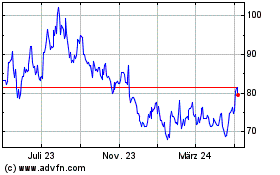

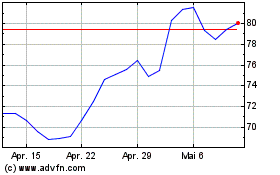

Alibaba Group Holding Limited (NYSE: BABA and HKEX: 9988,

“Alibaba” or “Alibaba Group”) today announced its financial results

for the quarter ended December 31, 2022.

“We delivered a solid quarter despite softer demand, supply

chain and logistics disruptions due to impact of changes in

COVID-19 measures,” said Daniel Zhang, Chairman and Chief Executive

Officer of Alibaba Group. “Looking ahead, we expect continued

recovery in consumer sentiment and economic activity. We are

focused on driving growth for our customers amid the competitive

landscape, and creating sustainable, long-term value for our

shareholders.”

“During the past quarter, we continued to improve operating

efficiency and cost optimization that resulted in robust profit

growth,” said Toby Xu, Chief Financial Officer of Alibaba Group.

“Our net cash position remains strong and we continue to generate

healthy cash flow. During the quarter ended December 31, 2022, we

repurchased 45.4 million ADSs for approximately US$3.3 billion

under our share repurchase program as part of our ongoing

commitment to improve our shareholder return.”

BUSINESS HIGHLIGHTS

In the quarter ended December 31,

2022:

- Revenue was RMB247,756 million (US$35,921 million), an

increase of 2% year-over-year.

- Income from operations was RMB35,031 million (US$5,079

million), an increase of 396% or RMB27,963 million year-over-year,

primarily due to a RMB22,427 million decrease in impairment of

goodwill in relation to Digital media and entertainment segment. We

excluded impairment of goodwill from our non-GAAP measurements.

Adjusted EBITA, a non-GAAP measurement, was RMB52,048

million (US$7,546 million), an increase of 16% year-over-year.

- Net income attributable to ordinary shareholders was

RMB46,815 million (US$6,788 million). Net income was

RMB45,746 million (US$6,633 million), an increase of 138% or

RMB26,522 million year-over-year, primarily due to a RMB22,427

million decrease in impairment of goodwill in relation to Digital

media and entertainment segment. Non-GAAP net income was

RMB49,932 million (US$7,239 million), an increase of 12%

year-over-year.

- Diluted earnings per ADS was RMB17.91 (US$2.60) and

diluted earnings per share was RMB2.24 (US$0.32 or HK$2.51).

Non-GAAP diluted earnings per ADS was RMB19.26 (US$2.79), an

increase of 14% year-over-year and non-GAAP diluted earnings per

share was RMB2.41 (US$0.35 or HK$2.70), an increase of 14%

year-over-year.

- Net cash provided by operating activities was RMB87,370

million (US$12,668 million), an increase of 9% compared to

RMB80,366 million in the same quarter of 2021. Free cash

flow, a non-GAAP measurement of liquidity, was RMB81,514

million (US$11,818 million), an increase of 15% compared to

RMB71,022 million in the same quarter of 2021.

BUSINESS AND STRATEGIC UPDATES

China Commerce

China commerce segment mainly includes our China commerce retail

businesses such as Taobao, Tmall, Taobao Deals, Taocaicai,

Freshippo, Tmall Supermarket, Sun Art, Tmall Global and Alibaba

Health, as well as wholesale businesses including 1688.com.

For the quarter ended December 31, 2022, online physical goods

GMV generated on Taobao and Tmall, excluding unpaid orders,

declined mid-single-digit year-over-year, mainly due to soft

consumption demand and ongoing competition as well as a surge in

COVID-19 cases in China that resulted in supply chain and logistics

disruptions in December. The declining GMV was driven by weakening

demand in fashion & accessories category, which was partially

offset by accelerating growth for healthcare, pet care and fresh

produce, as well as narrowing decline for consumer electronics

category.

Taobao Deals, our value-for-money platform, continues to enrich

product supply and enhance digital consumption experience for price

sensitive consumers. Taobao Deals has continued to help an

expanding base of manufacturers to sell directly to consumers (M2C)

and, in the December quarter, paid GMV of M2C products grew more

than 35% year-over-year on Taobao and Taobao Deals. Taocaicai

continues to drive category penetration in high purchase frequency

categories of groceries and fresh produce on our China retail

marketplaces. During the quarter, both Taobao Deals and Taocaicai

continued to narrow losses year-over-year by optimizing user

acquisition and improving overall operating efficiency.

During the quarter ended December 31, 2022, our direct sales and

others revenue grew 10% year-over-year to RMB74,421 million

(US$10,790 million), primarily driven by strong revenue growth of

Freshippo and Alibaba Health. Freshippo delivered double-digit same

store sales growth and expanded its digital and physical footprints

in targeted cities throughout China during the quarter. It also

continued to strengthen its merchandising capability, improve

delivery efficiency and enhance operations that contributed to

higher gross margin and significant loss reduction year-over-year

in the quarter. Benefitting from surging demand for medical and

healthcare products due to COVID-19 resurgence in December, Alibaba

Health achieved rapid year-over-year revenue growth during the

quarter.

International Commerce

Our International commerce retail businesses include Lazada,

AliExpress, Trendyol and Daraz. During the December quarter, the

combined order growth of Lazada, AliExpress, Trendyol and Daraz was

3% year-over-year, primarily driven by the robust order growth of

Trendyol.

During the quarter, the decline in AliExpress orders continued

to narrow compared to prior quarters. AliExpress continues to

improve consumer experience by strengthening its cross-border

delivery capabilities in partnership with Cainiao. Cross-border

delivery lead time has significantly improved in strategic

countries.

In Southeast Asia, Lazada saw recovering order growth that was

up slightly year-over-year. Lazada continues to improve

monetization rate by offering more value-added services and to

enhance operating efficiency. During the quarter, losses per order

for Lazada continued to improve compared to the same period last

year.

Trendyol delivered a robust year-over-year order growth in the

December quarter that was driven by rapid growth of its local

consumer service business and strong growth of its e-commerce

business.

Local Consumer Services

Local consumer services segment includes "To-Home" and

"To-Destination" businesses. For the quarter ended December 31,

2022, Local consumer services order volume growth was flat

year-over-year. Segment losses continued to narrow driven by

improving business efficiency of Ele.me.

To-Home

During the quarter, Ele.me continued to deliver positive GMV

growth driven by higher average order value and improving

year-over-year order growth that turned positive in the month of

December. As COVID-19 restrictions eased in December 2022, Ele.me

was able to adapt quickly to meet surging demands for groceries and

medicine, and the robust growth of these non-restaurant orders with

higher order value drove the increase in the overall average order

value of Ele.me. For the quarter ended December 31, 2022, Ele.me's

unit economics per order continued to be positive due to increased

average order value as well as reduced delivery cost per order

year-over-year.

To-Destination

In the quarter ended December 31, 2022, order volume of

"To-Destination" businesses slowed in the month of December, which

was negatively impacted by rising COVID-19 cases throughout China.

In January 2023, as COVID-19 cases stabilized and travel demand

improved, Amap saw recovering demand for its usage, and Fliggy’s

outbound travel business grew rapidly as well.

Cainiao

In the quarter ended December 31, 2022, revenue from Cainiao,

before inter-segment elimination, grew 17% year-over-year to

RMB23,023 million (US$3,338 million) of which 72% was generated

from external customers. Revenue from Cainiao, after inter-segment

elimination, grew 27% year-over-year to RMB16,553 million (US$2,400

million), primarily contributed by the increase in revenue from

domestic consumer logistics services as a result of service model

upgrade since late 2021 to enhance customer experience, and

international fulfillment solution services.

