5/5/20220000945764false00009457642022-05-052022-05-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 5, 2022

DENBURY INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-12935 | | 20-0467835 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 5851 Legacy Circle | | | | | | | |

| Plano, | Texas | | | | 75024 | | | (972) | 673-2000 |

| (Address of principal executive offices) | | | (Zip code) | | | (Registrant’s telephone number, including area code) |

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $.001 per share | | DEN | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 – Results of Operations and Financial Condition

On May 5, 2022, Denbury Inc. issued a press release announcing its 2022 first quarter financial and operating results. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished in this Item 2.02, in Item 7.01 below, and in Exhibits 99.1 and 99.2 hereto shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and shall not be deemed incorporated by reference in any filing with the Securities and Exchange Commission (unless otherwise specifically provided therein), whether or not filed under the Securities Act of 1933, as amended, or the 1934 Act, regardless of any general incorporation language in any such document.

Item 7.01 – Regulation FD Disclosure

On May 5, 2022, Denbury Inc. issued a press release announcing that its Board of Directors had authorized a common stock repurchase program, the details of which are set forth in Item 8.01 below.

Item 8.01 – Other Events

On May 5, 2022 the Board of Directors authorized a share repurchase program under which the Company may purchase up to $250 million of the Company’s outstanding common stock.

Subject to applicable rules and regulations, the Company may repurchase its common stock from time to time in open market transactions, through privately negotiated transactions, or by other means. The Company is not obligated to repurchase any specific dollar amount or specific number of shares of its common stock under the repurchase program. Such purchases will be at times and in amounts as the Company deems appropriate, based on factors such as assessment of the capital needs of the Company, the market price of its common stock, general market conditions, and other business considerations. This repurchase program has no prescribed term and may be suspended or discontinued at any time.

See the Company’s press release issued on May 5, 2022 attached as Exhibit 99.2.

Item 9.01 – Financial Statements and Exhibits

(d)Exhibits.

The following exhibit is furnished in accordance with the provisions of Item 601 of Regulation S-K:

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1* | | |

| 99.2* | |

|

| 104 | | The cover page has been formatted in Inline XBRL.

|

* Included herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Denbury Inc. (Registrant) |

| Date: May 5, 2022 | By: | /s/ James S. Matthews |

| | | James S. Matthews |

| | | Executive Vice President, Chief Administrative Officer,

General Counsel and Secretary |

Denbury Reports First Quarter 2022 Results

Generates Cash Flow Well Above Plan; Authorizes Share Repurchase Program

Carbon Solutions Agreements Solidify CCUS Leadership Position

PLANO, Texas – May 5, 2022 – Denbury Inc. (NYSE: DEN) (“Denbury” or the “Company”) today provided its first quarter 2022 financial and operating results.

FIRST QUARTER AND RECENT HIGHLIGHTS

•First quarter 2022 cash flows provided by operating activities totaled $90 million. Adjusted cash flows from operations(1) of nearly $131 million represent a 62% increase from the first quarter of 2021.

•Generated $51 million in free cash flow(1) during the first quarter of 2022.

•Commenced carbon dioxide (“CO2”) injection at the Cedar Creek Anticline (“CCA”) enhanced oil recovery (“EOR”) project, with 55 wells currently injecting more than 115 million cubic feet per day of industrial-sourced CO2.

•Signed a new term sheet for transportation and dedicated storage of approximately 2 million metric tons per year (“mmtpa”) of CO2 captured from a chemicals facility to be constructed in southeast Louisiana. The facility is anticipated to be built in close proximity to Denbury’s CO2 infrastructure and the arrangement covers a 12-year period.

•Amended the Company’s senior secured bank credit facility, increasing the borrowing base and lender commitments to $750 million, extending the maturity to 2027, and relaxing various covenants.

•Authorized a $250 million share repurchase program.

EXECUTIVE COMMENT

Chris Kendall, the Company’s President and CEO, commented, “Denbury made strong progress on our key 2022 objectives during the first quarter, with CO2 injection ahead of plan at the Cedar Creek Anticline EOR project and continued advancements in support of our CCUS business. The CCA EOR development, which will produce carbon-negative blue oil through 100% utilization of industrial-sourced CO2, provides the Company with a deep inventory of resource development opportunities and decades of significant cash flow.”

(1) A non-GAAP measure. See accompanying schedules that reconcile GAAP to non-GAAP measures along with a statement indicating why the Company believes the non-GAAP measures provide useful information for investors.

(2) Calculated using weighted average diluted shares outstanding of 55.0 million and 51.2 million for the three months ended March 31, 2022 and 2021, respectively.

1

“I am extremely excited about our successes in the Carbon Solutions business so far this year, and I believe we are on track to substantially exceed our goals for CO2 offtake and storage agreements established at the beginning of the year. Denbury’s proven track record in providing highly reliable transportation and secure underground injection of CO2 emissions from our industrial partners, combined with our ideally positioned infrastructure, is unmatched in the industry and positions us well for continued success and growth in CCUS.”

