0001710366FALSE00017103662024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 8, 2024

CONSOL Energy Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38147 | | 82-1954058 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

275 Technology Drive Suite 101

Canonsburg, Pennsylvania 15317

(Address of principal executive offices)

(Zip code)

Registrant's telephone number, including area code:

(724) 416-8300

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | CEIX | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

CONSOL Energy Inc. (the "Company," "we," "us," "our") issued a press release on August 8, 2024 announcing its 2024 second quarter results. A copy of the press release is attached to this Form 8-K as Exhibit 99.1.

Please refer to our website at www.consolenergy.com for additional information regarding the Company. For example, periodically during the quarter, we may provide investor presentations, which would appear on our website in the Investors section.

The information in this Current Report and the exhibit hereto are being furnished and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this Current Report and exhibit hereto shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 7.01 Regulation FD Disclosure.

The response to Item 2.02 is incorporated herein by reference to this Item 7.01.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| CONSOL Energy Inc. |

| (Registrant) |

| By: | /s/ MITESHKUMAR B. THAKKAR |

| | Miteshkumar B. Thakkar |

| | Chief Financial Officer and President |

Dated: August 8, 2024

Exhibit 99.1

CONSOL Energy Announces Results for the Second Quarter 2024

CANONSBURG, PA (August 8, 2024) - Today, CONSOL Energy Inc. (NYSE: CEIX) reported financial and operating results for the period ended June 30, 2024.

Second Quarter 2024 Highlights Include:

•GAAP net income of $58.1 million and GAAP dilutive earnings per share of $1.96;

•Quarterly adjusted EBITDA1 of $124.5 million;

•Net cash provided by operating activities of $116.3 million;

•Quarterly free cash flow1 of $58.6 million;

•Total revenue and other income of $501.1 million;

•Pennsylvania Mining Complex (PAMC) sold 5.8 million tons, despite export capacity limitations due to the Francis Scott Key (FSK) Bridge collapse;

•CONSOL Marine Terminal (CMT) resumed operations in late May, shipping 2.3 million tons;

•Itmann Mining Complex (IMC) sold 164 thousand tons;

•PAMC is near-fully contracted in 2024 and improved its position to 14.5 million tons in 2025; and

•IMC contracted position of 717 thousand tons in 2024 and 250 thousand tons in 2025.

Management Comments

“During the second quarter of 2024, the CONSOL team achieved robust financial and sales performances, despite navigating operational headwinds caused by the FSK Bridge collapse in the Port of Baltimore,” said Jimmy Brock, Chairman and Chief Executive Officer of CONSOL Energy Inc. “Despite having zero export capacity through our own CMT for more than half of the second quarter, we successfully sold 5.8 million PAMC tons and generated $59 million in free cash flow1. This strong performance was a testament to our team’s ability to effectively handle this unforeseen event and mitigate the financial impact to our stakeholders as much as possible. Consistent with our previously stated capital allocation framework, on a year-to-date basis through June 30, 2024, we have deployed $71 million towards share repurchases."

“On the safety front, our Bailey Preparation Plant, Itmann Preparation Plant, and CMT each had ZERO employee recordable incidents in the second quarter of 2024, and our year-to-date employee total recordable incident rate across our coal mining segment remained well below the historical national average for underground bituminous coal mines.”

Pennsylvania Mining Complex Review

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | June 30, 2024 | | June 30, 2023 |

| Total Coal Revenue (PAMC Segment) | thousands | $ | 384,442 | | | $ | 521,176 | |

| Operating and Other Costs | thousands | $ | 287,670 | | | $ | 276,596 | |

Total Cash Cost of Coal Sold1 | thousands | $ | 230,262 | | | $ | 233,523 | |

| Coal Production | million tons | 5.6 | | 6.3 |

| Total Tons Sold | million tons | 5.8 | | 6.4 |

| Average Coal Revenue per Ton Sold | per ton | $ | 66.83 | | | $ | 81.27 | |

Average Cash Cost of Coal Sold per Ton1 | per ton | $ | 39.82 | | | $ | 36.33 | |

