SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed

by the Registrant o

Filed

by a Party other than the Registrant x

Check the appropriate box:

| o |

Preliminary Proxy Statement |

| o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o |

Definitive Proxy Statement |

| o |

Definitive Additional Materials |

| x |

Soliciting Material Under Rule 14a-12 |

The Walt Disney Company

(Name of Registrant as Specified in Its Charter)

Trian Fund Management, L.P.

Trian Fund Management GP, LLC

Trian Partners, L.P.

Trian Partners Parallel Fund I, L.P.

Trian Partners Master Fund, L.P.

Trian Partners Fund (Sub)-G, L.P.

Trian Partners Strategic Investment Fund-A, L.P.

Trian Partners Strategic Investment Fund-N, L.P.

Trian Partners Strategic Fund-G II, L.P.

Trian Partners Strategic Fund-G III, L.P.

Trian Partners Strategic Fund-K, L.P.

Trian Partners Co-Investment Opportunities Fund,

Ltd.

Nelson Peltz

Peter W. May

Edward P. Garden

Matthew Peltz

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| x |

No fee required. |

| |

|

| o |

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| o |

Fee paid previously with preliminary materials. |

| o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

4) |

Date Filed: |

TRIAN NOMINATES NELSON PELTZ FOR ELECTION

TO DISNEY BOARD

Will File Preliminary Proxy Statement for Disney’s

2023 Annual Meeting

Shareholder Materials Available at RestoreTheMagic.com

NEW YORK, January 11, 2023 – Trian Fund Management,

L.P. (“Trian”), whose investment funds collectively own approximately 9.4 million common shares of The

Walt Disney Company (NYSE: DIS) (“Disney” or the “Company”) valued at approximately $900 million[i], tomorrow

will file a preliminary proxy statement with the Securities and Exchange Commission for the election of Nelson Peltz, its Chief Executive

Officer and Founding Partner, to Disney’s Board of Directors at the 2023 Annual Meeting of Shareholders.

Disney is one of the most advantaged consumer entertainment companies

in the world, with unrivaled global scale, irreplaceable brands, and opportunities to monetize its intellectual property (“IP”)

better than its peers by leveraging the Disney “flywheel” (e.g., networks, theme parks, consumer products, etc.). As such,

Disney should be well positioned to navigate the ongoing transition from legacy content distribution channels to streaming.

However, despite Disney’s significant advantages, recent

share price and operating performance have been disappointing. Disney shares are currently trading near an 8-year low despite the Company’s

recent decision to re-hire Bob Iger as CEO (see Appendix A). The Company’s total shareholder return (“TSR”) has

materially underperformed the S&P 500 over 1-year, 3-year, 5-year and 10-year periods by -24%, -60%, -66%, and -116%, respectively[ii]

(see Appendix B). Operating performance has deteriorated, including a 50% decline in adjusted Earnings Per Share (“EPS”)

since FY 2018 despite Parks profitability surpassing historical levels (see Appendix C).

Trian believes that Disney’s recent performance reflects

the hard truth that it is a company in crisis with many challenges weighing on investor sentiment. While we acknowledge that Disney, like

many media companies, is undergoing a challenging pivot to streaming, Disney also benefits from owning best-in-class intellectual property,

a more diversified business mix, and a Parks business that is enjoying all-time high profitability. As such, we believe that the Company’s

current problems are primarily self-inflicted and need to be addressed immediately, including:

POOR Corporate Governance

| · | Failed succession planning |

| · | “Over-the top” compensation practices |

| · | Minimal shareholder engagement, including an apparent unwillingness to fully

engage constructively with Trian

|

POOR Strategy & Operations

| · | Flawed Direct-to-Consumer (“DTC”) strategy struggling with profitability,

despite reaching similar revenues as Netflix and having a significant IP advantage |

| · | Lack of overall cost discipline |

| · | Overearning in the Parks business to subsidize streaming losses |

POOR Capital Allocation

| · | Since 2018, Disney’s EPS has been cut in half despite $162bn spent on

mergers and acquisitions (“M&A”), capital expenditures (“Capex”) and content – approximately equal to

Disney’s entire current market capitalization[iii] |

| · | Management, in Trian’s view, has shown poor judgment on recent M&A

efforts including overpaying for the 21st Century Fox assets and bidding aggressively for Sky plc |

| · | Increased financial leverage and deteriorating cash flow resulting in the

elimination of the dividend that had been paid for 50+ years, even as COVID receded and Parks profitability surpassed historical

levels |

“Disney

has an incredible legacy as one of the leading and most successful consumer entertainment companies in the world, having built

some of the most celebrated consumer brands and an unparalleled content portfolio that resonates with audiences of all

ages across the globe. But in recent years, the Company has lost its way resulting in a rapid deterioration in its financial performance

from a consistent dividend-paying, high free cash flow generative business into a highly leveraged enterprise with reduced earnings power

and weak free cash flow conversion,” said Nelson Peltz.