“I am also pleased that Denbury’s Board of Directors has authorized a $250 million share repurchase program. At current oil price levels, we believe that our cash flow generation will be more than sufficient to meet our anticipated capital needs, providing the opportunity to return meaningful capital to shareholders in this manner.”

FIRST QUARTER FINANCIAL AND OPERATIONAL RESULTS

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | 1Q 2022 | | | | | | | | | |

| (in thousands, except per-share and volume data) | | Total | | Per Diluted Share | | | | | | | | | | | |

| Net loss | | $(872) | | $(0.02) | | | | | | | | | | | |

Adjusted net income(1)(2) (non-GAAP) | | 93,122 | | 1.69 | | | | | | | | | | | |

Adjusted EBITDAX(1) (non-GAAP) | | 130,847 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Cash flows from operations | | 90,143 | | | | | | | | | | | | | |

Adjusted cash flows from operations(1) (non-GAAP) | | 130,580 | | | | | | | | | | | | | |

| Development capital expenditures - Oil & Gas | | 57,606 | | | | | | | | | | | | | |

| Capital expenditures - CCUS storage sites and related assets | | 20,949 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Average daily sales volumes (BOE/d) | | 46,925 | | | | | | | | | | | | | |

Blue Oil (% oil volumes using industrial-sourced CO2) | | 25% | | | | | | | | | | | | | |

Industrial-sourced CO2 injected (thousand metric tons) | | 936 | | | | | | | | | | | | | |

Total revenues and other income in the first quarter of 2022 were $412 million, a 64% increase over first quarter 2021 levels, supported predominantly by higher oil price realizations. Denbury’s first quarter 2022 average pre-hedge realized oil price was $93.17 per barrel (“Bbl”), which was $1.37 per Bbl below the daily average NYMEX WTI oil price for the period. The Company’s average oil price differential in both the Rocky Mountain and Gulf Coast regions has remained relatively consistent over the last several quarters, despite the significant increase in NYMEX oil prices.

Denbury’s oil and natural gas sales volumes averaged 46,925 barrels of oil equivalent per day (“BOE/d”) during the first quarter of 2022, generally in line with expectations. Oil represented 97% of

the Company’s first quarter 2022 volumes, and approximately 25% of the Company’s oil was attributable to the injection of industrial-sourced CO2 in its EOR operations, resulting in carbon-negative or blue oil. As compared to the fourth quarter of 2021, sales volumes were lower as a result of natural production declines due to lower levels of capital spending in prior years and severe winter weather impacts. In addition, the conversion of wells from water injection to CO2 injection as part of the CCA tertiary EOR project impacted first quarter 2022 volumes.

Lease operating expenses (“LOE”) in the first quarter of 2022 totaled $118 million, or $27.90 per BOE, within the Company’s annual guidance range. LOE per BOE increased slightly from the fourth quarter of 2021 as service costs and crude oil and natural gas prices have increased, which have raised power and fuel, CO2, and workover costs. The increase in LOE from the first quarter 2021 was more significant as first quarter 2021 LOE included a $15 million benefit resulting from a favorable adjustment for reduced power usage during winter storm Uri.

Transportation and marketing expenses totaled $5 million, and General and administrative expenses were $19 million in the first quarter of 2022, both in line with expectations. Depletion, depreciation, and amortization was $35 million, or $8.37 per BOE for the quarter.

Commodity derivatives expense totaled $193 million in the first quarter of the year, driven by the significant increase in the crude oil price outlook from the end of 2021 to March 31, 2022. Cash payments on hedges that settled in the first quarter of 2022 totaled $93 million.

The Company’s first quarter 2022 income tax benefit of $7 million is primarily related to the release of a valuation allowance on certain state tax benefits that the Company now expects to realize based on the outlook for higher commodity prices. As a result of the unique nature of the first quarter valuation allowance release, the Company has adjusted out of earnings the first quarter 2022 valuation allowance reversal in its net loss (GAAP) to adjusted net income (non-GAAP) reconciliation.

INVESTING ACTIVITIES

First quarter 2022 oil & gas development capital expenditures totaled $58 million. Approximately 35% of the first quarter total was incurred on the CCA EOR project, including field work to convert water wells to CO2 injection and pre-production tertiary injection costs. First tertiary production response at CCA is expected during the second half of 2023. Non-CCA oil & gas development capital during the first quarter included tertiary projects at the Beaver Creek and Soso fields, among others. During the first quarter, the Company also incurred $21 million in capital

expenditures related to its CCUS business, primarily consisting of lease acquisition costs and other storage-related expenditures.

FINANCIAL POSITION AND LIQUIDITY

Denbury’s total debt at the end of the first quarter 2022 was $35 million, consistent with year-end 2021. The Company had $529 million of financial liquidity (cash on hand and borrowing capacity under the Company’s credit facility) at the end of the period. Denbury’s leverage ratio is less than 0.1X.

