Current Report Filing (8-k)

01 Februar 2023 - 12:08PM

Edgar (US Regulatory)

0000027996

false

0000027996

2023-01-31

2023-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 31, 2023

DELUXE CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| MN | |

1-7945 | |

41-0216800 |

(State or other jurisdiction

of incorporation) | |

(Commission File Number) | |

(IRS Employer

Identification No.) |

801

S. Marquette Ave., Minneapolis,

MN

| 55402 |

| (Address of principal executive offices) | (Zip Code) |

(651) 483-7111

Registrant’s telephone number, including area

code

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which

registered |

| Common Stock, par $1.00 per share |

|

DLX |

|

NYSE |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

SECTION 1 – REGISTRANT’S BUSINESS

AND OPERATIONS

| Item 1.01 | Entry into a Material Definitive Agreement. |

On January 31, 2023, Deluxe Corporation,

a Minnesota corporation (the “Company”), through its subsidiary, Deluxe Small Business Sales, Inc., a Minnesota corporation

(“Seller”), entered into a Stock and Asset Purchase Agreement (the “Sale Agreement”) with HostPapa, Inc.,

an Ontario corporation (“Purchaser”). Subject to the terms and conditions of the Sale Agreement, on the closing date (the

“Closing Date”), Purchaser will acquire (i) all of the outstanding equity interests of the following wholly-owned subsidiaries

of Seller: LogoMix Inc., Hostopia Canada, Corp., Internet Names for Business Inc., Hostopia Bulgaria EOOD, and Hostopia Ireland

Limited; and (ii) the right, title and interest in specified assets of Seller and certain of its affiliates related to the Company’s

web hosting business (and Purchaser shall assume specified liabilities of Seller and such affiliates of Seller related to the web hosting

business). With this transaction, the Company will exit its web hosting and related businesses in the United States, Canada, Bulgaria

and Ireland.

The aggregate base purchase price payable to Seller

in connection with this transaction is $42,000,000, (i) $31,400,000 of which will be paid on the Closing Date, subject to customary

adjustments for changes in net working capital and net indebtedness, (ii) $4,550,000 of which will be deferred and paid one hundred

and eighty (180) days following the Closing Date (subject to adjustments under certain circumstances specified in the Sale Agreement)

and (iii) $6,050,000 of which will be deferred and paid three hundred and sixty-five (365) days following the Closing Date (subject

to adjustments under certain circumstances specified in the Sale Agreement).

The closing is subject to customary conditions.

The Sale Agreement contains customary representations, warranties and covenants of Seller and Purchaser. From the date of the Sale Agreement

until the Closing Date, Seller is, with limited exceptions, required to cause each purchased subsidiary described above to conduct its

business in the ordinary course consistent with past practice and to comply with certain covenants regarding the operation of its respective

business. For two (2) years following the Closing Date, Seller is also required to comply, and cause its affiliates to comply, with

certain customary non-competition and non-solicitation covenants with respect to the businesses sold in the transaction.

The Sale Agreement provides for certain termination

rights of Seller and Purchaser, including termination by Seller or Purchaser if the closing has not been consummated on or before March 31,

2023, provided that this termination right will not be available to any party whose breach of any representation, warranty or covenant

contained in the Sale Agreement was the cause of or resulted in the failure of the closing to occur on or before such date. Upon termination

of the Sale Agreement under specified circumstances, Purchaser will be required to pay Seller a termination fee of $2,500,000.

SECTION 7 - REGULATION FD

| Item 7.01 | Regulation FD Disclosure. |

On January 31, 2023, the Company issued a

press release announcing Seller’s entry into the Sale Agreement, which press release is attached as Exhibit 99.1 to this Current

Report on Form 8-K and incorporated herein by reference.

Pursuant to General Instruction B.2. to Form 8-K,

the information set forth in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18

of the Securities and Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

Cautionary Statement Regarding Forward-Looking

Statements

Statements made in this Current Report on Form 8-K

concerning the Company, the Company’s or management’s intentions, expectations, outlook or predictions about future results

or events are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such

statements reflect management’s current intentions, expectations or beliefs and are subject to risks and uncertainties that could

cause actual results or events to vary from those stated, which variations could be material and adverse. Factors that could produce such

variations include, but are not limited to, the following: potential continuing negative impacts from pandemic health issues, such as

the coronavirus / COVID-19, along with the impact of government restrictions or similar directives on the Company’s business or

financial condition; uncertainties related to the Russia-Ukraine dispute; the impact that further deterioration or prolonged softness

in the economy may have on demand for the Company’s products and services; the Company’s ability to execute its transformational

strategy and to realize the intended benefits; the inherent unreliability of earnings, revenue and cash flow predictions due to numerous

factors, many of which are beyond the Company’s control; declining demand for the Company’s checks and check-related products

and services and business forms; risks that the Company’s strategies intended to drive sustained revenue and earnings growth, despite

the continuing decline in checks and forms, are delayed or unsuccessful; intense competition; continued consolidation of financial institutions

and/or additional bank failures, thereby, among other things, reducing the number of potential customers and referral sources; risks that

future acquisitions will not be consummated; risks that any such acquisitions do not produce the anticipated results or synergies; risks

that the Company’s cost reduction initiatives will be delayed or unsuccessful; risks related to any divestitures; performance shortfalls

by one or more of the Company’s major suppliers, licensors or service providers; unanticipated delays, costs and expenses in the

development and marketing of products and services, including web services and financial technology and treasury management solutions;

the failure of such products and services to deliver the expected revenues and other financial targets; risks related to security breaches,

computer malware or other cyber-attacks; risks of interruptions to the Company’s website operations or information technology systems;

risks of unfavorable outcomes and the costs to defend litigation and other disputes; and the impact of governmental laws, regulations

or investigations. These statements speak only as of the time made, and management assumes no obligation to publicly update any such statements.

Additional information concerning these and other factors that could cause actual results and events to differ materially from current

expectations are contained in the Company’s Form 10-K for the year ended December 31, 2021. Neither the Company nor management

undertakes any obligation to update or revise any forward-looking statements to reflect subsequent events, new information or future circumstances.

SECTION 9 - FINANCIAL STATEMENTS AND EXHIBITS

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

DELUXE CORPORATION |

| |

|

| Dated: January 31, 2023 |

By: |

/s/ Jeffrey L. Cotter |

| |

Name: |

Jeffrey L. Cotter |

| |

Title: |

Senior Vice President, Chief Administrative Officer and General Counsel |

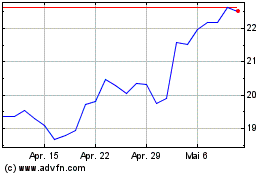

Deluxe (NYSE:DLX)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Deluxe (NYSE:DLX)

Historical Stock Chart

Von Apr 2023 bis Apr 2024