Cainiao continues to expand its international logistics network

by strengthening its end-to-end logistics capabilities, including

eHubs, line-haul, sorting centers and last-mile network. In the

quarter ended December 31, 2022, Cainiao commenced operation of

five new international sorting centers, bringing the number of

overseas sorting centers in operation to fifteen.

In China, Cainiao continues to expand its door-step delivery

services for our China commerce consumers. During the 11.11 Global

Shopping Festival period, peak daily door-step deliveries exceeded

18 million, including those delivered directly to door or through

Cainiao Post.

Cloud

Our Cloud segment comprises Alibaba Cloud and DingTalk. For the

quarter ended December 31, 2022, total revenue from our Cloud

segment before inter-segment elimination, which includes revenue

from services provided to other Alibaba businesses, was RMB26,693

million (US$3,870 million). For the quarter ended December 31,

2022, revenue after inter-segment elimination grew 3%

year-over-year to RMB20,179 million (US$2,925 million) mainly

driven by healthy public cloud growth, partially offset by

declining hybrid cloud revenue, as we continue to drive

high-quality, recurring revenue growth.

During the quarter, after inter-segment elimination, revenue

from non-Internet industries grew 9% year-over-year and contributed

53% of overall Cloud revenue. The non-Internet revenue growth was

mainly driven by solid growth of revenue from financial services,

education and automobile industries, which was partially offset by

the decline in revenue from public services industry. Revenue from

customers in the Internet industry declined by 4% year-over-year,

mainly driven by declining revenue from the top Internet customer

that has gradually stopped using our overseas cloud services for

its international business, partially offset by improving demands

from other customers in China’s Internet industry.

Alibaba Cloud continues to develop, expand and support our

partners to better serve our enterprise customers. Highlights

during the quarter ended December 31, 2022 include:

- Data Centers and Hardware: In December 2022, Alibaba

Cloud continues to ramp up its international presence and commenced

operation of its third data center in Japan to support the growing

cloud service demands from customers in the country. As we added

new data centers in Saudi Arabia, Germany, Thailand, South Korea

and Japan in 2022, Alibaba Cloud now offers computing services in

28 regions and 86 availability zones globally.

- Public Cloud: Alibaba Cloud was recognized as a leader

among the eleven Chinese public cloud providers evaluated in the

Forrester report (The Forrester Wave™ Public Cloud Development and

Infrastructure Platforms in China, Q4 2022) published in December

2022. Alibaba Cloud received the highest score in product offerings

and product strategies.

Digital Media and

Entertainment

In the December quarter, Youku’s daily average paying subscriber

base increased 2% year-over-year, primarily driven by quality

content and continued contribution from our 88VIP membership

program. Youku continues to improve operating efficiency through

disciplined investment in content and production capability, which

resulted in narrowing of losses year-over-year for seven

consecutive quarters.

Updates on ESG

Initiatives

China Rural Village COVID-19 Relief Support

COVID-19 resurged in China towards the end of 2022, and we

leveraged our digital, supply, and logistics capabilities to

support a smooth recovery for those in need.

- Alibaba Health: Alibaba Health launched 24-hour online

consultations for patients. Alibaba Health also supported the

timely delivery of medicines and medical supplies in more than 20

regions in different cities and provinces.

- Oximeter donation: In January 2023, we cooperated with

the China Social Entrepreneur Foundation and donated RMB125 million

(US$18.1 million) through the Alibaba Foundation to procure two

finger-clip oximeters for each of more than 600,000 village

clinics. Cainiao shipped more than one million oximeters within

four days. The initiative was completed before Chinese New Year and

helped address the pain points of low level of medical care and

resources in rural areas.

Türkiye Earthquake Emergency Relief

On February 6, 2023, two huge earthquakes struck Türkiye. We

quickly established an emergency working group to monitor the

safety of our employees in the region and delivered urgently needed

supplies to support local disaster relief activities. Trendyol

mobilized its resources to aid in disaster relief, including

sourcing urgently needed supplies, leveraging its logistics

capabilities to deliver to disaster-hit areas, and helping raise

donations from the global community as part of the “Türkiye

Earthquake Solidarity Campaign” to support NGOs providing disaster

relief on the ground. Alibaba helped deliver winter supplies from

China, including sleeping bags and outdoor jackets, to disaster

victims in Türkiye, and helped build a digital disaster relief

platform, which the Chinese Red Cross Foundation used to more

effectively and efficiently coordinate Chinese organizations to

participate in earthquake relief efforts.

Share Repurchases

During the quarter ended December 31, 2022, we repurchased 45.4

million ADSs (the equivalent of 363.3 million ordinary shares) for

approximately US$3.3 billion under our share repurchase program. As

of December 31, 2022, we had approximately 20.7 billion ordinary

shares (the equivalent of 2.6 billion ADSs) outstanding, and

approximately US$21.3 billion remaining under the current

authorization, effective through March 2025.

DECEMBER QUARTER SUMMARY FINANCIAL RESULTS

Three months ended December

31,

2021

2022

RMB

RMB

US$

YoY % Change

(in millions, except

percentages and per share amounts)

Revenue

242,580

247,756

35,921

2%

Income from operations

7,068

35,031

5,079

396%(2)

Operating margin

3%

14%

Adjusted EBITDA(1)

51,364

59,162

8,578

15%(3)

Adjusted EBITDA margin(1)

21%

24%

Adjusted EBITA(1)

44,822

52,048

7,546

16%(3)

Adjusted EBITA margin(1)

18%

21%

Net income

19,224

45,746

6,633

138%(4)

Net income attributable to ordinary

shareholders(5)

27,692

46,815

6,788

69%(4)

Non-GAAP net income(1)

44,624

49,932

7,239

12%(3)

Diluted earnings per share(5) (6)

1.27

2.24

0.32

76%(4) (7)

Diluted earnings per ADS(5) (6)

10.19

17.91

2.60

76%(4) (7)

Non-GAAP diluted earnings per share(1)

(6)

2.11

2.41

0.35

14%(3) (7)

Non-GAAP diluted earnings per ADS(1)

(6)

16.87

19.26

2.79

14%(3) (7)

________________

(1)

See the sections entitled “Non-GAAP

Financial Measures” and “Reconciliations of Non-GAAP Measures to

the Nearest Comparable U.S. GAAP Measures” for more information

about the non-GAAP measures referred to within this results

announcement.

(2)

The year-over-year increase was primarily

due to a RMB22,427 million decrease in impairment of goodwill in

relation to Digital media and entertainment segment. We excluded

impairment of goodwill from our non-GAAP measurements.

(3)

The year-over-year increase was primarily

due to the narrowed adjusted EBITA losses of International

commerce, Local consumer services and Digital media and

entertainment, as well as an increase in China commerce adjusted

EBITA.

(4)

The year-over-year increase of net income

was primarily due to a RMB22,427 million decrease in impairment of

goodwill in relation to Digital media and entertainment segment,

while net income attributable to ordinary shareholders and earnings

per share/ADS would further take into account the relevant

attributions to noncontrolling interests.

(5)

As noted in our results announcement for

the quarter and fiscal year ended March 31, 2022, which we

announced on May 26, 2022, net income attributable to ordinary

shareholders and earnings per share/ADS in the consolidated

financial information for the three months and nine months ended

December 31, 2021, which we announced on February 24, 2022, were

understated. This understatement was due to a non-cash goodwill

impairment charge that should have been partially attributed to

noncontrolling interests but was fully recorded in net income

attributable to ordinary shareholders. We have performed

quantitative and qualitative assessments and concluded that the

effect of the attribution was not material to the consolidated

financial information for the three months and nine months ended

December 31, 2021. The financial results for the three months and

nine months ended December 31, 2021 as presented have been revised

to reflect the above attribution (“Revised attribution to

noncontrolling interests”).

