Archrock, Inc. (NYSE: AROC) (“Archrock”) today reported results for

the fourth quarter and full year 2021 and provided 2022 financial

guidance.

Fourth Quarter and Full Year 2021

Highlights

- Revenue for the fourth quarter of

2021 was $195.2 million compared to $199.3 million in the fourth

quarter of 2020. Revenue for 2021 was $781.5 million compared to

$875.0 million in 2020.

- Net income for the fourth quarter

of 2021 was $6.0 million compared to $4.8 million in the

fourth quarter of 2020. Net income for 2021 was $28.2 million

compared to a net loss of $68.4 million in 2020.

- Adjusted EBITDA (a non-GAAP measure

defined below) for the fourth quarter of 2021 was $83.5 million

compared to $88.7 million in the fourth quarter of 2020. Adjusted

EBITDA for 2021 was $360.8 million compared to $414.8 million in

2020.

- Previously-declared quarterly

dividend of $0.145 per common share for the fourth quarter of 2021

resulted in dividend coverage of 2.0x. Dividend coverage for 2021

was 2.2x compared to 2.9x in 2020.

- Leverage ratio was 4.3x at year end

2021 compared to 4.2x as of December 31, 2020.

- Net cash provided by operating

activities and free cash flow after dividend for 2021 were $237.4

million and $164.2 million, respectively.

Management Commentary and

Outlook

“As the market continues to strengthen and

execution by team Archrock remains excellent, we delivered a

sequential increase in our contract operations revenue as well as

our highest quarterly levels of operating horsepower growth and

bookings for the year during the fourth quarter. We closed out 2021

generating positive net income and record annual free cash flow at

the bottom of the cycle,” said Brad Childers, Archrock’s President

and Chief Executive Officer. “More broadly, throughout this

downturn, we’ve demonstrated the stability and cash generating

power of our business, repaying $314 million in debt and returning

$178 million to shareholders since the end of 2019.

“We also achieved several important technology

milestones in 2021, completing the installation of expanded

telematics across our fleet, launching a suite of leading-edge

mobile tools for our field service technicians and migrating key

support functions to our new cloud-based ERP system. These

milestones reflect years of effort to radically transform our

business to ensure our franchise is prepared for energy transition.

With our optimized, standardized and digitized business, we are at

an exciting inflection point. And, as we enter the multi-year

upcycle in natural gas that we see ahead, we are invested in

leveraging the strong foundation of our core compression business

and evaluating complementary opportunities to help our customers

decarbonize.

“Looking at 2022 capital allocation, having

completed nearly $250 million in strategic divestments over the

last three years, together with the opportunity to invest in

high-profit, large midstream compressors, our ability to drive

higher-quality EBITDA growth is accelerating. Our commitment to

strong returns and reducing our emissions footprint are driving our

investment strategy as we grow prudently with our customers. As

such, we expect approximately 25% of our growth capex budget to

fund expansion of our electric motor-drive horsepower. Finally, we

are confident that the strength of our cash flows will continue to

fund our well-covered and competitive dividend and allow us to

maintain a healthy balance sheet,” concluded Childers.

Fourth Quarter and Full Year 2021

Financial Results

Archrock’s fourth quarter 2021 net income of

$6.0 million included a pre-tax non-cash long-lived and other asset

impairment of $6.2 million, a pre-tax insurance settlement related

to damages to facilities and compressors caused by Hurricane Ida of

$2.8 million and pre-tax restructuring costs of $950,000.

Archrock’s fourth quarter 2020 net income of $4.8 million included

a pre-tax non-cash long-lived and other asset impairment of $7.4

million and pre-tax restructuring costs totaling $1.4 million.

Adjusted EBITDA for the fourth quarter of 2021

of $83.5 million included $0.7 million in net gains related to the

sale of compression and other assets. Adjusted EBITDA for the

fourth quarter of 2020 of $88.7 million included $430,000 in net

losses related to the sale of compression and other assets.

Archrock’s full year 2021 net income of $28.2

million included the following pre-tax items: non-cash long-lived

and other asset impairment of $21.4 million, restructuring costs

related to severance and property exit and disposals totaling $2.9

million, a non-cash write-off of unamortized deferred financing

costs of $4.9 million, non-cash depreciation expense from the

write-off of assets damaged in Hurricane Ida of $2.0 million and a

non-income-based tax benefit of $2.5 million. Archrock’s full year

2020 net loss of $68.4 million included the following pre-tax

items: non-cash impairment of the remaining $99.8 million of

goodwill associated with the 2019 Elite Compression acquisition,

non-cash long-lived and other asset impairments of $79.6 million,

restructuring costs related to severance and property disposals

totaling $8.5 million and a net benefit from tax audit settlements

of $10.9 million.

Adjusted EBITDA for the full year 2021 and 2020

included $30.3 million and $10.6 million, respectively, in net

gains related to the sale of compression and other assets.

Contract Operations

For the fourth quarter of 2021, contract

operations segment revenue totaled $159.5 million compared to

$158.9 million in the third quarter of 2021 and $168.8 million in

the fourth quarter of 2020. Gross margin was $99.0 million,

compared to $97.6 million in the third quarter of 2021 and $110.2

million in the fourth quarter of 2020. This reflected a gross

margin percentage of 62%, compared to 61% in the third quarter of

2021 and 65% in the prior year quarter. Total operating horsepower

at the end of the fourth quarter of 2021 was 3.2 million, up 51,000

horsepower from the end of the third quarter of 2021 and compared

to 3.4 million at the end of the prior year quarter. The annual

decline reflected the sale of 147,000 active horsepower as part of

our ongoing fleet high-grading initiative. Utilization at the end

of the fourth quarter of 2021 was 84%, compared to 82% at both the

end of the third quarter of 2021 and the end of the fourth quarter

of 2020.

