The Solutions Transformation Strategic push

lays the foundation to achieve sustainable growth and improved

margins

Belden provides new 2028 financial targets,

outlines a roadmap to achieving the 2025 Adjusted EPS target, and

announces a new $300 million share repurchase authorization

Belden Inc. (NYSE: BDC) (the “Company”), a leading global

supplier of network infrastructure and digitization solutions, will

host its 2024 Investor Day today at the Belden Customer Innovation

Center in Chicago, Illinois. Management will provide an update on

Belden’s Solutions transformation, key accelerators to drive

further growth and margin expansion, and new long-term targets that

support enhanced shareholder returns.

Ashish Chand, President and CEO said, “I am thrilled to

highlight the tremendous progress we have made as an organization

over the past few years by focusing on customer outcomes through

our solutions framework. Our transformation has been well received

by customers and partners, and I am excited to share how we will

continue to evolve the business and drive incremental growth.

Strong secular tailwinds combined with growing data needs and

complex network challenges provide Belden with the ideal

environment to drive solutions growth and differentiate our

offerings in the marketplace. As we advance our transformation

journey, growth in Belden Solutions will further enable improved

operating and financial performance.”

“At our last investor day in 2022, we set ambitious targets for

the organization to achieve through 2025. Despite destocking

headwinds that started last year, I am pleased to share that our

performance is on track to be consistent with our previously

articulated value creation framework,” said Dr. Chand.

“Importantly, we have a realistic path to achieve $8.00 of Adjusted

EPS in 2025, assuming modest improvement in demand next year,

consistent with an end to customer destocking. Progress towards

this target demonstrates the benefits of our Solutions

transformation and that our business can consistently grow and

increase earnings. I am extremely proud of our achievements and

confident in the future ahead as we advance our Solutions

framework.”

Long-Term Financial Targets

Driven by its strategic initiatives, the Company’s financial

targets through 2028 are as follows:

- Mid-single-digit annual revenue growth

- Incremental Adjusted EBITDA Margins between 25% to 30%

- Free cash flow margin approaching 10%

- Net leverage around 1.5 times

- Annual Adjusted EPS growth of 10% to 12%

New Share Repurchase Authorization

Belden announced today that its Board of Directors has approved

a new share repurchase authorization of $300 million of the

company's outstanding common stock. Combined with the $115 million

balance remaining from the previous authorization, Belden’s total

authorization now stands at $415 million.

"Execution of the Solutions transformation over the last several

years, combined with the company's operating discipline, are

delivering through-cycle revenue growth, margin improvement and

healthy free cash flow," said Jeremy Parks, Chief Financial

Officer. "We are focused on advancing our Solutions transformation,

and with our robust cash flow, we will continue to be able to

invest in the business while returning cash to shareholders through

repurchases."

Segments Renamed

As Belden continues to advance forward with solutions focused on

data infrastructure, today Belden announced a change to the names

of its two reportable segments. The former Industrial Automation

Solutions segment will be renamed Automation Solutions and the

former Enterprise Solutions segment will be renamed Smart

Infrastructure Solutions. The composition of the segments did not

change as a result of these name changes.

Webcast

The Company has scheduled a webcast of the 2024 Investor Day for

Thursday, September 12, 2024 at 10:00 a.m. Eastern Time. A link to

the live webcast can be found on the Company’s Investor Relations

website at https://investor.belden.com. A replay of the event and

related presentations will remain accessible in the investor

relations section of the Company’s website for a limited time.

Non-GAAP Measures

Our financial targets include non-GAAP measures such as Adjusted

EPS, Adjusted EBITDA margins, free cash flow margin and net

leverage. All references to Adjusted EPS within this earnings

release refer to adjusted net income per diluted share attributable

to Belden stockholders. We define free cash flow as net cash from

operating activities adjusted for capital expenditures net of the

proceeds from the disposal of assets. Free cash flow margin is

calculated as free cash flow divided by revenues during the

comparable period. Net leverage is calculated as (A) total debt

less cash and cash equivalents divided by (B) the sum of trailing

twelve months Adjusted EBITDA plus trailing twelve months

stock-based compensation expense.

Our financial targets are based upon information currently

available regarding events and conditions that will impact our

future operating results. In particular, our results are subject to

the factors listed under "Forward-Looking Statements" in this

release. In addition, our actual results are likely to be impacted

by other additional events for which information is not available,

such as asset impairments, adjustments related to acquisitions and

divestitures, severance, restructuring, and acquisition integration

costs, gains (losses) recognized on the disposal of assets, gains

(losses) on debt extinguishment, discontinued operations, and other

gains (losses) related to events or conditions that are not yet

known. Therefore we are unable to provide quantitative

reconciliations of forward-looking non-GAAP financial measures,

such as our financial targets, to the most directly comparable GAAP

financial measures, because it is difficult to reliably predict or

estimate the relevant components without unreasonable effort due to

future uncertainties that may potentially have a significant impact

on such calculations, and providing them may imply a degree of

precision that would be confusing or potentially misleading.