On May 4, 2022, the Company amended its bank credit agreement, which among other things: (i) increased the borrowing base and lender commitments from $575 million to $750 million, (ii) extended the maturity date from January 30, 2024, to May 4, 2027, and (iii) relaxed certain covenants, such as permitting the Company to pay dividends on its common stock and make other unlimited restricted payments and investments so long as certain leverage and availability requirements are met. Financial liquidity, including the Company’s increased credit facility capacity, would have been $704 million at the end of the first quarter 2022.

As separately announced today, Denbury’s Board of Directors has authorized a share repurchase program under which the Company may repurchase up to $250 million of its outstanding shares of common stock (which represent more than 7% of Denbury’s current market capitalization). The timing and amount of any share repurchases will be determined by Denbury’s management at its discretion based on ongoing assessments of the capital needs of the business, the market price of Denbury’s common stock and general market conditions.

RECENT CCUS HIGHLIGHTS

Inclusive of the new term sheet announced today, Denbury has now executed various agreements or term sheets in 2022 for CO2 transportation, storage and/or utilization covering a total of approximately 5 mmtpa. Cumulative CO2 volumes under transportation, storage and utilization agreements now total approximately 7 mmtpa (2022 goal - cumulative 10 mmtpa). In addition, the Company has previously announced the acquisition of multiple potential CO2 sequestration sites along the U.S. Gulf Coast in Texas, Louisiana, and Alabama. Cumulative potential CO2 sequestration capacity is more than 1.4 billion metric tons (2022 goal - in excess of 1.2 billion metric tons). The Company has commenced the Class VI permitting process on all of its operated potential CO2 sequestration sites.

OUTLOOK

As a result of the increased outlook for commodity prices and recent inflationary pressures (in comparison to the Company’s originally-provided guidance at $70 per barrel WTI), Denbury anticipates full-year 2022 oil & gas capital expenditures, lease operating expense, and G&A to be in the upper half to upper end of their respective annual ranges for the year. The Company’s full-year 2022 production guidance range is unchanged.

For the second quarter, the Company anticipates sales volumes to be slightly lower than the first quarter of 2022 as a result of the timing of workover and development activities, with production volumes anticipated to grow through the second half of 2022. LOE per BOE is anticipated to increase in the second quarter primarily as a result of higher commodity prices and increased seasonal workover operations. Oil & gas development capital expenditures are anticipated to increase in the second quarter over the first quarter, driven by continued activity at CCA, including purchase of equipment for the EOR recycle facilities, as well as additional drilling and development activities across the Company’s Rocky Mountain and Gulf Coast regions.

The Company has determined that it expects to fully utilize all of its federal and certain of its state tax benefits and therefore a valuation allowance against these tax benefits is no longer necessary. Approximately $6 million of the valuation allowance was reversed in the first quarter of 2022 and the remaining portion of the valuation allowance reversal will occur over the remaining quarters in 2022, resulting in an estimated effective tax rate for the second through fourth quarters of approximately 15% based on the Company’s currently anticipated 2022 level of pre-tax income. Future increases or decreases in the Company’s anticipated income level will likely increase or decrease the Company’s effective tax rate for the year. In addition, with the anticipated higher levels of income, the Company now expects approximately 30% of its total taxes will be current, or cash taxes.

Further details on the Company’s 2022 guidance can be found in the supporting materials on Denbury’s website.

CONFERENCE CALL AND WEBCAST

Denbury management will host a conference call to review and discuss first quarter 2022 financial and operating results and its outlook for future periods, today, Thursday, May 5, at 11:00 a.m. Central Time (12:00 p.m. Eastern Time). Additionally, Denbury will post supporting materials on its website before market open today. The presentation webcast will be available, both live and for replay,

on the Investor Relations page of the Company’s website at www.denbury.com. Individuals who would like to participate in the conference call should dial the following numbers shortly before the scheduled start time: 844.200.6205 or 929.526.1599 with access code 328081.

ABOUT DENBURY

Denbury is an independent energy company with operations and assets focused on Carbon Capture, Use and Storage (CCUS) and Enhanced Oil Recovery (EOR) in the Gulf Coast and Rocky Mountain regions. For over two decades, the Company has maintained a unique strategic focus on utilizing CO2 in its EOR operations and since 2012 has also been active in CCUS through the injection of captured industrial-sourced CO2. The Company currently injects over four million tons of captured industrial-sourced CO2 annually, with an objective to fully offset its Scope 1, 2, and 3 CO2 emissions by 2030, primarily through increasing the amount of captured industrial-sourced CO2 used in its operations. For more information about Denbury, visit www.denbury.com.

# # #

This press release, other than historical information, contains forward-looking statements that involve risks and uncertainties including: expectations as to future oil prices, operating costs, production levels and cash flows; anticipated levels of 2022 capital expenditures, lease operating expenses and general and administrative expenses, along with other financial forecasts; future tax benefits and tax rates; the expected timing of first tertiary production at CCA; statements or predictions related to the ultimate economics of proposed carbon capture, use and storage arrangements and the CO2 volumes covered by such arrangements; and other risks and uncertainties detailed in the Company’s filings with the Securities and Exchange Commission, including Denbury’s most recent report on Form 10-K. These risks and uncertainties are incorporated by this reference as though fully set forth herein. These statements are based on oil pricing, financial and market, engineering, geological and operating assumptions that management believes are reasonable based on currently available information; however, management’s assumptions and the Company’s future performance are both subject to a wide range of risks, and there is no assurance that these goals and projections can or will be met. Actual results may vary materially, especially in light of the Russian war against Ukraine and rising levels of economic uncertainty due to inflation and the continuing impact of COVID-19. In addition, any forward-looking statements represent the Company’s estimates only as of today and should not be relied upon as representing its estimates as of any future date. Denbury assumes no obligation to update its forward-looking statements.