Aftermarket Services

For the fourth quarter of 2021, aftermarket

services segment revenue totaled $35.7 million, compared to $36.3

million in the third quarter of 2021 due to a seasonal slowdown.

Fourth quarter 2021 aftermarket services revenue was up from $30.6

million in the fourth quarter of 2020, driven by higher parts sales

and service activity. Gross margin of $5.2 million compared to $5.6

million in the third quarter of 2021 and was up from $3.8 million

in the fourth quarter of 2020. Gross margin percentage was 15%,

flat compared to the third quarter of 2021 and up from 13% in the

prior year quarter.

Balance Sheet

Long-term debt was $1.5 billion at December 31,

2021, reflecting net debt repayment of $158.5 million for the full

year 2021. Our leverage ratio was 4.3x, compared to 4.2x as of

December 31, 2020. Our available liquidity totaled $502.5 million

as of December 31, 2021.

Quarterly Dividend

Our Board of Directors recently declared a

quarterly dividend of $0.145 per share of common stock, or $0.58

per share on an annualized basis, resulting in dividend coverage in

the fourth quarter of 2021 of 2.0x. The dividend was paid on

February 15, 2022 to stockholders of record at the close of

business on February 8, 2022.

2022 Annual Guidance

Archrock is providing annual guidance as listed

below. All figures are in thousands, except percentages and

ratios:

|

|

|

|

|

|

|

|

|

|

|

|

Full Year 2022 Guidance |

|

| |

|

|

Low |

|

|

High |

|

| Net income (1) |

|

$ |

15,000 |

|

$ |

55,000 |

|

| Adjusted EBITDA (2) |

|

|

320,000 |

|

|

360,000 |

|

| Cash available for

dividend (3)(4) |

|

|

163,000 |

|

|

181,000 |

|

| |

|

|

|

|

|

|

|

| Segment |

|

|

|

|

|

|

|

| Contract operations

revenue |

|

$ |

660,000 |

|

$ |

690,000 |

|

| Contract operations gross

margin percentage |

|

|

60 |

% |

|

62 |

% |

| Aftermarket services

revenue |

|

$ |

140,000 |

|

$ |

155,000 |

|

| Aftermarket services gross

margin percentage |

|

|

16 |

% |

|

18 |

% |

| |

|

|

|

|

|

|

|

| Selling, general and

administrative |

|

$ |

113,000 |

|

$ |

115,000 |

|

| |

|

|

|

|

|

|

|

| Capital

expenditures |

|

|

|

|

|

|

|

| Growth capital

expenditures |

|

$ |

150,000 |

|

$ |

150,000 |

|

| Maintenance capital

expenditures |

|

|

55,000 |

|

|

75,000 |

|

| Other capital

expenditures |

|

|

8,000 |

|

|

10,000 |

|

(1) 2022 annual guidance for net income

does not include the impact of long-lived and other asset

impairment because due to its nature, it cannot be accurately

forecasted. Long-lived and other asset impairment does not impact

Adjusted EBITDA or cash available for dividend, however it is a

reconciling item between these measures and net income. Long-lived

and other asset impairment for the years 2021 and 2020 was $21.4

million and $79.6 million, respectively.(2) Management

believes Adjusted EBITDA provides useful information to investors

because this non-GAAP measure, when viewed with our GAAP results

and accompanying reconciliations, provides a more complete

understanding of our performance than GAAP results alone.

Management uses this non-GAAP measure as a supplemental measure to

review current period operating performance, comparability measure

and performance measure for period-to-period

comparisons.(3) Management uses cash available for dividend as

a supplemental performance measure to compute the coverage ratio of

estimated cash flows to planned dividends.(4) A

forward-looking estimate of cash provided by operating activities

is not provided because certain items necessary to estimate cash

provided by operating activities, including changes in assets and

liabilities, are not estimable at this time. Changes in assets and

liabilities were $(9.5) million and $19.1 million for the years

2021 and 2020, respectively.

Summary Metrics(in thousands,

except percentages, per share amounts and ratios)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Year Ended |

