Dun & Bradstreet Cuts Business Outlook Due to Strong USD -- Currency Comment

03 November 2022 - 5:40PM

Dow Jones News

By Paulo Trevisani

Dun & Bradstreet Holdings, Inc. said Thursday it was

reducing its business outlook due to the strengthening U.S.

dollar.

The Jacksonville, Fla., consultancy group increased to 3.4% from

2.5% the expected FX headwind on adjusted revenues.

Dun & Bradstreet now expects adjusted revenue between $2.22

billion and $2.24 billion, after the impact of foreign exchange,

down from between $2.23 billion and $2.27 billion in the previous

outlook.

The company said the FX impact was "due primarily to the

continued strengthening of the U.S. dollar versus the euro, Swedish

krona and in particular the British pound in the second half of

this year."

The dollar has strengthened this year as the Federal Reserve

raises interest rates faster than other major central banks.

So far this year, the greenback has strengthened 24% versus the

Swedish krona, 21% versus the pound, and 17% versus the euro.

Write to Paulo Trevisani at paulo.trevisani@wsj.com

(END) Dow Jones Newswires

November 03, 2022 12:25 ET (16:25 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

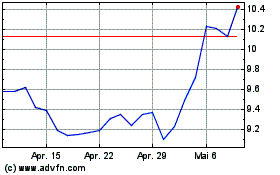

Dun and Bradstreet (NYSE:DNB)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

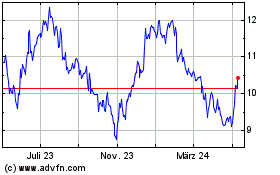

Dun and Bradstreet (NYSE:DNB)

Historical Stock Chart

Von Apr 2023 bis Apr 2024