Current Report Filing (8-k)

03 Dezember 2021 - 2:01PM

Edgar (US Regulatory)

false 0000315293 0000315293 2021-11-29 2021-11-29 0000315293 us-gaap:CapitalUnitClassAMember 2021-11-29 2021-11-29 0000315293 aon:GuaranteesOfAonPlcs4.000SeniorNotesDue2023Member 2021-11-29 2021-11-29 0000315293 aon:GuaranteesOfAonPlcs3.500SeniorNotesDue2024Member 2021-11-29 2021-11-29 0000315293 aon:GuaranteesOfAonPlcs3.875SeniorNotesDue2025Member 2021-11-29 2021-11-29 0000315293 aon:GuaranteesOfAonPlcs2.875SeniorNotesDue2026Member 2021-11-29 2021-11-29 0000315293 aon:GuaranteesOfAonPlcs205SeniorNotesDue2031Member 2021-11-29 2021-11-29 0000315293 aon:GuaranteesOfAonPlcs4.250SeniorNotesDue2042Member 2021-11-29 2021-11-29 0000315293 aon:GuaranteesOfAonPlcs4.450SeniorNotesDue2043Member 2021-11-29 2021-11-29 0000315293 aon:GuaranteesOfAonPlcs4.600SeniorNotesDue2044Member 2021-11-29 2021-11-29 0000315293 aon:GuaranteesOfAonPlcs4.750SeniorNotesDue2045Member 2021-11-29 2021-11-29 0000315293 aon:GuaranteesOfAonPlcs290SeniorNotesDue2051Member 2021-11-29 2021-11-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 29, 2021

Aon plc

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Ireland

|

|

1-7933

|

|

95-1539969

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

Metropolitan Building, James Joyce Street

Dublin 1, Ireland

|

|

D01 K0Y85

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: +353 1 266 6000

Former name or former address, if changed since last report: Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Class A Ordinary Shares, $0.01 nominal value

|

|

AON

|

|

New York Stock Exchange

|

|

Guarantees of Aon plc’s 4.000% Senior Notes due 2023

|

|

AON23

|

|

New York Stock Exchange

|

|

Guarantees of Aon plc’s 3.500% Senior Notes due 2024

|

|

AON24

|

|

New York Stock Exchange

|

|

Guarantees of Aon plc’s 3.875% Senior Notes due 2025

|

|

AON25

|

|

New York Stock Exchange

|

|

Guarantees of Aon plc’s 2.875% Senior Notes due 2026

|

|

AON26

|

|

New York Stock Exchange

|

|

Guarantees of Aon Corp. and Aon Global Holdings plc’s 2.050% Senior Notes due 2031

|

|

AON31

|

|

New York Stock Exchange

|

|

Guarantees of Aon plc’s 4.250% Senior Notes due 2042

|

|

AON42

|

|

New York Stock Exchange

|

|

Guarantees of Aon plc’s 4.450% Senior Notes due 2043

|

|

AON43

|

|

New York Stock Exchange

|

|

Guarantees of Aon plc’s 4.600% Senior Notes due 2044

|

|

AON44

|

|

New York Stock Exchange

|

|

Guarantees of Aon plc’s 4.750% Senior Notes due 2045

|

|

AON45

|

|

New York Stock Exchange

|

|

Guarantees of Aon Corp. and Aon Global Holdings plc’s 2.900% Senior Notes due 2051

|

|

AON51

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On November 29, 2021, Aon Corporation, a Delaware corporation (“Aon Corporation”), Aon Global Holdings plc, a public limited company formed under the laws of England and Wales (“AGH” and, together with Aon Corporation, the “Issuers”), Aon plc, an Irish public limited company (“Aon plc”) and Aon Global Limited, a private limited company formed under the laws of England and Wales, and prior to its re-registration, a public limited company formed under the laws of England and Wales named Aon plc (“AGL” and, together with Aon plc, the “Guarantors” and each, a “Guarantor”), entered into an underwriting agreement (the “Underwriting Agreement”) with J.P. Morgan Securities LLC, BofA Securities, Inc. and Goldman Sachs & Co. LLC as representatives of the several underwriters named therein, with respect to the offering and sale by Aon Corporation and AGH of $500,000,000 aggregate principal amount of their 2.600% Senior Notes due 2031 (the “Notes”) under the Registration Statement on Form S-3 (Registration Nos. 333-238189, 333-238189-01, 333-238189-02 and 333-238189-03). Each Guarantor has fully and unconditionally, jointly and severally, guaranteed the Notes pursuant to the Indenture (as defined below) (collectively, the “Guarantees” and, together with the Notes, the “Securities”). The Securities were issued pursuant to an indenture, dated December 3, 2018, as amended and restated on April 1, 2020, as further amended and supplemented by a second supplemental indenture on December 2, 2021 (together, the “Indenture”), among Aon Corporation, AGH, the Guarantors and The Bank of New York Mellon Trust Company, N.A., as trustee (the “Trustee”).

The net proceeds from the offering, after deducting the underwriting discount and estimated offering expenses payable by the Issuers, were approximately $495.4 million. Aon Corporation and AGH intend to use the net proceeds from the offering for general corporate purposes.

In connection with the issuance of the Securities, Matheson is filing the legal opinion attached as Exhibit 5.3 to this Current Report on Form 8-K.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: December 2, 2021

|

|

|

|

AON PLC

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Julie Cho

|

|

|

|

|

|

Name:

|

|

Julie Cho

|

|

|

|

|

|

Title:

|

|

Assistant Company Secretary

|

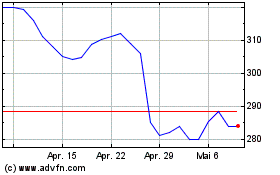

Aon (NYSE:AON)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

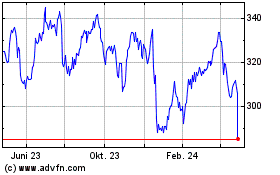

Aon (NYSE:AON)

Historical Stock Chart

Von Apr 2023 bis Apr 2024