| |

|

December 31, |

|

September 30, |

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

| |

|

2021 |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

Net income (loss) |

|

$ |

5,992 |

|

|

$ |

9,304 |

|

|

$ |

4,791 |

|

|

$ |

28,217 |

|

|

$ |

(68,445 |

) |

| Adjusted EBITDA |

|

$ |

83,499 |

|

|

$ |

92,351 |

|

|

$ |

88,712 |

|

|

$ |

360,809 |

|

|

$ |

414,770 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contract operations

revenue |

|

$ |

159,501 |

|

|

$ |

158,911 |

|

|

$ |

168,772 |

|

|

$ |

648,311 |

|

|

$ |

738,918 |

|

| Contract operations gross

margin |

|

$ |

99,047 |

|

|

$ |

97,631 |

|

|

$ |

110,170 |

|

|

$ |

403,825 |

|

|

$ |

477,831 |

|

| Contract operations gross

margin percentage |

|

|

62 |

% |

|

|

61 |

% |

|

|

65 |

% |

|

|

62 |

% |

|

|

65 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aftermarket services

revenue |

|

$ |

35,748 |

|

|

$ |

36,255 |

|

|

$ |

30,554 |

|

|

$ |

133,150 |

|

|

$ |

136,052 |

|

| Aftermarket services gross

margin |

|

$ |

5,242 |

|

|

$ |

5,603 |

|

|

$ |

3,834 |

|

|

$ |

18,719 |

|

|

$ |

19,946 |

|

| Aftermarket services gross

margin percentage |

|

|

15 |

% |

|

|

15 |

% |

|

|

13 |

% |

|

|

14 |

% |

|

|

15 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general, and

administrative |

|

$ |

27,167 |

|

|

$ |

28,839 |

|

|

$ |

27,048 |

|

|

$ |

107,167 |

|

|

$ |

105,100 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash available for

dividend |

|

$ |

45,545 |

|

|

$ |

50,128 |

|

|

$ |

56,311 |

|

|

$ |

199,838 |

|

|

$ |

253,707 |

|

| Cash available for dividend

coverage |

|

|

2.0 |

x |

|

|

2.2 |

x |

|

|

2.5 |

x |

|

|

2.2 |

x |

|

|

2.9 |

x |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free cash flow |

|

$ |

6,928 |

|

|

$ |

120,828 |

|

|

$ |

65,408 |

|

|

|

253,507 |

|

|

|

250,247 |

|

| Free cash flow after

dividend |

|

$ |

(15,423 |

) |

|

$ |

98,322 |

|

|

$ |

43,231 |

|

|

|

164,164 |

|

|

|

161,415 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total available horsepower (at

period end) |

|

|

3,878 |

|

|

|

3,913 |

|

|

|

4,120 |

|

|

|

|

|

|

|

|

| Total operating horsepower (at

period end) |

|

|

3,247 |

|

|

|

3,196 |

|

|

|

3,388 |

|

|

|

|

|

|

|

|

| Horsepower utilization spot

(at period end) |

|

|

84 |

% |

|

|

82 |

% |

|

|

82 |

% |

|

|

|

|

|

|

|

Conference Call Details

Archrock will host a conference call on

Wednesday, February 23, 2022, to discuss fourth quarter and full

year 2021 financial results and 2022 guidance. The call will begin

at 10:00 a.m. Eastern Time.

To listen to the call via a live webcast, please

visit Archrock’s website at www.archrock.com. The call will also be

available by dialing 1-888-440-5667 in the United States and Canada

or 1-646-960-0476 for international calls. The access code is

4749623.

A replay of the webcast will be available on Archrock’s website

for 90 days following the event.

Adjusted EBITDA, a non-GAAP measure, is defined

as net income (loss) excluding interest expense, income taxes,

depreciation and amortization, long-lived and other asset

impairment, goodwill impairment, restructuring charges, debt

extinguishment loss, non-cash stock-based compensation expense,

indemnification income (expense), net and other items. A

reconciliation of Adjusted EBITDA to net income (loss), the most

directly comparable GAAP measure, and a reconciliation of our full

year 2022 Adjusted EBITDA guidance to net income (loss) appear

below.

Gross margin, a non-GAAP measure, is defined as

revenue less cost of sales (excluding depreciation and

amortization). Gross margin percentage is defined as gross margin

divided by revenue. A reconciliation of gross margin to net income

(loss), the most directly comparable GAAP measure, appears

below.

Cash available for dividend, a non-GAAP measure,

is defined as net income (loss) excluding interest expense,

income taxes, depreciation and amortization, long-lived and other

asset impairment, goodwill impairment, restructuring charges, debt

extinguishment loss, non-cash stock-based compensation expense,

indemnification income (expense), net and other items, less

maintenance capital expenditures, other capital expenditures, cash

taxes and cash interest expense. Reconciliations of cash available

for dividend to net income (loss) and net cash provided by

operating activities, the most directly comparable GAAP measures,

appear below.

Free cash flow, a non-GAAP measure, is defined

as net cash provided by operating activities plus net cash provided

by (used in) investing activities. A reconciliation of free cash

flow to net cash provided by operating activities, the most

directly comparable GAAP measure, appears below.

Free cash flow after dividend, a non-GAAP

measure, is defined as net cash provided by operating activities

plus net cash provided by (used in) investing activities less

dividends paid to stockholders. A reconciliation of free cash flow

after dividend to net cash provided by operating activities, the

most directly comparable GAAP measure, appears below.

About Archrock

Archrock is an energy infrastructure company

with a pure-play focus on midstream natural gas

compression. Archrock is the leading provider of natural gas

compression services to customers in the oil and natural gas

industry throughout the U.S. and a leading supplier of aftermarket

services to customers that own compression equipment in the U.S.

Archrock is headquartered in Houston, Texas. For more information,

please visit www.archrock.com.

Forward-Looking Statements

All statements in this release (and oral

statements made regarding the subjects of this release) other than

historical facts are forward-looking statements within the meaning

of Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements rely on a number of assumptions

concerning future events and are subject to a number of

uncertainties and factors that could cause actual results to differ

materially from such statements, many of which are outside the

control of Archrock, Inc. Forward-looking information includes, but

is not limited to statements regarding: the effects of the COVID-19

pandemic on our business, operations, customers and financial

conditions; guidance or estimates related to Archrock’s results of

operations or of financial condition; fundamentals of Archrock’s

industry, including the attractiveness of returns and valuation,

stability of cash flows, demand dynamics and overall outlook, and

Archrock’s ability to realize the benefits thereof; Archrock’s

expectations regarding future economic and market conditions and

trends; Archrock’s operational and financial strategies, including

planned growth, coverage and leverage reduction strategies,

Archrock’s ability to successfully effect those strategies and the

expected results therefrom; Archrock’s financial and operational

outlook; demand and growth opportunities for Archrock’s services;

structural and process improvement initiatives, the expected timing

thereof, Archrock’s ability to successfully effect those

initiatives and the expected results therefrom; the operational and

financial synergies provided by Archrock’s size; and statements

regarding Archrock’s dividend policy.

