Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

11 Januar 2023 - 12:03PM

Edgar (US Regulatory)

Registration Statement No. 333 - 258403 Dated January 10, 2023; Rule 433 Page 1 F IXED - TO - F LOATING R ATE E LIGIBLE L IABILITIES S ENIOR N OTES DUE J ANUARY 18, 2029 E LIGIBLE L IABILITIES S ENIOR N OTES , S ERIES D Terms and Conditions Tuesday, January 10, 2023 Global Markets Final Terms of the Notes Relating to Preliminary Pricing Supplement No. 3145 dated January 10, 2023 (the “Preliminary Pricing Supplement”). Capitalized terms used but not defined herein are defined as set forth in the Preliminary Pricing Supplement. : Deutsche Bank AG New York Branch : Baa1 (Moody’s); BBB - (S&P); BBB+ (Fitch) : Eligible Liabilities Senior Notes (Senior non - preferred) : USD 1,500,000,000 Issuer Issuer’s Long - term Senior Non - Preferred Unsecured Rating Form of Debt Aggregate Principal Amount Trade Date Issue Date Reset Date Maturity Date Fixed Rate Floating Rate Compounded SOFR : January 10, 2023 : January 18, 2023 : January 18, 2028 : January 18, 2029 : From, and including, the Settlement Date to, but excluding the Reset Date (the “Fixed Rate Period”), the notes will bear interest at 6.720% per annum, payable semi - annually in arrears on each Interest Payment Date, based on a 30/360 day count convention. : From, and including, the Reset Date to, but excluding the Maturity Date (the “Floating Rate Period”), the notes will bear interest equal to Compounded SOFR plus the Spread, payable quarterly in arrears on each Interest Payment Date, based on an Actual/360 day count convention. In no case will the amount payable on any Interest Payment Date be less than zero. : A compounded average of daily SOFR determined for each quarterly Interest Period during the Floating Rate Period in accordance with the specific formula described in the accompanying prospectus supplement under “Description of the Notes — Interest Rates — Secured Overnight Financing Rate (SOFR).” Spread Reoffer Price Fees Day Count Basis Interest Periods Interest Payment Dates : 3.180% : 100.000% : 0.325% : During the Fixed Rate Period, 30/360 During the Floating Rate Period, Actual/360 : With respect to the Fixed Rate Period, each period from, and including, an Interest Payment Date (or the Settlement Date in the case of the first Interest Period during the Fixed Rate Period) to, but excluding, the following Interest Payment Date (or the Reset Date in the case of the final Interest Period during the Fixed Rate Period). With respect to the Floating Rate Period, each period from, and including, an Interest Payment Date (or the Reset Date in the case of the first Interest Period during the Floating Rate Period) to, but excluding, the following Interest Payment Date (or the Maturity Date in the case of the final Interest Period during the Floating Rate Period). : With respect to the Fixed Rate Period, January 18 and July 18 of each year, beginning on July 18, 2023 and ending on the Reset Date; provided that if any scheduled Interest Payment Date is not a Business Day, the interest will be paid on the first following day that is a Business Day. Notwithstanding the foregoing, such interest will be paid with the full force and effect as if made on such scheduled Interest Payment Date, and no adjustment will be made to the amount of interest to be paid. With respect to the Floating Rate Period, January 18, April 18, July 18 and October 18 of each year, beginning on April 18, 2028 and ending on the Maturity Date; provided that if any scheduled Interest Payment Date (other than the Maturity Date) is not a Business Day, it will be postponed to the following Business Day, except that, if that Business Day would fall in the next calendar month, the Interest Payment Date will be the immediately preceding Business Day. If the scheduled final Interest Payment Date (i.e., the Maturity Date) falls on a day that is not a Business Day, the payment of principal and interest will be made on the next succeeding Business Day, but interest on that payment will not accrue from and after the scheduled final Interest Payment Date.