Average Cash Margin per Ton Sold1 | per ton | $ | 27.01 | | | $ | 44.94 | |

The CEIX sales team sold 5.8 million tons of PAMC coal during the second quarter of 2024, generating coal revenue of $384.4 million for the PAMC segment and an average coal revenue per ton sold of $66.83. This compares to 6.4 million tons sold, generating coal revenue of $521.2 million and an average coal revenue per ton sold of $81.27 in the year-ago period. The variance is mainly due to our reduced export capacity in the quarter caused by the collapse of the FSK Bridge, which temporarily blocked vessel access to our CMT. Additionally, we incurred incrementally higher transportation costs to divert some export tons to an alternative port which reduced our coal revenue realization on those sales while access to our CONSOL Marine Terminal was blocked. Our performance, despite this headwind, is a testament to our ability to leverage our strong relationships with our transportation partners to quickly divert some export tonnage to an alternative port and optimize our sales book. With the temporary pause of operations at our CMT and the utilization of the alternative port, 49% of the total coal revenue for the PAMC segment during the second quarter was derived from sales into the export market.

During the second quarter of 2024, we produced 5.6 million tons at the PAMC, which was impressive considering that we swiftly realigned production with the export capacity limitations we faced due to the FSK Bridge collapse. This compares to 6.3 million tons in the year-ago period. Average cash cost of coal sold per ton1 at the PAMC for the second quarter of 2024 was $39.82, compared to $36.33 in the year-ago quarter. The increase was due to the lower sales tons resulting from our reduced export capacity, as well as ongoing inflationary pressures on costs for supplies, maintenance and contractor labor compared to the prior year period. Sales tonnage during the second quarter of 2024 outpaced production tonnage as we were able to reduce our inventory that accumulated at the end of the first quarter of 2024 due to the FSK Bridge collapse.

On the marketing front, API2 and Henry Hub natural gas spot prices saw an uptick in the second quarter compared to the first quarter of 2024. In the export market, API2 spot prices in the second quarter increased approximately 6% when compared to the first quarter of 2024. Domestically, average Henry Hub natural gas spot prices were up approximately 11% quarter over quarter, while PJM West day ahead power prices decreased 2% over the same period. According to the National Oceanic and Atmospheric Administration, the contiguous U.S. experienced the second highest average temperature on record for the month of June. These high temperatures caused Northern Appalachia coal burn to increase by approximately 32% in June when compared to May 2024, resulting in a reduction of Northern Appalachia coal stockpiles, according to Energy Ventures Analysis. As a result of the strong quality characteristics of our PAMC product, which allow us to sell it into many different end-use markets globally, and the improved demand outlook for power generation, we were able to enter into multiple new long-term domestic contracts, with some extending through 2028. Accordingly, the PAMC is now near fully contracted in 2024 based on the midpoint of our 2024 guidance, and we increased our 2025 contracted position to 14.5 million tons.

CONSOL Marine Terminal Review

During the second quarter of 2024, operations at the CMT resumed after being halted for approximately two months due to the FSK Bridge collapse and cleanup. The CMT team accelerated its annual summer shutdown maintenance during this time to improve efficiency and allow the CMT to remain open to load and ship vessels during the railroads’ and mining operations’ annual shutdown period beginning at the end of June and extending into early July. In the second quarter of 2024, throughput volume at the CMT was 2.3 million tons, compared to 5.4 million tons in the year-ago period. Terminal revenues and CMT total costs and expenses were $12.0 million and $9.9 million, respectively, compared to $31.4 million and $10.9 million, respectively, during the year-ago period. CMT operating cash costs1 were $6.1 million in the second quarter of 2024, compared to $7.0 million in the prior year period. CMT net income and CMT adjusted EBITDA1 were

$2.3 million and $5.2 million, respectively, in the second quarter of 2024 compared to $21.1 million and $23.9 million, respectively, in the year-ago period.

Itmann Mining Complex Update

During the second quarter of 2024, the IMC sold 164 thousand tons of Itmann Mine and third-party coal, compared to 193 thousand tons in the first quarter. The impairment in the second quarter was due to lower quantities of purchased coal being sold and adverse geological conditions which limited our production. During the second quarter of 2024, the Itmann Mine continued to focus on its long-term mains development while operating two of the three continuous miner sections as super sections. As of the end of the second quarter of 2024, the Itmann Mine staffing levels have improved, and the mine is now nearly fully staffed. On the supply chain front, we continue to deal with abnormally long lead times on both new and rebuilt section equipment. As the Itmann Mine team continues to work through these challenges, we remain focused on positioning this mine for long-term success. Looking forward, we expect to begin retreat mining late in the third quarter of 2024, which we expect will improve both our efficiency and productivity.

