Claros Mortgage Trust, Inc. (NYSE: CMTG) (the “Company” or

“CMTG”) today reported its financial results for the quarter ended

March 31, 2024. The Company’s first quarter 2024 GAAP net loss was

($52.8 million), or ($0.39) per diluted share. Distributable Loss

(a non-GAAP financial measure defined below) was ($16.8 million),

or ($0.12) per diluted share. Distributable Earnings prior to

realized losses was $27.7 million, or $0.20 per diluted share.

First Quarter 2024 Highlights

- $6.7 billion loan portfolio with a weighted average all-in

yield of 9.1%.

- Funded approximately $143 million of follow-on fundings related

to the existing loan portfolio.

- Received loan repayment proceeds of $146 million, including

$136 million from two full loan repayments.

- Sold three loans for $262 million, or 96% of unpaid principal

balance. As of December 31, 2023, these loans represented unpaid

principal balance of $272 million and unfunded commitments of $107

million.

- Reclassified one loan to held-for-sale, representing an unpaid

principal balance of $216 million and unfunded commitments of $45

million as of March 31, 2024.

- Subsequent to quarter end, the loan was sold for $175 million,

or 80% of unpaid principal balance; after the repayment of senior

financing and closing costs, the loan sale generated net liquidity

of $33 million.

- Repaid $384 million in financings during the first quarter.

- $261 million in connection with loan repayments or sales.

- $82 million of voluntary deleveraging payments.

- $41 million of scheduled deleveraging payments.

- Made incremental borrowings of $157 million.

- Total liquidity of $265 million consisting of $233 million of

cash and $32 million of approved and undrawn credit capacity.

- General CECL reserves increased by $0.15 per share to $0.72 per

share at March 31, 2024 from $0.57 per share at December 31, 2023.

Specific CECL reserves increased by $0.03 per share to $0.54 per

share at March 31, 2024 from $0.51 per share at December 31, 2023.

- Overall CECL reserves stand at 2.6% of overall unpaid principal

balance, comprised of 23% on the unpaid principal balance of 5

rated loans and 1.6% on the unpaid principal balance of the

remaining portfolio.

- Paid a cash dividend of $0.25 per share of common stock for the

first quarter of 2024.

- Book value per share of $15.55 per share.

“While underlying property fundamentals, excluding office,

remain stable, dynamic macroeconomic factors continue to create

uncertainty across our industry,” said Richard Mack, Chief

Executive Officer and Chairman of CMTG. “Given these conditions,

our focus is on proactive asset management, optimizing our balance

sheet, and drawing upon our Sponsor’s experience and platform to

drive results for the Company.”

Teleconference Details

A conference call to discuss CMTG’s financial results will be

held on Tuesday, May 7, 2024, at 10:00 a.m. ET. The conference call

may be accessed by dialing 1-833-470-1428 and referencing the

Claros Mortgage Trust, Inc. teleconference call; access code

186136.

The conference call will also be broadcast live over the

internet and may be accessed through the Investor Relations section

of CMTG’s website at www.clarosmortgage.com.The earnings

presentation accompanying this release and containing supplemental

information about the Company’s financial results may also be

accessed through this website in advance of the call.

For those unable to listen to the live broadcast, a webcast

replay will be available on CMTG’s website or by dialing

1-866-813-9403, access code 568613, beginning approximately two

hours after the event.

About Claros Mortgage Trust,

Inc.

CMTG is a real estate investment trust that is focused primarily

on originating senior and subordinate loans on transitional

commercial real estate assets located in major markets across the

U.S. CMTG is externally managed and advised by Claros REIT

Management LP, an affiliate of Mack Real Estate Credit Strategies,

L.P. Additional information can be found on the Company’s website

at www.clarosmortgage.com.

Forward-Looking

Statements

Certain statements contained in this press release may be

considered forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. CMTG intends for

all such forward-looking statements to be covered by the applicable

safe harbor provisions for forward-looking statements contained in

those acts. Such forward-looking statements can generally be

identified by CMTG’s use of forward-looking terminology such as

“may,” “will,” “expect,” “intend,” “anticipate,” “estimate,”

“believe,” “continue,” “seek,” “objective,” “goal,” “strategy,”

“plan,” “focus,” “priority,” “should,” “could,” “potential,”

“possible,” “look forward,” “optimistic,” or other similar words.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. Such statements are subject to certain risks and

uncertainties, including known and unknown risks, which could cause

actual results to differ materially from those projected or

anticipated. Therefore, such statements are not intended to be a

guarantee of CMTG’s performance in future periods. Except as

required by law, CMTG does not undertake any obligation to update

or revise any forward-looking statements contained in this

release.

