Securities Registration: Employee Benefit Plan (s-8)

08 November 2021 - 7:06PM

Edgar (US Regulatory)

As

filed with the Securities and Exchange Commission on November 8, 2021.

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT UNDER THE

SECURITIES

ACT OF 1933

AMPHENOL

CORPORATION

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

22-2785165

|

|

(State

or other jurisdiction of

|

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

|

Identification

No.)

|

358

Hall Avenue

Wallingford,

Connecticut 06492

(Address

of Principal Executive Offices) (Zip Code)

Amended

and Restated 2017 Stock Purchase and Option Plan for Key Employees of Amphenol and Subsidiaries

(Full

title of the plan)

Lance

E. D’Amico

Senior

Vice President, Secretary and General Counsel

Amphenol

Corporation

358

Hall Avenue

Wallingford,

CT 06492

(Name

and address of agent for service)

(203)-265-8900

(Telephone

number, including area code, of agent for service)

Copies

to:

Brian

D. Miller

Latham &

Watkins LLP

555

11th Street, N.W., Suite 1000

Washington,

DC 20004

(202)

637-2200

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

x

|

|

|

Accelerated filer

|

¨

|

|

|

|

|

|

|

|

|

|

|

Non-accelerated filer

|

¨

|

|

|

Smaller reporting company

|

¨

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

¨

|

|

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

CALCULATION

OF REGISTRATION FEE

|

Title of securities to be registered

|

|

Amount

to be

registered(1)

|

|

|

Proposed

maximum

offering price

per share(2)

|

|

|

Proposed

maximum

aggregate

offering

price(2)

|

|

|

Amount of

registration

fee

|

|

|

Class A Common Stock, par value $.001 per share

|

|

|

40,000,000

|

|

|

$

|

77.13

|

|

|

$

|

3,085,200,000

|

|

|

$

|

285,998.04

|

|

|

(1)

|

Pursuant

to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also covers

an indeterminate number of shares of Class A Common Stock, par value $.001 per share (the “Common Stock”), of Amphenol

Corporation (the “Company”) that may be offered or issued under the Amended and Restated 2017 Stock Purchase and Option

Plan for Key Employees of Amphenol and Subsidiaries (the “Plan”) as a result of a stock split, stock dividend or similar

transaction.

|

|

(2)

|

Estimated

solely for purposes of calculating the registration fee pursuant to Rules 457(c) and (h) of the Securities Act. The proposed

maximum offering price per share, proposed maximum aggregate offering price and the amount of the registration fee are based on the

average of the high and low sale prices per share for the Common Stock as reported on the New York Stock Exchange on November 1, 2021, which date is within five business days prior to filing this registration statement.

|

EXPLANATORY

NOTE

On

May 19, 2021, the stockholders of the Company approved the Plan, which is an amendment and restatement of the 2017 Stock Purchase and

Option Plan for Key Employees of Amphenol and Subsidiaries and increases the number of shares of Common Stock reserved for issuance under

the Plan by 40,000,000 shares. This registration statement is being filed to register the 40,000,000 additional shares of Common Stock

reserved for issuance pursuant to the Plan. The Common Stock registered hereunder is in addition to the 60,000,000 shares of Common Stock

previously reserved for issuance under the Plan (after adjustment for a 2 for 1 stock split in March 2021) and previously registered

on the Company’s registration statement on Form S-8 filed on May 19, 2017 (File No. 333-218107) (the “Prior Registration

Statement”).

This

registration statement is submitted in accordance with General Instruction E to Form S-8 regarding Registration of Additional Securities.

Pursuant to Instruction E, the contents of the Prior Registration Statements are incorporated by reference and made a part of this registration

statement except as amended hereby.

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

The

information called for in Part I of Form S-8 is not required to be filed with this registration statement.

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

|

Item

3.

|

Incorporation

of Documents by Reference.

|

The

following documents filed with the Securities and Exchange Commission (“SEC”) by the Company are incorporated herein by reference:

|

|

(b)

|

the

Company’s Quarterly Reports on Form 10-Q for the quarter ended March 31, 2021, filed

with the SEC on April 30, 2021, for the quarter ended June 30, 2021, filed with the SEC on

July 30, 2021 and for the quarter ended September 30, 2021, filed with the SEC on October 29, 2021;

|

|

|

|

|

|

|

(c)

|

the

Company’s Current Reports on Form 8-K filed with the SEC on January 27, 2021 (excluding

portion furnished pursuant to Item 2.02), February 4, 2021, March 12, 2021, April 7, 2021,

April 28, 2021 (excluding portion furnished pursuant to Item 2.02), May 19, 2021, July 29, 2021, September 9, 2021, September 14, 2021 and October 27, 2021 (excluding portion furnished

pursuant to Item 2.02); and

|

|

|

|

|

All

documents filed by the Company with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), after the date of this registration statement and prior to the filing of a post-effective amendment

to this registration statement, which indicates that all securities offered hereby have been sold or which deregisters all securities

then remaining unsold, shall be deemed incorporated by reference into this registration statement and to be a part hereof from the date

of filing of such document.

