Current Report Filing (8-k)

04 Januar 2022 - 1:41PM

Edgar (US Regulatory)

AZEK Co Inc.

false

0001782754

0001782754

2021-12-29

2021-12-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 29, 2021

The AZEK Company Inc.

(Exact name of Registrant as Specified in Its Charter)

|

Delaware

|

001-39322

|

90-1017663

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

1330 W Fulton Street 350

Chicago, Illinois

|

|

60607

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (877) 275-2935

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, par value $0.001 per share

|

|

AZEK

|

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On December 29, 2021, CPG International LLC (“Buyer”), a Delaware limited liability company and wholly-owned subsidiary of The AZEK Company Inc. (the “Company”), acquired all of the issued and outstanding membership interests of StruXure Outdoor, LLC (“Target”), a Georgia limited liability company, pursuant to a Membership Interest Purchase Agreement dated as of December 29, 2021 (the “Purchase Agreement”) by and among, Buyer, Effort Holdings, Inc., Effort Trust Dated October 8, 2020 and Christopher Scott Selzer. The acquisition was funded with cash on hand. The Purchase Agreement contains customary representations, warranties and covenants of the parties. As a result of the closing of the transactions contemplated by the Purchase Agreement, Target became an indirect, wholly-owned subsidiary of the Company. On January 4, 2022, the Company issued a press release relating to the transaction. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

The AZEK Company Inc.

|

|

|

|

|

|

|

Date: January 4, 2022

|

|

By:

|

/s/ Peter Clifford

|

|

|

|

|

Peter Clifford

|

|

|

|

|

Senior Vice President and Chief Financial Officer

|

2

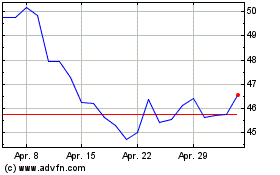

AZEK (NYSE:AZEK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

AZEK (NYSE:AZEK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024