Current Report Filing (8-k)

01 Dezember 2022 - 2:01PM

Edgar (US Regulatory)

0001531978false00015319782022-11-282022-11-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 28, 2022 |

Paragon 28, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40902 |

27-3170186 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

14445 Grasslands Drive |

|

Englewood, Colorado |

|

80112 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (720) 912-1332 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value |

|

FNA |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

As previously reported, on or about March 23, 2018, Wright Medical Technology, Inc., which was subsequently acquired by Stryker Corp., (collectively referred to as “Wright Medical”) filed a complaint against Paragon 28, Inc. (the “Company”) in the United States District Court for the District of Colorado, Case No. 18-cv-00691-STV (the “Colorado Complaint”). The Colorado Complaint, as amended, asserts that the Company (i) has infringed and continues to infringe nine Wright Medical patents, (ii) has misappropriated and continues to misappropriate Wright Medical trade secrets and confidential material, (iii) has and is unfairly competing with Wright Medical, and (iv) has intentionally interfered with Wright Medical contracts. The Colorado Complaint, as amended, requests customary remedies for the claims raised, including (a) a judgment that the Company has infringed the Wright Medical patents and misappropriated, used and disclosed Wright Medical’s trade secrets, (b) a permanent injunction preventing us from further engaging in the alleged misconduct, including infringing the Wright Medical patents, from manufacturing, selling or distributing products that allegedly infringe such Wright Medical patents and from misappropriating Wright Medical’s trade secrets and confidential information, (c) damages, including punitive and statutory enhanced damages, (d) attorneys’ fees, (e) interest on any foregoing sums, and (f) any relief as the court deems just and equitable, which could include future royalty payments. In addition, on or about December 23, 2021, Wright Medical filed an additional complaint against the Company in the United States District Court for the District of Delaware, Case No. 1:21-cv-01809-MN, which alleges infringement of certain other patents (the “Delaware Complaint”).

On November 28, 2022, the Company entered into a settlement agreement with Stryker Corp. to settle the Colorado Complaint, the Delaware Complaint and any Company counter claims for a total amount of $26.0 million paid by the Company to Stryker Corp. (the “Settlement Amount”). The Settlement Amount will be paid by the Company in three separate installments consisting of: (i) $5.0 million on or by December 16, 2022, (ii) $8.0 million at any time between January 1, 2023 and January 16, 2023, and (iii) $13.0 million at any time between April 1, 2023 and April 17, 2023. The settlement agreement does not impact the Company’s ability to continue operating its business and does not require any changes to the Company’s existing product lines. The Settlement Amount is the only consideration being paid, and the Company is not required to make any future payments to Stryker Corp.

The Company entered into the settlement agreement solely to eliminate the burden, expense, distraction, and uncertainties of litigation. The settlement agreement is not, and shall not be construed as, an admission of liability or that the Company engaged in any wrongful, tortious, or unlawful activity.

The foregoing summary of the settlement agreement does not purport to be complete and is qualified in its entirety by reference to the full and complete terms contained in the settlement agreement, a copy of which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the period ended December 31, 2022.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PARAGON 28, INC. |

|

|

|

|

Date: December 1, 2022 |

|

|

|

By: |

|

/s/ Jonathan Friedman |

|

|

|

|

|

|

Jonathan Friedman |

|

|

|

|

|

|

General Counsel |

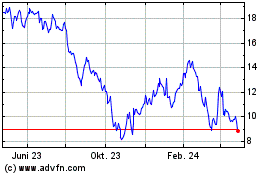

Paragon 28 (NYSE:FNA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

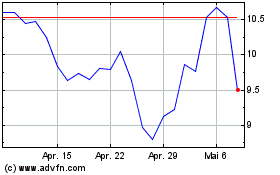

Paragon 28 (NYSE:FNA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024