Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

20 Januar 2023 - 5:38PM

Edgar (US Regulatory)

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed

by the Registrant ¨

Filed

by a Party other than the Registrant x

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| ¨ |

Definitive Additional Materials |

| x |

Soliciting Material Under Rule 14a-12 |

The Walt Disney Company

(Name of Registrant as Specified in Its Charter)

Trian Fund Management, L.P.

Trian Fund Management GP, LLC

Trian Partners, L.P.

Trian Partners Parallel Fund I, L.P.

Trian Partners Master Fund, L.P.

Trian Partners Fund (Sub)-G, L.P.

Trian Partners Strategic Investment Fund-A, L.P.

Trian Partners Strategic Investment Fund-N, L.P.

Trian Partners Strategic Fund-G II, L.P.

Trian Partners Strategic Fund-G III, L.P.

Trian Partners Strategic Fund-K, L.P.

Trian Partners Co-Investment Opportunities Fund,

Ltd.

Nelson Peltz

Peter W. May

Edward P. Garden

Matthew Peltz

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| x |

No fee required. |

| |

|

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

The following Twitter post (the “Tweet”)

was published, as a post and via hyperlink, to Trian Fund Management, L.P.’s (“Trian”) Twitter page relating to The

Walt Disney Company; from time to time Trian or its fellow participants in the proxy solicitation may publish the Tweet to its LinkedIn,

Facebook, Instagram and YouTube pages and various other social media channels relating to The Walt Disney Company, as well as to its website,

www.RestoretheMagic.com.

Video Transcript

Brian Sozzi: Last time I talked to you, maybe two and a half, three

months ago, you seem to have embraced your new activist investor and board member Nelson Peltz. Said he’s doing and he has good

ideas to help turn this company around and drive better results. Now, since then, Nelson has taken a campaign against Disney and they

do not have that view or that same approach. As someone that has dealt with Nelson, why are you embracing him, and a company like that

may not?

Alan Jope: Nelson Peltz has joined our board and brought all kinds

of good ideas. His view on what the company needs us to do is very aligned with the agenda that we’re working on. A big part of

our agenda last year was to simplify our organization. That was something he felt needed to happen. And somebody who has got a strong

track record in the CPG industry we thought would make a good board member for Unilever. I can’t obviously comment on other companies.

Brian Sozzi: Does he unlock value in those meetings? What’s

his thought processes?

I shouldn’t call in too much on one particular board member, but

we expect all of our board members to make contributions that help guide the company and steer us in the right direction. Nelson’s an experienced board member who is very focused on performance

and on setting up the company for the future.

Brian Sozzi: You’re also fresh off a key investor day, too.

Really interesting slide deck, it does seem like you are driving a reimagination of Unilever. Where are you at in the process?

Alan Jope: So over the last five years, we’ve really been

working on four things. First, making sure our executional muscle is in good shape. Secondly, continuing to evolve with portfolio, exiting

spreads exiting T. Building up a business in luxury beauty and health and well-being has been important part of our growth agenda. Third,

just to make sure everyone understands our strategic choices, what markets matter, what categories do we care about, what channels are

we building. And then the fourth part of reinventing Unilever has been a very successful organization change from a complex matrix to

five business groups with full accountability and extreme simplicity, so I only have now five I can either say throats to choke or backs

to pat.

Brian Sozzi: Before—you’re supposed to be retiring at

some point this year, what’s next for you?

Alan Jope: Well, at the moment, I’m 100% focused on Unilever,

making sure we keep cranking it, quarter after quarter. That’s my job. I have very, very many interests outside my business work,

and it’ll create some time to explore. There’ll be a bit of travel. I’ll get the chance to finish our around-the -world

motorcycle trip for a start. That’s a work in progress.

Brian Sozzi: Oh jeez well stay safe and wear a jacket too. Unilever

CEO Alan Jope. Good to see you again. Enjoy the rest of Davos.

Alan Jope: You bet.

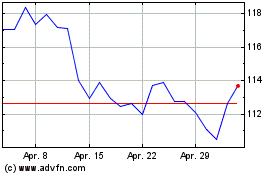

Walt Disney (NYSE:DIS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

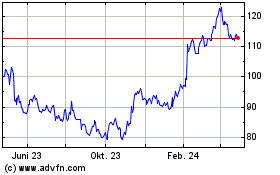

Walt Disney (NYSE:DIS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024