UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of August, 2022

Commission File Number 001-36671

Atento S.A.

(Translation of Registrant's name into

English)

1 rue Hildegard Von Bingen

L-1282, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F: x Form

40-F: o

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes: o No: x

Note: Regulation S-T Rule 101(b)(1) only permits

the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes: o No: x

Note: Regulation S-T Rule 101(b)(7)

only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign

private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled

or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which

the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been

the subject of a Form 6-K submission or other Commission filing on EDGAR.

Atento

Reports Fiscal 2022 Second Quarter and First Half Results

Demanding quarter, but

management believes positive inflection point has been reached with strong 2H trend underway

Record June sales of $34

million and Total Annual Value of Sales in Q2 increasing 16.4% to $54.7 million, growing to 60% in hard currency

Accelerated 2022 cost efficiency

program, targeting $15 million in cost reductions by year-end, or $25 million on annualized basis

Cash

position rose 6.1% to healthy $103 million, with strong free cash flow turnaround to positive $5 million, versus negative $26 million

in 2Q21 and negative $65 million in 1Q22

Working capital improved

to positive $9 million in 2Q22, versus negative $25 million in 2Q21

Due

to uncertain macroeconomic conditions, annual guidance revised to flat revenue growth, EBITDA margin of 11.5% to 12.5%, and leverage ratio

of 3.0x to 3.5x

Strong

year-end exit rate forecasted, based on sales momentum and improving cost structure

NEW

YORK, August 03, 2022 – Atento S.A. (NYSE: ATTO) (“Atento” or the “Company”), one of the five largest

providers of Customer Relationship Management and Business Process Outsourcing (CRM / BPO) services worldwide and sector leader in Latin

America, announced today its second quarter operating and financial results for the period ending June 30, 2022. All comparisons in this

announcement are year-over-year (YoY) and in constant-currency (CCY), unless otherwise noted.

Volume

recovery slower than expected

| • | Total Annual Value of sales

(TAV) increased 16.4% to $54.7 million, growing 88.7% in hard currencies that accounted for 60.2% of TAV |

| • | Excluding the effect of a large

one-time Covid-19 services contract signed with State of Maryland in first quarter 2021, TAV would have increased 27.7% in first-half

2022 |

| • | Revenue decreased 4.0% to $363.8

million, with Multisector and Telefónica (TEF) sales decreasing 3.3% and 5.5%, respectively, due to lower client volumes, mainly

in Brazil and the US, partially offset by inflation pass-through |

| • | Hard-currency revenues expanded

to 26% of total revenue |

| • | Brazil TEF sales declined 14.7%,

due to the cost-cutting program that this client implemented in the first quarter, which requires reduced CX volumes |

EBITDA

impacted by reduced volumes, additional one-time severance costs and higher inflation

| • | EBITDA decreased 44.2% to $28.5

million on aforementioned declines in Multisector and TEF sales, coupled with high severance costs related to new cost efficiency initiatives,

ramp up of new client programs and higher inflation, as well as positive one-offs in second quarter of 2021 |

| • | Decrease in EBITDA and 543 bps

margin contraction were partially offset by improved inflation pass-through |

| • | Net loss of $12.1 million, or

negative EPS of $0.83, mainly due to net financial expenses of $12.9 million, $8.7 million of which was non-cash items related to change

in fair value of hedges |

| • | Cash financial costs were $29.6

million, of which $20.9 million was a bond interest payment and other interest expenses, primarily those related to the Company’s

hedges and bank credit facilities |

| • | Free cash flow of $4.5 million

|

| • | Despite decreased EBITDA, improved

working capital management and lower Capex resulted in positive operating cash flow of $7 million |

| • | Healthy exit rate at quarter-end,

with revenue, EBITDA and operating cash flow forecasted to accelerate during second half of year |

Healthy

cash position

| • | Healthy cash position of $102.9

million, including $75 million from existing credit revolvers |

| • | At the end of 2Q22, LTM net

debt-to-EBITDA was 5.3x, or 3.8x when excluding EBITDA impact of cyberattack in Q4 2021 |

| • | Shareholders’ equity was

negative $130.9 million at June 30, 2022, mainly due to $108.5 million in financial items consisting of $68.8 million in balance sheet

and P&L conversion, $39.7 million in financial costs and a negative net $7.1 million change in fair value of hedging instruments |

| | |

| 1 |  |

Additional

cost reduction initiatives

| • | Cost reduction initiatives began

in April 2022, focused on two areas: SG&A efficiencies, Labor Cost/Headcount and 360° Vendor Revision |

| • | Reduction of fixed costs expected

to reach $25 million on an annualized basis ($15 million realizing through July) |