Registration Statement No. 333 - 258403 Dated January 10, 2023; Rule 433 Page 2 F IXED - TO - F LOATING R ATE E LIGIBLE L IABILITIES S ENIOR N OTES DUE J ANUARY 18, 2029 E LIGIBLE L IABILITIES S ENIOR N OTES , S ERIES D Terms and Conditions Tuesday, January 10, 2023 Global Markets Floating R at e I n t erest : Calculation In respect of each Interest Period during the Floating Rate Period, the amount of interest accrued and payable on the notes will be equal to the product of (i) the outstanding Principal Amount of the notes multiplied by (ii) the product of (a) the Floating Rate for such Interest Period multiplied by (b) the quotient of the actual number of calendar days in such Interest Period divided by 360. See “Description of the Notes — Interest Rates — Secured Overnight Financing Rate (SOFR)” in the accompanying prospectus supplement. Observation Period Early Redemption U.S. Government Securities Business Day Business Days Listing D enomin a t i ons ISIN C USIP Sole Book Runner Co - Managers Settlement Calculation Agent Documentation Eligible Liabilities Terms Resolution Measures : : In respect of each Interest Period during the Floating Rate Period, the period from, and including, the date two U.S. Government Securities Business Days preceding the first date in such Interest Period to, but excluding, the date two U.S. Government Securities Business Days preceding the Interest Payment Date for such Interest Period. : We have the right to redeem the notes in our sole discretion in whole, but not in part, at 100% of the Principal Amount together with any accrued but unpaid interest on the Reset Date by giving not less than 5 Business Days’ prior notice, subject to regulatory approval. If the scheduled Reset Date is not a Business Day, it will be postponed to the following Business Day. : Any day except for a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association (or any successor thereto) recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities. : New York and TARGET2 : None : Minimum denominations of USD 150,000 and integral multiples of USD 1,000 in excess thereof : US251526CS67 : 251526CS6 : Deutsche Bank Securities Inc. : Academy Securities, Inc. Bancroft Capital LLC BBVA Securities Inc . Blaylock Van, LLC CIBC World Markets Corp. Great Pacific Securities Loop Capital Markets LLC R. Seelaus & Co., LLC Samuel A . Ramirez & Company, Inc . Santander Investment Securities Inc . Scotia Capital (USA) Inc . TD Securities (USA) LLC : DTC and Euroclear/Clearstream : Deutsche Bank AG, London Branch : SEC Registered : Waiver of right to set - off; no events of default; repurchase prior to maturity subject to regulatory approval; recognition of applicable resolution measures Holders of notes will be bound by and will be deemed irrevocably to consent to the imposition of any Resolution Measure (as defined under “Resolution Measures and Deemed Agreement” in the Preliminary Pricing Supplement) by the competent resolution authority, which may include the write down of all, or a portion, of any payment on the notes or the conversion of the notes into ordinary shares or other instruments of ownership. In a German insolvency proceeding or in the event of the imposition of Resolution Measures with respect to the Issuer, certain specifically defined senior unsecured debt instruments, including the notes, would rank junior to all other outstanding unsecured unsubordinated obligations of the Issuer and would be satisfied only if all such other senior unsecured obligations of the Issuer have been paid in full. Please see “Resolution Measures and Deemed Agreement” in the Preliminary Pricing Supplement. Capitalized terms used but not defined in this term sheet have the meanings assigned to them in the accompanying prospectus supplement and prospectus . • Preliminary pricing supplement dated January 10, 2023 :