Definitions

Distributable Earnings (Loss):

Distributable Earnings (Loss) is a non-GAAP measure used to

evaluate our performance excluding the effects of certain

transactions, non-cash items and GAAP adjustments, as determined by

our Manager. Distributable Earnings (Loss) is a non-GAAP measure,

which the Company defines as net income (loss) in accordance with

GAAP, excluding (i) non-cash stock-based compensation expense, (ii)

real estate depreciation and amortization, (iii) any unrealized

gains or losses from mark-to-market valuation changes (other than

permanent impairments) that are included in net income (loss) for

the applicable period, (iv) one-time events pursuant to changes in

GAAP and (v) certain non-cash items, which in the judgment of our

Manager, should not be included in Distributable Earnings (Loss).

Furthermore, the Company presents Distributable Earnings prior to

realized gains and losses, which includes principal charge-offs, as

the Company believes this more easily allows our Board, Manager,

and investors to compare our operating performance to our peers, to

assess our ability to declare and pay dividends, and to determine

our compliance with certain financial covenants. Pursuant to the

Management Agreement, we use Core Earnings, which is substantially

the same as Distributable Earnings (Loss) excluding incentive fees,

to determine the incentive fees we pay our Manager.

The Company believes that Distributable Earnings (Loss) and

Distributable Earnings prior to realized gains and losses provide

meaningful information to consider in addition to our net income

(loss) and cash flows from operating activities in accordance with

GAAP. Distributable Earnings (Loss) and Distributable Earnings

prior to realized gains and losses do not represent net income

(loss) or cash flows from operating activities in accordance with

GAAP and should not be considered as an alternative to GAAP net

income (loss), an indication of our cash flows from operating

activities, a measure of our liquidity or an indication of funds

available for our cash needs. In addition, the Company’s

methodology for calculating these non-GAAP measures may differ from

the methodologies employed by other companies to calculate the same

or similar supplemental performance measures and, accordingly, the

Company’s reported Distributable Earnings (Loss) and Distributable

Earnings prior to realized gains and losses may not be comparable

to the Distributable Earnings (Loss) and Distributable Earnings

prior to realized gains and losses reported by other companies.

In order to maintain the Company’s status as a REIT, the Company

is required to distribute at least 90% of its REIT taxable income,

determined without regard to the deduction for dividends paid and

excluding net capital gain, as dividends. Distributable Earnings

(Loss), Distributable Earnings prior to realized gains and losses,

and other similar measures, have historically been a useful

indicator over time of a mortgage REIT’s ability to cover its

dividends, and to mortgage REITs themselves in determining the

amount of any dividends to declare. Distributable Earnings (Loss)

and Distributable Earnings prior to realized gains and losses are

key factors, among others, considered by the Board in determining

the dividend each quarter and as such the Company believes

Distributable Earnings (Loss) and Distributable Earnings prior to

realized gains and losses are also useful to investors.

While Distributable Earnings (Loss) excludes the impact of our

provision for or reversal of current expected credit loss reserve,

principal charge-offs are recognized through Distributable Earnings

(Loss) when deemed non-recoverable. Non-recoverability is

determined (i) upon the resolution of a loan (i.e., when the loan

is repaid, fully or partially, or when the Company acquires title

in the case of foreclosure, deed-in-lieu of foreclosure, or

assignment-in-lieu of foreclosure), or (ii) with respect to any

amount due under any loan, when such amount is determined to be

uncollectible.

Claros Mortgage Trust, Inc.

Reconciliation of Distributable (Loss)

Earnings to Net (Loss) Income

(Amounts in thousands, except share and per

share data)

Three Months Ended

March 31, 2024

December 31, 2023

Net (loss) income:

$

(52,795

)

$

34,043

Adjustments:

Non-cash stock-based compensation

expense

4,353

4,469

Provision for current expected credit loss

reserve

69,960

5,247

Depreciation and amortization expense

2,599

2,579

Amortization of above and below market

lease values, net

354

354

Unrealized loss on interest rate cap

998

1,835

Loss on extinguishment of debt

2,244

-

Gain on foreclosure of real estate

owned

-

(4,162

)

Distributable Earnings prior to realized

losses

$

27,713

$

44,365

Loss on extinguishment of debt

(2,244

)

-

Principal charge-offs

(42,266

)

(7,468

)

Distributable (Loss) Earnings

$

(16,797

)

$

36,897

Weighted average diluted shares -

Distributable (Loss) Earnings

141,403,825

141,321,572

Diluted Distributable Earnings per share

prior to realized losses

$

0.20

$

0.31

Diluted Distributable (Loss) Earnings per

share

$

(0.12

)

$

(0.26

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240506019723/en/

Investor Relations: Claros Mortgage Trust, Inc.

Anh Huynh 212-484-0090 cmtgIR@mackregroup.com Media

Relations: Financial Profiles Kelly McAndrew

203-613-1552 Kmcandrew@finprofiles.com

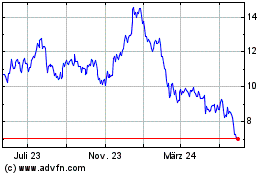

Claros Mortgage (NYSE:CMTG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

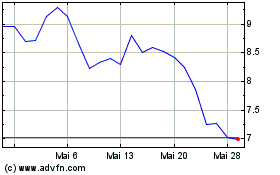

Claros Mortgage (NYSE:CMTG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024