While Archrock believes that the assumptions

concerning future events are reasonable, it cautions that there are

inherent difficulties in predicting certain important factors that

could impact the future performance or results of its business. The

factors that could cause results to differ materially from those

indicated by such forward-looking statements include, but are not

limited to: changes in customer, employee or supplier

relationships; local, regional and national economic and financial

market conditions and the impact they may have on Archrock and its

customers; changes in tax laws; conditions in the oil and gas

industry, including a sustained decrease in the level of supply or

demand for oil or natural gas or a sustained decrease in the price

of oil or natural gas; changes in economic conditions in key

operating markets; impacts of world events, including the COVID-19

pandemic; the financial condition of Archrock’s customers; the

failure of any customer to perform its contractual obligations;

changes in safety, health, environmental and other regulations; and

the effectiveness of Archrock’s control environment, including the

identification of control deficiencies.

These forward-looking statements are also

affected by the risk factors, forward-looking statements and

challenges and uncertainties described in Archrock’s Annual Report

on Form 10-K for the year ended December 31, 2020, Archrock’s

Quarterly Reports on Form 10-Q for the quarters ended March 31,

2021, June 30, 2021 and September 30, 2021, and those set forth

from time to time in Archrock’s filings with the Securities and

Exchange Commission, which are available at www.archrock.com.

Except as required by law, Archrock expressly disclaims any

intention or obligation to revise or update any forward-looking

statements whether as a result of new information, future events or

otherwise.

SOURCE: Archrock, Inc.

For information, contact:

Megan RepineVP of Investor

Relations281-836-8360investor.relations@archrock.com

Archrock, Inc.Unaudited

Condensed Consolidated Statements of Operations(in

thousands, except per share amounts)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

| |

|

2021 |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contract operations |

|

$ |

159,501 |

|

|

$ |

158,911 |

|

|

$ |

168,772 |

|

|

$ |

648,311 |

|

|

$ |

738,918 |

|

|

Aftermarket services |

|

|

35,748 |

|

|

|

36,255 |

|

|

|

30,554 |

|

|

|

133,150 |

|

|

|

136,052 |

|

|

Total revenue |

|

|

195,249 |

|

|

|

195,166 |

|

|

|

199,326 |

|

|

|

781,461 |

|

|

|

874,970 |

|

| Cost of sales (excluding

depreciation and amortization): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contract operations |

|

|

60,454 |

|

|

|

61,280 |

|

|

|

58,602 |

|

|

|

244,486 |

|

|

|

261,087 |

|

|

Aftermarket services |

|

|

30,506 |

|

|

|

30,652 |

|

|

|

26,720 |

|

|

|

114,431 |

|

|

|

116,106 |

|

|

Total cost of sales (excluding depreciation and amortization) |

|

|

90,960 |

|

|

|

91,932 |

|

|

|

85,322 |

|

|

|

358,917 |

|

|

|

377,193 |

|

| Selling, general and

administrative |

|

|

27,167 |

|

|

|

28,839 |

|

|

|

27,048 |

|

|

|

107,167 |

|

|

|

105,100 |

|

| Depreciation and

amortization |

|

|

43,761 |

|

|

|

45,280 |

|

|

|

47,188 |

|

|

|

178,946 |

|

|

|

193,138 |

|

| Long-lived and other asset

impairment |

|

|

6,243 |

|

|

|

5,121 |

|

|

|

7,424 |

|

|

|

21,397 |

|

|

|

79,556 |

|

| Goodwill impairment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

99,830 |

|

| Restructuring charges |

|

|

950 |

|

|

|

313 |

|

|

|

1,414 |

|

|

|

2,903 |

|

|

|

8,450 |

|

| Interest expense |

|

|

25,424 |

|

|

|

25,508 |

|

|

|

25,052 |

|

|

|

108,135 |

|

|

|

105,716 |

|

| Debt extinguishment loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,971 |

|

| (Gain) loss on sale of assets,

net |

|

|

(709 |

) |

|

|

(15,393 |

) |

|

|

430 |

|

|

|

(30,258 |

) |

|

|

(10,643 |

) |

| Other (income) expense,

net |

|

|

(3,073 |

) |

|

|

337 |

|

|

|

(42 |

) |

|

|

(4,707 |

) |

|

|

(1,359 |

) |

| Income (loss) before income

taxes |

|

|

4,526 |

|

|

|

13,229 |

|

|

|

5,490 |

|

|

|

38,961 |

|

|

|

(85,982 |

) |

| Provision for (benefit from)

income taxes |

|

|

(1,466 |

) |

|

|

3,925 |

|

|

|

699 |

|

|

|

10,744 |

|

|

|

(17,537 |

) |

| Net income (loss) |

|

$ |

5,992 |

|

|

$ |

9,304 |

|

|

$ |

4,791 |

|

|

$ |

28,217 |

|

|

$ |

(68,445 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net income

(loss) per common share (1) |

|

$ |

0.04 |

|

|

$ |

0.06 |

|

|

$ |

0.03 |

|

|

$ |

0.18 |

|

|

$ |

(0.46 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

152,320 |

|

|

|

152,158 |

|

|

|

151,161 |

|

|

|

151,684 |

|

|

|

150,828 |

|

| Diluted |

|

|

152,442 |

|

|

|

152,297 |

|

|

|

151,215 |

|

|

|

151,830 |

|

|

|

150,828 |

|

(1) Basic and diluted net income (loss) per

common share is computed using the two-class method to determine

the net income per share for each class of common stock and

participating security (restricted stock and stock-settled

restricted stock units that have non-forfeitable rights to receive

dividends or dividend equivalents) according to dividends declared

and participation rights in undistributed earnings. Accordingly, we

have excluded net income attributable to participating securities

from our calculation of basic and diluted net income per common

share.