DENBURY IR CONTACTS:

Brad Whitmarsh, 972.673.2020, brad.whitmarsh@denbury.com

Beth Bierhaus, 972.673.2554, beth.bierhaus@denbury.com

FINANCIAL AND STATISTICAL DATA TABLES AND RECONCILIATION SCHEDULES

The following tables include selected unaudited financial and operational information for the comparative three-month periods ended March 31, 2022 and 2021. All sales volumes and dollars are expressed on a net revenue interest basis with gas volumes converted to equivalent barrels at 6:1.

DENBURY INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

The following information is based on GAAP reporting earnings (along with additional required disclosures) included or to be included in the Company’s periodic reports:

| | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | | | |

| | March 31, | | | | |

| In thousands, except per-share data | | 2022 | | 2021 | | | | |

| Revenues and other income | | | | | | | | |

| Oil sales | | $ | 381,242 | | | $ | 233,044 | | | | | |

| Natural gas sales | | 3,669 | | | 2,401 | | | | | |

CO2 sales and transportation fees | | 13,422 | | | 9,228 | | | | | |

| Oil marketing revenues | | 13,276 | | | 6,126 | | | | | |

| Other income | | 250 | | | 360 | | | | | |

| Total revenues and other income | | 411,859 | | | 251,159 | | | | | |

| Expenses | | | | | | | | |

| Lease operating expenses | | 117,828 | | | 81,970 | | | | | |

| Transportation and marketing expenses | | 4,645 | | | 7,797 | | | | | |

CO2 operating and discovery expenses | | 2,817 | | | 993 | | | | | |

| Taxes other than income | | 31,381 | | | 18,963 | | | | | |

| Oil marketing purchases | | 13,040 | | | 6,085 | | | | | |

| General and administrative expenses | | 18,692 | | | 31,983 | | | | | |

| Interest, net of amounts capitalized of $1,158 and $1,083, respectively | | 657 | | | 1,536 | | | | | |

| Depletion, depreciation, and amortization | | 35,345 | | | 39,450 | | | | | |

| Commodity derivatives expense | | 192,719 | | | 115,743 | | | | | |

| | | | | | | | |

| Write-down of oil and natural gas properties | | — | | | 14,377 | | | | | |

| Other expenses | | 2,112 | | | 2,146 | | | | | |

| Total expenses | | 419,236 | | | 321,043 | | | | | |

| Loss before income taxes | | (7,377) | | | (69,884) | | | | | |

| Income tax benefit | | | | | | | | |

| Current income taxes | | (561) | | | (191) | | | | | |

| Deferred income taxes | | (5,944) | | | (51) | | | | | |

| Net loss | | $ | (872) | | | $ | (69,642) | | | | | |

| | | | | | | | |

| Net loss per common share | | | | | | | | |

| Basic | | $ | (0.02) | | | $ | (1.38) | | | | | |

| Diluted | | $ | (0.02) | | | $ | (1.38) | | | | | |

| | | | | | | | |

| Weighted average common shares outstanding | | | | | | | | |

| Basic | | 51,602 | | | 50,319 | | | | | |

| Diluted | | 51,602 | | | 50,319 | | | | | |

DENBURY INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | | | |

| | March 31, | | | | |

| In thousands | | 2022 | | 2021 | | | | |

| Cash flows from operating activities | | | | | | | | |

| Net loss | | $ | (872) | | | $ | (69,642) | | | | | |

| Adjustments to reconcile net loss to cash flows from operating activities | | | | | | | | |

| Depletion, depreciation, and amortization | | 35,345 | | | 39,450 | | | | | |

| Write-down of oil and natural gas properties | | — | | | 14,377 | | | | | |

| Deferred income taxes | | (5,944) | | | (51) | | | | | |

| Stock-based compensation | | 2,971 | | | 17,680 | | | | | |

| Commodity derivatives expense | | 192,719 | | | 115,743 | | | | | |

| Payment on settlements of commodity derivatives | | (93,057) | | | (38,453) | | | | | |

| | | | | | | | |

| Debt issuance costs | | 685 | | | 685 | | | | | |

| Other, net | | (1,267) | | | 727 | | | | | |

| Changes in assets and liabilities, net of effects from acquisitions | | | | | | | | |

