.2 |

77 |

12,847 |

See notes to financial statements.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND ANNUAL REPORT l 25

| |

|

|

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| COMMON STOCKS† – 0.7% (continued) |

|

|

| Technology – 0.1% (continued) |

|

|

| Qorvo, Inc.*,2 |

129 |

$ 12,692 |

| Fortinet, Inc.*,2 |

210 |

12,457 |

| Akamai Technologies, Inc.*,2 |

135 |

12,452 |

| Advanced Micro Devices, Inc.*,2 |

73 |

12,183 |

| Autodesk, Inc.*,2 |

60 |

12,096 |

| Paycom Software, Inc.2 |

83 |

12,062 |

| Adobe, Inc.*,2 |

27 |

12,009 |

| Salesforce, Inc.2 |

49 |

11,488 |

| Accenture plc — Class A2 |

40 |

11,292 |

| Dayforce, Inc.*,2 |

224 |

11,079 |

| Intel Corp.2 |

341 |

10,520 |

| Super Micro Computer, Inc.*,2 |

13 |

10,199 |

| EPAM Systems, Inc.*,2 |

48 |

8,541 |

| Qlik Technologies, Inc. – Class B*,††† |

27,624 |

3 |

| Total Technology |

|

1,019,023 |

| Communications – 0.1% |

|

|

| Figs, Inc. — Class A*,2 |

10,450 |

55,385 |

| Vacasa, Inc. — Class A* |

9,841 |

45,269 |

| Corning, Inc.2 |

459 |

17,102 |

| Gen Digital, Inc.2 |

680 |

16,884 |

| Motorola Solutions, Inc.2 |

45 |

16,421 |

| Arista Networks, Inc.*,2 |

55 |

16,371 |

| Paramount Global — Class B2 |

1,372 |

16,341 |

| eBay, Inc.2 |

298 |

16,158 |

| Netflix, Inc.*,2 |

25 |

16,040 |

| Palo Alto Networks, Inc.*,2 |

54 |

15,925 |

| T-Mobile US, Inc.2 |

91 |

15,921 |

| AT&T, Inc.2 |

872 |

15,888 |

| Verizon Communications, Inc.2 |

380 |

15,637 |

| Omnicom Group, Inc.2 |

164 |

15,245 |

| Charter Communications, Inc. — Class A*,2 |

53 |

15,217 |

| Amazon.com, Inc.*,2 |

86 |

15,174 |

| Booking Holdings, Inc.2 |

4 |

15,105 |

| Interpublic Group of Companies, Inc.2 |

465 |

14,587 |

| Juniper Networks, Inc.2 |

402 |

14,339 |

| Warner Bros Discovery, Inc.*,2 |

1,718 |

14,156 |

| Walt Disney Co.2 |

136 |

14,132 |

| Comcast Corp. — Class A2 |

352 |

14,091 |

| Cisco Systems, Inc.2 |

303 |

14,090 |

| Meta Platforms, Inc. — Class A2 |

30 |

14,005 |

| VeriSign, Inc.*,2 |

79 |

13,771 |

See notes to financial statements.

26 l GOF l GUGGENHEIM STRATEGIC

OPPORTUNITIES FUND ANNUAL REPORT

| |

|

|

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| COMMON STOCKS† – 0.7% (continued) |