Shareholder Returns Update

Through a 10b5-1 plan put into place in the first quarter of 2024, CEIX deployed $13 million toward share repurchases in April of 2024. Due to our limited cash flow generation in the first half of the quarter and uncertainties surrounding the temporary closure of and restrictions to the shipping lane in the Port of Baltimore, we slowed our return of capital efforts during the quarter. From the beginning of December 2022 through June 30, 2024, CEIX has repurchased 6.1 million shares of its common stock, or approximately 18% of its public float as of year-end 2022, at a weighted average price of $77.14 per share.

2024 Guidance and Outlook

Based on our current contracted position, estimated prices, production plans, and the effect of the FSK Bridge collapse, we are providing the following financial and operating performance guidance for full fiscal year 2024:

•PAMC coal sales volume of 24.5-26.0 million tons

•PAMC average coal revenue per ton sold expectation of $63.50-$66.50

•PAMC average cash cost of coal sold per ton2 expectation of $37.50-$39.50

•IMC coal sales volume of 700-900 thousand tons

•Total capital expenditures of $165-$190 million

Second Quarter Earnings Conference Call

A conference call and webcast, during which management will discuss the second quarter 2024 financial and operational results, is scheduled for August 8, 2024 at 10:00 AM eastern time. Prepared remarks by members of management will be followed by a question and answer session. Interested parties may listen via webcast on the "Events and Presentations" page of our website, www.consolenergy.com. An archive of the webcast will be available for 30 days after the event.

Participant dial in (toll free) 1-800-836-8184

Participant international dial in 1-646-357-8785

Availability of Additional Information

Please refer to our website, www.consolenergy.com, for additional information regarding the company. In addition, we may provide other information about the company from time to time on our website.

We will also file our Form 10-Q with the Securities and Exchange Commission (SEC) reporting our results for the period ended June 30, 2024 on August 8, 2024. Investors seeking our detailed financial statements can refer to the Form 10-Q once it has been filed with the SEC.

Footnotes:

1 "Adjusted EBITDA", "Free Cash Flow", "CMT Adjusted EBITDA", "CMT Operating Cash Costs", and "Total Cash Cost of Coal Sold" are non-GAAP financial measures and "Average Cash Cost of Coal Sold per Ton" and "Average Cash

Margin per Ton Sold" are operating ratios derived from non-GAAP financial measures, each of which are reconciled to the most directly comparable GAAP financial measures below, under the caption “Reconciliation of Non-GAAP Financial Measures".

2 CEIX is unable to provide a reconciliation of PAMC Average Cash Cost of Coal Sold per Ton guidance, which is an operating ratio derived from non-GAAP financial measures, due to the unknown effect, timing and potential significance of certain income statement items.

About CONSOL Energy Inc.

CONSOL Energy Inc. (NYSE: CEIX) is a Canonsburg, Pennsylvania-based producer and exporter of high-Btu bituminous thermal coal and metallurgical coal. It owns and operates some of the most productive longwall mining operations in the Northern Appalachian Basin. CONSOL’s flagship operation is the Pennsylvania Mining Complex, which has the capacity to produce approximately 28.5 million tons of coal per year and is comprised of 3 large-scale underground mines: Bailey Mine, Enlow Fork Mine, and Harvey Mine. CONSOL recently developed the Itmann Mine in the Central Appalachian Basin, which has the capacity when fully operational to produce roughly 900 thousand tons per annum of premium, low-vol metallurgical coking coal. The company also owns and operates the CONSOL Marine Terminal, which is located in the port of Baltimore and has a throughput capacity of approximately 20 million tons per year. In addition to the ~584 million reserve tons associated with the Pennsylvania Mining Complex and the ~28 million reserve tons associated with the Itmann Mining Complex, the company controls approximately 1.3 billion tons of greenfield thermal and metallurgical coal reserves and resources located in the major coal-producing basins of the eastern United States. Additional information regarding CONSOL Energy may be found at www.consolenergy.com.