(6)

Each ADS represents eight ordinary

shares.

(7)

The year-over-year percentages as stated

are calculated based on the exact amount and there may be minor

differences from the year-over-year percentages calculated based on

the RMB amounts after rounding.

DECEMBER QUARTER INFORMATION BY SEGMENTS

The table below sets forth selected financial information of our

operating segments for the periods indicated:

Three months ended December

31, 2022

China

commerce(1)

International

commerce

Local

consumer

services(1)

Cainiao

Cloud

Digital

media and

entertainment

Innovation

initiatives

and others

Unallocated(2)

Consolidated

RMB

RMB

RMB

RMB

RMB

RMB

RMB

RMB

RMB

US$

(in millions, except

percentages)

Revenue

169,986

19,465

13,164

16,553

20,179

7,586

823

—

247,756

35,921

YoY% change

(1

)%

18

%

6

%

27

%

3

%

(6

)%

(20

)%

N/A

2

%

Income (Loss) from operations

53,127

(1,661

)

(5,473

)

(983

)

(1,495

)

(1,024

)

(1,933

)

(5,527

)

35,031

5,079

Add: Share-based compensation expense

2,390

869

942

717

1,848

522

487

998

8,773

1,272

Add: Amortization and impairment of

intangible assets

3,110

29

1,394

254

3

477

211

52

5,530

801

Add: Impairment of goodwill

—

—

—

—

—

—

—

2,714

2,714

394

Adjusted EBITA

58,627

(763

)

(3,137

)

(12

)

356

(25

)

(1,235

)

(1,763

)

52,048

7,546

Adjusted EBITA YoY% change(3)

1

%

74

%

38

%

87

%

166

%

98

%

23

%

17

%

16

%

Adjusted EBITA margin

34

%

(4

)%

(24

)%

(0

)%

2

%

(0

)%

(150

)%

N/A

21

%

Three months ended December

31, 2021

China

commerce(1)

International

commerce

Local

consumer

services(1)

Cainiao

Cloud

Digital

media and

entertainment

Innovation

initiatives

and others

Unallocated(2)

Consolidated

RMB

RMB

RMB

RMB

RMB

RMB

RMB

RMB

RMB

(in millions, except

percentages)

Revenue

171,901

16,449

12,466

13,078

19,539

8,113

1,034

—

242,580

Income (Loss) from operations

54,558

(3,707

)

(7,733

)

(987

)

(2,137

)

(2,139

)

(2,434

)

(28,353

)

7,068

Add: Share-based compensation expense

2,740

769

1,158

639

2,267

566

608

1,029

9,776

Add: Amortization of intangible assets

580

21

1,499

256

4

199

217

61

2,837

Add: Impairment of goodwill

—

—

—

—

—

—

—

25,141

25,141

Adjusted EBITA

57,878

(2,917

)

(5,076

)

(92

)

134

(1,374

)

(1,609

)

(2,122

)

44,822

Adjusted EBITA margin

34

%

(18

)%

(41

)%

(1

)%

1

%

(17

)%

(156

)%

N/A

18

%

Nine months ended December 31,

2022

China

commerce(1)

International

commerce

Local

consumer

services(1)

Cainiao

Cloud

Digital

media and

entertainment

Innovation

initiatives

and others

Unallocated(2)

Consolidated

RMB

RMB

RMB

RMB

RMB

RMB

RMB

RMB

RMB

US$

(in millions, except

percentages)

Revenue

446,658

50,663

37,563

42,062

58,621

23,209

1,711

—

660,487

95,762

YoY% change

(1

)%

8

%

11

%

22

%

5

%

(4

)%

(30

)%

N/A

2

%

Income (Loss) from operations

135,662

(5,455

)

(16,703

)

(2,455

)

(4,241

)

(2,936

)

(6,972

)

(11,789

)

85,111

12,340

Add: Share-based compensation expense

6,425

2,096

2,609

1,622

5,269

1,315

1,262

2,687

23,285

3,376

Add: Amortization and impairment of

intangible assets

4,288

69

4,226

761

9

849

633

175

11,010

1,596

Add: Impairment of goodwill

—

—

—

—

—

—

—

2,714

2,714

394

Add: Equity-settled donation expense

—

—

—

—

—

—

—

511

511

74

Adjusted EBITA

146,375

(3,290

)

(9,868

)

(72

)

1,037

(772

)

(5,077

)

(5,702

)

122,631

17,780

Adjusted EBITA YoY% change(3)

(3

)%

49

%

40

%

87

%

19

%

72

%

(9

)%

(2

)%

7

%

Adjusted EBITA margin

33

%

(6

)%

(26

)%

(0

)%

2

%

(3

)%

(297

)%

N/A

19

%

Nine months ended December 31,

2021

China

commerce(1)

International

commerce

Local

consumer

services(1)

Cainiao

Cloud

Digital

media and

entertainment

Innovation

initiatives

and others

Unallocated(2)

Consolidated

RMB

RMB

RMB

RMB

RMB

RMB

RMB

RMB

RMB

(in millions, except

percentages)

Revenue

451,501

46,743

33,920

34,525

55,597

24,267

2,457

—

649,010

Income (Loss) from operations

139,980

(8,737

)

(24,214

)

(2,839

)

(5,765

)

(4,849

)

(6,697

)

(33,958

)

52,921

Add: Share-based compensation expense

7,980

2,233

3,035

1,481

6,623

1,515

1,775

3,066

27,708

Add: Amortization of intangible assets

2,237

76

4,655

805

12

610

245

176

8,816

Add: Impairment of goodwill

—

—

—

—

—

—

—

25,141

25,141

Adjusted EBITA

150,197

(6,428

)

(16,524

)

(553

)

870

(2,724

)

(4,677

)

(5,575

)

114,586

Adjusted EBITA margin

33

%

(14

)%

(49

)%

(2

)%

2

%

(11

)%

(190

)%

N/A

18

%

________________

(1)

Beginning on October 1, 2022, we

reclassified the results of our Instant Supermarket Delivery (全能�市)

business, which was previously reported under China commerce

segment, to Local consumer services segment following the strategy

refinement of Instant Supermarket Delivery business to focus on

building customer mindshare for grocery delivery services through

Ele.me platform. This reclassification conforms to the way that we

manage and monitor segment performance. Comparative figures were

reclassified to conform to this presentation.

(2)

Unallocated expenses primarily relate to

corporate administrative costs and other miscellaneous items that

are not allocated to individual segments. The goodwill impairment,

and the equity-settled donation expense related to the allotment of

shares to a charitable trust, are presented as unallocated items in

the segment information because our management does not consider

these as part of the segment operating performance measure.

(3)

For a more intuitive presentation,

widening of loss in YoY% is shown in terms of negative growth rate,

and narrowing of loss in YoY% is shown in terms of positive growth

rate.

DECEMBER QUARTER SEGMENT RESULTS

Revenue

Revenue for the quarter ended December 31, 2022 was RMB247,756

million (US$35,921 million), an increase of 2% compared to

RMB242,580 million in the same quarter of 2021.