Peltz continued, “Disney has enormous potential, but today is struggling

with numerous challenges and must act with urgency to accelerate profitability in its DTC business. As a highly engaged shareholder

serving on Disney’s Board, my goal would be to work collaboratively with Bob Iger and other directors to take decisive action

that will result in improved operations and financial performance, enhanced shareholder value and a robust succession planning process

that will set the stage for sustainable growth over the long term. Trian has studied Disney’s business for over a decade, and we

are confident that as an independent voice I can add significant value in the boardroom and represent the interests of all Disney shareholders.”

Trian Believes Nelson Peltz Can Help Disney Address Its Challenges

Trian believes that it can help Disney restore the magic and reclaim

its position as a best-in-class company that delivers highly attractive returns for shareholders. Mr. Peltz and Trian have significant

expertise and successful track records of working with management teams and boards to turn around companies with strong

underlying fundamentals that have drifted off course. Mr. Peltz, as a director with meaningful ownership of Disney’s stock,

will also bring an ownership mentality to the boardroom and will seek to increase transparency and accountability.

At companies in which Trian has invested where Mr. Peltz has served on the

board of directors, company TSR growth during Mr. Peltz’s board tenure has, on average, outpaced the S&P 500 by ~900

basis points annually[iv].

Upon attaining Board representation, Trian will look to work collaboratively

with Disney’s leadership to:

FIX Corporate Governance

| · | Develop an effective succession plan |

| · | Align compensation with performance |

FIX Strategy & Operations

| · | Improve DTC operating margins |

| · | Eliminate redundant and/or excessive costs |

| · | Refocus the creative engine to drive profitable growth |

FIX Capital Allocation

| · | Enhance accountability on capital allocation |

| · | Reinstate the dividend by FY 2025 |

What Trian is Pushing

FOR and is NOT Pushing For

Trian’s objective is to create sustainable,

long-term value at Disney by working WITH Bob Iger and the Disney Board. We recognize that Disney is undergoing a period of significant

change and we are NOT trying to create additional instability.

TRIAN IS:

| NOT looking to replace Bob Iger |

FOR ensuring a successful CEO succession within 2 years |

| NOT advocating for a break-up of Disney |

FOR reinvigorating the Disney “flywheel” |

| NOT advocating to increase financial leverage |

FOR orderly deleveraging |

| NOT seeking to cut costs that impact product quality or customer experience |

FOR driving efficiencies and additional profits |

| NOT advocating for aggressive price increases at the expense of customer experience |

FOR ensuring customers get real value across all business lines |

| NOT advocating for a permanent dividend cut |

FOR reinstating the dividend by FY 2025 |

Trian’s preference was to avoid a proxy contest.

To that end, Trian has tried to effect a resolution through constructive

dialogues with members of the Disney Board and management team over the past several months. Trian is disappointed that, to date, the

Company has rejected Trian’s request to expand the Disney Board by one director who can provide fresh perspectives and represent

shareholders’ interests – an action we strongly believe would lead to positive change with no discernible downside.

Nelson Peltz’s Background and Experience

Nelson Peltz is Chief Executive Officer and a Founding Partner of Trian. Mr. Peltz, along with Ed Garden and Peter May, founded

Trian in November 2005.

Mr. Peltz serves as the non-executive Chairman of The Wendy’s Company.

Mr. Peltz is also a director of Unilever PLC and Madison Square Garden Sports Corp. (f/k/a The Madison Square Garden Company). He previously

served as a director of Janus Henderson Group plc from February 2022 to November 2022, Invesco Ltd. from October 2020 to February 2022,

The Procter & Gamble Company from March 2018 to October 2021, Sysco Corporation from August 2015 to August 2021, Legg Mason, Inc.

from October 2009 to December 2014 and May 2019 to July 2020, Mondelēz International, Inc. from January 2014 to March 2018, MSG Networks

Inc. from December 2014 to September 2015, Ingersoll-Rand plc from August 2012 to June 2014, and H. J. Heinz Company from September

2006 to June 2013. Mr. Peltz was recognized by The National Association of Corporate Directors in 2010, 2011 and 2012 as among the

most influential people in the global corporate governance arena.

