Current Report Filing (8-k)

22 September 2022 - 12:33PM

Edgar (US Regulatory)

0001915657false00019156572022-09-202022-09-22

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 22, 2022 (September 20, 2022)

___________________

HF SINCLAIR CORPORATION

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 001-41325 | 87-2092143 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| 2828 N. Harwood St., Suite 1300 | Dallas | TX | 75201 |

| (Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (214) 871-3555

Not applicable

(Former name or former address, if changed since last report)

| | | | | | | | |

| Securities registered pursuant to 12(b) of the Securities Exchange Act of 1934: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock $0.01 par value | DINO | NYSE |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 1.01 | Entry into a Material Definitive Agreement. |

On September 20, 2022, HF Sinclair Corporation (the “Company”) entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with REH Company (formerly known as The Sinclair Companies) (the “Selling Stockholder” or “REH Company”), pursuant to which the Company agreed to repurchase from the Selling Stockholder 2,453,385 shares of the Company’s outstanding common stock, par value $0.01 per share (the “Common Stock”) in a privately negotiated transaction. The price per share to be paid by the Company under the Stock Purchase Agreement is $50.95 per share resulting in an aggregate purchase price of $124,999,966. The purchase price will be funded with cash on hand. The Stock Purchase Agreement contains customary representations, warranties and covenants of the parties. The shares to be repurchased under the Stock Purchase Agreement will be held as treasury stock by the Company. This share repurchase is the fourth privately negotiated transaction between the Company and the Selling Stockholder.

The share repurchase described above will be made pursuant to the Company’s existing $1 billion share repurchase program and is expected to be completed on or around September 23, 2022. To date, the Company has repurchased $974,853,458 in common stock under the Company’s existing repurchase program, which is inclusive of the share repurchase described above. The timing and amount of future share repurchases under the Company’s existing repurchase program, including any additional repurchases from REH Company, will depend on market conditions and corporate, tax, regulatory and other relevant considerations. The existing repurchase program may be discontinued at any time by the Board of Directors of the Company.

The foregoing description of the Stock Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Stock Purchase Agreement, a copy of which is filed herewith as Exhibit 10.1 and is incorporated by reference herein. For more information on the Selling Stockholder’s relationship to the Company, please refer to the Company’s Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on April 25, 2022.

On September 21, 2022, the Board of Directors of the Company authorized a new $1 billion share repurchase program (the “New Share Repurchase Program”), effective September 26, 2022, which, effective September 26, 2022, replaces all existing share repurchase authorizations, of which there was approximately $25 million remaining. Share repurchases may be made in the open market or through privately negotiated transactions from time to time or by other means in accordance with federal securities laws. Privately negotiated repurchases from REH Company are also authorized under the New Share Repurchase Program, subject to REH Company’s interest and other limitations. The timing and amount of share repurchases under the New Share Repurchase Program, including any repurchases from REH Company, will depend on market conditions and corporate, tax, regulatory and other relevant considerations. The New Share Repurchase Program may be discontinued at any time by the Board of Directors of the Company.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL).

Cautionary Statement Regarding Forward-Looking Statements

The following is a “safe harbor” statement under the Private Securities Litigation Reform Act of 1995: The statements in this Current Report on Form 8-K relating to matters that are not historical facts are “forward-looking statements” based on management’s beliefs and assumptions using currently available information and expectations as of the date hereof, are not guarantees of future performance and involve certain risks and uncertainties, including those contained in our filings with the Securities and Exchange Commission. Forward-looking statements use words such as “anticipate,” “project,” “will,” “expect,” “plan,” “goal,” “forecast,” “strategy,” “intend,” “should,” “would,” “could,” “believe,” “may,” and similar expressions and statements regarding our plans and objectives for future operations. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that our expectations will prove correct. Therefore, actual outcomes and results could materially differ from what is expressed, implied or forecast in such statements. Any differences could be caused by a number of factors, including, but not limited to, the Company’s ability to complete the transactions contemplated under the Stock Purchase Agreement on the expected timing; and other financial, operational and legal risks and uncertainties detailed from time to time in the Company’s SEC filings. The forward-looking statements speak only as of the date made and, other than as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

HF SINCLAIR CORPORATION

By: /s/ Vaishali S. Bhatia

Name: Vaishali S. Bhatia

Title: Senior Vice President, General Counsel and Secretary

Date: September 22, 2022

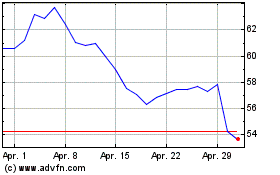

HF Sinclair (NYSE:DINO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

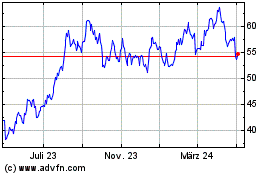

HF Sinclair (NYSE:DINO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024