The following table sets forth a breakdown of our revenue by

segment for the periods indicated:

Three months ended December

31,

2021

2022

RMB

% of Revenue

RMB

US$

% of Revenue

YoY % Change

(in millions, except

percentages)

China commerce:

China commerce retail

- Customer management

100,089

41

%

91,344

13,244

37

%

(9

)%

- Direct sales and others(1) (2)

67,581

28

%

74,421

10,790

30

%

10

%

167,670

69

%

165,765

24,034

67

%

(1

)%

China commerce wholesale

4,231

2

%

4,221

612

2

%

(0

)%

Total China commerce

171,901

71

%

169,986

24,646

69

%

(1

)%

International commerce:

International commerce retail

11,606

5

%

14,644

2,123

6

%

26

%

International commerce wholesale

4,843

2

%

4,821

699

2

%

(0

)%

Total International commerce

16,449

7

%

19,465

2,822

8

%

18

%

Local consumer services(1)

12,466

5

%

13,164

1,909

5

%

6

%

Cainiao

13,078

5

%

16,553

2,400

7

%

27

%

Cloud

19,539

8

%

20,179

2,925

8

%

3

%

Digital media and entertainment

8,113

3

%

7,586

1,100

3

%

(6

)%

Innovation initiatives and others

1,034

1

%

823

119

0

%

(20

)%

Total

242,580

100

%

247,756

35,921

100

%

2

%

________________

(1)

Beginning on October 1, 2022, we

reclassified the revenue of our Instant Supermarket Delivery (全能�市)

business, which was previously reported under China commerce

segment, as revenue from Local consumer services segment following

the strategy refinement of Instant Supermarket Delivery business to

focus on building customer mindshare for grocery delivery services

through Ele.me platform. This reclassification conforms to the way

that we manage and monitor segment performance. Comparative figures

were reclassified to conform to this presentation.

(2)

Direct sales and others revenue under

China commerce retail primarily represents our direct sales

businesses, comprising mainly Sun Art, Tmall Supermarket and

Freshippo, where revenue and the cost of inventory are recorded on

a gross basis.

China Commerce

(i) Segment revenue

- China Commerce Retail Business

Revenue from our China commerce retail business in the quarter

ended December 31, 2022 was RMB165,765 million (US$24,034 million),

a decrease of 1% compared to RMB167,670 million in the same quarter

of 2021.

Customer management revenue decreased by 9% year-over-year,

primarily due to the mid-single-digit decline of online physical

goods GMV generated on Taobao and Tmall, excluding unpaid orders

year-over-year, which was mainly due to soft consumption demand and

ongoing competition as well as a surge in COVID-19 cases in China

that resulted in supply chain and logistics disruptions in December

2022.

Direct sales and others revenue under China commerce retail

business in the quarter ended December 31, 2022 was RMB74,421

million (US$10,790 million), an increase of 10% compared to

RMB67,581 million in the same quarter of 2021, primarily due to the

revenue growth contributed by our Freshippo and Alibaba Health’s

direct sales businesses.

- China Commerce Wholesale Business

Revenue from our China commerce wholesale business in the

quarter ended December 31, 2022 was RMB4,221 million (US$612

million), remained stable compared to RMB4,231 million in the same

quarter of 2021.

(ii) Segment adjusted EBITA

China commerce adjusted EBITA increased by 1% to RMB58,627

million (US$8,500 million) in the quarter ended December 31, 2022,

compared to RMB57,878 million in the same quarter of 2021. The

increase was primarily due to reduced losses of Taobao Deals,

Freshippo and Taocaicai, partly offset by a decrease in profit from

customer management services. Adjusted EBITA margin remained stable

at 34% in the quarter ended December 31, 2022, as compared to the

same quarter of 2021. During the quarter ended December 31, 2022,

Taobao Deals significantly narrowed losses year-over-year, driven

by optimized spending in user acquisition. Freshippo significantly

narrowed losses year-over-year, mainly due to the improved gross

margin and fulfillment efficiency. Taocaicai significantly narrowed

losses year-over-year, driven by improving overall operating

efficiency.

International Commerce

(i) Segment revenue

- International Commerce Retail Business

Revenue from our International commerce retail business in the

quarter ended December 31, 2022 was RMB14,644 million (US$2,123

million), an increase of 26% compared to RMB11,606 million in the

same quarter of 2021. The increase was primarily due to an increase

in revenue contributed by Trendyol. The increase in revenue from

Trendyol resulted from robust year-over-year order growth and more

efficient use of subsidies.

- International Commerce Wholesale Business

Revenue from our International commerce wholesale business in

the quarter ended December 31, 2022 was RMB4,821 million (US$699

million), remained stable compared to RMB4,843 million in the same

quarter of 2021.

(ii) Segment adjusted EBITA

International commerce adjusted EBITA was a loss of RMB763

million (US$111 million) in the quarter ended December 31, 2022,

compared to a loss of RMB2,917 million in the same quarter of 2021.

The decrease in loss year-over-year was primarily due to the

reduced losses from Trendyol and Lazada. The reduced loss from

Trendyol is primarily due to revenue growth and enhanced operating

efficiency. Continued narrowing of losses from Lazada was a result

of continued improvement in monetization rate by offering more

value-added services as well as enhanced operating efficiency.

Local Consumer Services

(i) Segment revenue

Revenue from Local consumer services, which includes “To-Home”

and “To-Destination” businesses such as Ele.me, Amap and Fliggy,

was RMB13,164 million (US$1,909 million) in the quarter ended

December 31, 2022, an increase of 6% compared to RMB12,466 million

in the same quarter of 2021, primarily due to positive GMV growth

of “To-Home” business driven by higher average order value of

Ele.me.

(ii) Segment adjusted EBITA

Local consumer services adjusted EBITA was a loss of RMB3,137

million (US$455 million) in the quarter ended December 31, 2022,

compared to a loss of RMB5,076 million in the same quarter of 2021,

primarily due to the continued narrowing of loss from our “To-Home”

business. Narrowing of loss from our “To-Home” business was driven

by Ele.me’s improved unit economics per order, which was due to

increased average order value and reduced delivery cost per order

year-over-year.

Cainiao

(i) Segment revenue

Revenue from Cainiao, which represents revenue from its domestic

and international one-stop-shop logistics services and supply chain

management solutions, after inter-segment elimination, was

RMB16,553 million (US$2,400 million) in the quarter ended December

31, 2022, an increase of 27% compared to RMB13,078 million in the

same quarter of 2021, primarily contributed by the increase in

revenue from domestic consumer logistics services as a result of

service model upgrade since late 2021 whereby Cainiao takes on more

responsibilities throughout the logistics process to better serve

customers and enhance customer experience, as well as the increase

in revenue from international fulfillment solution services.

Total revenue generated by Cainiao, before inter-segment

elimination, which includes revenue from services provided to other

Alibaba businesses, was RMB23,023 million (US$3,338 million), an

increase of 17% compared to RMB19,600 million in the same quarter

of 2021.

(ii) Segment adjusted EBITA

Cainiao adjusted EBITA was a loss of RMB12 million (US$2

million) in the quarter ended December 31, 2022, compared to a loss

of RMB92 million in the same quarter of 2021.

Cloud

(i) Segment revenue

Revenue from our Cloud segment, after inter-segment elimination,

was RMB20,179 million (US$2,925 million) in the quarter ended

December 31, 2022, an increase of 3% compared to RMB19,539 million

in the same quarter of 2021. Year-over-year revenue growth of our

Cloud segment reflected the revenue growth from non-Internet

industries driven by solid growth of revenue from financial

services, education and automobile industries, which was partially

offset by the decline in revenue from public services industry.

Total revenue from our Cloud segment, before inter-segment

elimination, which includes revenue from services provided to other

Alibaba businesses, was RMB26,693 million (US$3,870 million), an

increase of 1% compared to RMB26,431 million in the same quarter of

2021.

(ii) Segment adjusted EBITA

Cloud adjusted EBITA, which comprises Alibaba Cloud and

DingTalk, was RMB356 million (US$52 million) in the quarter ended

December 31, 2022, compared to RMB134 million in the same quarter

of 2021.

