Current Report Filing (8-k)

06 Januar 2023 - 10:07PM

Edgar (US Regulatory)

0000027996false00000279962023-01-022023-01-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 2, 2023

DELUXE CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| MN | 1-7945 | 41-0216800 |

| (State or other jurisdiction | (Commission | (I.R.S. Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | |

801 S. Marquette Ave., Minneapolis, MN | | 55402-2807 |

| (Address of principal executive offices) | (Zip Code) |

(651) 483-7111

Registrant's telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock, par value $1.00 per share | DLX | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Section 5 - Corporate Governance and Management

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 2, 2023, Christopher L. Thomas, Senior Vice President, Chief Revenue Officer (“CRO”) of Deluxe Corporation (the “Company”), entered into a Separation Agreement with the Company providing for the transition out of the role of CRO and into the role of a Special Advisor to the Company’s Chief Executive Officer, effective January 6, 2023. Mr. Thomas will serve as Special Advisor during a transition period until Mr. Thomas’ separation from the Company on April 28, 2023 (the “Separation Date”). In accordance with the terms of the Separation Agreement, Mr. Thomas’ compensation and benefits will continue during the transition period as in effect on December 1, 2022. The Separation Agreement provides for the release of claims by Mr. Thomas as of the date of the Separation Agreement and a second release following the Separation Date (the “Second Release”).

In connection with his separation, Mr. Thomas will also be entitled to receive severance payments in accordance with the Company’s Severance Plan for Certain Executive Level Employees (the “Executive Severance Plan”), subject to his providing the Second Release. Pursuant to the terms of the Executive Severance Plan, following the Separation Date, Mr. Thomas will be entitled to receive: (i) a severance payment equal to twelve months of his base salary, (ii) a cash bonus equal to one-third of his target bonus for fiscal year 2023 and (iii) a one-time payment of $45,000. He is also required to comply with the post-employment restrictions and the other terms of an existing confidentiality agreement and non-competition agreement. Mr. Thomas’ outstanding equity awards will be handled in accordance with the applicable terms of the Company’s related plans and awards, copies of which have been previously filed with the Securities and Exchange Commission. Mr. Thomas will also receive his fiscal year 2022 cash bonus and any payment under the retention agreement into which Mr. Thomas previously entered with the Company. Each of these payments will be made in the spring of 2023, prior to the Separation Date.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit

Number | | Description |

| 101.INS | | XBRL Instance Document – the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document |

| 101.SCH | | XBRL Taxonomy Extension Schema Document |

| 101.LAB | | XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE | | XBRL Taxonomy Extension Presentation Linkbase Document |

| 104 | | Cover page interactive data file (formatted as Inline XBRL and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 6, 2023

| | | | | | | | |

| DELUXE CORPORATION | |

| | |

| /s/ Jeffrey L. Cotter | |

| | |

| Jeffrey L. Cotter | |

| Senior Vice President, Chief | |

| Administrative Officer and | |

| General Counsel | |

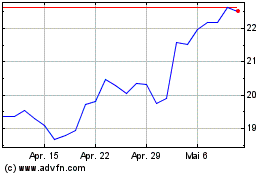

Deluxe (NYSE:DLX)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Deluxe (NYSE:DLX)

Historical Stock Chart

Von Apr 2023 bis Apr 2024