We

are not, however, incorporating by reference any documents or portions thereof, whether specifically listed above or included in future

filings, that are not deemed “filed” with the SEC.

Any

statement contained in this registration statement or in a document incorporated or deemed to be incorporated by reference in this registration

statement shall be deemed to be modified or superseded for purposes of this registration statement to the extent that a statement contained

in any subsequently filed document that also is or is deemed to be incorporated by reference in this registration statement modifies

or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this registration statement.

* Filed

herewith.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the Town of Wallingford, State of Connecticut, on this 8th day of November, 2021.

|

|

AMPHENOL CORPORATION

|

|

|

|

|

|

By:

|

/s/ R. Adam Norwitt

|

|

|

Name:

|

R. Adam Norwitt

|

|

|

Title:

|

President and Chief Executive Officer

|

POWER OF ATTORNEY

We,

the undersigned directors and officers of Amphenol Corporation do hereby constitute and appoint R. Adam Norwitt, Craig A. Lampo and Lance

E. D’Amico and each of them, our true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution,

to do any and all acts and things in our names and on our behalf in our capacities as directors and officers and to execute any and all

instruments for us in the capacities indicated below, which said attorney and agent may deem necessary or advisable to enable said corporation

to comply with the Securities Act and any rules, regulations and agreements of the Securities and Exchange Commission, in connection

with this registration statement, or any registration statement for this offering that is to be effective upon filing pursuant to Rule

462(b) under the Securities Act, including specifically, but without limitation, any and all amendments (including post-effective amendments)

hereto; and we hereby ratify and confirm all that said attorney and agent shall do or cause to be done by virtue thereof.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities

and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/

R. ADAM NORWITT

|

|

President,

Chief Executive Officer and Director (Principal Executive Officer)

|

|

November 8, 2021

|

|

R.

Adam Norwitt

|

|

|

|

|

|

|

|

|

|

|

/s/

CRAIG A. LAMPO

|

|

Senior

Vice President and Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer)

|

|

November 8, 2021

|

|

Craig

A. Lampo

|

|

|

|

|

|

|

|

|

|

|

/s/

MARTIN H. LOEFFLER

|

|

Chairman

of the Board of Directors

|

|

November 8, 2021

|

|

Martin

H. Loeffler

|

|

|

|

|

|

|

|

|

|

|

|

/s/

David P. FALCK

|

|

Presiding

Director

|

|

November 8, 2021

|

|

David

P. Falck

|

|

|

|

|

|

|

|

|

|

|

|

/s/

NANCY A. ALTOBELLO

|

|

Director

|

|

November 8, 2021

|

|

Nancy

A. Altobello

|

|

|

|

|

|

|

|

|

|

|

|

/s/

STANLEY L. Clark

|

|

Director

|

|

November 8, 2021

|

|

Stanley

L. Clark

|

|

|

|

|

|

|

|

|

|

|

|

/s/

JOHN D. CRAIG

|

|

Director

|

|

November 8, 2021

|

|

John

D. Craig

|

|

|

|

|

|

|

|

|

|

|

|

/s/

EDWARD G. JEPSEN

|

|

Director

|

|

November 8, 2021

|

|

Edward

G. Jepsen

|

|

|

|

|

|

|

|

|

|

|

|

/s/

RITA S. LANE

|

|

Director

|

|

November 8, 2021

|

|

Rita

S. Lane

|

|

|

|

|

|

|

|

|

|

|

|

/s/

ROBERT A. LIVINGSTON

|

|

Director

|

|

November 8, 2021

|

|

Robert

A. Livingston

|

|

|

|

|

|

|

|

|

|

|

|

/s/

ANNE CLARKE WOLFF

|

|

Director

|

|

November 8, 2021

|

|

Anne

Clarke Wolff

|

|

|

|

|

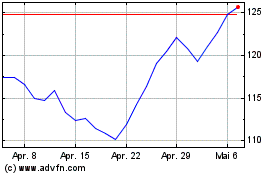

Amphenol (NYSE:APH)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

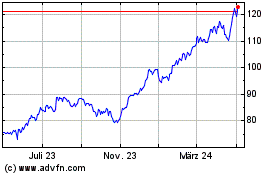

Amphenol (NYSE:APH)

Historical Stock Chart

Von Apr 2023 bis Apr 2024