Digital Media and

Entertainment

(i) Segment revenue

Revenue from our Digital media and entertainment segment in the

quarter ended December 31, 2022 was RMB7,586 million (US$1,100

million), a decrease of 6%, compared to RMB8,113 million in the

same quarter of 2021, primarily due to the decrease in revenue from

Alibaba Pictures.

(ii) Segment adjusted EBITA

Digital media and entertainment adjusted EBITA in the quarter

ended December 31, 2022 was a loss of RMB25 million (US$4 million),

compared to a loss of RMB1,374 million in the same quarter of 2021,

primarily due to the narrowing of loss from Youku driven by

disciplined investment in content and production capability.

Innovation Initiatives and

Others

(i) Segment revenue

Revenue from Innovation initiatives and others was RMB823

million (US$119 million) in the quarter ended December 31, 2022, a

decrease of 20% compared to RMB1,034 million in the same quarter of

2021.

(ii) Segment adjusted EBITA

Innovation initiatives and others adjusted EBITA in the quarter

ended December 31, 2022 was a loss of RMB1,235 million (US$179

million), compared to a loss of RMB1,609 million in the same

quarter of 2021.

DECEMBER QUARTER OTHER FINANCIAL RESULTS

Costs and Expenses

The following tables set forth a breakdown of our costs and

expenses, share-based compensation expense, and costs and expenses

excluding share-based compensation expense by function for the

periods indicated.

Three months ended December

31,

% of Revenue YoY

change

2021

2022

RMB

% of Revenue

RMB

US$

% of Revenue

(in millions, except

percentages)

Costs and expenses:

Cost of revenue

146,658

61

%

150,005

21,749

61

%

0

%

Product development expenses

15,705

6

%

13,521

1,960

6

%

0

%

Sales and marketing expenses

36,706

15

%

30,628

4,441

12

%

(3

)%

General and administrative expenses

8,465

4

%

10,327

1,497

4

%

0

%

Amortization and impairment of intangible

assets

2,837

1

%

5,530

801

2

%

1

%

Impairment of goodwill

25,141

10

%

2,714

394

1

%

(9

)%

Total costs and expenses

235,512

97

%

212,725

30,842

86

%

(11

)%

Share-based compensation

expense:

Cost of revenue

2,307

1

%

1,660

241

1

%

0

%

Product development expenses

4,196

2

%

3,755

544

2

%

0

%

Sales and marketing expenses

1,199

0

%

1,081

157

0

%

0

%

General and administrative expenses

2,074

1

%

2,277

330

1

%

0

%

Total share-based compensation expense

9,776

4

%

8,773

1,272

4

%

0

%

Costs and expenses excluding

share-based compensation expense:

Cost of revenue

144,351

60

%

148,345

21,508

60

%

0

%

Product development expenses

11,509

4

%

9,766

1,416

4

%

0

%

Sales and marketing expenses

35,507

15

%

29,547

4,284

12

%

(3

)%

General and administrative expenses

6,391

3

%

8,050

1,167

3

%

0

%

Amortization and impairment of intangible

assets

2,837

1

%

5,530

801

2

%

1

%

Impairment of goodwill

25,141

10

%

2,714

394

1

%

(9

)%

Total costs and expenses excluding

share-based compensation expense

225,736

93

%

203,952

29,570

82

%

(11

)%

Cost of revenue – Cost of revenue in the quarter ended

December 31, 2022 was RMB150,005 million (US$21,749 million), or

61% of revenue, compared to RMB146,658 million, or 61% of revenue,

in the same quarter of 2021. Without the effect of share-based

compensation expense, cost of revenue as a percentage of revenue

would have remained stable at 60% in the quarter ended December 31,

2022, as compared to the same quarter last year.

Product development expenses – Product development

expenses in the quarter ended December 31, 2022 were RMB13,521

million (US$1,960 million), or 6% of revenue, compared to RMB15,705

million, or 6% of revenue, in the same quarter of 2021. Without the

effect of share-based compensation expense, product development

expenses as a percentage of revenue would have remained stable at

4% in the quarter ended December 31, 2022, as compared to the same

quarter last year.

Sales and marketing expenses – Sales and marketing

expenses in the quarter ended December 31, 2022 were RMB30,628

million (US$4,441 million), or 12% of revenue, compared to

RMB36,706 million, or 15% of revenue, in the same quarter of 2021.

Without the effect of share-based compensation expense, sales and

marketing expenses as a percentage of revenue would have decreased

from 15% in the quarter ended December 31, 2021 to 12% in the

quarter ended December 31, 2022.

General and administrative expenses – General and

administrative expenses in the quarter ended December 31, 2022 were

RMB10,327 million (US$1,497 million), or 4% of revenue, compared to

RMB8,465 million, or 4% of revenue, in the same quarter of 2021.

Without the effect of share-based compensation expense, general and

administrative expenses as a percentage of revenue would have

remained stable at 3% in the quarter ended December 31, 2022, as

compared to the same quarter last year.

Share-based compensation expense – Total share-based

compensation expense included in the cost and expense items above

in the quarter ended December 31, 2022 was RMB8,773 million

(US$1,272 million), compared to RMB9,776 million in the same

quarter of 2021. Share-based compensation expense as a percentage

of revenue remained stable at 4% in the quarter ended December 31,

2022, as compared to the same quarter last year.

The following table sets forth our analysis of share-based

compensation expense for the quarters indicated by type of

share-based awards:

Three months ended December

31,

2021

2022

% Change

RMB

% of Revenue

RMB

US$

% of Revenue

YoY

(in millions, except

percentages)

By type of awards:

Alibaba Group share-based awards(1)

7,874

3

%

6,841

992

3

%

(13

)%

Ant Group share-based awards(2)

340

0

%

354

51

0

%

4

%

Others(3)

1,562

1

%

1,578

229

1

%

1

%

Total share-based compensation expense

9,776

4

%

8,773

1,272

4

%

(10

)%

________________

(1)

This represents Alibaba Group share-based

awards granted to our employees.

(2)

This represents Ant Group share-based

awards granted to our employees, which is subject to mark-to-market

accounting treatment.

(3)

This represents share-based awards of our

subsidiaries.

Share-based compensation expense related to Alibaba Group

share-based awards decreased in the quarter ended December 31, 2022

compared to the same quarter of 2021. This decrease is primarily

due to the general decrease in the average fair market value of the

awards granted.

We expect that our share-based compensation expense will

continue to be affected by changes in the fair value of the

underlying awards and the quantity of awards we grant in the

future.

Amortization and impairment of intangible assets –

Amortization and impairment of intangible assets in the quarter

ended December 31, 2022 was RMB5,530 million (US$801 million), an

increase of 95% from RMB2,837 million in the same quarter of 2021,

primarily due to impairment losses of intangible assets recorded in

the quarter ended December 31, 2022.

Impairment of goodwill - Impairment of goodwill in the

quarter ended December 31, 2022 was RMB2,714 million (US$394

million), a decrease of 89% or RMB22,427 million, from RMB25,141

million in the same quarter of 2021. Impairment recorded in both

years represents the amount by which the carrying value of certain

reporting units within the Digital media and entertainment segment

exceeds their fair value, based on an annual goodwill impairment

assessment.

Income from operations and operating

margin

Income from operations in the quarter ended December 31, 2022

was RMB35,031 million (US$5,079 million), or 14% of revenue, an

increase of 396% or RMB27,963 million year-over-year, compared to

RMB7,068 million, or 3% of revenue, in the same quarter of 2021.