Summarized Consolidated

Financials

| ($ in millions except EPS) |

Q2 2022 |

Q2 2021 |

CCY

Growth (1) |

YTD 2022 |

YTD 2021 |

CCY

Growth (1) |

| Income Statement (5) |

|

|

|

|

|

|

| Revenue |

363.8 |

382.7 |

-4.0% |

720.4 |

753.3 |

-3.2% |

| EBITDA |

28.5 |

50.7 |

-44.2% |

63.5 |

89.8 |

-29.5% |

| EBITDA Margin |

7.8% |

13.3% |

-5.4 p.p. |

8.8% |

11.9% |

-3.1 p.p. |

| Net Loss (2) |

(12.1) |

(14.7) |

-19.0% |

(82.6) |

(34.9) |

-134.7% |

| Earnings Per Share on the reverse split basis (2) (4) |

($0.83) |

($1.05) |

N.M. |

($5.66) |

($2.48) |

N.M. |

| Cash Flow, Debt and Leverage |

|

|

|

|

|

|

| Net Cash Used in Operating Activities |

27.5 |

14.9 |

|

(15.6) |

14.4 |

|

| Cash and Cash Equivalents |

102.9 |

153.8 |

|

102.9 |

153.8 |

|

| Net Debt (3) |

633.1 |

589.5 |

|

633.1 |

589.5 |

|

| Net Leverage (3) |

5.3x |

4.0x |

|

5.3x |

4.0x |

|

| Net Leverage (w/o Cyber Q4-2021) (3) |

3.8x |

4.0x |

|

3.8x |

4.0x |

|

(1) Unless otherwise noted,

all results are for Q2; all revenue growth rates are on a constant currency basis, year-over-year; (2) Reported Net Loss and Earnings

per Share (EPS) include the impact of non-cash foreign exchange gains/losses on intercompany balances; (3) Includes IFRS 16 impact in

Net Debt and Leverage; (4) Earnings per share on the reverse split basis is calculated with weighted average number of ordinary shares

outstanding. (5) The following selected financial information are unaudited.

Message from Management

The second quarter was a challenging

one, as the recovery in volumes was slower than our expectations, with continued higher inflation across our markets and one-off costs

on accelerating structural efficiency programs.

However, based on strong sales

in June and July and a growing pipeline, we are expecting 2022 to be the fourth consecutive year of record sales. Moreover, with the investments

that we made in further reducing Atento’s cost structure, we expect to reap the benefits of $25 million in annualized cost savings,

as revenues rise and we continue ramping up new client programs during the remainder of the year and into 2023.

A new account management structure

combined with expanding partnerships and effective channel marketing are enabling us to sell more, sell better and sell what we want,

namely delivering higher-value services to higher-growth, higher-margin clients. A more effective sales organization also means increasing

hard currency revenues, which represented 60% of sales in Q2, versus 37% last year.

Also encouraging was the nearly

$5 million in free cash flow that we generated in the quarter, which allowed us to finish with healthy cash position. The cash flow reflects

not just a leaner cost structure, but also greater efficiencies, including significantly better working capital management, thanks to

new processes and systems that have been implemented to improve the core of our organization. After passing the halfway mark, we remain

ahead of plan with regard to inflation pass-through, which we still expect to be approximately 80% of total contract value by year-end.

Given the uncertain macroeconomic

conditions, annual guidance was revised to flat revenue growth, EBITDA margin of 11.5% to 12.5%, and a leverage ratio of 3.0 to 3.5x.

Although we have revised guidance downward, we still forecast a healthy exit rate at the end of the year, in terms of revenue growth and

EBITDA margin, putting us back on a course for much-improved cash flow and debt leverage in 2023.

Carlos

López-Abadía |

Sergio Passos |

Chief

Executive Officer |

Chief Financial Officer |

| | |

| 2 |  |

Second Quarter Segment Reporting

Brazil

| ($ in millions) |

Q2 2022 |

Q2 2021 |

CCY growth |

YTD 2022 |

YTD 2021 |

CCY growth |

| Brazil Region |

|

|

|

|

|

|

| Revenue |

156.3 |

156.0 |

-6.9% |

302.6 |

304.9 |

-6.5% |

| EBITDA |

15.0 |

22.7 |

-38.6% |

36.7 |

41.4 |

-17.1% |

| EBITDA Margin |

9.6% |

14.5% |

-5.0 p.p. |

12.1% |

13.6% |

-1.5 p.p. |

| Profit/(loss) for the period |

(10.1) |

0.5 |

N.M. |

(9.2) |

(4.4) |

-114.0% |

| Brazil Revenue Mix |

H1 2022

|

H1 2021

|

Brazil

revenue decreased 6.9% in the second quarter to $156.3 million, mainly due to a 14.7% decline in TEF revenue, as this client implemented

a cost-cutting program in the first quarter, which requires reduced CX volumes. Multisector revenues decreased 3.8%, mostly related to

volume reductions. Multisector sales accounted for 74.7% of revenue in the quarter, down 237 bps compared to last year’s comparable

quarter.

EBITDA

in Brazil decreased 38.6% to $15.0 million, with the corresponding margin declining 500 bps to 9.6%, mainly due to tax credits that benefited

2Q21 profitability and to union agreements signed in 1Q22, partially offset by inflation pass-through negotiation and improved cost efficiencies.