Contacts:

Investor:

Nathan Tucker, (724) 416-8336

nathantucker@consolenergy.com

Media:

Erica Fisher, (724) 416-8292

ericafisher@consolenergy.com

Condensed Consolidated Statements of Cash Flows

The following table presents the condensed consolidated statements of cash flows for the three months ended June 30, 2024 and 2023 (in thousands):

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | |

| 2024 | | 2023 | | | | |

| Cash Flows from Operating Activities: | (Unaudited) | | (Unaudited) | | | | |

| Net Income | $ | 58,061 | | | $ | 167,723 | | | | | |

| Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: | | | | | | | |

| Depreciation, Depletion and Amortization | 54,847 | | | 64,528 | | | | | |

| Other Non-Cash Adjustments to Net Income | 1,832 | | | 2,189 | | | | | |

| Changes in Working Capital | 1,524 | | | (6,867) | | | | | |

| Net Cash Provided by Operating Activities | 116,264 | | | 227,573 | | | | | |

| Cash Flows from Investing Activities: | | | | | | | |

| Capital Expenditures | (55,408) | | | (42,325) | | | | | |

| Proceeds from Sales of Assets | 757 | | | 239 | | | | | |

| Other Investing Activity | (4,553) | | | (29,069) | | | | | |

| Net Cash Used in Investing Activities | (59,204) | | | (71,155) | | | | | |

| Cash Flows from Financing Activities: | | | | | | | |

| Net Payments on Long-Term Debt, Including Fees | (3,471) | | | (54,596) | | | | | |

| Repurchases of Common Stock | (12,998) | | | (65,398) | | | | | |

| Dividends and Dividend Equivalents Paid | (516) | | | (37,187) | | | | | |

| Other Financing Activities | (27) | | | (3,410) | | | | | |

| Net Cash Used in Financing Activities | (17,012) | | | (160,591) | | | | | |

| Net Increase (Decrease) in Cash and Cash Equivalents and Restricted Cash | 40,048 | | | (4,173) | | | | | |

| Cash and Cash Equivalents and Restricted Cash at Beginning of Period | 216,778 | | | 246,843 | | | | | |

| Cash and Cash Equivalents and Restricted Cash at End of Period | $ | 256,826 | | | $ | 242,670 | | | | | |

Reconciliation of Non-GAAP Financial Measures

We evaluate our cost of coal sold and cash cost of coal sold on an aggregate basis by segment, and our average cash cost of coal sold per ton on a per-ton basis. Cost of coal sold includes items such as direct operating costs, royalty and production taxes, direct administration costs, and depreciation, depletion and amortization costs on production assets. Cost of coal sold excludes any indirect costs and other costs not directly attributable to the production of coal. The cash cost of coal sold includes cost of coal sold less depreciation, depletion and amortization costs on production assets. We define average cash cost of coal sold per ton as cash cost of coal sold divided by tons sold. The GAAP measure most directly comparable to cost of coal sold, cash cost of coal sold and average cash cost of coal sold per ton is operating and other costs.

The following table presents a reconciliation for the PAMC segment of cash cost of coal sold, cost of coal sold and average cash cost of coal sold per ton to operating and other costs, the most directly comparable GAAP financial measure, on a historical basis, for each of the periods indicated (in thousands, except per ton information).

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | |

| 2024 | | 2023 | | | | |

| Operating and Other Costs | $ | 287,670 | | | $ | 276,596 | | | | | |

| Less: Other Costs (Non-Production and non-PAMC) | (57,408) | | | (43,073) | | | | | |

| Cash Cost of Coal Sold | $ | 230,262 | | | $ | 233,523 | | | | | |

| Add: Depreciation, Depletion and Amortization (PAMC Production) | 42,284 | | | 47,877 | | | | | |

| Cost of Coal Sold | $ | 272,546 | | | $ | 281,400 | | | | | |

| Total Tons Sold (in millions) | 5.8 | | 6.4 | | | | |

| Average Cost of Coal Sold per Ton | $ | 47.38 | | | $ | 43.88 | | | | | |

| Less: Depreciation, Depletion and Amortization Costs per Ton Sold | 7.56 | | | 7.55 | | | | | |

| Average Cash Cost of Coal Sold per Ton | $ | 39.82 | | | $ | 36.33 | | | | | |

We evaluate our average cash margin per ton sold on a per-ton basis. We define average cash margin per ton sold as average coal revenue per ton sold, net of average cash cost of coal sold per ton. The GAAP measure most directly comparable to average cash margin per ton sold is total coal revenue.