| Accrued production receivable | | (72,795) | | | (36,750) | | | | | |

| Trade and other receivables | | 1,644 | | | 865 | | | | | |

| Other current and long-term assets | | 189 | | | (2,542) | | | | | |

| Accounts payable and accrued liabilities | | 11,410 | | | (1,402) | | | | | |

| Oil and natural gas production payable | | 23,348 | | | 12,795 | | | | | |

| Other liabilities | | (4,233) | | | (826) | | | | | |

| Net cash provided by operating activities | | 90,143 | | | 52,656 | | | | | |

| | | | | | | | |

| Cash flows from investing activities | | | | | | | | |

| Oil and natural gas capital expenditures | | (58,707) | | | (19,627) | | | | | |

| CCUS storage sites and related capital expenditures | | (14,900) | | | — | | | | | |

| Acquisitions of oil and natural gas properties | | — | | | (10,665) | | | | | |

| Pipelines and plants capital expenditures | | (15,204) | | | (458) | | | | | |

| Other | | (1,396) | | | (2,913) | | | | | |

| Net cash used in investing activities | | (90,207) | | | (33,663) | | | | | |

| | | | | | | | |

| Cash flows from financing activities | | | | | | | | |

| Bank repayments | | (274,000) | | | (202,000) | | | | | |

| Bank borrowings | | 274,000 | | | 207,000 | | | | | |

| | | | | | | | |

| Pipeline financing repayments | | — | | | (16,509) | | | | | |

| Other | | (3,068) | | | (3,013) | | | | | |

| Net cash used in financing activities | | (3,068) | | | (14,522) | | | | | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | | (3,132) | | | 4,471 | | | | | |

| Cash, cash equivalents, and restricted cash at beginning of period | | 50,344 | | | 42,248 | | | | | |

| Cash, cash equivalents, and restricted cash at end of period | | $ | 47,212 | | | $ | 46,719 | | | | | |

DENBURY INC.

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

| | | | | | | | | | | | | | |

| | |

| In thousands, except par value and share data | | March 31, 2022 | | Dec. 31, 2021 |

| Assets | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 517 | | | $ | 3,671 | |

| Accrued production receivable | | 216,161 | | | 143,365 | |

| Trade and other receivables, net | | 17,571 | | | 19,270 | |

| Prepaids | | 10,175 | | | 9,099 | |

| Total current assets | | 244,424 | | | 175,405 | |

| Property and equipment | | | | |

| Oil and natural gas properties (using full cost accounting) | | | | |

| Proved properties | | 1,149,762 | | | 1,109,011 | |

| Unevaluated properties | | 131,677 | | | 112,169 | |

CO2 properties | | 184,043 | | | 183,369 | |

| Pipelines | | 226,766 | | | 224,394 | |

| CCUS storage sites and related assets | | 20,949 | | | — | |

| Other property and equipment | | 94,993 | | | 93,950 | |

| Less accumulated depletion, depreciation, amortization and impairment | | (210,537) | | | (181,393) | |

| Net property and equipment | | 1,597,653 | | | 1,541,500 | |

| Operating lease right-of-use assets | | 18,595 | | | 19,502 | |

| Derivative assets | | 265 | | | — | |

| Deferred tax assets, net | | 4,306 | | | — | |

| Intangible assets, net | | 85,966 | | | 88,248 | |

| Cash restricted for future asset retirement obligations | | 46,695 | | | 46,673 | |

| Other assets | | 33,445 | | | 31,625 | |

| Total assets | | $ | 2,031,349 | | | $ | 1,902,953 | |

| Liabilities and Stockholders’ Equity | | | | |

| Current liabilities | | | | |

| Accounts payable and accrued liabilities | | $ | 201,598 | | | $ | 191,598 | |

| Oil and gas production payable | | 99,247 | | | 75,899 | |

| Derivative liabilities | | 223,598 | | | 134,509 | |

| Operating lease liabilities | | 4,683 | | | 4,677 | |

| Total current liabilities | | 529,126 | | | 406,683 | |

| Long-term liabilities | | | | |

| Long-term debt, net of current portion | | 35,000 | | | 35,000 | |

| Asset retirement obligations | | 282,792 | | | 284,238 | |

| Derivative liabilities | | 10,837 | | | — | |

| Deferred tax liabilities, net | | — | | | 1,638 | |

| Operating lease liabilities | | 16,095 | | | 17,094 | |

| Other liabilities | | 19,850 | | | 22,910 | |

| Total long-term liabilities | | 364,574 | | | 360,880 | |

| Commitments and contingencies | | | | |

| Stockholders’ equity | | | | |

| Preferred stock, $.001 par value, 50,000,000 shares authorized, none issued and outstanding | | — | | | — | |

| Common stock, $.001 par value, 250,000,000 shares authorized; 50,349,390 and 50,193,656 shares issued, respectively | | 50 | | | 50 | |

| Paid-in capital in excess of par | | 1,133,127 | | | 1,129,996 | |

| Retained earnings | | 4,472 | | | 5,344 | |

Total stockholders’ equity | | 1,137,649 | | | 1,135,390 | |

| Total liabilities and stockholders’ equity | | $ | 2,031,349 | | | $ | 1,902,953 | |

DENBURY INC.

