Citi and Apollo Announce $25 Billion Private Credit, Direct Lending Program

26 September 2024 - 3:00PM

Business Wire

Mubadala and Athene to Participate as Apollo

Strategic Partner and Affiliate, Respectively

Citi & Apollo Private Credit, Direct

Lending Program Marks Largest Relationship of its Kind

Citigroup Inc. (NYSE: C) and Apollo (NYSE: APO) today announced

that they have entered into an exclusive agreement for a subsidiary

of Citi and certain affiliates of Apollo to form a landmark $25

billion private credit, direct lending program initially in North

America, with the potential to expand to additional geographies.

The program will include participation from Mubadala Investment

Company as Apollo’s strategic partner as well as Apollo’s

subsidiary, Athene, both of which will have the opportunity to join

commitments appropriate for their respective mandates.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240926673479/en/

The strategic program is designed to significantly enhance

access for corporate and sponsor clients to the private lending

capital pool, at a scale and size which can provide funding

certainty in strategic transactions. The program will join Citi’s

expansive banking client reach, origination and capital markets

expertise with Apollo’s scaled, extensive capital base. The firms

anticipate the program will finance approximately $25 billion of

debt opportunities over the next several years, encompassing both

corporate and financial sponsor transactions. Citi and Apollo

expect strong client demand and maintain the flexibility to

significantly expand the size of the program beyond the initial $25

billion.

“This exciting project brings Citi together with Apollo and

other best-in-class partners to offer a full suite of innovative,

private financing solutions to our clients,” said Viswas Raghavan,

Head of Banking and Executive Vice Chair at Citi. “Combining the

strength of Citi’s Banking and Capital Markets franchise with

Apollo’s deep capital resources will provide clients with a range

of options to meet their evolving financing needs and achieve their

strategic goals.”

Apollo Co-President Jim Zelter said, “We are pleased to form a

first-of-its-kind, scaled direct lending program with Citi, a

preeminent banking partner and leader in capital markets and

advisory. Our collaboration will allow Citi to enhance its client

offerings and bring more private solutions to bear, while enabling

Apollo to increase origination flow and tap into Citi’s extensive

client relationships. As financial markets continue to evolve,

together we believe this is a win-win arrangement that uses our

respective strengths and assets to better serve our clients and

other stakeholders in a reliable, scalable and capital efficient

manner.”

Cravath, Swaine & Moore LLP is serving as legal counsel and

Citigroup Global Markets Inc. is acting as advisor to Citi; Paul,

Weiss, Rifkind, Wharton & Garrison LLP is serving as legal

counsel and Sullivan & Cromwell LLP is serving as regulatory

counsel to Apollo.

About Citi

Citi is a preeminent banking partner for institutions with

cross-border needs, a global leader in wealth management and a

valued personal bank in its home market of the United States. Citi

does business in more than 180 countries and jurisdictions,

providing corporations, governments, investors, institutions and

individuals with a broad range of financial products and

services.

Additional information may be found at www.citigroup.com | X:

@Citi | LinkedIn: www.linkedin.com/company/citi | YouTube:

www.youtube.com/citi | Facebook: www.facebook.com/citi

About Apollo

Apollo is a high-growth, global alternative asset manager. In

our asset management business, we seek to provide our clients

excess return at every point along the risk-reward spectrum from

investment grade to private equity with a focus on three investing

strategies: yield, hybrid, and equity. For more than three decades,

our investing expertise across our fully integrated platform has

served the financial return needs of our clients and provided

businesses with innovative capital solutions for growth. Through

Athene, our retirement services business, we specialize in helping

clients achieve financial security by providing a suite of

retirement savings products and acting as a solutions provider to

institutions. Our patient, creative, and knowledgeable approach to

investing aligns our clients, businesses we invest in, our

employees, and the communities we impact to expand opportunity and

achieve positive outcomes. As of June 30, 2024, Apollo had

approximately $696 billion of assets under management. To learn

more, please visit www.apollo.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240926673479/en/

Lauren Sambrotto Communications Citi (917) 656-8511

Lauren.sambrotto@citi.com

Joanna Rose Global Head of Communications Apollo Global

Management, Inc. (212) 822-0491 Communications@apollo.com

Noah Gunn Global Head of Investor Relations Apollo Global

Management, Inc. (212) 822-0540 IR@apollo.com

Apollo Global Management (NYSE:APO)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

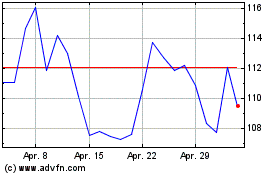

Apollo Global Management (NYSE:APO)

Historical Stock Chart

Von Nov 2023 bis Nov 2024