From April 1993 through June 2007, Mr. Peltz served as Chairman and

Chief Executive Officer of Triarc Companies, Inc. which during that period of time owned Arby’s Restaurant Group, Inc. and the Snapple

Beverage Group, as well as other consumer and industrial businesses. From 1983 until December 1988, Mr. Peltz was Chairman and Chief Executive

Officer and a director of Triangle Industries, Inc., the largest packaging company in the world and a Fortune 100 industrial company,

after which that company was acquired by Pechiney, S.A., a leading international metals and packaging company.

A native of Brooklyn, New York, Mr. Peltz attended The Wharton School of

the University of Pennsylvania.

More information about Trian and its thesis for constructive change at Disney

can be found at: RestoreTheMagic.com

About Trian Fund Management, L.P.

Founded in 2005, Trian Fund Management, L.P. (“Trian”) is a

multi-billion dollar investment management firm. Trian is a highly engaged shareowner that combines concentrated public equity ownership

with operational expertise. Leveraging the 40+ years’ operating experience of our Founding Partners, Nelson Peltz, Ed Garden and

Peter May, Trian seeks to invest in high quality but undervalued and underperforming public companies and to work collaboratively with

management teams and boards to help companies execute operational and strategic initiatives designed to drive long-term sustainable earnings

growth for the benefit of all stakeholders.

Media Contacts:

Anne A. Tarbell

(212) 451-3030

atarbell@trianpartners.com

Paul Caminiti / Pamela Greene / Jacqueline Zuhse

Reevemark

(212) 433-4600

Trian@reevemark.com

Investor Contacts:

Matthew Peltz

(212) 451-3060

mpeltz@trianpartners.com

Ryan Bunch

(212) 451-3176

rbunch@trianpartners.com

Bruce Goldfarb / Pat McHugh

Okapi Partners LLC

(212) 297-0720

(877) 629-6357

info@okapipartners.com

[i]

Based on the closing price of Disney’s common stock on 1/10/23.

[ii] Source: FactSet as of 1/10/23. References to the S&P

500 throughout this press release refer to the S&P 500 Total Return Index, which includes the price changes of all underlying stocks

and all dividends reinvested.

[iii] Source: Market capitalization as of 1/10/23 from FactSet.

$162bn represents cumulative M&A (net of divestitures), Capital Expenditures,

and content spend from FY 2019 – FY 2022.

[iv] Source: FactSet as of 12/31/22. Note: Companies where Nelson

Peltz has served on the board of directors and in which Trian has invested consist of The Wendy’s Company, H.J. Heinz Company, Sysco

Corporation, Legg Mason Inc. on two separate occasions (and treated as two separate investments for purposes of the analysis), Mondelēz

International, Inc., The Procter & Gamble Company, Ingersoll-Rand Inc., Invesco Ltd., Janus Henderson plc, and Unilever plc. Such

investments do not represent all of the investments purchased or sold for Trian’s clients and it should not be assumed that any

or all of these investments were or will be profitable. We highlight the S&P 500 Index here only as a widely recognized index, however,

for various reasons the performance of the index and that of Trian’s Investments may not be comparable. One cannot invest directly

in an index. While Trian believes that the total shareholder returns (“TSR”) at Trian’s investments where Nelson Peltz

served on the board of directors was attributable in part to the cumulative effects of the implementation of operational and strategic

initiatives during the period of Trian’s active involvement, there is no objective method to confirm what portion of such returns

were attributable to Trian’s efforts and what portion may have been attributable to other factors. This press release does not provide

the performance of Trian’s funds or the performance of individual fund investments. In order to perform this analysis, Trian (1)

calculated the annualized TSR (consisting of the change in stock price plus the effect of dividends received) at each of the companies

listed above during Nelson Peltz’s board tenure at each company (with Legg Mason Inc. treated as two separate investments for purposes

of this analysis), (2) compared each company’s TSR figure with the annualized TSR of the S&P 500 Index during the same time

period, and (3) calculated the simple average of annualized TSR over- or under-performance versus the S&P 500 Index at each company

(or each investment, in the case of Legg Mason Inc.). Based on the foregoing methodology, Trian calculated that companies in which Trian

has invested where Mr. Peltz has served on the board of directors have, on average, generated annualized TSR growth during Mr. Peltz’s

board tenure exceeding that of the S&P 500 Index by +872 bps as of 12/31/22. This analysis includes Unilever plc, where Mr. Peltz

has served as a director for less than one year.