Americas

Region

| ($ in millions) |

Q2 2022 |

Q2 2021 |

CCY growth |

YTD 2022 |

YTD 2021 |

CCY growth |

| Americas Region |

|

|

|

|

|

|

| Revenue |

149.7 |

164.2 |

-4.1% |

296.4 |

318.4 |

-2.0% |

| EBITDA |

7.8 |

16.5 |

-50.9% |

17.0 |

29.3 |

-39.3% |

| EBITDA Margin |

5.2% |

10.0% |

-4.8 p.p. |

5.7% |

9.2% |

-3.5 p.p. |

| Profit/(loss) for the period |

(3.3) |

(0.1) |

N.M. |

(11.6) |

(1.7) |

N.M |

| Americas Revenue Mix |

H1 2022

|

H1 2021

|

Second

quarter revenue declined 4.1% to $149.7 million in the Americas region. Multisector sales decreased 5.0% to 67.9% of revenue, due to a

temporary Covid-19 contract, lower volumes related to the higher absentee rates, and the loss of several client programs, partially offset

by volumes stemming from new client wins. Most reductions in client volumes were in the US and Mexico, with the latter being impacted

by changes in Mexico’s outsourcing regulations, while South American countries had slight increases in volumes.

Americas

EBITDA decreased 50.9% to $7.8 million, due to a 480 bps contraction in the corresponding margin. The margin decline was due to the aforementioned

volume reductions and to cost increases stemming mostly from hyper-inflation in certain countries.

| | |

| 3 |  |

EMEA Region

| ($ in millions) |

Q2 2022 |

Q2 2021 |

CCY growth |

YTD 2022 |

YTD 2021 |

CCY growth |

| EMEA Region |

|

|

|

|

|

|

| Revenue |

59.4 |

63.6 |

5.6% |

123.8 |

132.7 |

2.6% |

| EBITDA |

3.2 |

6.7 |

-46.2% |

6.8 |

13.3 |

-44.0% |

| EBITDA Margin |

5.4% |

10.6% |

-5.2 p.p. |

5.5% |

10.0% |

-4.5 p.p. |

| Profit/(loss) for the period |

1.9 |

0.9 |

146.4% |

1.8 |

1.8 |

-0.1% |

| EMEA Revenue Mix |

H1 2022

|

H1 2021

|

Second quarter EMEA revenue

increased 5.6% to $59.4 million, with Multisector sales increasing 6.8% and TEF sales rising 4.3%. Sales in the latter category still

benefited from TEF shifting volumes to Atento, as this client recently consolidated the number of CX providers it utilizes. Multisector

sales rose on new sales, mainly driven by the insurance sector.

EBITDA decreased 46.2% in

EMEA on a 520 bps margin contraction stemming from offshore to onshore business coverage mix. For the quarter, EMEA EBITDA accounted for

11.2% of consolidated EBITDA.

Cash Flow

| Cash Flow Statement ($ in millions) |

Q2 2022 |

Q2 2021 |

YTD 2022 |

YTD 2021 |

| Cash and cash equivalents at beginning of period |

97.0 |

176.1 |

128.9 |

209.0 |

| Net Cash from Operating activities |

27.5 |

14.9 |

(15.6) |

14.4 |

| Net Cash used in Investing activities |

(8.6) |

(16.2) |

(18.4) |

(23.7) |

| Net Cash (used in)/ provided by Financing activities |

(10.7) |

(30.8) |

2.1 |

(45.2) |

| Net (increase/decrease) in cash and cash equivalents |

8.2 |

(32.1) |

(32.0) |

(54.5) |

| Effect of changes in exchanges rates |

(2.3) |

9.8 |

6.0 |

(0.7) |

| Cash and cash equivalents at end of period |

102.9 |

153.8 |

102.9 |

153.8 |

Indirect Cash Flow View –

Q2 2022 ($ in millions)

| | |

| 4 |  |

Although EBITDA decreased during the

second quarter, improved working capital management as well as lower Capex and tax payments resulted in $7.7 million of operating cash

flow and $4.5 million of free cash flow. The free cash flow was partially offset by $3.2 million in net financial expenses., which were

primarily due to the impact of the Brazilian Reais’ appreciation and a higher CDI rate on the Company’s currency hedge.

