Current Report Filing (8-k)

02 Juni 2022 - 12:02PM

Edgar (US Regulatory)

0001552797false00015527972022-05-262022-05-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

May 26, 2022

Date of Report (Date of earliest event reported)

DELEK LOGISTICS PARTNERS, LP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | 001-35721 | 45-5379027 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| | | |

7102 Commerce Way | Brentwood | Tennessee | 37027 |

(Address of Principal Executive) | | | (Zip Code) |

(615) 771-6701

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Units Representing Limited Partner Interests | DKL | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01 Entry into a Material Definitive Agreement.

Credit Agreement Amendments

On May 26, 2022, Delek Logistics Partners, LP (the “Partnership”) and substantially all of its subsidiaries (together with the Partnership, the “Borrowers”) entered into a Third Amendment (the “Third Amendment”) to its Third Amended and Restated Credit Agreement with Fifth Third Bank, National Association, as Administrative Agent (the “Administrative Agent”), and the Lenders party thereto, which modifies the Third Amended and Restated Credit Agreement, dated as of September 28, 2018 (as amended from time to time, the “Credit Agreement”), by and among the Borrowers, the Administrative Agent, the Lenders and the L/C Issuers from time to time party thereto. Among other things, the Third Amendment provides for certain changes to the Credit Agreement in connection with the Borrowers’ previously announced acquisition of the equity interests of 3 Bear Delaware Holding - NM, LLC in respect of pro forma calculations of EBITDA with respect to such acquisition.

Further, on May 26, 2022, the Borrowers entered into a Fourth Amendment (the “Fourth Amendment”) to the Credit Agreement. Among other things, the Fourth Amendment: (i) increases the U.S. Revolving Credit Commitments (as defined in the Credit Agreement) by an amount equal to $150,000,000, for an aggregate amount of $1,000,000,000, (ii) increases the U.S. L/C Sublimit (as defined in the Credit Agreement) to an aggregate amount equal to $90,000,000 and (iii) increases the U.S. Swing Line Sublimit (as defined in the Credit Agreement) to an aggregate amount equal to $18,000,000.

Item 2.01 Completion of Acquisition or Disposition of Assets.

As previously announced, on April 8, 2022, DKL Delaware Gathering, LLC (the “Purchaser”), a subsidiary of the Partnership, entered into a Membership Interest Purchase Agreement with 3 Bear Energy – New Mexico LLC (the “Seller”) to purchase 100% of the limited liability company interests in 3 Bear Delaware Holding – NM, LLC (the “Purchased Interests”), related to Seller’s crude oil and gas gathering, processing and transportation businesses, as well as water disposal and recycling operations, in the Delaware Basin in New Mexico (the “Purchase Agreement”).

The acquisition of the Purchased Interests contemplated by the Purchase Agreement closed on June 1, 2022. The total consideration for the acquisition of the Purchased Interests is $624.7 million, subject to customary closing adjustments. The acquisition was financed through a combination of cash on hand and borrowings under the Credit Agreement. The Purchase Agreement is attached to this Current Report on Form 8-K as Exhibit 2.1 and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 above is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On June 1, 2022, the Partnership issued a press release announcing the closing of the acquisition of the Purchased Interests. A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 7.01 is being furnished, not filed, pursuant to Regulation FD. Accordingly, the information in Item 7.01 of this report will not be incorporated by reference into any registration statement filed by the Partnership under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated by reference. The furnishing of the information in this report is not intended to, and does not, constitute a determination or admission by the Partnership that the information in this report is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Partnership or any of its affiliates.

Item 9.01 Financial Statements and Exhibits.

(a) Financial Statements of Business Acquired.

The financial statements required by Item 9.01(a) of Form 8-K will be filed by amendment to this Current Report not later than 71 days after the date on which this Current Report is required to be filed.

(b) Pro Forma Financial Information.

The financial statements required by Item 9.01(b) of Form 8-K will be filed by amendment to this Current Report not later than 71 days after the date on which this Current Report is required to be filed.

| | | | | | | | |

| (d) | | Exhibits. |

| | |

| | |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

Dated: June 1, 2022 | DELEK LOGISTICS PARTNERS, LP |

| By: Delek Logistics GP, LLC |

| its general partner |

| |

| /s/ Reuven Spiegel |

| Name: Reuven Spiegel |

| Title: Executive Vice President and Chief Financial Officer (Principal Financial Officer) |

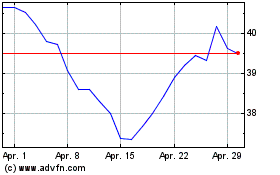

Delek Logistics Partners (NYSE:DKL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Delek Logistics Partners (NYSE:DKL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024