Disclaimer

Except as otherwise set forth in this press release,

the views expressed in this press release reflect the opinions of Trian Fund Management, L.P. and its affiliates (“Trian”),

and are based on publicly available information with respect to the Company. Trian recognizes that there may be confidential information

in the possession of the Company that could lead it or others to disagree with Trian’s conclusions. Trian reserves the right to

change any of its opinions expressed herein at any time as it deems appropriate and disclaims any obligation to notify the market or any

other party of any such change, except as required by law. Trian disclaims any obligation to update the information or opinions contained

in this press release. For the avoidance of doubt, this press release is not affiliated with or endorsed by Disney.

This press release is provided merely as information and is not intended

to be, nor should it be construed as, an offer to sell or a solicitation of an offer to buy any security nor as a recommendation to purchase

or sell any security. Funds managed by Trian currently beneficially own shares of the Company. These funds are in the business of trading

– buying and selling– securities and intend to continue trading in the securities of the Company. You should assume such funds

may from time to time sell all or a portion of their holdings of the Company in open market transactions or otherwise, buy additional

shares (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls, swaps or other derivative

instruments relating to such shares.

Some of the materials in this press release contain

forward-looking statements. All statements contained herein that are not clearly historical in nature or that necessary depend on future

events are forward-looking, and the words “anticipate,” “believe,” “expect,” “potential,”

“could,” “opportunity,” “estimate,” “plan,” and similar expressions are generally intended

to identify forward-looking statements. The projected results and statements contained herein release that are not historical facts are

based on current expectations, speak only as of the date of these materials and involve risks, uncertainties and other factors that may

cause actual results, performances or achievements to be materially different from any future results, performances or achievements expressed

or implied by such projected results and statements. Assumptions relating to the foregoing involve judgments with respect to, among other

things, future economic competitive and market conditions and future business decisions, all of which are difficult or impossible to predict

accurately and many of which are beyond the control of Trian.

The estimates, projections and potential impact of

the opportunities identified by Trian herein are based on assumptions that Trian believes to be reasonable as of the date of this press

release, but there can be no assurance or guarantee (i) that any of the proposed actions set forth in this press release will be completed,

(ii) that the actual results or performance of the Company will not differ, and such differences may be material, or (iii) that any of

the assumptions provided in this press release are accurate.

Important Information

Trian, together with certain other affiliates who

are expected to be participants (the “Participants”) in solicitation of shareholders of the Company in connection

with its 2023 annual meeting of shareholders (the “2023 Annual Meeting”), intend to file a definitive proxy

statement and accompanying proxy card with the Securities and Exchange Commission (the “SEC”) in anticipation of

such solicitation. Shareholders are advised to read the definitive proxy statement and any other documents related to the 2023

Annual Meeting when they become available because they will contain important information.

Information about the Participants and a description of their direct or

indirect interests by security holdings will be contained in the preliminary proxy statement

to be filed by the Participants with the SEC on January 12, 2023. This document is available free of charge on the SEC website. The definitive

proxy statement, when filed, and other relevant documents, will also be available on www.RestoreTheMagic.com and the SEC website, free

of charge, and by directing a request to Trian Partners’ proxy solicitor, Okapi Partners LLC, 1212 Avenue of the Americas, 17th

Floor New York, New York 10036 (Shareholders can call toll-free: +1 (877) 629-6357).

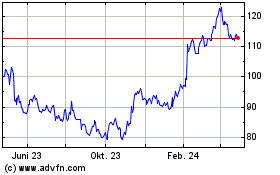

Appendix A: Disney’s 10-Year Share Price Performance

Appendix B: Disney’s Total Shareholder Return (“TSR”)

Consistently Underperforms

Appendix C: Change in Financial Performance Since 2018

Walt Disney (NYSE:DIS)

Historical Stock Chart

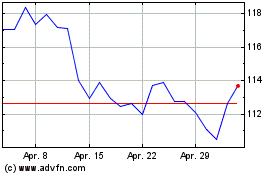

Von Mär 2024 bis Apr 2024

Walt Disney (NYSE:DIS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024