The following table presents a reconciliation for the PAMC segment of average cash margin per ton sold to total coal revenue, the most directly comparable GAAP financial measure, on a historical basis, for each of the periods indicated (in thousands, except per ton information).

| | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | |

| 2024 | | 2023 | | | | |

| Total Coal Revenue (PAMC Segment) | $ | 384,442 | | | $ | 521,176 | | | | | |

| Operating and Other Costs | 287,670 | | | 276,596 | | | | | |

| Less: Other Costs (Non-Production and non-PAMC) | (57,408) | | | (43,073) | | | | | |

| Cash Cost of Coal Sold | $ | 230,262 | | | $ | 233,523 | | | | | |

| Total Tons Sold (in millions) | 5.8 | | 6.4 | | | | |

| Average Coal Revenue per Ton Sold | $ | 66.83 | | | $ | 81.27 | | | | | |

| Less: Average Cash Cost of Coal Sold per Ton | 39.82 | | | 36.33 | | | | | |

| Average Cash Margin per Ton Sold | $ | 27.01 | | | $ | 44.94 | | | | | |

We define CMT operating costs as operating and other costs related to throughput tons. CMT operating costs exclude any indirect costs and other costs not directly attributable to throughput tons. CMT operating cash costs include CMT operating costs, less depreciation, depletion and amortization costs on throughput assets. The GAAP measure most directly comparable to CMT operating costs and CMT operating cash costs is operating and other costs.

The following table presents a reconciliation of CMT operating costs and CMT operating cash costs to operating and other costs, the most directly comparable GAAP financial measure, on a historical basis, for each of the periods indicated (in thousands).

| | | | | | | | | | | |

| | Three Months Ended

June 30, |

| | 2024 | | 2023 |

| Operating and Other Costs | $ | 287,670 | | | $ | 276,596 | |

| Less: Other Costs (Non-Throughput) | (280,359) | | | (268,507) | |

| CMT Operating Costs | $ | 7,311 | | | $ | 8,089 | |

| Less: Depreciation, Depletion and Amortization (Throughput) | (1,176) | | | (1,065) | |

| CMT Operating Cash Costs | $ | 6,135 | | | $ | 7,024 | |

We define adjusted EBITDA as (i) net income (loss) plus income taxes, interest expense and depreciation, depletion and amortization, as adjusted for (ii) certain non-cash items, such as stock-based compensation and loss on debt extinguishment. The GAAP measure most directly comparable to adjusted EBITDA is net income (loss).

The following tables present a reconciliation of adjusted EBITDA to net income (loss), the most directly comparable GAAP financial measure, on a historical basis, for each of the periods indicated (in thousands).

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2024 |

| | PAMC | | CONSOL Marine Terminal | | Other | | Consolidated |

| Net Income (Loss) | $ | 94,295 | | | $ | 2,321 | | | $ | (38,555) | | | $ | 58,061 | |

| | | | | | | | |

| Add: Income Tax Expense | — | | | — | | | 9,027 | | | 9,027 | |

| Add: Interest Expense | — | | | 1,518 | | | 3,475 | | | 4,993 | |

| Less: Interest Income | (1,320) | | | — | | | (3,307) | | | (4,627) | |

| Earnings (Loss) Before Interest & Taxes (EBIT) | 92,975 | | | 3,839 | | | (29,360) | | | 67,454 | |

| | | | | | | | |

| Add: Depreciation, Depletion & Amortization | 43,675 | | | 1,233 | | | 9,939 | | | 54,847 | |

| | | | | | | | |

| Earnings (Loss) Before Interest, Taxes and DD&A (EBITDA) | $ | 136,650 | | | $ | 5,072 | | | $ | (19,421) | | | $ | 122,301 | |

| | | | | | | | |

| Adjustments: | | | | | | | |

| Add: Stock-Based Compensation | $ | 1,796 | | | $ | 96 | | | $ | 345 | | | $ | 2,237 | |

| | | | | | | |

| | | | | | | |

| | | | | | | | |

| Adjusted EBITDA | $ | 138,446 | | | $ | 5,168 | | | $ | (19,076) | | | $ | 124,538 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2023 |

| | PAMC | | CONSOL Marine Terminal | | Other | | Consolidated |

| Net Income (Loss) | $ | 218,636 | | | $ | 21,094 | | | $ | (72,007) | | | $ | 167,723 | |