Indebtedness & Capital

Structure

| US$MM |

Maturity |

Interest Rate |

Outstanding Balance Q2 2022 |

| SSN (1) (USD) |

2026 |

8.0% |

504.5 |

| Super Senior Credit Facility |

2023 |

4.5% |

43.7 |

| Other Borrowings and Leases |

2025 |

Variable |

48.4 |

| BNDES (BRL) |

2022 |

TJLP + 2.0% |

0.1 |

| Debt with Third Parties |

|

|

596.7 |

| Leasing (IFRS 16) |

|

|

139.3 |

| Gross Debt (Debt with Third Parties + IFRS 16) |

|

|

736.0 |

| Cash and Cash Equivalents |

|

|

102.9 |

| Net Debt |

|

|

633.2 |

| (1) | Notes are protected by certain

hedging instruments, with the coupons hedged through maturity, while the principal is hedged for a period of 3 years. The instruments

consist mainly of cross-currency swaps in BRL, PEN and Euro. |

At June 30, 2022, Gross debt

totaled $736.0 million, or $596.7 million when excluding lease obligations under IFRS 16. With cash and cash equivalents of $102.9 million,

net debt was $633.2 million at the end of the quarter. Approximately $89.2 million in revolving credit facilities were available at quarter-end,

of which $74.6 million was drawn from existing and new credit facilities.

At the end

of the second quarter, LTM net debt-to-EBITDA was 5.3x, or 3.8x when excluding the one-time EBITDA impact of the cyberattack in Q4 2021.

The Company finished the quarter with a comfortable maturity profile going out to 2026.

Fiscal 2022 Guidance

| |

YTD22

Reported |

2022

Guidance |

| Revenue growth (in constant currency) |

-3.2% |

Flat |

| EBITDA margin |

8.8% |

11.5% - 12.5% |

| Leverage (x) |

5.3x |

3.0x - 3.5x |

| | |

| 5 |  |

Conference Call

Atento will host

a conference call and webcast on Thursday, August 04, 2022, at 8:30 am ET to discuss the Company’s fiscal second quarter 2022 operating

and financial results. The conference call can be accessed by dialing: USA: +1 (866) 807-9684; UK: (+44) 20 3514 3188; Brazil: (+55) 11

4933-0682; Spain: (+34) 80 030-0687; or International: (+1) 412 317 5415. No passcode is required. Individuals who dial in will be asked

to identify themselves and their affiliations. A live webcast of the conference call will be available on Atento's Investor Relations

website at investors.atento.com (click here). A web-based archive of the conference call will also

be available at the website.

About

Atento

Atento

one of the largest CRM / BPO providers worldwide and sector leader in Latin America and global provider for client relationship management

and business process outsourcing services. Since 1999, the company has developed its business model in 13 countries with a workforce of

131,000 employees. Atento has over 400 clients for which it provides a wide range of CRM/BPO services through multiple channels. Its clients

are leading multinational companies in the technology, digital, telecommunications, finance, health, consumer and public administration

sectors, amongst others. Atento trades under ATTO on the New York Stock Exchange. In 2019, Atento was recognized by Great Place to Work®

as one of the 25 World’s Best Multinational Workplaces and as one of the Best Places to Work in Latin America. For more information www.atento.com

Media

Relations

press@atento.com

Investor

and analyst inquiries

Hernan van Waveren

+1 979-633-9539

hernan.vanwaveren@atento.com

Forward-Looking

Statements

This press release contains forward-looking

statements. Forward-looking statements can be identified by the use of words such as "may," "should," "expects,"

"plans," "anticipates," "believes," "estimates," "predicts," "intends," "continue"

or similar terminology. These statements reflect only Atento’s current expectations and are not guarantees of future performance

or results. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those contained

in the forward-looking statements. In particular, the COVID-19 pandemic, and governments’ extraordinary measures to limit the spread

of the virus, are disrupting the global economy and Atento’s industry, and consequently adversely affecting the Company’s

business, results of operation and cash flows and, as conditions are recent, uncertain and changing rapidly, it is difficult to predict

the full extent of the impact that the pandemic will have. Risks and uncertainties include, but are not limited to, competition in Atento’s

highly competitive industries; increases in the cost of voice and data services or significant interruptions in these services; Atento’s

ability to keep pace with its clients' needs for rapid technological change and systems availability; the continued deployment and adoption

of emerging technologies; the loss, financial difficulties or bankruptcy of any key clients; the effects of global economic trends on

the businesses of Atento’s clients; the non-exclusive nature of Atento’s client contracts and the absence of revenue commitments;

security and privacy breaches of the systems Atento uses to protect personal data; the cost of pending and future litigation; the cost

of defending Atento against intellectual property infringement claims; extensive regulation affecting many of Atento’s businesses;

Atento’s ability to protect its proprietary information or technology; service interruptions to Atento’s data and operation

centers; Atento’s ability to retain key personnel and attract a sufficient number of qualified employees; increases in labor costs

and turnover rates; the political, economic and other conditions in the countries where Atento operates; changes in foreign exchange rates;

Atento’s ability to complete future acquisitions and integrate or achieve the objectives of its recent and future acquisitions;

future impairments of our substantial goodwill, intangible assets, or other long-lived assets; and Atento’s ability to recover consumer

receivables on behalf of its clients. In addition, Atento is subject to risks related to its level of indebtedness. Such risks include

Atento’s ability to generate sufficient cash to service its indebtedness and fund its other liquidity needs; Atento’s ability

to comply with covenants contained in its debt instruments; the ability to obtain additional financing; the incurrence of significant

additional indebtedness by Atento and its subsidiaries; and the ability of Atento’s lenders to fulfill their lending commitments.

