Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

23 Februar 2022 - 11:18PM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Relating to Preliminary Prospectus Supplement dated February 23, 2022 to

Prospectus dated May 12, 2020

Registration Statement Nos. 333-238189,

333-238189-01, 333-238189-02 and 333-238189-03

Aon Corporation and Aon Global Holdings plc

$600,000,000 2.850% SENIOR NOTES DUE 2027 (the “2027 Notes”)

$900,000,000 3.900% SENIOR NOTES DUE 2052 (the “2052 Notes”)

(together, the “Notes”)

PRICING TERM SHEET

Terms Applicable to the Notes

|

|

|

| Issuers: |

|

Aon Corporation and Aon Global Holdings plc |

|

|

| Guarantors: |

|

Aon plc and Aon Global Limited |

|

|

| Offering Format: |

|

SEC Registered |

|

|

| Expected Ratings*: |

|

Moody’s Investors Service: Baa2

Standard & Poor’s: A-

Fitch: BBB+ |

|

|

| Ranking: |

|

Senior Unsecured |

|

|

| Trade Date: |

|

February 23, 2022 |

|

|

| Settlement Date (T+3)**: |

|

February 28, 2022 |

|

|

| Denominations: |

|

$2,000 and multiples of $1,000 |

|

|

| Joint Book-Running Managers: |

|

Morgan Stanley & Co. LLC Barclays

Capital Inc. Credit Suisse Securities (USA) LLC Deutsche Bank

Securities Inc. |

|

|

| Co-Managers: |

|

Aon Securities LLC ANZ Securities, Inc.

BNY Mellon Capital Markets, LLC nabSecurities, LLC

Scotia Capital (USA) Inc. UniCredit Capital Markets LLC

U.S. Bancorp Investments, Inc. |

|

|

| Principal Amount: |

|

$600,000,000 for the 2027 Notes $900,000,000

for the 2052 Notes |

|

|

| Maturity Date: |

|

May 28, 2027 for the 2027 Notes

February 28, 2052 for the 2052 Notes |

|

|

|

| Reference Treasury: |

|

UST 1.500% due January 31, 2027 for the 2027 Notes

UST 1.875% due November 15, 2051 for the 2052 Notes |

|

|

| Reference Treasury Price and Yield: |

|

98-05+; 1.890% for the 2027 Notes

91-05; 2.287% for the 2052 Notes |

|

|

| Reoffer Spread to Reference Treasury: |

|

+97 bps for the 2027 Notes +170 bps for the

2052 Notes |

|

|

| Re-offer Yield: |

|

2.860% for the 2027 Notes 3.987% for the 2052

Notes |

|

|

| Coupon: |

|

2.850% for the 2027 Notes 3.900% for the 2052

Notes |

|

|

| Interest Payment Dates: |

|

Semi-annually in arrears on May 28 and November 28 beginning on November 28, 2022 for the 2027 Notes (long first coupon)

Semi-annually in arrears on February 28 and August 28, beginning on

August 28, 2022 for the 2052 Notes |

|

|

| Price to Public: |

|

99.944% for the 2027 Notes 98.486% for the 2052

Notes |

|

|

| Proceeds to Issuers (before deducting our offering expenses and underwriting discounts): |

|

$1,486,038,000 for the Notes |

|

|

| CUSIP / ISIN: |

|

03740L AD4 / US03740LAD47 for the 2027 Notes

03740L AE2 / US03740LAE20 for the 2052 Notes |

|

|

| Optional Redemption: |

|

Prior to April 28, 2027 (one month prior to the 2027 Notes maturity date) (the “2027 Par Call Date”), and prior to

August 28, 2051 (six months prior to the 2052 Notes maturity date) (the “2052 Par Call Date” and together with the 2027 Par Call Date, each a “Par Call Date”), the Issuers may redeem the 2027 Notes and/or the 2052 Notes at

their option, in whole or in part, at any time and from time to time, at a redemption price (expressed as a percentage of the principal amount and rounded to three decimal places) equal to the greater of:

(1) (a) the sum of the present values of the remaining scheduled payments of principal

and interest on the Notes of such series being redeemed discounted to the redemption date (assuming the Notes of such series being redeemed matured on the applicable Par Call Date) on a semi-annual basis (assuming a

360-day year consisting of twelve 30-day months) at the Treasury Rate (as defined under “Description of the Securities—Optional Redemption”), plus 15

basis points (0.150%), in the case of the 2027 Notes, and plus 30 basis points (0.300%), in the case of the 2052 Notes less, (b) interest accrued to the date of redemption, |

2

|

|

|

|

|

and

(2) 100% of the principal amount of the Notes of such series being redeemed,

plus, in either case, accrued and unpaid interest on the principal amount of the Notes of such series being redeemed to the redemption date.100% of the

principal amount of the Notes of such series being redeemed, On or after the

applicable Par Call Date, the Issuers may redeem the 2027 Notes and/or the 2052 Notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the Notes of such series being redeemed

plus accrued and unpaid interest thereon to the redemption date. See

“Description of the Securities—Optional Redemption” and “Description of the Securities—Optional Tax Redemption” in the preliminary prospectus supplement for more information. |

|

|

| Conflicts of Interest: |

|

Aon Securities LLC is an indirect wholly owned subsidiary of Aon Corporation. This offering is subject to, and will be conducted in compliance with, the requirements of Rule 5121 of the Financial Industry Regulatory Authority, Inc.

(“FINRA”) regarding a FINRA member firm distributing the securities of an affiliate. |

*Note: An explanation of the significance of ratings may be obtained from the rating agencies. Generally,

rating agencies base their ratings on such material and information, and such of their own investigations, studies and assumptions, as they deem appropriate. The rating of the Notes should be evaluated independently from similar ratings of other

securities. A credit rating of a security is not a recommendation to buy, sell or hold securities and may be subject to review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency.

**Note: Under Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the

secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes offered hereby on the date of pricing will be required, by

virtue of the fact that such Notes initially will settle T+3, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of these Notes who wish to trade the Notes on the date of pricing should

consult their own advisors.

The issuers and the guarantors have filed a registration statement, including a prospectus, with the

SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuers have filed with the SEC for more complete information about the issuers, the

guarantors and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Joint Book-Running Managers in the offering will arrange to send you the prospectus if you request it by

contacting Morgan Stanley & Co. LLC at 1-866-718-1649, Barclays Capital Inc. at 1-888-603-5847, Credit Suisse Securities (USA) LLC at

1-800-221-1037 or Deutsche Bank Securities Inc. 1-800-503-4611.

3

Any disclaimers or other notices that may appear below are not applicable to this

communication and should be disregarded (other than any statement relating to the identity of the legal entity authorizing or sending this communication in a non-US jurisdiction). Such disclaimers or other

notices were automatically generated as a result of this communication having been sent via Bloomberg or another e-mail system.

4

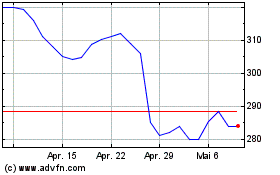

Aon (NYSE:AON)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

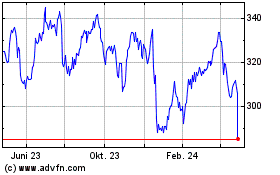

Aon (NYSE:AON)

Historical Stock Chart

Von Apr 2023 bis Apr 2024