Ares Management Corporation Announces Record U.S. Direct Lending Origination Activity for Fourth Quarter and Full Year 2021

11 Februar 2022 - 12:30PM

Business Wire

Nearly $14 Billion in New Commitments Closed in

the Fourth Quarter and More Than $33 Billion Closed in 2021

Ares Management Corporation (NYSE: ARES) announced today that

new financing commitments made across its U.S. direct lending

strategies more than doubled to $33.4 billion in 2021. Funds

managed by Ares Management Corporation’s Credit Group (collectively

“Ares”) closed approximately $13.7 billion in commitments across 93

transactions during the fourth quarter of 2021 and approximately

$33.4 billion in commitments across 269 transactions in the year

ended December 31, 2021. This compares to the $7.3 billion in

commitments closed across 68 transactions during the fourth quarter

of 2020 and approximately $13.7 billion in commitments across 163

transactions in the year ended December 31, 2020.

"We closed out a record year as our direct lending investment

activity reflects both an expanding market for flexible capital

solutions and Ares’ increased scale," said Kipp deVeer, Head of the

Ares Credit Group. “During 2021, our incumbent relationships and

large client base of over 600 sponsors provided significant

competitive advantages with more than seventy percent of our

transactions being completed with existing sponsor

relationships."

Below is a description of selected transactions that Ares closed

during the fourth quarter.

BioIVT / Linden Capital Partners Ares served as the

administrative agent, lead arranger, and bookrunner for a senior

secured credit facility to support Linden Capital Partners’

acquisition of BioIVT. BioIVT is a leading provider of

mission-critical biological specimens and related services for the

pharmaceutical discovery and development market.

Businessolver / Stone Point Capital Ares served as the

administrative agent for a senior secured credit facility to

support Stone Point Capital’s acquisition of Businessolver.

Businessolver is a leading provider of SaaS-based benefits

administration solutions and technology services.

Chamberlain Group / Blackstone Ares served as the

administrative agent, lead arranger and lead bookrunner for a

senior secured credit facility to support Blackstone’s acquisition

of Chamberlain Group. Chamberlain Group is a global leader in smart

access solutions across residential and commercial properties.

Cornerstone OnDemand / Clearlake Capital Ares served as

the joint lead arranger and joint bookrunner for a senior secured

credit facility to support Clearlake Capital’s acquisition of

Cornerstone OnDemand. Cornerstone is a leading provider of

cloud-based talent management software solutions.

Dye & Durham Ares served as the administrative agent

and sole lead arranger for a senior secured credit facility to

support the operations and growth of Dye & Durham. Dye &

Durham is a market-leading provider of cloud-based workflow

management software and technology solutions designed to improve

efficiency and increase productivity for legal and business

professionals conducting real estate, corporate and commercial

transactions.

Foundation Risk Partners / Warburg Pincus Ares served as

the administrative agent, joint lead arranger and joint bookrunner

for a senior secured credit facility to Foundation Risk Partners to

support the company’s continued growth plans. Foundation Risk

Partners is a full-service, independent insurance brokerage

platform.

Harvey Performance Company / Berkshire Partners Ares

served as the administrative agent, joint lead arranger, and joint

bookrunner for a senior secured credit facility to support

Berkshire Partners’ majority investment in Harvey Performance

Company. Harvey Performance Company is a leading designer and

manufacturer of specialized cutting tools for precision machining

applications.

Ministry Brands / Reverence Capital Partners Ares served

as the administrative agent, joint lead arranger and joint lead

bookrunner for a senior secured credit facility to support

Reverence Capital Partners’ acquisition of Ministry Brands.

Ministry Brands is a leading provider of cloud-based software,

payments solutions, services and information platforms for

churches, ministries and those they serve.

Moon Valley Nurseries / Stonecourt Capital Ares served as

the administrative agent, lead arranger and bookrunner for a senior

secured credit facility to support Stonecourt Capital’s acquisition

of Moon Valley Nurseries. Moon Valley Nurseries is a vertically

integrated large tree and shrub nursery.

Pritchard Industries / Littlejohn & Co. Ares served

as the administrative agent, joint lead arranger and joint

bookrunner for a senior secured credit facility to support

Littlejohn & Co.’s acquisition of Pritchard Industries.

Pritchard Industries is a leading full-service provider of

essential commercial janitorial cleaning services.

Stamps.com / Thoma Bravo Ares served as the

administrative agent and joint lead arranger for a senior secured

credit facility to support Thoma Bravo’s acquisition of Stamps.com.

Stamps.com is a leading provider of e-commerce shipping software

solutions to customers including consumers, small businesses,

e-commerce shippers, enterprises and high-volume shippers.

Ares Management Corporation (NYSE: ARES) is a leading global

alternative investment manager offering clients complementary

primary and secondary investment solutions across the credit,

private equity, real estate and infrastructure asset classes. We

seek to provide flexible capital to support businesses and create

value for our stakeholders and within our communities. By

collaborating across our investment groups, we aim to generate

consistent and attractive investment returns throughout market

cycles. As of December 31, 2021, Ares Management Corporation's

global platform had approximately $306 billion of assets under

management, with approximately 2,100 employees operating across

North America, Europe, Asia Pacific and the Middle East. For more

information, please visit www.aresmgmt.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220210005980/en/

Ares Management Corporation Carl Drake, (888) 818-5298

cdrake@aresmgmt.com or John Stilmar, (888) 818-5298

jstilmar@aresmgmt.com

Media: Ares Management Corporation Priscila Roney,

212-808-1185 proney@aresmgmt.com

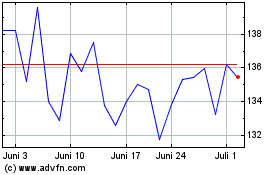

Ares Management (NYSE:ARES)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

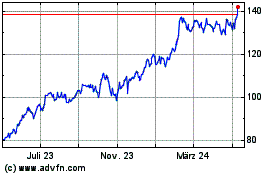

Ares Management (NYSE:ARES)

Historical Stock Chart

Von Apr 2023 bis Apr 2024