Archrock, Inc.Unaudited

Supplemental Information(in thousands, except percentages,

per share amounts and ratios)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Year Ended |

| |

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

| |

|

2021 |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contract operations |

|

$ |

159,501 |

|

|

$ |

158,911 |

|

|

$ |

168,772 |

|

|

$ |

648,311 |

|

|

$ |

738,918 |

|

|

Aftermarket services |

|

|

35,748 |

|

|

|

36,255 |

|

|

|

30,554 |

|

|

|

133,150 |

|

|

|

136,052 |

|

|

Total revenue |

|

$ |

195,249 |

|

|

$ |

195,166 |

|

|

$ |

199,326 |

|

|

$ |

781,461 |

|

|

$ |

874,970 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin (1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contract operations |

|

$ |

99,047 |

|

|

$ |

97,631 |

|

|

$ |

110,170 |

|

|

$ |

403,825 |

|

|

$ |

477,831 |

|

|

Aftermarket services |

|

|

5,242 |

|

|

|

5,603 |

|

|

|

3,834 |

|

|

|

18,719 |

|

|

|

19,946 |

|

|

Total gross margin |

|

$ |

104,289 |

|

|

$ |

103,234 |

|

|

$ |

114,004 |

|

|

$ |

422,544 |

|

|

$ |

497,777 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin percentage: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contract operations |

|

|

62 |

% |

|

|

61 |

% |

|

|

65 |

% |

|

|

62 |

% |

|

|

65 |

% |

|

Aftermarket services |

|

|

15 |

% |

|

|

15 |

% |

|

|

13 |

% |

|

|

14 |

% |

|

|

15 |

% |

|

Total gross margin percentage |

|

|

53 |

% |

|

|

53 |

% |

|

|

57 |

% |

|

|

54 |

% |

|

|

57 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative |

|

$ |

27,167 |

|

|

$ |

28,839 |

|

|

$ |

27,048 |

|

|

$ |

107,167 |

|

|

$ |

105,100 |

|

|

% of revenue |

|

|

14 |

% |

|

|

15 |

% |

|

|

14 |

% |

|

|

14 |

% |

|

|

12 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA (1) |

|

$ |

83,499 |

|

|

$ |

92,351 |

|

|

$ |

88,712 |

|

|

$ |

360,809 |

|

|

$ |

414,770 |

|

|

% of revenue |

|

|

43 |

% |

|

|

47 |

% |

|

|

45 |

% |

|

|

46 |

% |

|

|

47 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital expenditures |

|

$ |

27,004 |

|

|

$ |

32,132 |

|

|

$ |

9,959 |

|

|

$ |

97,885 |

|

|

$ |

140,302 |

|

| Proceeds from sale of

property, plant and equipment and other assets |

|

|

(5,149 |

) |

|

|

(70,785 |

) |

|

|

(5,605 |

) |

|

|

(112,907 |

) |

|

|

(52,562 |

) |

| Net capital expenditures |

|

$ |

21,855 |

|

|

$ |

(38,653 |

) |

|

$ |

4,354 |

|

|

$ |

(15,022 |

) |

|

$ |

87,740 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total available horsepower (at

period end) (2) |

|

|

3,878 |

|

|

|

3,913 |

|

|

|

4,120 |

|

|

|

3,878 |

|

|

|

4,120 |

|

| Total operating horsepower (at

period end) (3) |

|

|

3,247 |

|

|

|

3,196 |

|

|

|

3,388 |

|

|

|

3,247 |

|

|

|

3,388 |

|

| Average operating

horsepower |

|

|

3,220 |

|

|

|

3,225 |

|

|

|

3,423 |

|

|

|

3,282 |

|

|

|

3,657 |

|

| Horsepower utilization: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spot (at period end) |