Forward-Looking Statements

This release contains, and any statements made by us concerning

the subject matter of this release may contain, forward-looking

statements, including our outlook for the remainder of 2024 and

beyond. Forward-looking statements also include any statements

regarding future financial performance (including revenues, growth,

expenses, earnings, margins, cash flows, dividends, capital

expenditures and financial condition), plans and objectives, and

related assumptions. In some cases these statements are

identifiable through the use of words such as “anticipate,”

“believe,” “estimate,” “forecast,” “guide,” “expect,” “intend,”

“plan,” “project,” “target,” “can,” “could,” “may,” “should,”

“will,” “would” and similar expressions. Forward-looking statements

reflect management’s current beliefs and expectations and are not

guarantees of future performance. Actual results may differ

materially from those suggested by any forward-looking statements

for a number of reasons, including, without limitation: the impact

of a challenging global economy, including the impact of inflation,

or a downturn in served markets; volatility in credit and foreign

exchange markets; the competitiveness of the global markets in

which we operate; the inability of the Company to develop and

introduce new products; competitive responses to our products; the

inability to execute and realize the expected benefits from

strategic initiatives (including revenue growth, cost control, and

productivity improvement programs); difficulty in forecasting

revenues due to the unpredictable timing of orders related to

customer projects as well as the impacts of channel inventory;

foreign and domestic political, economic and other uncertainties,

including changes in currency exchange rates; the impact of

disruptions in the global supply chain, including the inability to

timely obtain raw materials and components in sufficient quantities

on commercially reasonable terms; the inability to achieve our

strategic priorities in emerging markets; the impact of changes in

global tariffs and trade agreements; the presence of substitute

products in the marketplace; disruptions in the Company’s

information systems including due to cyber-attacks; inflation and

changes in the price and availability of raw materials leading to

higher input and labor costs; the possibility of future epidemics

or pandemics; changes in tax laws and variability in the Company’s

quarterly and annual effective tax rates; the increased prevalence

of cloud computing; the inability to successfully complete and

integrate acquisitions, in furtherance of the Company’s strategic

plan, as well as the inability to accurately forecast the financial

impacts of acquisitions; the inability to retain key employees;

disruption of, or changes in, the Company’s key distribution

channels; the presence of activists proposing certain actions by

the Company; perceived or actual product failures; the impact of

regulatory requirements and other legal compliance issues;

inability to satisfy the increasing expectations with respect to

environmental, social and governance matters; assertions that the

Company violates the intellectual property of others and the

ownership of intellectual property by competitors and others that

prevents the use of that intellectual property by the Company;

risks related to the use of open source software; the impairment of

goodwill and other intangible assets and the resulting impact on

financial performance; disruptions and increased costs attendant to

collective bargaining groups and other labor matters; and other

factors.

For a more complete discussion of risk factors, please see our

Annual Report on Form 10-K for the period ended December 31, 2023,

filed with the SEC on February 13, 2024. Although the content of

this release represents our best judgment as of the date of this

report based on information currently available and reasonable

assumptions, we give no assurances that the expectations will prove

to be accurate. Deviations from the expectations may be material.

For these reasons, Belden cautions readers to not place undue

reliance on these forward-looking statements, which speak only as

of the date made. Belden disclaims any duty to update any

forward-looking statements as a result of new information, future

developments, or otherwise, except as required by law.

About Belden

Belden Inc. delivers the infrastructure that makes the digital

journey simpler, smarter and secure. We’re moving beyond

connectivity, from what we make to what we make possible through a

performance-driven portfolio, forward-thinking expertise and

purpose-built solutions. With a legacy of quality and reliability

spanning 120-plus years, we have a strong foundation to continue

building the future. We are headquartered in St. Louis and have

manufacturing capabilities in North America, Europe, Asia, and

Africa. For more information, visit us at www.belden.com; follow us

on Facebook, LinkedIn and Twitter.

BDC-Financial

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240912943543/en/

Belden Investor Relations Aaron Reddington, CFA

(317) 219-9359 Investor.Relations@Belden.com

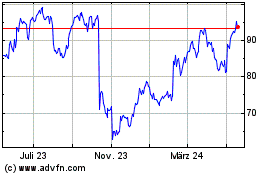

Belden (NYSE:BDC)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

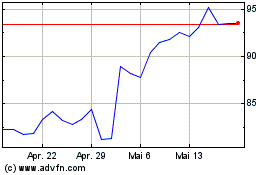

Belden (NYSE:BDC)

Historical Stock Chart

Von Nov 2023 bis Nov 2024