Atento is also subject to other risk factors described in documents filed by the comp any with the United States Securities and Exchange

Commission.

These forward-looking statements speak

only as of the date on which the statements were made. Atento undertakes no obligation to update or revise publicly any forward-looking

statements, whether as a result of new information, future events or otherwise.

| | |

| 6 |  |

SELECTED

FINANCIAL DATA:

The

following selected financial information are preliminary, unaudited and are based on management's initial review of operations for the

second quarter ended June 30, 2022 and remain subject to the completion of the Company's customary annual closing and review procedures.

Consolidated Statements of Operations for the Three

and Six Months Ended June 30, 2021 and 2022

| |

For the three months ended June 30 |

For the six months ended June 30 |

|

($ million, except percentage changes)

|

2022 |

2021 |

Change (%) |

Change excluding FX (%) |

2022 |

2021 |

Change (%) |

Change excluding FX (%) |

| |

(unaudited) |

|

|

(unaudited) |

|

|

| Revenue with third parties |

363.8 |

382.7 |

(4.9) |

(4.0) |

720.4 |

753.3 |

(4.4) |

(3.2) |

| Other operating income |

0.5 |

2.0 |

(75.0) |

(73.7) |

11.9 |

3.3 |

N.M. |

N.M. |

| Operating expenses: |

|

|

|

|

|

|

|

|

| Supplies |

(30.1) |

(28.7) |

4.9 |

3.8 |

(57.5) |

(49.7) |

15.7 |

16.2 |

| Employee benefit expenses |

(283.6) |

(289.9) |

(2.2) |

(0.9) |

(562.9) |

(572.8) |

(1.7) |

(0.3) |

| Depreciation |

(18.2) |

(17.5) |

4.0 |

2.8 |

(36.4) |

(35.2) |

3.4 |

2.8 |

| Amortization |

(13.3) |

(10.9) |

22.0 |

19.8 |

(25.2) |

(23.7) |

6.3 |

6.3 |

| Changes in trade provisions |

0.1 |

0.1 |

- |

0.0 |

(0.1) |

1.6 |

N.M. |

N.M. |

| Other operating expenses |

(22.3) |

(15.4) |

44.8 |

51.7 |

(48.4) |

(46.1) |

5.0 |

7.3 |

| Operating profit |

(2.9) |

22.3 |

(113.0) |

(113.0) |

1.8 |

30.9 |

(94.2) |

(94.2) |

| Finance income |

2.8 |

6.5 |

(56.9) |

(50.0) |

4.3 |

9.6 |

(55.2) |

(48.2) |

| Finance costs |

(20.4) |

(22.3) |

(8.5) |

(9.3) |

(38.6) |

(46.6) |

(17.2) |

(17.7) |

| Change in fair value of financial instruments |

(8.5) |

(10.8) |

(21.3) |

(21.3) |

(68.7) |

(24.5) |

N.M. |

N.M. |

| Net foreign exchange loss |

13.2 |

(1.5) |

N.M. |

N.M. |

10.3 |

5.8 |

77.6 |

68.9 |

| Net finance expense |

(12.9) |

(28.0) |

(53.9) |

(55.7) |

(92.6) |

(55.8) |

65.9 |

62.5 |

| Profit/(loss) before income tax |

(15.8) |

(5.7) |

N.M. |

132.4 |

(90.8) |

(24.9) |

N.M. |

N.M. |

| Income tax benefit/(expense) |

3.7 |

(9.0) |

(141.1) |

(145.1) |

8.2 |

(10.0) |

N.M. |

N.M. |

| Profit/(loss) for the period |

(12.1) |

(14.7) |

(17.7) |

(19.0) |

(82.7) |

(34.9) |

137.0 |

134.7 |

| Other financial data: |

|

|

|

|

|

|

|

|

| EBITDA (1) (unaudited) |

28.5 |

50.7 |

(43.8) |

(44.2) |

63.5 |

89.8 |

(29.3) |

(29.5) |

| |

|

|

|

|

|

|

|

|

|

|

|

(1) In considering the financial performance

of the business, our management analyzes the financial performance measure of EBITDA at a company and operating segment level, to facilitate

decision-making. EBITDA is defined as profit/(loss) for the period from continuing operations before net finance expense, income taxes

and depreciation and amortization. EBITDA is not a measure defined by IFRS. The most directly comparable IFRS measure to EBITDA is profit/(loss)

for the year/period.

