Additional Proxy Soliciting Materials (definitive) (defa14a)

03 Februar 2022 - 12:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

|

Definitive Proxy Statement

|

|

☐

|

|

Definitive Additional Materials

|

|

☒

|

|

Soliciting Material Pursuant to § 240.14a-12

|

DELEK US HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies: ____________________________________

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies: ____________________________________

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): _______________________________

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction: ___________________________________________

|

|

|

|

|

(5)

|

Total fee paid: _________________________________________________________________________

|

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

(1)

|

Amount Previously Paid: _________________________________________________________________

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.: _______________________________________________

|

|

|

|

|

|

|

(3)

|

Filing Party: ___________________________________________________________________________

|

|

|

|

|

|

|

(4)

|

Date Filed: ____________________________________________________________________________

|

|

Delek US Holdings Director Nomination Response

BRENTWOOD, Tenn., February 1, 2022 -- Delek US Holdings, Inc. (NYSE: DK) (“Delek US” or the “Company”) today issued the following statement regarding the nomination by IEP Energy Holding LLC, a company controlled by Carl Icahn, of three candidates for election to the Delek US Board of Directors at the Company's 2022 Annual Meeting of Stockholders:

Delek US is committed to maintaining a strong, independent and diverse Board that serves the best interests of its stockholders, employees, customers and partners, and regularly reviews opportunities to create and deliver value. The Nominating and Corporate Governance Committee of the Company's Board will evaluate the nominees and make a recommendation to the Board of Directors, which will make its recommendation to stockholders. Delek US stockholders are not required to take any action at this time.

About Delek US Holdings, Inc.

Delek US Holdings, Inc. is a diversified downstream energy company with assets in petroleum refining, logistics, asphalt, renewable fuels and convenience store retailing. The refining assets consist of refineries operated in Tyler and Big Spring, Texas, El Dorado, Arkansas and Krotz Springs, Louisiana with a combined nameplate crude throughput capacity of 302,000 barrels per day.

The logistics operations consist of Delek Logistics. Delek US and its affiliates also own the general partner and an approximate 80 percent limited partner interest in Delek Logistics. Delek Logistics is a growth-oriented master limited partnership focused on owning and operating midstream energy infrastructure assets.

The convenience store retail business operates approximately 250 convenience stores in central and west Texas and New Mexico.

Additional Information

Delek US, its directors and certain of its executive officers and employees may be deemed to be participants in the solicitation of proxies from the company's shareholders in connection with the matters to be considered at the Company's 2022 Annual Meeting. Delek US intends to file a proxy statement and a WHITE proxy card with the SEC in connection with any such solicitation of proxies from the Company's shareholders. DELEK US SHAREHOLDERS ARE STRONGLY ENCOURAGED TO READ ANY SUCH PROXY STATEMENT AND ACCOMPANYING WHITE PROXY CARD WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION.

Information regarding the ownership of the Company's stock and other securities by the Company's directors and executive officers is included in SEC filings on Forms 3, 4, and 5, which can be found through the Company's website (www.delekus.com) in the section "Investors" or through the SEC's website at www.sec.gov. Information can also be found in the Company's other SEC filings, including the Company's Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. More detailed and updated information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement and other materials to be filed with the SEC in connection with the Company's 2022 Annual Meeting. Shareholders will be able to obtain any proxy statement, any amendments or supplements to the proxy statement and other documents filed by Delek US with the SEC for no charge at the SEC's website at www.sec.gov. Copies will also be available at no charge on the Company's website at www.delekus.com.

Investor Relations Contact:

Blake Fernandez, Senior Vice President of Investor Relations and Market Intelligence, 615-224-1312

Public Relations Contacts:

Nick Lamplough- Joele Frank, Wilkinson Brimmer Katcher, 212-355-4449

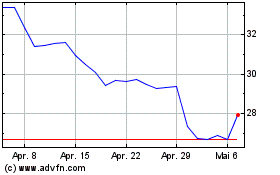

Delek US (NYSE:DK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

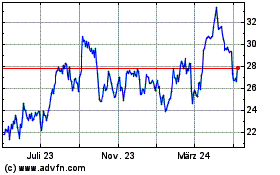

Delek US (NYSE:DK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024