Current Report Filing (8-k)

20 Mai 2022 - 10:18PM

Edgar (US Regulatory)

0000896159

false

--12-31

0000896159

2022-05-19

2022-05-19

0000896159

us-gaap:CommonStockMember

2022-05-19

2022-05-19

0000896159

CB:INASeniorNotesDueDecember2024Member

2022-05-19

2022-05-19

0000896159

CB:INASeniorNotesDueJune2027Member

2022-05-19

2022-05-19

0000896159

CB:INASeniorNotesDueMarch2028Member

2022-05-19

2022-05-19

0000896159

CB:INASeniorNotesDueDecember2029Member

2022-05-19

2022-05-19

0000896159

CB:INASeniorNotesDueJune2031Member

2022-05-19

2022-05-19

0000896159

CB:INASeniorNotesDueMarch2038Member

2022-05-19

2022-05-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

Current Report

Pursuant To Section 13

or 15 (d) of the

Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): May 19, 2022

Chubb Limited

(Exact name of registrant

as specified in its charter)

| Switzerland |

|

1-11778 |

|

98-0091805 |

(State

or other jurisdiction of

incorporation)

|

|

(Commission File

Number)

|

|

(I.R.S.

Employer Identification No.)

|

Baerengasse

32

CH-8001

Zurich, Switzerland

(Address of principal executive

offices)

Registrant’s telephone number,

including area code: +41 (0)43 456 76 00

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which

registered |

| Common

Shares, par value CHF 24.15 per share |

|

CB |

|

New

York Stock Exchange |

| Guarantee of Chubb INA Holdings Inc. 0.30% Senior Notes due 2024 |

|

CB/24A |

|

New York Stock Exchange |

| Guarantee of Chubb INA Holdings Inc. 0.875% Senior Notes due 2027 |

|

CB/27 |

|

New York Stock Exchange |

| Guarantee of Chubb INA Holdings Inc. 1.55% Senior Notes due 2028 |

|

CB/28 |

|

New York Stock Exchange |

| Guarantee of Chubb INA Holdings Inc. 0.875% Senior Notes due 2029 |

|

CB/29A |

|

New York Stock Exchange |

| Guarantee of Chubb INA Holdings Inc. 1.40% Senior Notes due 2031 |

|

CB/31 |

|

New York Stock Exchange |

| Guarantee of Chubb INA Holdings Inc. 2.50% Senior Notes due 2038 |

|

CB/38A |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.03 Amendments to Articles of

Incorporation or Bylaws; Change in Fiscal Year

At the Chubb Limited (“Company”) Annual General Meeting of Shareholders (“annual general meeting”) held on May 19, 2022, the Company’s shareholders approved an amendment to Article 6(a) of the Articles of Association to authorize the Company’s Board of Directors to increase the Company’s share capital within two years following the 2022 annual general meeting to a maximum amount equal to CHF 4,830,000,000, which amount would be divided into 200,000,000 shares. In connection therewith, the amendment limits or withdraws the shareholders’ pre-emptive rights in specified and limited circumstances, all as further described in the Company’s 2022 Proxy Statement under the heading "Agenda Item 9: Amendment to the Articles of Association Relating to Authorized Share Capital for General Purposes", which is incorporated herein by reference. The Company’s amended Articles of Association containing the amendment will become effective upon registration with the Commercial Register of the Canton of Zurich, Switzerland (“Swiss Commercial Register”). Subject to the subsequent approval by the Swiss Federal Commercial Register Office, the effective date of such registration is expected to be on or about May 24, 2022.

A copy of the amended Articles of Association is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

At the Company’s 2022 annual general meeting, the Company’s shareholders also prospectively approved an amendment to Article 3(a) of the Company’s Articles of Association in conjunction with their approval of a share capital reduction, all as further described in the Company’s Proxy Statement under the heading “Agenda Item 10: Reduction of Share Capital”, which is incorporated herein by reference. Subject to publication of three notices to creditors and a subsequent two-month waiting period in accordance with Swiss law, and registration with the Swiss Commercial Register, the share capital reduction and amended Article 3(a) of the Articles of Association will become effective. The amended Articles of Association of the Company reflecting the share capital reduction will be filed with the SEC upon effectiveness.

Item 5.07 Submission of Matters to a Vote of Security Holders

The Company convened its annual general meeting

on May 19, 2022, pursuant to notice duly given. Agenda Items 1-12 submitted by the Company at the annual general meeting were approved.

With respect to the non-binding shareholder proposals, Agenda Item 13 was rejected and Agenda Item 14 was approved. The matters voted

upon at the meeting and the results of such voting are set forth below.

The vote required to approve each agenda item noted

below is described in the Company’s 2022 Proxy Statement under the headings “What vote is required to approve each agenda

item?” and “What is the effect of broker non-votes and abstentions?”.

| 1. | Approval of the management report, standalone financial statements and consolidated financial statements

of Chubb Limited for the year ended December 31, 2021 |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 379,298,800 | |

147,921 | |

988,376 | |

0 |

| 2.1 | Allocation of disposable profit |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 380,061,087 | |

158,997 | |

215,013 | |

0 |

| 2.2 | Distribution of a dividend out of legal reserves (by way of release and allocation to a dividend reserve) |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 380,144,792 | |

133,928 | |

156,377 | |

0 |

| 3. | Discharge of the Board of Directors |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 352,500,463 | |

3,216,918 | |

1,618,446 | |

22,640,952 |

The voting results for Agenda Item 3 exclude shares

held by the Company’s directors, nominees and executive officers, who are not permitted by Swiss law to vote their shares on the

discharge of the Board of Directors.