OPERATING HIGHLIGHTS (UNAUDITED)

All sales volumes and dollars are expressed on a net revenue interest basis with gas volumes converted to equivalent barrels at 6:1.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | | | | | |

| | March 31, | | | | | | | | |

| | 2022 | | 2021 | | | | | | | | | | | | |

| Average daily sales (BOE/d) | | | | | | | | | | | | | | | | |

| Tertiary | | | | | | | | | | | | | | | | |

| Gulf Coast region | | 23,016 | | | 24,281 | | | | | | | | | | | | | |

| Rocky Mountain region | | 9,220 | | | 7,187 | | | | | | | | | | | | | |

| Total tertiary sales | | 32,236 | | | 31,468 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Non-tertiary | | | | | | | | | | | | | | | | |

| Gulf Coast region | | 3,630 | | | 3,621 | | | | | | | | | | | | | |

| Rocky Mountain region | | 11,059 | | | 12,268 | | | | | | | | | | | | | |

| Total non-tertiary sales | | 14,689 | | | 15,889 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Total Company | | | | | | | | | | | | | | | | |

| Oil (Bbls/d) | | 45,466 | | | 46,007 | | | | | | | | | | | | | |

| Natural gas (Mcf/d) | | 8,753 | | | 8,102 | | | | | | | | | | | | | |

| BOE/d (6:1) | | 46,925 | | | 47,357 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Unit sales price (excluding derivative settlements) | | | | | | | | | | | | | | | | |

| Gulf Coast region | | | | | | | | | | | | | | | | |

| Oil (per Bbl) | | $ | 93.17 | | | $ | 56.46 | | | | | | | | | | | | | |

| Natural gas (per mcf) | | 4.71 | | | 3.39 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Rocky Mountain region | | | | | | | | | | | | | | | | |

| Oil (per Bbl) | | $ | 93.16 | | | $ | 56.03 | | | | | | | | | | | | | |

| Natural gas (per mcf) | | 4.62 | | | 3.20 | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Total Company | | | | | | | | | | | | | | | | |

Oil (per Bbl)(1) | | $ | 93.17 | | | $ | 56.28 | | | | | | | | | | | | | |

| Natural gas (per mcf) | | 4.66 | | | 3.29 | | | | | | | | | | | | | |

| BOE (6:1) | | 91.14 | | | 55.24 | | | | | | | | | | | | | |

(1)Total company realized oil prices including derivative settlements were $70.43 per Bbl and $47.00 per Bbl during the three months ended March 31, 2022 and 2021, respectively.

DENBURY INC.

SUPPLEMENTAL NON-GAAP FINANCIAL MEASURES (UNAUDITED)

Reconciliation of net loss (GAAP measure) to adjusted net income (non-GAAP measure)

Adjusted net income is a non-GAAP measure provided as a supplement to present an alternative net income (loss) measure which excludes expense and income items (and their related tax effects) not directly related to the Company’s ongoing operations. Management believes that adjusted net income may be helpful to investors by eliminating the impact of noncash and/or special items not indicative of the Company’s performance from period to period, and is widely used by the investment community, while also being used by management, in evaluating the comparability of the Company’s ongoing operational results and trends. Adjusted net income should not be considered in isolation, as a substitute for, or more meaningful than, net income (loss) or any other measure reported in accordance with GAAP, but rather to provide additional information useful in evaluating the Company’s operational trends and performance.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | Quarter Ended |

| | March 31, 2022 | | March 31, 2021 |

| In thousands, except per-share data | | Amount | | Per Diluted Share | | Amount | | Per Diluted Share |

Net loss (GAAP measure)(1) | | $ | (872) | | | $ | (0.02) | | | $ | (69,642) | | | $ | (1.38) | |

| Adjustments to reconcile to adjusted net income (non-GAAP measure) | | | | | | | | |

Noncash fair value losses on commodity derivatives(2) | | 99,662 | | | 1.81 | | | 77,290 | | | 1.51 | |

Write-down of oil and natural gas properties(3) | | — | | | — | | | 14,377 | | | 0.28 | |

| | | | | | | | |

| | | | | | | | |

Noncash fair value adjustment - contingent consideration(4) | | 185 | | | 0.01 | | | — | | | — | |

Other(5) | | — | | | — | | | 325 | | | 0.03 | |

| | | | | | | | |

Income taxes - valuation allowance reversal(6) | | (5,853) | | | (0.11) | | | — | | | — | |

| Adjusted net income (non-GAAP measure) | | $ | 93,122 | | | $ | 1.69 | | | $ | 22,350 | | | $ | 0.44 | |

(1)Diluted net income (loss) per common share includes the impact of potentially dilutive securities including nonvested restricted stock, restricted stock units, performance stock units and warrants.

(2)The net change between periods of the fair market values of open commodity derivative positions, excluding the impact of settlements on commodity derivatives during the period.

(3)Full cost pool ceiling test write-downs related to the Company’s oil and natural gas properties.

(4)Expense related to the change in fair value of the contingent consideration payments related to our March 2021 Wind River Basin CO2 EOR field acquisition.