| | | | | | | | |

| Add: Income Tax Expense | — | | | — | | | 37,574 | | | 37,574 | |

| Add: Interest Expense | — | | | 1,526 | | | 5,629 | | | 7,155 | |

| Less: Interest Income | (513) | | | — | | | (3,198) | | | (3,711) | |

| Earnings (Loss) Before Interest & Taxes (EBIT) | 218,123 | | | 22,620 | | | (32,002) | | | 208,741 | |

| | | | | | | | |

| Add: Depreciation, Depletion & Amortization | 50,268 | | | 1,176 | | | 13,084 | | | 64,528 | |

| | | | | | | | |

| Earnings (Loss) Before Interest, Taxes and DD&A (EBITDA) | $ | 268,391 | | | $ | 23,796 | | | $ | (18,918) | | | $ | 273,269 | |

| | | | | | | | |

| Adjustments: | | | | | | | |

| Add: Stock-Based Compensation | $ | 1,674 | | | $ | 60 | | | $ | 259 | | | $ | 1,993 | |

| Add: Loss on Debt Extinguishment | — | | | — | | | 688 | | | 688 | |

| Total Pre-tax Adjustments | 1,674 | | | 60 | | | 947 | | | 2,681 | |

| | | | | | | | |

| Adjusted EBITDA | $ | 270,065 | | | $ | 23,856 | | | $ | (17,971) | | | $ | 275,950 | |

Free cash flow is a non-GAAP financial measure, defined as net cash provided by operating activities plus proceeds from sales of assets less capital expenditures and investments in mining-related activities. Management believes that this measure is meaningful to investors because management reviews cash flows generated from operations and non-core asset sales after taking into consideration capital expenditures due to the fact that these expenditures are considered necessary to maintain and expand CONSOL’s asset base and are expected to generate future cash flows from operations. It is important to note that free cash flow does not represent the residual cash flow available for discretionary expenditures since other non-discretionary expenditures, such as mandatory debt service requirements, are not deducted from the measure. The following table presents a reconciliation of free cash flow to net cash provided by operations, the most directly comparable GAAP financial measure, on a historical basis, for each of the periods indicated (in thousands).

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Three Months Ended | | | | | | | | |

| | June 30, 2024 | | June 30, 2023 | | | | | | | | |

| Net Cash Provided by Operations | $ | 116,264 | | | $ | 227,573 | | | | | | | | | |

| | | | | | | | | | | | |

| Capital Expenditures | (55,408) | | | (42,325) | | | | | | | | | |

| Proceeds from Sales of Assets | 757 | | | 239 | | | | | | | | | |

| Investments in Mining-Related Activities | (3,025) | | | (4,731) | | | | | | | | | |

| Free Cash Flow | $ | 58,588 | | | $ | 180,756 | | | | | | | | | |

Cautionary Statement Regarding Forward-Looking Statements

Certain statements in this press release are “forward-looking statements” within the meaning of the federal securities laws. With the exception of historical matters, the matters discussed in this press release are forward-looking statements (as defined in Section 21E of the Securities Exchange Act of 1934, as amended) that involve risks and uncertainties that could cause actual results to differ materially from results projected in or implied by such forward-looking statements. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. The forward-looking statements may include projections and estimates concerning the timing and success of specific projects and our future production, revenues, income and capital spending. When we use the words “anticipate,” “believe,” “could,” “continue,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “target,” “will,” “would,” or their negatives, or other similar expressions, the statements which include those words are usually forward-looking statements. When we describe our expectations with respect to the Itmann Mine or any other strategy that involves risks or uncertainties, we are making forward-looking statements. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. Specific risks, contingencies and uncertainties are discussed in more detail in our filings with the Securities and Exchange Commission. The forward-looking statements in this press release speak only as of the date of this press release and CEIX disclaims any intention or obligation to update publicly any forward-looking statements, whether in response to new information, future events, or otherwise, except as required by applicable law.

Source: CONSOL Energy Inc.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

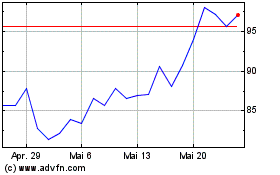

CONSOL Energy (NYSE:CEIX)

Historical Stock Chart

Von Okt 2024 bis Dez 2024

CONSOL Energy (NYSE:CEIX)

Historical Stock Chart

Von Dez 2023 bis Dez 2024