|

|

| Communications – 0.1% (continued) |

|

|

| CDW Corp.2 |

61 |

$ 13,641 |

| Match Group, Inc.*,2 |

443 |

13,569 |

| Airbnb, Inc. — Class A*,2 |

91 |

13,189 |

| F5, Inc.*,2 |

78 |

13,180 |

| Etsy, Inc.*,2 |

207 |

13,138 |

| FactSet Research Systems, Inc.2 |

32 |

12,936 |

| Expedia Group, Inc.*,2 |

110 |

12,415 |

| Uber Technologies, Inc.*,2 |

191 |

12,331 |

| Fox Corp. — Class A2 |

346 |

11,913 |

| News Corp. — Class A2 |

434 |

11,800 |

| Alphabet, Inc. — Class A2 |

60 |

10,350 |

| Alphabet, Inc. — Class C2 |

50 |

8,698 |

| Fox Corp. — Class B2 |

191 |

6,101 |

| News Corp. — Class B2 |

131 |

3,652 |

| Total Communications |

|

610,167 |

| Utilities – 0.0% |

|

|

| Mountain Creek Power LLC*,†† |

68,676 |

68,676 |

| NextEra Energy, Inc.2 |

259 |

20,725 |

| Vistra Corp.2 |

203 |

20,113 |

| NRG Energy, Inc.2 |

247 |

20,007 |

| AES Corp.2 |

923 |

19,928 |

| Constellation Energy Corp.2 |

88 |

19,118 |

| Public Service Enterprise Group, Inc.2 |

233 |

17,652 |

| Southern Co.2 |

217 |

17,390 |

| Dominion Energy, Inc.2 |

313 |

16,877 |

| PG&E Corp.2 |

906 |

16,797 |

| Edison International2 |

217 |

16,676 |

| American Water Works Company, Inc.2 |

127 |

16,608 |

| Pinnacle West Capital Corp.2 |

209 |

16,482 |

| Duke Energy Corp.2 |

158 |

16,364 |

| Entergy Corp.2 |

145 |

16,311 |

| Xcel Energy, Inc.2 |

294 |

16,302 |

| Sempra2 |

211 |

16,253 |

| PPL Corp.2 |

552 |

16,190 |

| CenterPoint Energy, Inc.2 |

530 |

16,170 |

| American Electric Power Company, Inc.2 |

179 |

16,155 |

| NiSource, Inc.2 |

555 |

16,128 |

| Evergy, Inc.2 |

291 |

15,906 |

| FirstEnergy Corp.2 |

394 |

15,862 |

| Consolidated Edison, Inc.2 |

166 |

15,695 |

| CMS Energy Corp.2 |

249 |

15,670 |

See notes to financial statements.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND ANNUAL REPORT l 27

| |

|

|

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| COMMON STOCKS† – 0.7% (continued) |

|

|

| Utilities – 0.0% (continued) |

|

|

| Alliant Energy Corp.2 |

304 |

$ 15,653 |

| DTE Energy Co.2 |

133 |

15,499 |

| Exelon Corp.2 |

406 |

15,245 |

| Atmos Energy Corp.2 |

130 |

15,070 |

| Ameren Corp.2 |

205 |

15,041 |

| WEC Energy Group, Inc.2 |

184 |

14,910 |

| Eversource Energy2 |

250 |

14,808 |

| Total Utilities |

|

586,281 |

| Energy – 0.0% |

|

|

| First Solar, Inc.*,2 |

93 |

25,274 |

| Marathon Oil Corp.2 |

606 |

17,550 |

| Williams Companies, Inc.2 |

416 |

17,269 |

| Targa Resources Corp.2 |

144 |

17,025 |

| Equities Corp.2 |

400 |

16,436 |

| Baker Hughes Co.2 |

490 |

16,405 |

| Kinder Morgan, Inc.2 |

841 |

16,391 |

| Diamondback Energy, Inc.2 |

82 |

16,339 |

| Chevron Corp.2 |

100 |

16,230 |

| Coterra Energy, Inc. — Class A2 |

569 |

16,228 |

| Exxon Mobil Corp.2 |

138 |

16,182 |

| Hess Corp.2 |

104 |

16,026 |

| Devon Energy Corp.2 |

325 |

15,951 |

| ONEOK, Inc.2 |

194 |

15,714 |

| Valero Energy Corp.2 |

100 |

15,714 |

| EOG Resources, Inc.2 |

126 |

15,693 |

| ConocoPhillips2 |

133 |

15,492 |

| Occidental Petroleum Corp.2 |

247 |

15,438 |

| Halliburton Co.2 |

414 |

15,194 |

| APA Corp.2 |

487 |

14,868 |

| Marathon Petroleum Corp.2 |

84 |

14,835 |

| Enphase Energy, Inc.*,2 |

115 |

14,708 |

| Phillips 662 |

100 |

14,211 |

| Schlumberger N.V.2 |

298 |

13,675 |

| Revenir Energy, Inc.††† |

2,359 |

11,205 |

| Permian Production Partners LLC*,††† |

184,043 |

8,797 |

| Total Energy |

|

408,850 |

| Basic Materials – 0.0% |

|

|

| Freeport-McMoRan, Inc.2 |

376 |

19,827 |

| International Paper Co.2 |

414 |

18,667 |

| Newmont Corp.2 |

442 |

18,537 |

See notes to financial statements.

