UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number: 001-33153

Endeavour Silver Corp.

(Translation of registrant's name into English)

#1130-609 Granville Street

Vancouver, British Columbia, Canada V7Y 1G5

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [ X ]

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Endeavour Silver Corp. |

| | | (Registrant) |

| | | |

| | | |

| Date: July 9, 2024 | | /s/ DAN DICKSON |

| | | Dan Dickson |

| | | CEO |

| | | |

EXHIBIT INDEX

EXHIBIT 99.1

Endeavour Silver Reports Q2 2024 Production Results; In-Line with Guidance

VANCOUVER, British Columbia, July 09, 2024 (GLOBE NEWSWIRE) -- Endeavour Silver Corp. (“Endeavour” or the “Company”) (NYSE: EXK; TSX: EDR) is pleased to report second quarter 2024 production of 1,312,572 silver ounces (oz) and 10,549 gold oz, for silver equivalent (1) (“AgEq”) production of 2.2 million oz. Total year-to-date production of 4.4 million AgEq oz is tracking towards the upper range of the full year 2024 production guidance of 8.1 million to 8.8 million silver equivalent ounces.

“Our safe, reliable and consistent production from operations has been key as capital expenditures increase at Terronera. As construction activities are beginning to peak, we have been implementing our business readiness strategy to smoothly transition into operations.” stated Dan Dickson, Chief Executive Officer. “We remain focused on the commissioning of the Terronera mine in Q4 2024 and production in 2025.”

Q2 2024 Highlights

- Guanaceví Reliably Delivering: Throughput and silver production were consistent with plan, while higher gold grades mined and from third-party feed contributed to higher gold production than planned.

- Bolañitos Results Remain Consistent: Strong gold production continued following on from the first quarter of 2024. Silver production continues to be slightly below plan due to lower silver grades and lower silver recovery, while throughput remains steady. Milled grades are expected to have similar variation for the second half of the year.

- Metal Sales and Inventories: Sold 1,217,569 oz silver and 9,887 oz gold during the quarter. A total of 262,160 oz silver and 939 oz gold bullion inventory and 5,860 oz silver and 322 oz gold in concentrate inventory were held at quarter end.

- Published 2023 Sustainability Report entitled “Transformation In Motion”: The Company highlighted progress during the second year of our 2022-2024 Sustainability Strategy (see news release dated May 16, 2024).

- Newly Appointed Director, Angela Johnson: Ms. Johnson is a Professional Geologist, MBA, who brings over thirteen years of experience in the mining industry in both technical and corporate development roles as well as extensive knowledge in ESG best practices (see news release dated April 18, 2024).

- First Drawdown of the Terronera Senior Secured Debt Facility: Proceeds of USD $60M are being used to develop the Terronera mine. An additional USD $60M remains committed and available for future drawdowns during the second half of 2024 (see news release dated April 10, 2024).

Q2 2024 Mine Operations

Consolidated silver production decreased 12% to 1,312,572 ounces in Q2 2024 compared to Q2 2023, primarily driven by variations in grades, specifically lower silver grades at the Guanaceví mine. Gold production increased by 7% to 10,549 ounces in Q2 2024 compared to Q2 2023, primarily due to higher gold grades mined at both Guanaceví and Bolañitos as well as higher gold content in third-party feed processed at the Guanaceví mine.

Local third-party feed continued to supplement Guanaceví mine production, totaling 15% of quarterly throughput. With current prices, management expects local third-party feed to remain above 10% of throughput going forward. The Guanaceví operations are benefiting from the significant plant improvements and modifications made in 2023, as plant throughput and recoveries have been in line with plan and consistent throughout Q2 and year-to-date 2024.

Production Highlights for the Three and Six Months Ended June 30, 2024

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | 2023 | % Change | | 2024 | 2023 | % Change |

| 218,989 | 228,575 | (4 | %) | Throughput (tonnes) | 440,783 | 439,648 | 0 | % |

| 1,312,572 | 1,494,000 | (12 | %) | Silver ounces produced | 2,772,578 | 3,117,545 | (11 | %) |

| 10,549 | 9,819 | 7 | % | Gold ounces produced | 20,682 | 19,161 | 8 | % |

| 1,303,461 | 1,482,255 | (12 | %) | Payable silver ounces produced | 2,753,769 | 3,090,467 | (11 | %) |

| 10,369 | 9,636 | 8 | % | Payable gold ounces produced | 20,317 | 18,820 | 8 | % |

| 2,156,453 | 2,279,520 | (5 | %) | Silver equivalent ounces produced1 | 4,427,130 | 4,650,425 | (5 | %) |

| 1,217,569 | 1,299,672 | (6 | %) | Silver ounces sold | 2,973,663 | 2,967,080 | 0 | % |

| 9,887 | 9,883 | 0 | % | Gold ounces sold | 20,767 | 19,009 | 9 | % |

Production Tables for Q2 2024 by Mine

| Production | Tonnes | Tonnes | Grade | Grade | Recovery | Recovery | Silver | Gold |

| by mine | Processed | per day | Ag gpt* | Au gpt* | Ag % | Au % | Oz | Oz |

| Guanaceví | 112,897 | 1,241 | 364 | 1.29 | 90.4% | 90.4% | 1,195,753 | 4,243 |

| Bolañitos | 106,092 | 1,166 | 41 | 2.06 | 83.4% | 89.6% | 116,819 | 6,306 |

| Consolidated | 218,989 | 2,407 | 208 | 1.67 | 89.8% | 89.9% | 1,312,572 | 10,549 |