N.M. means not meaningful

| | |

| 7 |  |

Consolidated Statements of Operations by Segment for

the Three and Six Months Ended June 30, 2021 and 2022

| ($ in millions, except percentage changes) |

For the three months ended June 30 |

Change (%) |

Change Excluding FX (%) |

For the six months ended June 30 |

Change (%) |

Change Excluding FX (%) |

| 2022 |

2021 |

2022 |

2021 |

| Revenue: |

(unaudited) |

|

|

(unaudited) |

|

|

| Brazil |

156.3 |

156.0 |

0.2 |

(6.9) |

302.6 |

304.9 |

(0.8) |

(6.5) |

| Americas |

149.7 |

164.2 |

(8.8) |

(4.1) |

296.4 |

318.4 |

(6.9) |

(2.0) |

| EMEA |

59.4 |

63.6 |

(6.6) |

5.6 |

123.8 |

132.7 |

(6.7) |

2.6 |

| Other and eliminations (1) |

(1.6) |

(1.1) |

45.5 |

33.3 |

(2.4) |

(2.7) |

(11.1) |

(7.7) |

| Total revenue |

363.8 |

382.7 |

(4.9) |

(4.0) |

720.4 |

753.3 |

(4.4) |

(3.2) |

| Operating expenses: |

|

|

|

|

|

|

|

|

| Brazil |

(160.5) |

(148.6) |

8.0 |

0.3 |

(313.3) |

(299.4) |

4.6 |

(1.4) |

| Americas |

(154.0) |

(160.6) |

(4.1) |

1.0 |

(302.8) |

(314.0) |

(3.6) |

1.5 |

| EMEA |

(59.7) |

(61.6) |

(3.1) |

9.5 |

(123.9) |

(128.3) |

(3.4) |

6.3 |

| Other and eliminations (1) |

6.8 |

8.5 |

(20.0) |

(20.0) |

9.6 |

15.8 |

(39.2) |

(41.8) |

| Total operating expenses |

(367.4) |

(362.3) |

1.4 |

2.5 |

(730.4) |

(725.9) |

0.6 |

2.0 |

| EBITDA (2): |

|

|

|

|

|

|

|

|

| Brazil |

15.0 |

22.7 |

(33.9) |

(38.6) |

36.7 |

41.4 |

(11.4) |

(17.1) |

| Americas |

7.8 |

16.5 |

(52.7) |

(50.9) |

17.0 |

29.3 |

(42.0) |

(39.3) |

| EMEA |

3.2 |

6.7 |

(52.2) |

(46.2) |

6.8 |

13.3 |

(48.9) |

(44.0) |

| Other and eliminations (1) |

2.5 |

4.8 |

(47.9) |

(47.9) |

3.0 |

5.8 |

(48.3) |

(46.4) |

| Total EBITDA (unaudited) |

28.5 |

50.7 |

(43.8) |

(44.2) |

63.5 |

89.8 |

(29.3) |

(29.4) |

| Brazil |

(10.1) |

0.5 |

N.M. |

N.M. |

(9.2) |

(4.4) |

109.1 |

114.0 |

| Americas |

(3.3) |

(0.1) |

N.M. |

N.M. |

(11.6) |

(1.7) |

N.M. |

N.M. |

| EMEA |

1.9 |

0.9 |

111.1 |

146.4 |

1.8 |

1.8 |

0.0 |

0.1 |

| Other and eliminations (1) |

(0.6) |

(16.0) |

(96.3) |

(96.2) |

(63.7) |

(30.6) |

108.2 |

106.8 |

| Profit/(loss) |

(12.1) |

(14.7) |

(17.7) |

(18.8) |

(82.7) |

(34.9) |

137.0 |

134.9 |

(1) Included revenue and expenses

at the holding-company level (such as corporate expenses and acquisition related expenses), as applicable, as well as consolidation adjustments.

(2) In considering the financial performance

of the business, our management analyzes the financial performance measure of EBITDA at a company and operating segment level, to facilitate

decision-making. EBITDA is defined as profit/(loss) for the period from continuing operations before net finance expense, income taxes

and depreciation and amortization. EBITDA is not a measure defined by IFRS. The most directly comparable IFRS measure to EBITDA is profit/(loss)

for the year/period.

IFRS 16 Effect ($ million)

The following table intends to represent the effect of EBITDA

before and after IFRS 16 lease accounting standards.

| IFRS 16: Effect |

1H 2022 |

1H 2021 |

| EBITDA |

63.5 |

89.8 |

| Lease payments |

(26.8) |

(26.0) |

| EBITDA w/o IFRS 16 |

36.7 |

63.8 |

| Depreciation & Amortization |

(20.3) |

(21.2) |

| Finance costs |

(6.5) |

(6.5) |

| IFRS 16 total (loss)/expense |

(26.8) |

(27.7) |

| | |

| 8 |  |

Balance Sheet ($ Thousands)