|

|

84 |

% |

|

|

82 |

% |

|

|

82 |

% |

|

|

84 |

% |

|

|

82 |

% |

|

Average |

|

|

83 |

% |

|

|

82 |

% |

|

|

83 |

% |

|

|

82 |

% |

|

|

86 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividend declared for the

period per share |

|

$ |

0.145 |

|

|

$ |

0.145 |

|

|

$ |

0.145 |

|

|

$ |

0.580 |

|

|

$ |

0.580 |

|

| Dividend declared for the

period to all shareholders |

|

$ |

22,598 |

|

|

$ |

22,393 |

|

|

$ |

22,192 |

|

|

$ |

89,590 |

|

|

$ |

88,853 |

|

| Cash available for dividend

coverage (4) |

|

|

2.0 |

x |

|

|

2.2 |

x |

|

|

2.5 |

x |

|

|

2.2 |

x |

|

|

2.9 |

x |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free cash flow (5) |

|

$ |

6,928 |

|

|

$ |

120,828 |

|

|

$ |

65,408 |

|

|

$ |

253,507 |

|

|

$ |

250,247 |

|

| Free cash flow after dividend

(5) |

|

$ |

(15,423 |

) |

|

$ |

98,322 |

|

|

$ |

43,231 |

|

|

$ |

164,164 |

|

|

$ |

161,415 |

|

(1) Management believes gross margin and

Adjusted EBITDA provide useful information to investors because

these non-GAAP measures, when viewed with our GAAP results and

accompanying reconciliations, provide a more complete understanding

of our performance than GAAP results alone. Management uses these

non-GAAP measures as supplemental measures to review current period

operating performance, comparability measures and performance

measures for period-to-period comparisons.(2) Defined as idle

and operating horsepower, and includes new compressor units

completed by a third party manufacturer that have been delivered to

us.(3) Defined as horsepower that is operating under contract

and horsepower that is idle but under contract and generating

revenue such as standby revenue.(4) Defined as cash available

for dividend divided by dividends declared for the

period.(5) Management believes free cash flow and free cash

flow after dividend provide useful information to investors because

these non-GAAP measures, when viewed with our GAAP results and

accompanying reconciliations, provide a more complete understanding

of our performance and the amount of cash that is available for

dividends, debt repayment and other general corporate purposes.

|

|

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

September 30, |

|

December 31, |

| |

|

2021 |

|

2021 |

|

2020 |

| Balance

Sheet |

|

|

|

|

|

|

|

|

|

| Long-term debt (1) |

|

$ |

1,530,825 |

|

$ |

1,516,135 |

|

$ |

1,688,867 |

| Total equity |

|

|

891,438 |

|

|

904,047 |

|

|

935,557 |

(1) Carrying

values are shown net of unamortized debt premium and deferred

financing costs.

Archrock, Inc.Unaudited

Supplemental Information(in thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

| |

|

2021 |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Reconciliation of Net

Income (Loss) to Adjusted EBITDA and Gross Margin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

5,992 |

|

|

$ |

9,304 |

|

|

$ |

4,791 |

|

|

$ |

28,217 |

|

|

$ |

(68,445 |

) |

| Depreciation and

amortization |

|

|

43,761 |

|

|

|

45,280 |

|

|

|

47,188 |

|

|

|

178,946 |

|

|

|

193,138 |

|

| Long-lived and other asset

impairment |

|

|

6,243 |

|

|

|

5,121 |

|

|

|

7,424 |

|

|

|

21,397 |

|

|

|

79,556 |

|

| Goodwill impairment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

99,830 |

|

| Restructuring charges |

|

|

950 |

|

|

|

313 |

|

|

|

1,414 |

|

|

|

2,903 |

|

|

|

8,450 |

|

| Interest expense |

|

|

25,424 |

|

|

|

25,508 |

|

|

|

25,052 |

|

|

|

108,135 |

|

|

|

105,716 |

|

| Debt extinguishment loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,971 |

|

| Stock-based compensation

expense |

|

|

2,595 |

|

|

|

2,900 |

|

|

|

2,128 |

|

|

|

11,336 |

|

|

|

10,551 |

|

| Indemnification (income)

expense, net (1) |

|

|

— |

|

|

|

— |

|

|

|

16 |

|

|

|

(869 |

) |

|

|

(460 |

) |

| Provision for (benefit from)

income taxes |

|

|

(1,466 |

) |

|

|

3,925 |

|

|

|

699 |

|

|

|

10,744 |

|

|

|

(17,537 |

) |

| Adjusted EBITDA (2) |

|

|

83,499 |

|

|

|

92,351 |

|

|

|

88,712 |

|

|

|

360,809 |

|

|

|

414,770 |

|

| Selling, general and

administrative |

|

|

27,167 |

|

|

|

28,839 |

|

|

|

27,048 |

|

|

|

107,167 |

|

|

|

105,100 |

|

| Stock-based compensation

expense |

|

|

(2,595 |

) |

|

|

(2,900 |

) |

|

|

(2,128 |

) |

|

|

(11,336 |

) |

|

|

(10,551 |

) |

| Indemnification income

(expense), net (1) |

|

|

— |

|

|

|

— |

|

|

|

(16 |

) |

|

|

869 |

|

|

|

460 |

|

| (Gain) loss on sale of assets,

net |

|

|

(709 |

) |

|

|

(15,393 |

) |

|

|

430 |

|

|

|

(30,258 |

) |

|

|

(10,643 |

) |

| Other (income) expense,

net |

|

|

(3,073 |

) |

|

|

337 |

|

|

|

(42 |

) |

|

|

(4,707 |

) |

|

|

(1,359 |

) |

| Gross margin (2) |

|

$ |

104,289 |

|

|

$ |

103,234 |

|

|

$ |

114,004 |

|

|

$ |

422,544 |

|

|

$ |

497,777 |

|

(1) Represents the net income earned or net

expense incurred pursuant to indemnification provisions of our

separation and distribution and tax matters agreements with

Exterran Corporation.(2) Management believes Adjusted EBITDA

and gross margin provide useful information to investors because

these non-GAAP measures, when viewed with our GAAP results and

accompanying reconciliations, provide a more complete understanding

of our performance than GAAP results alone. Management uses these

non-GAAP measures as supplemental measures to review current period

operating performance, comparability measures and performance

measures for period-to-period comparisons.

