Current Report Filing (8-k)

06 April 2022 - 1:01PM

Edgar (US Regulatory)

DICK'S SPORTING GOODS, INC. false 0001089063 0001089063 2022-04-05 2022-04-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 5, 2022

DICK’S SPORTING GOODS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-31463 |

|

16-1241537 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

345 Court Street, Coraopolis, PA 15108

(Address of principal executive offices)(Zip Code)

(724) 273-3400

Registrant’s telephone number, including area code

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

DKS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On April 5, 2022, DICK’S Sporting Goods, Inc. (the “Company”) entered into, with certain financial institutions (collectively, the “Hedge Counterparties”), partial unwind agreements relating to a portion of the convertible note hedge transactions (the “Note Hedge Early Termination Agreements”) and a portion of the warrant transactions (the “Warrant Early Termination Agreements” and together with the Note Hedge Early Termination Agreements, the “Early Termination Agreements”) that were previously entered into by the Company with each such Hedge Counterparty in connection with the issuance of its 3.25% Convertible Senior Notes due 2025 (the “2025 Notes”). The Note Hedge Early Termination Agreements relate to a number of call options corresponding to the number of 2025 Notes subject to exchange pursuant to the Exchange Agreements described below (the “Exchanged Notes”), and the Warrant Early Termination Agreements relate to a number of warrants corresponding to the number of shares of the Company’s common stock underlying such Exchanged Notes. Pursuant to such Early Termination Agreements, the Hedge Counterparties will deliver to the Company a number of shares of the Company’s common stock in respect of the call option transactions and warrant transactions being early terminated, which number of shares will be determined based upon the volume-weighted average price per share of the Company’s common stock during an averaging period, commencing on April 6, 2022.

The foregoing description of the Early Termination Agreements does not purport to be complete and is qualified in its entirety by reference to the full text of the form of Note Hedge Early Termination Agreement and the form of Warrant Early Termination Agreement, copies of which are filed with this Current Report on Form 8-K as Exhibit 10.1 and 10.2, respectively, and are incorporated herein by reference.

HudsonWest LLC, a full-service independent equity derivatives and convertible securities advisory firm, acted as financial advisor to DICK’S on the call spread terminations and the exchange transactions described below.

| Item 3.02 |

Unregistered Sale of Equity Securities. |

On April 5, 2022, the Company entered into exchange agreements (the “Exchange Agreements” and each, an “Exchange Agreement”) with certain holders (the “Noteholders”) of the 2025 Notes. The Noteholders have agreed to exchange $100 million in aggregate principal amount of the Company’s outstanding 2025 Notes for a combination of cash and shares of the Company’s common stock. The total number of shares of common stock to be issued by the Company to the Noteholders will be determined based upon the volume-weighted average price per share of the Company’s common stock during an averaging period, commencing on April 6, 2022.

The Company’s shares of common stock to be issued in connection with the exchange will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), and will be issued in reliance on the exemption from the registration requirements thereof provided by Section 4(a)(2) of the Securities Act in a transaction by an issuer not involving a public offering.

The 2025 Notes to be exchanged represent approximately 17% of the outstanding principal amount. Following the exchange, approximately $475 million in aggregate principal amount will remain outstanding, and the Company’s annual interest payments will be reduced by approximately $3.25 million.

The foregoing description of the Exchange Agreements does not purport to be complete and is qualified in its entirety by reference to the full text of the form of Exchange Agreements, a copy of which is filed with this Current Report on Form 8-K as Exhibit 10.3 and is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| Exhibit 10.1 |

|

Form of Note Hedge Early Termination Agreement, dated as of April 5, 2022, by and between DICK’S Sporting Goods, Inc. and the applicable call option counterparty. |

|

|

| Exhibit 10.2 |

|

Form of Warrant Early Termination Agreement, dated as of April 5, 2022, by and between DICK’S Sporting Goods, Inc. and the applicable warrant counterparty. |

|

|

| Exhibit 10.3 |

|

Form of Exchange Agreement, dated as of April 5, 2022, by and between DICK’S Sporting Goods, Inc. and the applicable Noteholder. |

|

|

| Exhibit 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

DICK’S SPORTING GOODS, INC. |

|

|

|

|

| Date: April 6, 2022 |

|

|

|

By: |

|

/s/ Navdeep Gupta |

|

|

|

|

|

|

Navdeep Gupta |

|

|

|

|

|

|

Executive Vice President - Chief Financial Officer |

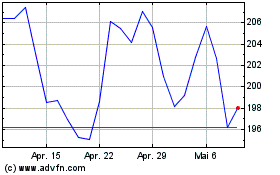

Dicks Sporting Goods (NYSE:DKS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Dicks Sporting Goods (NYSE:DKS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024