(5)Other adjustments primarily include <$1 million write-off of trade receivables during the three months ended March 31, 2021.

(6)The income tax adjustment removes the impact of the valuation allowance reversed during the three months ended March 31, 2022. During the three months ended March 31, 2022, largely due to the significant increase in worldwide oil prices, the Company determined that it was no longer appropriate to carry a valuation allowance against certain of its federal and state deferred tax assets, as we now consider it more likely than not that we will realize those deferred tax assets. Accordingly, during the three months ended March 31, 2022, we reversed $5.9 million of the valuation allowance, which lowered our deferred tax expense. In addition, we expect to reverse an additional $59.0 million of valuation allowance during the second through fourth quarters of 2022.

DENBURY INC.

SUPPLEMENTAL NON-GAAP FINANCIAL MEASURES (UNAUDITED)

Reconciliation of net loss (GAAP measure) to Adjusted EBITDAX (non-GAAP measure)

Adjusted EBITDAX is a non-GAAP measure which management uses and excludes certain items that are included in net loss, the most directly comparable GAAP financial measure. Items excluded include interest, income taxes, depletion, depreciation, and amortization, and items that the Company believes affect the comparability of operating results such as items whose timing and/or amount cannot be reasonably estimated or are nonrecurring. Management believes Adjusted EBITDAX may be helpful to investors in order to assess the Company’s operating performance as compared to that of other companies in the industry, without regard to financing methods, capital structure or historical costs basis. It is also commonly used by third parties to assess leverage and the Company’s ability to incur and service debt and fund capital expenditures. Adjusted EBITDAX should not be considered in isolation, as a substitute for, or more meaningful than, net loss, cash flow from operations, or any other measure reported in accordance with GAAP. The Company’s Adjusted EBITDAX may not be comparable to similarly titled measures of another company because all companies may not calculate Adjusted EBITDAX, EBITDAX or EBITDA in the same manner. The following table presents a reconciliation of the Company’s net loss to Adjusted EBITDAX.

| | | | | | | | | | | | | | | | | | |

| In thousands | | Quarter Ended | | | | |

| March 31, | | | | |

| 2022 | | 2021 | | | | |

| Net loss (GAAP measure) | | $ | (872) | | | $ | (69,642) | | | | | |

| Adjustments to reconcile to Adjusted EBITDAX | | | | | | | | |

| Interest expense | | 657 | | | 1,536 | | | | | |

| Income tax expense (benefit) | | (6,505) | | | (242) | | | | | |

| Depletion, depreciation, and amortization | | 35,345 | | | 39,450 | | | | | |

| Noncash fair value losses on commodity derivatives | | 99,662 | | | 77,290 | | | | | |

| Stock-based compensation | | 2,971 | | | 17,680 | | | | | |

| Write-down of oil and natural gas properties | | — | | | 14,377 | | | | | |

| Noncash, non-recurring and other | | (411) | | | 1,467 | | | | | |

| Adjusted EBITDAX (non-GAAP measure) | | $ | 130,847 | | | $ | 81,916 | | | | | |

DENBURY INC.

SUPPLEMENTAL NON-GAAP FINANCIAL MEASURES (UNAUDITED)

Reconciliation of cash flows from operations (GAAP measure) to adjusted cash flows from operations (non-GAAP measure) and free cash flow (non-GAAP measure)

Adjusted cash flows from operations is a non-GAAP measure that represents cash flows provided by operations before changes in assets and liabilities, as summarized from the Company’s Unaudited Condensed Consolidated Statements of Cash Flows. Adjusted cash flows from operations measures the cash flows earned or incurred from operating activities without regard to the collection or payment of associated receivables or payables. Free cash flow is a non-GAAP measure that represents adjusted cash flows from operations less oil and gas development expenditures, CCUS asset capital and capitalized interest, but before acquisitions. Management believes that it is important to consider these additional measures, along with cash flows from operations, as it believes the non-GAAP measures can often be a better way to discuss changes in operating trends in its business caused by changes in sales volumes, prices, operating costs and related factors, without regard to whether the earned or incurred item was collected or paid during that period. Adjusted cash flows from operations and free cash flow are not measures of financial performance under GAAP and should not be considered as alternatives to cash flows from operations, investing, or financing activities, nor as a liquidity measure or indicator of cash flows.

| | | | | | | | | | | | | | | | | | |

| In thousands | | Quarter Ended | | | | |

| March 31, | | | | |

| 2022 | | 2021 | | | | |

| Cash flows from operations (GAAP measure) | | $ | 90,143 | | | $ | 52,656 | | | | | |

| Net change in assets and liabilities relating to operations | | 40,437 | | | 27,860 | | | | | |

Adjusted cash flows from operations (non-GAAP measure)(2) | | 130,580 | | | 80,516 | | | | | |

| | | | | | | | |

| Oil & gas development expenditures | | (57,606) | | | (20,079) | | | | | |

| CCUS storage sites and related capital expenditures | | (20,949) | | | — | | | | | |

| Capitalized interest | | (1,158) | | | (1,083) | | | | | |

| Free cash flow (non-GAAP measure) | | $ | 50,867 | | | $ | 59,354 | | | | | |

DENBURY INC.