The year-over-year increase was primarily due to a RMB22,427

million decrease in impairment of goodwill in relation to Digital

media and entertainment segment. Excluding the impairment of

goodwill, income from operations would have increased by 17%

year-over-year, from RMB32,209 million in the quarter ended

December 31, 2021 to RMB37,745 million (US$5,473 million) in the

quarter ended December 31, 2022.

Adjusted EBITDA and Adjusted

EBITA

Adjusted EBITDA increased 15% year-over-year to RMB59,162

million (US$8,578 million) in the quarter ended December 31, 2022,

compared to RMB51,364 million in the same quarter of 2021. Adjusted

EBITA increased 16% year-over-year to RMB52,048 million (US$7,546

million) in the quarter ended December 31, 2022, compared to

RMB44,822 million in the same quarter of 2021. The year-over-year

increase was primarily due to the narrowed adjusted EBITA losses of

International commerce, Local consumer services and Digital media

and entertainment, as well as an increase in China commerce

adjusted EBITA. A reconciliation of net income to adjusted EBITDA

and adjusted EBITA is included at the end of this results

announcement.

Adjusted EBITA and Adjusted EBITA

margin by segments

Adjusted EBITA and adjusted EBITA margin by segments as well as

a reconciliation of income from operations to adjusted EBITA are

set forth in the section entitled “December Quarter Information by

Segments” above.

Interest and investment income,

net

Interest and investment income, net in the quarter ended

December 31, 2022 was RMB15,516 million (US$2,250 million),

compared to RMB18,361 million in the same quarter of 2021. The

year-over-year decrease was primarily due to a decrease in net

gains arising from the changes in fair value of our equity

investments, partly offset by the decrease in impairment losses on

certain investments.

The above-mentioned gains and losses were excluded from our

non-GAAP net income.

Other income, net

Other income, net in the quarter ended December 31, 2022 was

RMB1,462 million (US$212 million), compared to RMB5,083 million in

the same quarter of 2021. The year-over-year decrease was primarily

due to net exchange losses in the quarter ended December 31, 2022,

compared to net exchange gains in the same quarter last year.

Income tax expenses

Income tax expenses in the quarter ended December 31, 2022 were

RMB3,820 million (US$554 million), compared to RMB9,553 million in

the same quarter of 2021. The year-over-year decrease was mainly

due to the deferred tax on basis differences arising from our

equity method investees, which includes the reversal of deferred

tax arising from dividend receivable from Ant Group.

Excluding share-based compensation expense, revaluation and

disposal gains/losses of investments, impairment of goodwill and

investments, as well as the deferred tax effects on basis

differences arising from our equity method investees, our effective

tax rate would have been 13% in the quarter ended December 31,

2022.

Share of results of equity method

investees

Share of results of equity method investees in the quarter ended

December 31, 2022 was a loss of RMB893 million (US$129 million),

compared to a loss of RMB549 million in the same quarter of 2021.

Share of results of equity method investees in the quarter ended

December 31, 2022 and the same quarter in the prior year consisted

of the following:

Three months ended December

31,

2021

2022

RMB

RMB

US$

(in millions)

Share of profit (loss) of equity method

investees

- Ant Group

5,811

1,005

146

- Others

(1,632

)

(807

)

(117

)

Impairment loss

(3,577

)

(132

)

(19

)

Others(1)

(1,151

)

(959

)

(139

)

Total

(549

)

(893

)

(129

)

________________

(1)

“Others” mainly include amortization of

intangible assets of equity method investees, share-based

compensation expense related to share-based awards granted to

employees of our equity method investees, as well as gain or loss

arising from the dilution of our investments in equity method

investees.

We record our share of results of all equity method investees

one quarter in arrears. The year-over-year decrease in share of

profit of Ant Group was mainly due to decrease in the valuation of

certain overseas equity investments, resulted from changes in

capital market conditions.

Net income and Non-GAAP net

income

Our net income in the quarter ended December 31, 2022 was

RMB45,746 million (US$6,633 million), an increase of 138% or

RMB26,522 million, compared to RMB19,224 million in the same

quarter of 2021. The year-over-year increase was primarily due to a

RMB22,427 million decrease in impairment of goodwill in relation to

Digital media and entertainment segment.

Excluding share-based compensation expense, revaluation and

disposal gains/losses of investments, impairment of goodwill and

investments, and certain other items, non-GAAP net income in the

quarter ended December 31, 2022 was RMB49,932 million (US$7,239

million), an increase of 12% compared to RMB44,624 million in the

same quarter of 2021. A reconciliation of net income to non-GAAP

net income is included at the end of this results announcement.

Net income attributable to ordinary

shareholders

Net income attributable to ordinary shareholders in the quarter

ended December 31, 2022 was RMB46,815 million (US$6,788 million),

an increase of 69% compared to net income attributable to ordinary

shareholders of RMB27,692 million in the same quarter of 2021 was

primarily due to a decrease in impairment of goodwill in relation

to Digital media and entertainment segment attributable to ordinary

shareholders.

Diluted earnings per ADS/share and

non-GAAP diluted earnings per ADS/share

Diluted earnings per ADS in the quarter ended December 31, 2022

was RMB17.91 (US$2.60), compared to diluted earnings per ADS of

RMB10.19 in the same quarter in 2021. Excluding share-based

compensation expense, revaluation and disposal gains/losses of

investments, impairment of goodwill and investments, and certain

other items, non-GAAP diluted earnings per ADS in the quarter ended

December 31, 2022 was RMB19.26 (US$2.79), an increase of 14%

compared to RMB16.87 in the same quarter of 2021.

Diluted earnings per share in the quarter ended December 31,

2022 was RMB2.24 (US$0.32 or HK$2.51), compared to diluted earnings

per share of RMB1.27 in the same quarter of 2021. Excluding

share-based compensation expense, revaluation and disposal

gains/losses of investments, impairment of goodwill and

investments, and certain other items, non-GAAP diluted earnings per

share in the quarter ended December 31, 2022 was RMB2.41 (US$0.35

or HK$2.70), an increase of 14% compared to RMB2.11 in the same

quarter of 2021.

A reconciliation of diluted earnings per ADS/share to non-GAAP

diluted earnings per ADS/share is included at the end of this

results announcement. Each ADS represents eight ordinary

shares.

Cash and cash

equivalents, short-term investments

and other treasury investments

As of December 31, 2022, cash and cash equivalents, short-term

investments and other treasury investments included in equity

securities and other investments on the consolidated balance

sheets, were RMB539,216 million (US$78,179 million), compared to

RMB446,412 million as of March 31, 2022. Other treasury investments

consist of fixed deposits and certificate of deposits with original

maturities over one year. The increase in cash and cash

equivalents, short-term investments and other treasury investments

during the nine months ended December 31, 2022 was primarily due to

free cash flow generated from operations of RMB139,396 million

(US$20,211 million) and effect of exchange rate changes of

RMB14,931 million (US$2,165 million) mainly due to the appreciation

of the U.S. dollar against Renminbi, partly offset by cash used in

repurchase of ordinary shares of RMB62,135 million (US$9,009

million).

Net cash from operating activities and

free cash flow

In the quarter ended December 31, 2022, net cash provided by

operating activities was RMB87,370 million (US$12,668 million), an

increase of 9% compared to RMB80,366 million in the same quarter of

2021. Free cash flow, a non-GAAP measurement of liquidity, was

RMB81,514 million (US$11,818 million), an increase of 15% compared

to RMB71,022 million in the quarter ended December 31, 2021, mainly

due to narrowing losses of certain businesses driven by improving

operating efficiency, as well as the decrease in capital

expenditures. A reconciliation of net cash provided by operating

activities to free cash flow is included at the end of this results

announcement.