Archrock, Inc.Unaudited

Supplemental Information(in thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

| |

|

2021 |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Reconciliation of Net

Income (Loss) to Adjusted EBITDA and Cash Available for

Dividend |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

5,992 |

|

|

$ |

9,304 |

|

|

$ |

4,791 |

|

|

$ |

28,217 |

|

|

$ |

(68,445 |

) |

| Depreciation and

amortization |

|

|

43,761 |

|

|

|

45,280 |

|

|

|

47,188 |

|

|

|

178,946 |

|

|

|

193,138 |

|

| Long-lived and other asset

impairment |

|

|

6,243 |

|

|

|

5,121 |

|

|

|

7,424 |

|

|

|

21,397 |

|

|

|

79,556 |

|

| Goodwill impairment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

99,830 |

|

| Restructuring charges |

|

|

950 |

|

|

|

313 |

|

|

|

1,414 |

|

|

|

2,903 |

|

|

|

8,450 |

|

| Interest expense |

|

|

25,424 |

|

|

|

25,508 |

|

|

|

25,052 |

|

|

|

108,135 |

|

|

|

105,716 |

|

| Debt extinguishment loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,971 |

|

| Stock-based compensation

expense |

|

|

2,595 |

|

|

|

2,900 |

|

|

|

2,128 |

|

|

|

11,336 |

|

|

|

10,551 |

|

| Indemnification (income)

expense, net |

|

|

— |

|

|

|

— |

|

|

|

16 |

|

|

|

(869 |

) |

|

|

(460 |

) |

| Provision for (benefit from)

income taxes |

|

|

(1,466 |

) |

|

|

3,925 |

|

|

|

699 |

|

|

|

10,744 |

|

|

|

(17,537 |

) |

| Adjusted EBITDA (1) |

|

|

83,499 |

|

|

|

92,351 |

|

|

|

88,712 |

|

|

|

360,809 |

|

|

|

414,770 |

|

| Less: Maintenance capital

expenditures |

|

|

(11,883 |

) |

|

|

(14,086 |

) |

|

|

(4,019 |

) |

|

|

(47,346 |

) |

|

|

(31,958 |

) |

| Less: Other capital

expenditures |

|

|

(1,789 |

) |

|

|

(3,430 |

) |

|

|

(4,763 |

) |

|

|

(13,376 |

) |

|

|

(29,214 |

) |

| Less: Cash tax refund

(payment) |

|

|

358 |

|

|

|

— |

|

|

|

118 |

|

|

|

(247 |

) |

|

|

(94 |

) |

| Less: Cash interest

expense |

|

|

(24,640 |

) |

|

|

(24,707 |

) |

|

|

(23,737 |

) |

|

|

(100,002 |

) |

|

|

(99,797 |

) |

| Cash available for dividend

(2) |

|

$ |

45,545 |

|

|

$ |

50,128 |

|

|

$ |

56,311 |

|

|

$ |

199,838 |

|

|

$ |

253,707 |

|

(1) Management believes Adjusted EBITDA

provides useful information to investors because this non-GAAP

measure, when viewed with our GAAP results and accompanying

reconciliations, provides a more complete understanding of our

performance than GAAP results alone. Management uses this

non-GAAP measure as a supplemental measure to review current period

operating performance, comparability measure and performance

measure for period-to-period comparisons.(2) Management uses

cash available for dividend as a supplemental performance measure

to compute the coverage ratio of estimated cash flows to planned

dividends.

Archrock, Inc.Unaudited

Supplemental Information(in thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

| |

|

2021 |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Reconciliation of Cash

Flows From Operating Activities to Cash Available for

Dividend |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

$ |

28,675 |

|

|

$ |

82,108 |

|

|

$ |

68,444 |

|

|

$ |

237,400 |

|

|

$ |

335,278 |

|

| Inventory write-downs |

|

|

(376 |

) |

|

|

(110 |

) |

|

|

(434 |

) |

|

|

(997 |

) |

|

|

(1,349 |

) |

| Provision for credit

losses |

|

|

241 |

|

|

|

(366 |

) |

|

|

(1,290 |

) |

|

|

90 |

|

|

|

(3,525 |

) |

| Gain (loss) on sale of assets,

net |

|

|

709 |

|

|

|

15,393 |

|

|

|

(430 |

) |

|

|

30,258 |

|

|

|

10,643 |

|

| Current income tax provision

(benefit) |

|

|

(67 |

) |

|

|

142 |

|

|

|

175 |

|

|

|

365 |

|

|

|

227 |

|

| Cash tax refund (payment) |

|

|

358 |

|

|

|

— |

|

|

|

118 |

|

|

|

(247 |

) |

|

|

(94 |

) |

| Amortization of operating

lease ROU assets |

|

|

(958 |

) |

|

|

(1,031 |

) |

|

|

(922 |

) |

|

|

(3,880 |

) |

|

|

(3,477 |

) |

| Amortization of contract

costs |

|

|

(4,467 |

) |

|

|

(4,771 |

) |

|

|

(6,343 |

) |

|

|

(19,990 |

) |

|

|

(26,629 |

) |

| Deferred revenue recognized in

earnings |

|

|

2,301 |

|

|

|

3,033 |

|

|

|

2,306 |

|

|

|

10,382 |

|

|

|

19,489 |

|

| Cash restructuring

charges |

|

|

950 |

|

|

|

313 |

|

|

|

1,414 |

|

|

|

2,903 |

|

|

|

6,790 |

|

| Indemnification (income)