28 l GOF l GUGGENHEIM STRATEGIC

OPPORTUNITIES FUND ANNUAL REPORT

| |

|

|

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| COMMON STOCKS† – 0.7% (continued) |

|

|

| Basic Materials – 0.0% (continued) |

|

|

| International Flavors & Fragrances, Inc.2 |

190 |

$ 18,274 |

| DuPont de Nemours, Inc.2 |

210 |

17,254 |

| Eastman Chemical Co.2 |

167 |

16,922 |

| Air Products and Chemicals, Inc.2 |

62 |

16,535 |

| Albemarle Corp.2 |

127 |

15,569 |

| Ecolab, Inc.2 |

67 |

15,557 |

| Dow, Inc.2 |

265 |

15,272 |

| Steel Dynamics, Inc.2 |

114 |

15,261 |

| LyondellBasell Industries N.V. — Class A2 |

152 |

15,112 |

| Mosaic Co.2 |

475 |

14,692 |

| Celanese Corp. — Class A2 |

96 |

14,596 |

| FMC Corp.2 |

239 |

14,567 |

| CF Industries Holdings, Inc.2 |

178 |

14,192 |

| PPG Industries, Inc.2 |

107 |

14,061 |

| Linde plc2 |

32 |

13,937 |

| Nucor Corp.2 |

81 |

13,677 |

| Sherwin-Williams Co.2 |

44 |

13,367 |

| Total Basic Materials |

|

315,876 |

| Total Common Stocks |

|

|

| (Cost $14,636,294) |

|

11,796,333 |

| PREFERRED STOCKS†† – 6.0% |

|

|

| Financial – 5.2% |

|

|

| Citigroup, Inc. |

|

|

| 7.38%5 |

4,300,000 |

4,401,226 |

| 3.88%5 |

4,000,000 |

3,763,191 |

| 4.15%2,5 |

2,000,000 |

1,851,555 |

| 4.00%5 |

1,750,000 |

1,672,352 |

| Bank of America Corp. |

|

|

| 4.38%2,5 |

2,925,000 |

7,799,248 |

| 6.50%5 |

2,000,000 |

1,998,277 |

| 6.30%5 |

1,000,000 |

1,004,373 |

| 4.13%2 |

26,000 |

475,540 |

| Wells Fargo & Co. |

|

|

| 4.75%2 |

183,750 |

3,752,175 |

| 3.90%5 |

3,300,000 |

3,118,840 |

| 4.70%2 |

148,000 |

3,010,320 |

| 4.38%2 |

50,000 |

961,000 |

| Goldman Sachs Group, Inc. |

|

|

| 7.50%5 |

7,700,000 |

7,911,096 |

| Kuvare US Holdings, Inc. |

|

|

| 7.00% due 02/17/515,6 |

6,400,000 |

6,384,000 |

See notes to financial statements.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND ANNUAL REPORT l 29

| |

|

|

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| PREFERRED STOCKS†† – 6.0% (continued) |

|

|

| Financial – 5.2% (continued) |

|

|

| Equitable Holdings, Inc. |

|

|

| 4.95%5 |

3,650,000 |

$ 3,582,468 |

| 4.30%2 |

82,000 |

1,530,940 |

| Markel Group, Inc. |

|

|

| 6.00%2,5 |

4,770,000 |

4,733,104 |

| Jackson Financial, Inc. |

|

|

| 8.00%2 |

152,000 |

4,058,400 |

| Lincoln National Corp. |

|

|

| 9.25%5 |

3,600,000 |

3,878,323 |

| Public Storage |

|

|

| 4.63%2 |

144,400 |

2,991,968 |

| 4.13%2 |

16,400 |

307,336 |

| W R Berkley Corp. |

|

|

| 4.13% due 03/30/61 |

126,000 |

2,305,800 |

| 4.25% due 09/30/60 |

36,800 |

684,848 |

| Charles Schwab Corp. |

|

|

| 4.00%5 |

3,150,000 |

2,623,503 |

| PartnerRe Ltd. |

|

|

| 4.88% |

128,000 |

2,497,280 |

| JPMorgan Chase & Co. |

|

|

| 4.55%2 |

49,000 |

1,001,560 |

| 4.20%2 |

40,000 |

762,000 |

| 4.63%2 |

24,000 |

496,560 |

| American Financial Group, Inc. |

|

|

| 4.50% due 09/15/60 |

100,000 |

1,849,000 |

| MetLife, Inc. |

|

|

| 3.85%5 |

1,820,000 |

1,749,936 |

| CNO Financial Group, Inc. |

|

|

| 5.13% due 11/25/60 |

80,000 |

1,572,000 |

| Assurant, Inc. |

|

|

| 5.25% due 01/15/61 |

58,000 |

1,219,740 |

| American National Group, Inc. |

|

|

| 5.95% |

46,000 |

1,119,180 |

| Arch Capital Group Ltd. |

|

|

| 4.55%2 |

38,000 |

742,520 |

| Selective Insurance Group, Inc. |

|

|

| 4.60%2 |

36,000 |

658,080 |

| Avison Young (Canada), Inc. |

|

|

| 12.50%* |

815,493 |

326,197 |

| RenaissanceRe Holdings Ltd. |

|

|

| 4.20% |

13,000 |

228,410 |

| Globe Life, Inc. |

|

|

| 4.25% due 06/15/61 |

11,000 |

159,720 |

| Reinsurance Group of America, Inc. |

|

|

| 7.13% due 10/15/52 |

2,900 |

75,719 |

See notes to financial statements.