CAPITAL EXPENDITURE SUMMARY (UNAUDITED)(1)

| | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | |

| | March 31, | | | | |

| In thousands | | 2022 | | 2021 | | | | | | |

| Capital expenditure summary | | | | | | | | | | |

CCA EOR field expenditures(2) | | $ | 17,722 | | | $ | 9 | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

CCA CO2 pipelines | | 2,191 | | | 48 | | | | | | | |

| CCA tertiary development | | 19,913 | | | 57 | | | | | | | |

| Non-CCA tertiary and non-tertiary fields | | 29,363 | | | 12,422 | | | | | | | |

CO2 sources and other CO2 pipelines | | 730 | | | — | | | | | | | |

| | | | | | | | | | |

Capitalized internal costs(3) | | 7,600 | | | 7,600 | | | | | | | |

| Oil & gas development capital expenditures | | 57,606 | | | 20,079 | | | | | | | |

| CCUS storage sites and related capital expenditures | | 20,949 | | | — | | | | | | | |

Acquisitions of oil and gas properties(4) | | 371 | | | 10,665 | | | | | | | |

| | | | | | | | | | |

| Capitalized interest | | 1,158 | | | 1,083 | | | | | | | |

| Total capital expenditures | | $ | 80,084 | | | $ | 31,827 | | | | | | | |

(1)Capital expenditure amounts incurred during the period, including accrued capital costs.

(2)Includes pre-production CO2 costs associated with the CCA EOR development project totaling $2.8 million during the first quarter of 2022.

(3)Includes capitalized internal acquisition, exploration and development costs and pre-production tertiary startup costs.

(4)Primarily consists of working interest positions in the Wind River Basin enhanced oil recovery fields acquired on March 3, 2021.

Denbury Announces $250MM Share Repurchase Authorization

PLANO, Texas – May 5, 2022 – Denbury Inc. (NYSE: DEN) (“Denbury” or the “Company”) today announced that its Board of Directors has authorized a share repurchase program under which the Company may repurchase up to $250 million of its outstanding shares of common stock, which represent more than 7% of Denbury’s current market capitalization.

“Denbury maintains a disciplined approach to capital allocation and is committed to deploying capital toward opportunities that drive the greatest value for our shareholders,” commented Mark Allen, EVP and Chief Financial Officer. “With our anticipated strong free cash flow generation and the significant value opportunity ahead of us with CCUS, we believe a share repurchase program is warranted. We expect to maintain our strong balance sheet and advance our EOR and CCUS strategic priorities while returning meaningful capital to shareholders through this share repurchase program.”

The timing and amount of any share repurchases under the share repurchase program will be determined by Denbury’s management at its discretion based on ongoing assessments of the capital needs of its business, the market price of Denbury’s common stock, general market conditions and applicable legal requirements. Share repurchases may be made through a variety of methods, which could include open market purchases, negotiated transactions, block trades, exchange transactions, other methods or any combination of such methods. The program does not obligate Denbury to acquire any particular dollar amount or number of shares of its common stock, and the share repurchase program may be suspended or discontinued at any time at the Company’s discretion. The share repurchase program has no prescribed term.

ABOUT DENBURY

Denbury is an independent energy company with operations and assets focused on Carbon Capture, Use and Storage (CCUS) and Enhanced Oil Recovery (EOR) in the Gulf Coast and Rocky Mountain regions. For over two decades, the Company has maintained a unique strategic focus on utilizing CO2 in its EOR operations and since 2012 has also been active in CCUS through the injection of captured industrial-sourced CO2. The Company currently injects over four million tons of captured industrial-sourced CO2 annually, with an objective to fully offset its Scope 1, 2, and 3 CO2 emissions by 2030, primarily through increasing the amount of captured industrial-sourced CO2 used in its operations. For more information about Denbury, visit www.denbury.com.

Follow Denbury on Twitter and Linkedin.

This press release contains forward looking statements that involve risks and uncertainties, including risks and uncertainties detailed in the Company’s filings with the Securities and Exchange Commission, which risks and uncertainties are incorporated by reference as though fully set forth herein. These statements are based on financial and operating assumptions that the Company believes are reasonable based on currently available information however, management’s assumptions and the Company’s future performance are subject to a wide range of business risks, and there is no assurance that these goals and projections can or will be met. Actual results may vary materially. Any forward-looking statements represent the Company’s estimates only as of today and should not be relied upon as representing its projections as of any future date.

# # #

DENBURY IR CONTACTS

Brad Whitmarsh, 972.673.2020, brad.whitmarsh@denbury.com

Beth Bierhaus, 972.673.2554, beth.bierhaus@denbury.com

v3.22.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

This regulatory filing also includes additional resources:

den-20220505.pdf

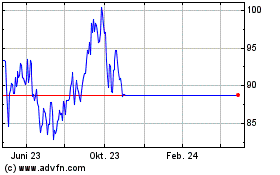

Denbury (NYSE:DEN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Denbury (NYSE:DEN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024