*gpt = grams per tonne

Totals may not add up due to rounding

Production Tables for the Six Months Ended June 30, 2024 by Mine

| Production | Tonnes | Tonnes | Grade | Grade | Recovery | Recovery | Silver | Gold |

| by mine | Processed | per day | Ag gpt* | Au gpt* | Ag % | Au % | Oz | Oz |

| Guanaceví | 227,901 | 1,252 | 383 | 1.27 | 90.1% | 89.6% | 2,531,495 | 8,367 |

| Bolañitos | 212,882 | 1,170 | 42 | 2.00 | 84.5% | 89.9% | 241,083 | 12,315 |

| Consolidated | 440,783 | 2,422 | 218 | 1.63 | 89.6% | 89.8% | 2,772,578 | 20,682 |

*gpt = grams per tonne

Totals may not add up due to rounding

About Endeavour Silver

Endeavour is a mid-tier precious metals company with a strong commitment to sustainable and responsible mining practices. With operations in Mexico and the development of the new cornerstone mine in Jalisco state, the company aims to contribute positively to the mining industry and the communities in which it operates. In addition, Endeavour has a portfolio of exploration projects in Mexico, Chile and the United States to facilitate its goal to become a premier senior silver producer.

Qualified Person

Dale Mah, P.Geo., Vice President Corporate Development, a qualified person under NI 43-101, has approved the scientific and technical information related to operations matters in this news release.

Q2 2024 Financial Results and Conference Call

Q2 2024 financial results will be released before market open on Thursday August 1, 2024, and Management will host a conference call the same day at 1:00 pm Eastern time to discuss the results.

| Date: | | Thursday August 1, 2024 |

| | | |

| Time: | | 10:00am Pacific / 1:00pm Eastern |

| | | |

| Telephone: | | Canada & US +1-844-763-8274 |

| | | International +1-647-484-8814 |

| | | |

| Replay: | | Canada & US +1-604-674-8052 |

| | | International +1-855-669-9658 |

| | | Audio replay will be available on Company’s website |

Management Changes

Galina Meleger, Vice President of Investor Relations, resigned from the Company in June 2024 to pursue another opportunity. We wish Galina all the best in her new position and thank her for being an integral part of the team and our growth over the past years.

Contact Information

Dan Dickson, CEO

Email: ddickson@edrsilver.com

Website: www.edrsilver.com

Follow Endeavour Silver on Facebook, X, Instagram and LinkedIn

Endnotes

1 Silver equivalent (AgEq)

AgEq is calculated using an 80:1 silver:gold ratio.

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of the United States private securities litigation reform act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Such forward-looking statements and information herein include but are not limited to statements regarding Endeavour’s anticipated performance in 2024 including changes in mining operations and forecasts of production levels and the timing and results of various activities. The Company does not intend to and does not assume any obligation to update such forward-looking statements or information, other than as required by applicable law.

Forward-looking statements or information involve known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, production levels, performance or achievements of Endeavour and its operations to be materially different from those expressed or implied by such statements. Such factors include but are not limited changes in production and costs guidance; the ongoing effects of inflation and supply chain issues on mine economics; national and local governments, legislation, taxation, controls, regulations and political or economic developments in Canada and Mexico; financial risks due to precious metals prices; operating or technical difficulties in mineral exploration, development and mining activities; risks and hazards of mineral exploration, development and mining; the speculative nature of mineral exploration and development; risks in obtaining necessary licenses and permits; fluctuations in the prices of silver and gold, fluctuations in the currency markets (particularly the Mexican peso, Chilean peso, Canadian dollar and U.S. dollar); and challenges to the Company’s title to properties; as well as those factors described in the section “risk factors” contained in the Company’s most recent form 40F/Annual Information Form filed with the S.E.C. and Canadian securities regulatory authorities.

Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to: the continued operation of the Company’s mining operations, no material adverse change in the market price of commodities, forecasted mine economics as of 2024, mining operations will operate and the mining products will be completed in accordance with management’s expectations and achieve their stated production outcomes, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or information, there may be other factors that cause results to be materially different from those anticipated, described, estimated, assessed or intended. There can be no assurance that any forward-looking statements or information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.

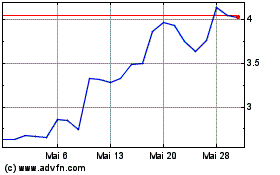

Endeavour Silver (NYSE:EXK)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

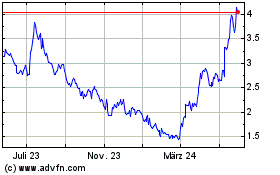

Endeavour Silver (NYSE:EXK)

Historical Stock Chart

Von Nov 2023 bis Nov 2024