Current Report Filing (8-k)

02 Dezember 2022 - 10:19PM

Edgar (US Regulatory)

false000170471512/3100017047152022-12-012022-12-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 1, 2022

ALPHA METALLURGICAL RESOURCES, INC.

(Exact Name of Registrant as Specified in Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| | | | | |

001-38735 | 81-3015061 |

(Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

340 Martin Luther King Jr. Blvd. Bristol, Tennessee 37620 |

(Address of Principal Executive Offices, zip code) |

(423) 573-0300

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | AMR | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 1, 2022, the Board of Directors (the “Board”) of Alpha Metallurgical Resources, Inc. (the “Company”) appointed Joanna Baker de Neufville and Michael Gorzynski to serve as directors of the Company, effective January 1, 2023. The Board also appointed Ms. Baker de Neufville to the Board’s Audit Committee and to its Safety, Health and Environmental Committee, and appointed Mr. Gorzynski to the Board’s Compensation Committee and to its Nominating and Corporate Governance Committee, each effective January 1, 2023. The Company previously announced that Charles Andrew (“Andy”) Eidson will also join the Board upon assuming the Chief Executive Officer role on January 1, 2023. In connection with the upcoming appointments of Ms. Baker de Neufville and Mr. Gorzynski, the Board will temporarily expand to ten members through next year’s Annual Meeting of Stockholders. The Board will decrease to nine members following the 2023 Annual Meeting and is expected to remain at that size through at least the 2024 Annual Meeting.

Michael Gorzynski (44) is the founder and managing partner of MG Capital Management, a significant shareholder of Alpha. He also serves as executive chairman of Continental General Insurance Company. Prior to forming MG Capital Management in 2011, Mr. Gorzynski was an investor in special situations globally at Third Point LLC. Earlier in his career, he worked in investment banking at Credit Suisse First Boston and Spectrum Equity Investors. He received an MBA from Harvard Business School and a BA from The University of California, Berkeley.

Joanna Baker de Neufville (43) is a principal of the investment fund De Neufville and Company, L.P., where she oversees the firm’s investment portfolio. Prior to joining De Neufville & Company in 2020, she worked for three years as a strategy consultant. Prior to that, she served as chief operating officer and chief financial officer of the Tamara Mellon Brand. Before that, Ms. Baker de Neufville co-founded and was chief executive officer of HealthLeap, an online medical portal, which she sold in 2011. Ms. Baker de Neufville began her career in the equities division at Goldman Sachs. She received an MBA from Harvard Business School and a BA from Dartmouth College. She serves as a board member of the Society of Memorial Sloan Kettering Cancer Center and The Roxiticus Foundation.

These appointments followed discussions between members of the Company’s management team and the Board with Mr. Gorzynski regarding the composition of the Board and the appointment of additional independent directors. In connection therewith, the Company agreed to reimburse Continental General Insurance Company, one of the entities controlled by Mr. Gorzynski, in an amount up to $500,000 for legal fees. Neither of the two new directors has any family relationship with any of the Company’s directors or executive officers or any person nominated or chosen by the Company to be a director or executive officer. The new directors will be compensated for their service as directors according to the Company’s Non-Employee Director Compensation Policy, as amended from time to time.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

On December 1, 2022, the Board adopted and approved an amendment and restatement of the Company’s Third Amended and Restated Bylaws (as amended and restated, the “Amended Bylaws”) that became effective immediately. The amendments, among other things:

•Update the procedural mechanics and disclosure requirements in connection with stockholder nominations of directors and submissions of proposals regarding other business at stockholder meetings, including to address the effectiveness of rules related to the use of “universal” proxy cards adopted by the Securities and Exchange Commission, by:

◦Adding a requirement that a stockholder making a nomination will comply with the requirements of Rule 14a-19 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”);

◦Adding a requirement that a stockholder making a nomination provide a representation that it intends to solicit the holders of shares representing at least 67% of the voting power of shares entitled to vote on the election of directors in support of director nominees other than the corporation’s nominees;

◦Adding a requirement that the stockholder provide the Company by a specified date prior to the meeting with reasonable evidence that the stockholder complied with Rule 14a-19 under the Exchange Act;

◦Specifying that in the event the Company receives proxies for nominees that did not meet the requirements of Rule 14a-19 under the Exchange Act, the proposed nominations will be disregarded;

◦Adding a requirement that each dissident nominee submit a written consent to be named as a nominee in any proxy statement for the applicable meeting and any associated proxy card;

◦Adding a requirement that a dissident stockholder not use a white proxy card;

◦Requiring the provision of additional background information and disclosures regarding proposed or possible nominees;

•Update provisions regarding notice of an adjournment of a virtual meeting of stockholders, to align with recent amendments to the Delaware General Corporation Law;

•Update Article 5 to provide that all shares of capital stock of the Company shall be registered in book-entry form; and

•Incorporate technical, ministerial, clarifying and conforming changes, including to align the Amended Bylaws with various provisions of the Delaware General Corporation Law.

The foregoing description of the changes to the Company’s Amended and Restated Bylaws as set forth in the Amended Bylaws does not purport to be complete and is qualified in its entirety by reference to the full text of the Amended Bylaws, which is included as Exhibit 3.1 hereto and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On December 1, 2022, the Company issued a press release announcing the appointments of Ms. Baker de Neufville and Mr. Gorzynski to the Board. The press release also announced the company’s slate of director candidates for the 2023 Annual Meeting, with the following having been nominated: Kenneth S. Courtis, Andy Eidson, Albert E. Ferrara, Jr., Elizabeth Fessenden, Michael Gorzynski, Joanna Baker de Neufville, Michael J. Quillen, Danny Smith and David J. Stetson. A copy of the press release is furnished with this Current Report on Form 8-K as Exhibit 99.1, and is incorporated herein by reference.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| 3.1 | Fourth Amended and Restated Bylaws of Alpha Metallurgical Resources, Inc. |

| 99.1 | Press release of Alpha Metallurgical Resources, Inc. dated December 1, 2022 (furnished herewith) |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Alpha Metallurgical Resources, Inc. |

| | |

Date: December 2, 2022 | By: | /s/ J. Todd Munsey |

| | Name: J. Todd Munsey |

| | Title: Chief Financial Officer |

EXHIBIT INDEX

| | | | | |

| Exhibit No. | Description |

| 3.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

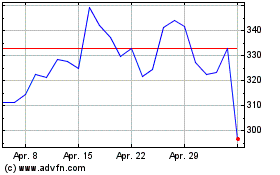

Alpha Metallurgical Reso... (NYSE:AMR)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

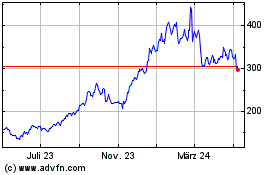

Alpha Metallurgical Reso... (NYSE:AMR)

Historical Stock Chart

Von Apr 2023 bis Apr 2024