Current Report Filing (8-k)

01 November 2021 - 2:28PM

Edgar (US Regulatory)

0000004962false00000049622021-11-012021-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2021

AMERICAN EXPRESS COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York

|

|

1-7657

|

|

13-4922250

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

200 Vesey Street,

New York, New York 10285

(Address of principal executive offices and zip code)

(212) 640-2000

(Registrant's telephone number, including area code)

|

|

|

|

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Shares (par value $0.20 per Share)

|

|

AXP

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On November 1, 2021, American Express Company (the “Company”) announced that it is commencing an exchange offer (the “Exchange Offer”) pursuant to which it is offering to issue its new senior notes (the “AXP Notes”) in exchange for any and all of the $2 billion aggregate principal amount of the outstanding 3.300% Senior Notes due May 3, 2027 (the “Credco Notes”) issued by American Express Credit Corporation (“Credco”), a wholly-owned subsidiary of the Company. Concurrently with the Exchange Offer, Credco is soliciting consents (the “Consent Solicitation”) to adopt certain proposed amendments to the indenture under which the Credco Notes were issued (the “Credco Indenture”) that would, among other things, eliminate certain of the covenants and events of default in the Credco Indenture (including the reporting covenant). Documents relating to the Exchange Offer and Consent Solicitation will only be distributed to eligible holders of the Credco Notes who complete and return an eligibility form confirming that they are either a “qualified institutional buyer” under Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), or outside the United States, not a “U.S. person” within the meaning of Regulation S under the Securities Act and a Non-U.S. qualified offeree (as defined in the offering memorandum and consent solicitation statement dated November 1, 2021 relating to the Exchange Offer and Consent Solicitation), and, in either case, not located in or a resident of Canada. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to risks and uncertainties. The forward-looking statements, which address the Exchange Offer and Consent Solicitation contain words such as “expect,” “anticipate,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely” and similar expressions. Actual results may differ from those set forth in the forward-looking statements due to a variety of factors, including market conditions, the satisfaction of the conditions described in the offering memorandum and consent solicitation statement dated November 1, 2021 and those contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2021 and the Company’s other filings with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The Company undertakes no obligation to update or revise any forward-looking statements.

Important Information for Investors and Stockholders

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

Exhibit

|

Description

|

|

99.1

|

|

|

104

|

The cover page of this Current Report on Form 8-K, formatted as inline XBRL

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

AMERICAN EXPRESS COMPANY

|

|

|

(REGISTRANT)

|

|

|

|

|

|

|

By:

|

/s/ Kristina V. Fink

|

|

|

|

Name: Kristina V. Fink

|

|

|

|

Title: Deputy Corporate Secretary

|

Date: November 1, 2021

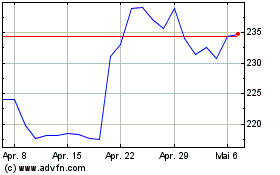

American Express (NYSE:AXP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

American Express (NYSE:AXP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024