Net cash used in investing

activities

During the quarter ended December 31, 2022, net cash used in

investing activities of RMB72,943 million (US$10,576 million)

primarily reflected (i) an increase in short-term investments by

RMB48,448 million (US$7,024 million), (ii) an increase in other

treasury investments by RMB19,991 million (US$2,898 million), (iii)

capital expenditures of RMB6,897 million (US$1,000 million), and

(iv) cash outflow of RMB5,496 million (US$797 million) for

investment and acquisition activities. These cash outflows were

partially offset by cash inflow of RMB7,386 million (US$1,071

million) from disposal of investments.

Net cash used in financing

activities

During the quarter ended December 31, 2022, net cash used in

financing activities of RMB23,808 million (US$3,452 million)

primarily reflected cash used in repurchase of ordinary shares of

RMB24,455 million (US$3,546 million).

Employees

As of December 31, 2022, we had a total of 239,740 employees,

compared to 243,903 as of September 30, 2022.

WEBCAST AND CONFERENCE CALL INFORMATION

Alibaba Group’s management will hold a conference call to

discuss the financial results at 7:30 a.m. U.S. Eastern Time (8:30

p.m. Hong Kong Time) on Thursday, February 23, 2023.

All participants must pre-register to join this conference call

using the Participant Registration link below: English:

https://s1.c-conf.com/diamondpass/10028049-efanhb.html Chinese:

https://s1.c-conf.com/diamondpass/10028050-dj6f7n.html

Upon registration, each participant will receive details for the

conference call, including dial-in numbers, conference call

passcode and a unique access PIN. To join the conference, please

dial the number provided, enter the passcode followed by your PIN,

and you will join the conference.

A live webcast of the earnings conference call can be accessed

at

https://www.alibabagroup.com/en-US/ir-financial-reports-quarterly-results.

An archived webcast will be available through the same link

following the call. A replay of the conference call will be

available for one week from the date of the conference (Dial-in

number: +1 855 883 1031; English conference PIN 10028049; Chinese

conference PIN 10028050).

Please visit Alibaba Group’s Investor Relations website at

https://www.alibabagroup.com/en-US/investor-relations on February

23, 2023 to view the earnings release and accompanying slides prior

to the conference call.

ABOUT ALIBABA GROUP

Alibaba Group’s mission is to make it easy to do business

anywhere. The company aims to build the future infrastructure of

commerce. It envisions that its customers will meet, work and live

at Alibaba, and that it will be a good company that lasts for 102

years.

EXCHANGE RATE INFORMATION

This results announcement contains translations of certain

Renminbi (“RMB”) amounts into U.S. dollars (“US$”) and Hong Kong

dollars (“HK$”) for the convenience of the reader. Unless otherwise

stated, all translations of RMB into US$ were made at RMB6.8972 to

US$1.00, the exchange rate on December 30, 2022 as set forth in the

H.10 statistical release of the Federal Reserve Board, and all

translations of RMB into HK$ were made at RMB0.89327 to HK$1.00,

the middle rate on December 30, 2022 as published by the People’s

Bank of China. The percentages stated in this announcement are

calculated based on the RMB amounts and there may be minor

differences due to rounding.

SAFE HARBOR STATEMENTS

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“may,” “will,” “expect,” “anticipate,” “future,” “aim,” “estimate,”

“intend,” “seek, ” “plan,” “believe,” “potential,” “continue,”

“ongoing,” “target,” “guidance,” “is/are likely to” and similar

statements. In addition, statements that are not historical facts,

including statements about Alibaba’s strategies and business plans,

Alibaba’s beliefs, expectations and guidance regarding the growth

of its business and its revenue, the business outlook and

quotations from management in this announcement, as well as

Alibaba’s strategic and operational plans, are or contain

forward-looking statements. Alibaba may also make forward-looking

statements in its periodic reports to the U.S. Securities and

Exchange Commission (the “SEC”), in announcements made on the

website of the Hong Kong Stock Exchange Limited (the “Hong Kong

Stock Exchange”), in press releases and other written materials and

in oral statements made by its officers, directors or employees to

third parties. Forward-looking statements involve inherent risks

and uncertainties. A number of factors could cause actual results

to differ materially from those contained in any forward-looking

statement. These factors include but are not limited to the

following: Alibaba’s corporate structure, including the VIE

structure it uses to operate certain businesses in the PRC,

Alibaba’s ability to maintain the trusted status of its ecosystem;

risks associated with sustained investments in Alibaba’s

businesses; Alibaba’s ability to maintain or grow its revenue or

business, including expanding its international and cross border

businesses and operations; risks associated with Alibaba’s

acquisitions, investments and alliances; uncertainties arising from

competition among countries and geopolitical tensions, including

protectionist or national security policies; uncertainties and

risks associated with a broad range of complex laws and regulations

(including in the areas of anti-monopoly and anti-unfair

competition, consumer protection, data security and privacy

protection and regulation of Internet platforms) in the PRC and

globally; cybersecurity risks; fluctuations in general economic and

business conditions in China and globally; impacts of the COVID-19

pandemic and assumptions underlying or related to any of the

foregoing. Further information regarding these and other risks is

included in Alibaba’s filings with the SEC and announcements on the

website of the Hong Kong Stock Exchange. All information provided

in this results announcement is as of the date of this results

announcement and are based on assumptions that we believe to be

reasonable as of this date, and Alibaba does not undertake any

obligation to update any forward-looking statement, except as

required under applicable law.

NON-GAAP FINANCIAL MEASURES

To supplement our consolidated financial statements, which are

prepared and presented in accordance with GAAP, we use the

following non-GAAP financial measures: for our consolidated

results, adjusted EBITDA (including adjusted EBITDA margin),

adjusted EBITA (including adjusted EBITA margin), non-GAAP net

income, non-GAAP diluted earnings per share/ADS and free cash flow.

For more information on these non-GAAP financial measures, please

refer to the table captioned “Reconciliations of Non-GAAP Measures

to the Nearest Comparable U.S. GAAP Measures” in this results

announcement.

We believe that adjusted EBITDA, adjusted EBITA, non-GAAP net

income and non-GAAP diluted earnings per share/ADS help identify

underlying trends in our business that could otherwise be distorted

by the effect of certain income or expenses that we include in

income from operations, net income and diluted earnings per

share/ADS. We believe that these non-GAAP measures provide useful

information about our core operating results, enhance the overall

understanding of our past performance and future prospects and

allow for greater visibility with respect to key metrics used by

our management in its financial and operational decision-making. We

present three different income measures, namely adjusted EBITDA,

adjusted EBITA and non-GAAP net income in order to provide more

information and greater transparency to investors about our

operating results.

We consider free cash flow to be a liquidity measure that

provides useful information to management and investors about the

amount of cash generated by our business that can be used for

strategic corporate transactions, including investing in our new

business initiatives, making strategic investments and acquisitions

and strengthening our balance sheet.

Adjusted EBITDA, adjusted EBITA, non-GAAP net income, non-GAAP

diluted earnings per share/ADS and free cash flow should not be

considered in isolation or construed as an alternative to income

from operations, net income, diluted earnings per share/ADS, cash

flows or any other measure of performance or as an indicator of our

operating performance. These non-GAAP financial measures presented

here do not have standardized meanings prescribed by U.S. GAAP and

may not be comparable to similarly titled measures presented by

other companies. Other companies may calculate similarly titled

measures differently, limiting their usefulness as comparative

measures to our data.