| 4.1 | Election of PricewaterhouseCoopers AG (Zurich) as the Company’s statutory auditor for the year ending December 31, 2022 |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 363,363,520 | |

16,944,899 | |

126,678 | |

0 |

| 4.2 | Ratification of appointment of PricewaterhouseCoopers LLP (United States) as independent registered public accounting firm for purposes

of U.S. securities law reporting for the year ending December 31, 2022 |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 359,786,527 | |

20,537,141 | |

111,429 | |

0 |

| 4.3 | Election of BDO AG (Zurich) as special audit firm until the Company’s next annual general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 379,883,612 | |

414,811 | |

136,674 | |

0 |

| 5.1 | Election of Evan G. Greenberg as director until the Company’s next annual general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 328,874,295 | |

28,440,477 | |

479,373 | |

22,640,952 |

| 5.2 | Election of Michael P. Connors as director until the Company’s next annual general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 340,821,647 | |

16,815,587 | |

156,911 | |

22,640,952 |

| 5.3 | Election of Michael G. Atieh as director until the Company’s next annual general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 341,353,384 | |

16,279,646 | |

161,115 | |

22,640,952 |

| 5.4 | Election of Kathy Bonanno as director until the Company’s next annual general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 357,040,104 | |

615,226 | |

138,815 | |

22,640,952 |

| 5.5 | Election of Sheila P. Burke as director until the Company’s next annual general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 354,523,078 | |

3,130,175 | |

140,892 | |

22,640,952 |

| 5.6 | Election of Mary Cirillo as director until the Company’s next annual general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 327,098,923 | |

30,552,119 | |

143,103 | |

22,640,952 |

| 5.7 | Election of Robert J. Hugin as director until the Company’s next annual general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 354,582,552 | |

3,057,485 | |

154,108 | |

22,640,952 |

| 5.8 | Election of Robert W. Scully as director until the Company’s next annual general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 352,769,895 | |

4,873,998 | |

150,252 | |

22,640,952 |

| 5.9 | Election of Theodore E. Shasta as director until the Company’s next annual general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 349,922,601 | |

7,717,683 | |

153,861 | |

22,640,952 |

| 5.10 | Election of David H. Sidwell as director until the Company’s next annual general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 353,823,323 | |

3,817,180 | |

153,642 | |

22,640,952 |

| 5.11 | Election of Olivier Steimer as director until the Company’s next annual general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 341,275,575 | |

16,334,322 | |

184,248 | |

22,640,952 |

| 5.12 | Election of Luis Téllez as director until the Company’s next annual general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 353,588,682 | |

4,052,464 | |

152,999 | |

22,640,952 |

| 5.13 | Election of Frances F. Townsend as director until the Company’s next annual general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 344,692,197 | |

12,949,870 | |

152,078 | |

22,640,952 |

| 6. | Election of Evan G. Greenberg as Chairman of the Board of Directors until the Company’s next annual

general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 230,428,983 | |

126,858,954 | |

506,208 | |

22,640,952 |

| 7.1 | Election of Michael P. Connors as Compensation Committee member until the Company’s next annual

general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 344,120,520 | |

13,490,221 | |

183,404 | |

22,640,952 |

| 7.2 | Election of Mary Cirillo as Compensation Committee member until the Company’s next annual general

meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 337,288,820 | |

20,345,788 | |

159,537 | |

22,640,952 |

| 7.3 | Election of Frances F. Townsend as Compensation Committee member until the Company’s next annual

general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 344,035,378 | |

13,591,892 | |

166,875 | |

22,640,952 |

| 8. | Election of Homburger AG as independent proxy until the conclusion of the Company’s next annual

general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 380,000,184 | |

193,484 | |

241,429 | |

0 |

| 9. | Amendment to the Articles of Association relating to authorized share capital for general purposes |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 365,572,098 | |

14,621,702 | |

241,297 | |

0 |

| 10. | Reduction of share capital |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 379,635,170 | |

521,815 | |

278,112 | |

0 |

| 11.1 | Compensation of the Board of Directors until the next annual general meeting |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 355,618,270 | |

1,259,461 | |

916,414 | |

22,640,952 |

| 11.2 | Compensation of Executive Management for the next calendar year |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 343,710,093 | |

13,154,338 | |

929,714 | |

22,640,952 |

| 12. | Advisory vote to approve executive compensation under U.S. securities law requirements |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 333,917,973 | |

23,632,372 | |

243,800 | |

22,640,952 |

| 13. | Shareholder proposal regarding a policy restricting underwriting of new fossil fuel supplies |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 68,481,227 | |

284,798,068 | |

4,514,850 | |

22,640,952 |

| 14. | Shareholder proposal regarding a report on greenhouse gas emissions |

| Shares Voted For | |

Shares Voted Against | |

Shares Abstained | |

Broker Non-Votes |

| 255,924,942 | |

98,645,026 | |

3,224,177 | |

22,640,952 |

| Item 9.01. | Financial Statements and Exhibits |

| | |

| (d) | Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CHUBB LIMITED |

| |

|

| |

|

| |

By: |

/s/ Joseph F. Wayland |

| |

|

Joseph F. Wayland |

| |

|

General Counsel |

DATE: May 20, 2022

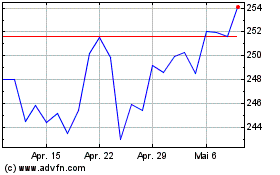

DBA Chubb (NYSE:CB)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

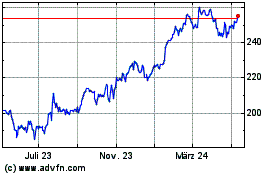

DBA Chubb (NYSE:CB)

Historical Stock Chart

Von Apr 2023 bis Apr 2024