Registration Statement No. 333 - 258403 Dated January 10, 2023; Rule 433 Page 3 F IXED - TO - F LOATING R ATE E LIGIBLE L IABILITIES S ENIOR N OTES DUE J ANUARY 18, 2029 E LIGIBLE L IABILITIES S ENIOR N OTES , S ERIES D Terms and Conditions Tuesday, January 10, 2023 Global Markets https://www.sec.gov/Archives/edgar/data/1159508/000095010323000298/dp186847_424b2 - 3145.htm • Prospectus supplement dated August 3, 2021 : https://www.sec.gov/Archives/edgar/data/1159508/000095010321011860/crt_dp155597 - 424b2.pdf • Prospectus dated August 3, 2021 : https://www.sec.gov/Archives/edgar/data/1159508/000119312521235184/d205567d424b21.pdf Prohibition of Sales To EEA Retail Investors The notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (“ EEA ”) . For these purposes, a retail investor means a person who is one (or more) of : (i) a retail client as defined in point ( 11 ) of Article 4 ( 1 ) of Directive 2014 / 65 /EU (as amended, “MiFID II”) ; or (ii) a customer within the meaning of Directive (EU) 2016 / 97 (as amended, the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined in point ( 10 ) of Article 4 ( 1 ) of MiFID II or (iii) not a qualified investor as defined in the Prospectus Regulation . The expression an offer includes the communication in any form and by any means of sufficient information on the terms of the offer and the notes to be offered so as to enable an investor to decide to purchase or subscribe for the notes . Consequently no key information document required by Regulation (EU) No 1286 / 2014 (as amended, the “PRIIPs Regulation”) for offering or selling the notes or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the notes or otherwise making them available to any retail investor in the EEA be unlawful under the PRIIPs Regulation . Prohibition of Sales to UK Retail Investors The notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the United Kingdom (“ UK ”) . For these purposes, a retail investor means a person who is one (or more) of : (i) a retail client, as defined in point ( 8 ) of Article 2 of Regulation (EU) No 2017 / 565 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (“ EUWA ”) ; or (ii) a customer within the meaning of the provisions of the Financial Services and Markets Act 2000 , as amended (“ FSMA ”), and any rules or regulations made under the FSMA to implement Directive (EU) 2016 / 97 , where that customer would not qualify as a professional client, as defined in point ( 8 ) of Article 2 ( 1 ) of Regulation (EU) No 600 / 2014 as it forms part of domestic law by virtue of the EUWA or (iii) not a qualified investor as defined in Article 2 of the UK Prospectus Regulation . The expression an offer includes the communication in any form and by any means of sufficient information on the terms of the offer and the notes to be offered so as to enable an investor to decide to purchase or subscribe for the notes . Consequently no key information document required by Regulation (EU) No 1286 / 2014 as it forms part of domestic law by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering or selling the notes or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation . MiFID II Product Governance/Professional Investors and ECPs - only Target Market The target market for the notes is eligible counterparties and professional clients, each as defined in MiFID II (all distribution channels, with appropriateness check) having ( 1 ) at least informed knowledge and/or experience with financial products, ( 2 ) a long - term investment horizon, ( 3 ) general capital formation/asset optimization as their investment objective, ( 4 ) no or only minor investment loss bearing capacity and ( 5 ) a medium risk tolerance . UK MIFIR product governance/Professional Investors and ECPs - only Target Market The target market for the notes is eligible counterparties, as defined in the FCA Handbook Conduct of Business Sourcebook (“COBS”), and professional clients, as defined in Regulation (EU) No 600 / 2014 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 ("UK MiFIR") (all distribution channels, with appropriateness check) having ( 1 ) at least informed knowledge and/or experience with financial products, ( 2 ) a long - term investment horizon, ( 3 ) general capital formation/asset optimization as their investment objective, ( 4 ) no or only minor investment loss bearing capacity and ( 5 ) a medium risk tolerance . Deutsche Bank AG has filed a registration statement (including a prospectus) with the Securities and Exchange Commission for the offering to which this term sheet relates. Before you invest, you should read the prospectus in that registration statement and the other documents relating to this offering that Deutsche Bank AG has filed with the SEC for more complete information about Deutsche Bank AG and this offering. You may obtain these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Deutsche Bank AG, any agent or any dealer participating in this offering will arrange to send you the prospectus, prospectus supplement and this term sheet if you so request by calling toll - free 1 - 800 - 503 - 4611.

Deutsche Bank Aktiengese... (NYSE:DB)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

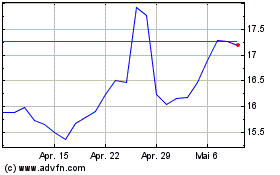

Deutsche Bank Aktiengese... (NYSE:DB)

Historical Stock Chart

Von Apr 2023 bis Apr 2024