expense, net |

|

|

— |

|

|

|

— |

|

|

|

16 |

|

|

|

(869 |

) |

|

|

(460 |

) |

| Changes in assets and

liabilities |

|

|

32,958 |

|

|

|

(25,953 |

) |

|

|

3,099 |

|

|

|

9,535 |

|

|

|

(19,098 |

) |

| Maintenance capital

expenditures |

|

|

(11,883 |

) |

|

|

(14,086 |

) |

|

|

(4,019 |

) |

|

|

(47,346 |

) |

|

|

(31,958 |

) |

| Other capital

expenditures |

|

|

(1,789 |

) |

|

|

(3,430 |

) |

|

|

(4,763 |

) |

|

|

(13,376 |

) |

|

|

(29,214 |

) |

| Payments for settlement of

interest rate swaps that include financing elements |

|

|

(1,107 |

) |

|

|

(1,114 |

) |

|

|

(1,060 |

) |

|

|

(4,390 |

) |

|

|

(2,916 |

) |

| Cash available for dividend

(1) |

|

$ |

45,545 |

|

|

$ |

50,128 |

|

|

$ |

56,311 |

|

|

$ |

199,838 |

|

|

$ |

253,707 |

|

(1) Management uses cash available for

dividend as a supplemental performance measure to compute the

coverage ratio of estimated cash flows to planned dividends.

Archrock, Inc.Unaudited

Supplemental Information(in thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

| |

|

2021 |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Reconciliation of Cash

Flows From Operating Activities to Free Cash Flow and Free Cash

Flow After Dividend |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

$ |

28,675 |

|

|

$ |

82,108 |

|

|

$ |

68,444 |

|

|

$ |

237,400 |

|

|

$ |

335,278 |

|

| Net cash provided by (used in)

investing activities |

|

|

(21,747 |

) |

|

|

38,720 |

|

|

|

(3,036 |

) |

|

|

16,107 |

|

|

|

(85,031 |

) |

| Free cash flow (1) |

|

|

6,928 |

|

|

|

120,828 |

|

|

|

65,408 |

|

|

|

253,507 |

|

|

|

250,247 |

|

| Dividends paid to

stockholders |

|

|

(22,351 |

) |

|

|

(22,506 |

) |

|

|

(22,177 |

) |

|

|

(89,343 |

) |

|

|

(88,832 |

) |

| Free cash flow after dividend

(1) |

|

$ |

(15,423 |

) |

|

$ |

98,322 |

|

|

$ |

43,231 |

|

|

$ |

164,164 |

|

|

$ |

161,415 |

|

(1) Management believes free cash flow and

free cash flow after dividend provide useful information to

investors because these non-GAAP measures, when viewed with our

GAAP results and accompanying reconciliations, provide a more

complete understanding of our performance and the amount of cash

that is available for dividends, debt repayment and other general

corporate purposes.

Archrock, Inc.Unaudited

Supplemental Information(in thousands)

| |

|

|

|

|

|

|

| |

|

Annual Guidance Range |

| |

|

2022 |

| |

|

Low |

|

High |

| Reconciliation of Net

Income to Adjusted EBITDA and Cash Available for

Dividend |

|

|

|

|

|

|

|

Net income (1) |

|

$ |

15,000 |

|

|

$ |

55,000 |

|

| Depreciation and

amortization |

|

|

179,000 |

|

|

|

179,000 |

|

| Interest expense |

|

|

98,000 |

|

|

|

98,000 |

|

| Stock-based compensation

expense |

|

|

11,000 |

|

|

|

11,000 |

|

| Provision for income

taxes |

|

|

17,000 |

|

|

|

17,000 |

|

| Adjusted EBITDA (2) |

|

|

320,000 |

|

|

|

360,000 |

|

| Less: Maintenance capital

expenditures |

|

|

55,000 |

|

|

|

75,000 |

|

| Less: Other capital

expenditures |

|

|

8,000 |

|

|

|

10,000 |

|

| Less: Cash tax refund |

|

|

(1,000 |

) |

|

|

(1,000 |

) |

| Less: Cash interest

expense |

|

|

95,000 |

|

|

|

95,000 |

|

| Cash available for dividend

(3)(4) |

|

$ |

163,000 |

|

|

$ |

181,000 |

|

(1) 2022 annual guidance for net income

does not include the impact of long-lived and other asset

impairment because due to its nature, it cannot be accurately

forecasted. Long-lived and other asset impairment does not impact

Adjusted EBITDA or cash available for dividend, however it is a

reconciling item between these measures and net income. Long-lived

and other asset impairment for the years 2021 and 2020 was $21.4

million and $79.6 million, respectively.(2) Management

believes Adjusted EBITDA provides useful information to investors

because this non-GAAP measure, when viewed with our GAAP results

and accompanying reconciliations, provides a more complete

understanding of our performance than GAAP results alone.

Management uses this non-GAAP measure as a supplemental measure to

review current period operating performance, comparability measure

and performance measure for period-to-period

comparisons.(3) Management uses cash available for

dividend as a supplemental performance measure to compute the

coverage ratio of estimated cash flows to planned

dividends.(4) A forward-looking estimate of cash

provided by operating activities is not provided because certain

items necessary to estimate cash provided by operating activities,

including changes in assets and liabilities, are not estimable at

this time. Changes in assets and liabilities were $(9.5) million

and $19.1 million for the years 2021 and 2020, respectively.

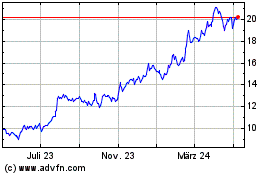

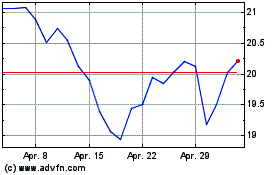

Archrock (NYSE:AROC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Archrock (NYSE:AROC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024