| ASSETS |

June 30,

2022 |

December 31,

2021 |

| |

(unaudited) |

(audited) |

| NON-CURRENT ASSETS |

577,145 |

606,138 |

| |

|

|

| Property, plant and equipment |

79,294 |

81,395 |

| Goodwill |

94,943 |

91,941 |

| Right-of-use assets |

125,446 |

142,705 |

| Intangible assets |

87,550 |

104,886 |

| Non-current financial assets |

58,851 |

57,847 |

| Derivative financial instruments |

4,104 |

12,757 |

| Other taxes recoverable |

4,522 |

4,505 |

| Deferred tax assets |

122,435 |

110,102 |

| |

|

|

| CURRENT ASSETS |

453,826 |

501,638 |

| |

|

|

| Trade and other receivables |

298,935 |

326,208 |

| Derivative financial instruments |

609 |

3,235 |

| Other taxes receivable |

50,415 |

42,627 |

| Other current financial assets |

958 |

744 |

| Cash and cash equivalents |

102,909 |

128,824 |

| |

|

|

| TOTAL ASSETS |

1,030,971 |

1,107,776 |

| | |

| 9 |  |

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

June 30,

2022 |

December 31,

2021 |

| |

(unaudited) |

(audited) |

| |

|

|

| NON-CURRENT LIABILITIES |

716,456 |

683,543 |

| |

|

|

| Debt with third parties |

583,093 |

599,262 |

| Derivative financial instruments |

78,406 |

26,302 |

| Provisions and contingencies |

42,662 |

37,672 |

| Non-trade payables |

10,869 |

18,654 |

| Other taxes payable |

1,426 |

1,653 |

| |

|

|

| CURRENT LIABILITIES |

445,440 |

437,108 |

| |

|

|

| Debt with third parties |

154,385 |

119,017 |

| Derivative financial instruments |

48,996 |

29,646 |

| Trade and other payables |

229,845 |

271,429 |

| Provisions and contingencies |

12,214 |

17,016 |

| |

|

|

| TOTAL LIABILITIES |

1,161,896 |

1,120,651 |

| |

|

|

| TOTAL EQUITY |

(130,925) |

(12,875) |

| | |

| 10 |  |

Cash Flow ($ million)