30 l GOF l GUGGENHEIM STRATEGIC

OPPORTUNITIES FUND ANNUAL REPORT

| |

|

|

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| PREFERRED STOCKS†† – 6.0% (continued) |

|

|

| Financial – 5.2% (continued) |

|

|

| First Republic Bank |

|

|

| 4.50%*††† |

200,000 |

$ 6,000 |

| 4.25%*††† |

158,000 |

4,740 |

| 4.13%*††† |

84,800 |

2,544 |

| Total Financial |

|

89,271,069 |

| Communications – 0.6% |

|

|

| AT&T Mobility II LLC |

|

|

| 6.80%*,††† |

10,000 |

9,897,700 |

| Government – 0.1% |

|

|

| Farmer Mac |

|

|

| 5.75%2 |

105,224 |

2,402,264 |

| Consumer, Cyclical – 0.1% |

|

|

| Exide Technologies*,††† |

761 |

997,509 |

| Total Preferred Stocks |

|

|

| (Cost $123,470,837) |

|

102,568,542 |

| WARRANTS† – 0.0% |

|

|

| Ginkgo Bioworks Holdings, Inc. |

|

|

| Expiring 09/16/26* |

26,852 |

1,074 |

| Pershing Square Holdings, Ltd. |

|

|

| Expiring 12/31/49*,†††,4 |

318,615 |

32 |

| Pershing Square Tontine Holdings, Ltd. |

|

|

| Expiring 07/24/25*,†††,4 |

115,860 |

12 |

| Total Warrants |

|

|

| (Cost $62,178) |

|

1,118 |

| EXCHANGE-TRADED FUNDS† – 0.3% |

|

|

| SPDR S&P 500 ETF Trust2 |

4,334 |

2,285,622 |

| iShares Russell 2000 Index ETF2 |

5,815 |

1,196,552 |

| Invesco QQQ Trust Series2 |

2,572 |

1,159,226 |

| Total Exchange-Traded Funds |

|

|

| (Cost $3,328,876) |

|

4,641,400 |

| CLOSED-END MUTUAL FUNDS† – 1.3% |

|

|

| Guggenheim Active Allocation Fund3 |

950,000 |

14,269,000 |

| Blackstone Strategic Credit Fund |

186,741 |

2,214,748 |

| BlackRock Credit Allocation Income Trust |

184,289 |

1,951,621 |

| Nuveen Taxable Municipal Income Fund |

110,767 |

1,660,397 |

| Eaton Vance Limited Duration Income Fund |

141,764 |

1,390,705 |

| Western Asset High Income Opportunity Fund, Inc. |

160,170 |

602,239 |

| Nuveen AMT-Free Municipal Credit Income Fund |

234 |

2,756 |

| Nuveen AMT-Free Quality Municipal Income Fund |

156 |

1,696 |

See notes to financial statements.

GOF l GUGGENHEIM STRATEGIC OPPORTUNITIES

FUND ANNUAL REPORT l 31

| |

|

|

| SCHEDULE OF INVESTMENTS continued |

|

May 31, 2024 |

| |

| |

Shares |

Value |

| CLOSED-END MUTUAL FUNDS† – 1.3% (continued) |

|

|

| Nuveen Quality Municipal Income Fund |

128 |

$ 1,439 |

| Total Closed-End Mutual Funds |

|

|

| (Cost $22,390,697) |

|

22,094,601 |

| MONEY MARKET FUNDS† – 2.3% |

|

|

| Dreyfus Treasury Securities Cash Management Fund — Institutional Shares, 5.19%7 |

39,428,315 |

39,428,315 |

| Dreyfus Treasury Obligations Cash Management Fund — Institutional Shares, 5.19%7 |

492,159 |

492,159 |

| Total Money Market Funds |

|

|

| (Cost $39,920,474) |

|

39,920,474 |

| |

Face |

|

| |

Amount~ |

|

| CORPORATE BONDS†† – 44.2% |

|

|

| Financial – 12.4% |

|

|

| Morgan Stanley Finance LLC |

|

|

| 0.50% due 10/23/29à,†††,8 |

13,500,000 |

10,897,200 |

| Dyal Capital Partners III |

|

|

| 4.40% due 06/15/40††† |

10,000,000 |

8,851,424 |