Adjusted EBITDA represents net income before (i) interest

and investment income, net, interest expense, other income, net,

income tax expenses and share of results of equity method investees

(ii) certain non-cash expenses, consisting of share-based

compensation expense, amortization and impairment of intangible

assets and, depreciation and impairment of property and equipment,

operating lease cost relating to land use rights, impairment of

goodwill as well as equity-settled donation expense, which we do

not believe are reflective of our core operating performance during

the periods presented.

Adjusted EBITA represents net income before (i) interest

and investment income, net, interest expense, other income, net,

income tax expenses and share of results of equity method

investees, (ii) certain non-cash expenses, consisting of

share-based compensation expense, amortization and impairment of

intangible assets, impairment of goodwill as well as equity-settled

donation expense, which we do not believe are reflective of our

core operating performance during the periods presented.

Non-GAAP net income represents net income before

share-based compensation expense, amortization and impairment of

intangible assets, impairment of goodwill and investments, gain or

loss on deemed disposals/disposals/revaluation of investments,

equity-settled donation expense and others, as adjusted for the tax

effects.

Non-GAAP diluted earnings per share represents non-GAAP

net income attributable to ordinary shareholders divided by the

weighted average number of shares for computing non-GAAP diluted

earnings per share, on a diluted basis. Non-GAAP diluted

earnings per ADS represents non-GAAP diluted earnings per share

after adjusting for the ordinary share-to-ADS ratio.

Free cash flow represents net cash provided by operating

activities as presented in our consolidated cash flow statement

less purchases of property and equipment (excluding acquisition of

land use rights and construction in progress relating to office

campuses) and intangible assets (excluding those acquired through

acquisitions), as well as adjustments to exclude from net cash

provided by operating activities the consumer protection fund

deposits from merchants on our marketplaces. We deduct certain

items of cash flows from investing activities in order to provide

greater transparency into cash flow from our revenue-generating

business operations. We exclude “acquisition of land use rights and

construction in progress relating to office campuses” because the

office campuses are used by us for corporate and administrative

purposes and are not directly related to our revenue-generating

business operations. We also exclude consumer protection fund

deposits from merchants on our marketplaces because these deposits

are restricted for the purpose of compensating consumers for claims

against merchants.

The table captioned “Reconciliations of Non-GAAP Measures to the

Nearest Comparable U.S. GAAP Measures” in this results announcement

have more details on the non-GAAP financial measures that are most

directly comparable to GAAP financial measures and the related

reconciliations between these financial measures.

ALIBABA GROUP HOLDING LIMITED

UNAUDITED CONSOLIDATED INCOME

STATEMENTS

Three months ended December

31,

Nine months ended December

31,

2021

2022

2021

2022

RMB

RMB

US$

RMB

RMB

US$

(in millions, except per share

data)

(in millions, except per share

data)

Revenue

242,580

247,756

35,921

649,010

660,487

95,762

Cost of revenue

(146,658

)

(150,005

)

(21,749

)

(400,505

)

(410,872

)

(59,571

)

Product development expenses

(15,705

)

(13,521

)

(1,960

)

(44,521

)

(42,864

)

(6,215

)

Sales and marketing expenses

(36,706

)

(30,628

)

(4,441

)

(92,599

)

(78,565

)

(11,391

)

General and administrative expenses

(8,465

)

(10,327

)

(1,497

)

(24,507

)

(29,351

)

(4,255

)

Amortization and impairment of intangible

assets

(2,837

)

(5,530

)

(801

)

(8,816

)

(11,010

)

(1,596

)

Impairment of goodwill

(25,141

)

(2,714

)

(394

)

(25,141

)

(2,714

)

(394

)

Income from operations

7,068

35,031

5,079

52,921

85,111

12,340

Interest and investment income, net

18,361

15,516

2,250

21,006

(21,567

)

(3,127

)

Interest expense

(1,186

)

(1,550

)

(225

)

(3,720

)

(4,182

)

(606

)

Other income, net

5,083

1,462

212

8,903

4,515

654

Income before income tax and share of

results of equity method investees

29,326

50,459

7,316

79,110

63,877

9,261

Income tax expenses

(9,553

)

(3,820

)

(554

)

(24,736

)

(11,791

)

(1,709

)

Share of results of equity method

investees

(549

)

(893

)

(129

)

11,062

(8,509

)

(1,234

)

Net income

19,224

45,746

6,633

65,436

43,577

6,318

Net loss attributable to noncontrolling

interests(1)

8,585

1,167

169

12,929

5,562

806

Net income attributable to Alibaba Group

Holding Limited(1)

27,809

46,913

6,802

78,365

49,139

7,124

Accretion of mezzanine equity

(117

)

(98

)

(14

)

(165

)

(146

)

(21

)

Net income attributable to ordinary

shareholders(1)

27,692

46,815

6,788

78,200

48,993

7,103

Earnings per share attributable to

ordinary shareholders(1) (2)

Basic

1.29

2.25

0.33

3.62

2.32

0.34

Diluted

1.27

2.24

0.32

3.58

2.31

0.33

Earnings per ADS attributable to

ordinary shareholders(1) (2)

Basic

10.29

18.00

2.61

28.95

18.59

2.70

Diluted

10.19

17.91

2.60

28.62

18.49

2.68

Weighted average number of shares used

in calculating earnings per ordinary share (million

shares)(2)

Basic

21,516

20,805

21,610

21,089

Diluted

21,716

20,912

21,849

21,190

________________

(1)

The financial results for the three months

and nine months ended December 31, 2021 as presented have been

revised to reflect the Revised attribution to noncontrolling

interests.

(2)

Each ADS represents eight ordinary

shares.

ALIBABA GROUP HOLDING LIMITED

UNAUDITED CONSOLIDATED BALANCE

SHEETS

As of March 31,

As of December 31,

2022

2022

RMB

RMB

US$

(in millions)

Assets

Current assets:

Cash and cash equivalents

189,898

195,249

28,308

Short-term investments

256,514

315,990

45,814

Restricted cash and escrow receivables

37,455

40,188

5,827

Equity securities and other

investments

8,673

7,974

1,156

Prepayments, receivables and other

assets(1)

145,995

168,975

24,499

Total current assets

638,535

728,376

105,604

Equity securities and other

investments

223,611

227,519

32,988

Prepayments, receivables and other

assets

113,147

112,766

16,350

Investment in equity method investees

219,642

208,594

30,243

Property and equipment, net

171,806

177,796

25,778

Intangible assets, net

59,231

48,914

7,092

Goodwill

269,581

268,159

38,879

Total assets

1,695,553

1,772,124

256,934

Liabilities, Mezzanine Equity and

Shareholders’ Equity

Current liabilities:

Current bank borrowings

8,841

6,700

971

Current unsecured senior notes

—

4,865

705

Income tax payable

21,753

18,825

2,729

Accrued expenses, accounts payable and

other liabilities

271,460

293,666

42,578

Merchant deposits

14,747

25,493

3,696

Deferred revenue and customer advances

66,983

68,286

9,901

Total current liabilities

383,784

417,835

60,580

ALIBABA GROUP HOLDING LIMITED

UNAUDITED CONSOLIDATED BALANCE SHEETS

(CONTINUED)

As of March 31,

As of December 31,

2022

2022

RMB

RMB

US$

(in millions)

Deferred revenue

3,490

3,548

514

Deferred tax liabilities

61,706

61,384

8,900

Non-current bank borrowings

38,244

49,858

7,229

Non-current unsecured senior notes

94,259

98,402

14,267

Other liabilities

31,877

31,314

4,540

Total liabilities

613,360

662,341

96,030

Commitments and contingencies

Mezzanine equity

9,655

9,654

1,400

Shareholders’ equity:

Ordinary shares

1

1

-

Additional paid-in capital

410,506

414,695

60,125

Treasury shares at cost

(2,221

)

(29,026

)

(4,209

)