| |

For the three months ended June 30, |

For the six months ended June 30, |

| |

2021 |

2022 |

2021 |

2022 |

| |

(unaudited) |

(unaudited) |

| Operating activities |

|

|

|

|

| Loss before income tax |

(5.7) |

(15.8) |

(24.9) |

(90.8) |

| Adjustments to reconcile loss before income tax to net cash flows: |

|

|

|

|

| Amortization and depreciation |

28.5 |

31.4 |

58.9 |

61.6 |

| Changes in trade provisions |

(0.1) |

(0.1) |

(1.6) |

0.1 |

| Share-based payment expense |

4.1 |

0.7 |

6.2 |

3.2 |

| Change in provisions |

6.0 |

4.5 |

14.7 |

15.8 |

| Grants released to income |

(0.3) |

0.2 |

(0.4) |

(0.1) |

| Losses on disposal of property, plant and equipment |

(0.1) |

0.3 |

- |

0.6 |

| Finance income |

(6.5) |

(2.7) |

(9.6) |

(4.3) |

| Finance costs |

22.3 |

20.3 |

46.6 |

38.6 |

| Net foreign exchange differences |

1.5 |

(12.5) |

(5.9) |

(8.6) |

| Change in fair value of financial instruments |

10.8 |

8.6 |

24.5 |

68.9 |

| Change in other (gains)/ losses and own work capitalized |

- |

1.6 |

- |

1.3 |

| |

66.2 |

52.2 |

133.4 |

177.1 |

| Changes in working capital: |

|

|

|

|

| Changes in trade and other receivables |

(9.5) |

11.1 |

(45.5) |

6.0 |

| Changes in trade and other payables |

8.2 |

(19.6) |

25.4 |

(67.7) |

| Other assets/(payables) |

(24.9) |

0.3 |

(23.7) |

9.4 |

| |

(26.2) |

(8.2) |

(43.8) |

(52.3) |

| |

|

|

|

|

| Interest paid |

(2.4) |

(3.3) |

(31.7) |

(29.4) |

| Interest received |

- |

0.1 |

7.8 |

0.4 |

| Income tax paid |

(8.2) |

(6.3) |

(12.2) |

(9.3) |

| Other payments |

(8.8) |

8.8 |

(14.2) |

(11.3) |

| |

(19.4) |

(0.7) |

(50.3) |

(49.6) |

| Net cash flows from operating activities |

14.9 |

27.5 |

14.4 |

(15.6) |

| Investing activities |

|

|

|

|

| Payments for acquisition of intangible assets |

0.4 |

(0.3) |

(0.5) |

(2.4) |

| Payments for acquisition of property, plant and equipment |

(16.6) |

(8.3) |

(23.2) |

(16.0) |

| Net cash flows used in investing activities |

(16.2) |

(8.6) |

(23.7) |

(18.4) |

| Financing activities |

|

|

|

|

| Proceeds from borrowing from third parties |

- |

53.3 |

501.8 |

147.0 |

| Repayment of borrowing from third parties |

(10.6) |

(49.6) |

(518.3) |

(118.1) |

| Payments of lease liabilities |

(17.9) |

(14.4) |

(26.0) |

(26.8) |

| Payments of financial instruments |

(1.8) |

0.0 |

(1.8) |

(0.1) |

| Acquisition of treasury shares |

(0.5) |

- |

(0.9) |

- |

| Net cash flows provided by/ (used in) financing activities |

(30.8) |

(10.7) |

(45.2) |

2.1 |

| Net (decrease)/increase in cash and cash equivalents |

(32.1) |

8.2 |

(54.5) |

(32.0) |

| Foreign exchange differences |

9.8 |

(2.3) |

(0.7) |

6.0 |

| Cash and cash equivalents at beginning of period |

176.1 |

97.0 |

209.0 |

128.8 |

| Cash and cash equivalents at end of period |

153.8 |

102.9 |

153.8 |

102.9 |

| |

|

|

|

|

| | |

| 11 |  |

Financing Arrangements

Net debt with third parties as of

December 31, 2021 and June 30, 2022 is as follow:

| ($ million, except Net Debt/ EBITDA LTM(2)) |

On December 31, 2021 |

On June 30, 2022 |

| Cash and cash equivalents |

128.8 |

102.9 |

| Debt: |

|

|

| Senior Secured Notes |

503.9 |

504.5 |

| Super Senior Credit Facility |

25 |

43.7 |

| BNDES |

0.6 |

0.1 |

| Lease Liabilities |

155.8 |

139.3 |

| Other Borrowings |

32.9 |

48.4 |

| Total Debt |

718.3 |

736 |

| Net Debt with third parties (1) (unaudited) |

589.5 |

633.1 |

| Net Debt/ EBITDA LTM(2) (non-GAAP) (unaudited) |

4.0x |

5.3x |

| (1) | In considering our financial condition, our management analyzes Net debt with third parties, which is

defined as total debt less cash and cash equivalents. Net debt with third parties is not a measure defined by IFRS and it has limitations

as an analytical tool. Net debt with third parties is neither a measure defined by or presented in accordance with IFRS nor a measure

of financial performance and should not be considered in isolation or as an alternative financial measure determined in accordance with

IFRS. Net debt is not necessarily comparable to similarly titled measures used by other companies. |

| (2) | EBITDA LTM (Last Twelve Months) |

Number of Workstations and Delivery

Centers

| |

Number of Workstations |

Number of Service

Delivery Centers (1) |

Headcount |

| |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

| Brazil |

50,569 |

40,947 |

32 |

27 |

76,969 |

68,764 |

| Americas |

37,089 |

35,118 |

48 |

44 |

54,549 |

49,487 |

| Argentina (2) |

3,664 |

3,133 |

11 |

10 |

6,851 |

6,291 |

| Central America (3) |

2,788 |

2,772 |

3 |

3 |

5,038 |

4,415 |

| Chile |

2,320 |

1,171 |

4 |

3 |

5,041 |

4,784 |

| Colombia |

9,798 |

10,681 |

9 |

8 |

9,807 |

10,247 |

| Mexico |

10,326 |

9,991 |

15 |

15 |

16,609 |

13,819 |

| Peru |

6,890 |

6,199 |

3 |

2 |

9,546 |

8,436 |

| United States (4) |

1,303 |

1,171 |

3 |

3 |

1,657 |

1,495 |

| EMEA |

5,325 |

5,191 |

14 |

14 |

12,870 |

12,047 |

| Spain |

5,325 |

5,191 |

14 |

14 |

12,870 |

12,047 |

| Corporate |

- |

- |

- |

- |

130 |

148 |

| Total |

92,983 |

81,256 |

94 |

85 |

144,518 |

130,446 |

(1)

Includes service delivery centers at facilities operated by us and those owned by our clients where we provide operations personnel and

workstations (2) Includes Uruguay (3) Includes Guatemala and El Salvador (4) Includes Puerto Rico

FX Rates

| FX Assumptions (Average) |

Q2 2021 |

Q2 2022 |

| Euro (EUR) |

0.83 |

0.94 |

| Brazilian Real (BRL) |

5.47 |

4.92 |

| Mexican Peso (MXN) |

20.33 |

20.04 |

| Colombian Peso (COP) |

3,552.49 |

3,914.75 |

| Chilean Peso (CLP) |

723.99 |

841.49 |

| Peruvian Soles (PEN) |

3.66 |

3.75 |

| Argentinean Peso (ARS) |

88.55 |

117.97 |

| | |

| 12 |  |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

ATENTO S.A. |

| Date: August 3, 2022. |

|

|

| |

By: |

/s/ Carlos López-Abadía |

| |

Name: Carlos López-Abadía |

| |

Title: Chief Executive Officer

|

| |

|

|

| |

By: |

/s/ José Antonio de Sousa Azevedo |

| |

Name: José Antonio de Sousa Azevedo |

| |

Title: Chief Financial Officer |

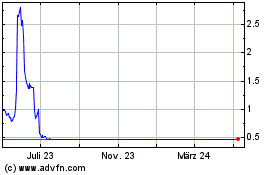

Atento (NYSE:ATTO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Atento (NYSE:ATTO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024