0001004434false00010044342022-02-072022-02-070001004434us-gaap:CommonStockMember2022-02-072022-02-070001004434amg:FivePointEightSeventyFiveJuniorSubordinatedNotesDue2059Member2022-02-072022-02-070001004434amg:FourPointSeventyFiveJuniorSubordinatedNotesDue2060Member2022-02-072022-02-070001004434amg:FourPointTwoJuniorSubordinatedNotesDue2061Member2022-02-072022-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 7, 2022

AFFILIATED MANAGERS GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| | | | | | | | | | | |

| 001-13459 | | 04-3218510 |

| (Commission File Number) | | (IRS Employer Identification No.) |

777 South Flagler Drive, West Palm Beach, Florida 33401

(Address of principal executive offices)

(800) 345-1100

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock ($0.01 par value) | | AMG | | New York Stock Exchange |

| 5.875% Junior Subordinated Notes due 2059 | | MGR | | New York Stock Exchange |

| 4.750% Junior Subordinated Notes due 2060 | | MGRB | | New York Stock Exchange |

| 4.200% Junior Subordinated Notes due 2061 | | MGRD | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| ITEM 2.02 | Results of Operations and Financial Condition. |

On February 7, 2022, Affiliated Managers Group, Inc. (the “Company”) issued a press release setting forth its financial and operating results for the quarter and year ended December 31, 2021.

The press release announced that the Company’s Board of Directors authorized and declared a quarterly dividend of $0.01 per share of common stock, payable March 3, 2022 to stockholders of record as of the close of business on February 17, 2022.

The press release further announced that the Board of Directors authorized an additional share repurchase program. Under this program, the Company may repurchase up to 2.0 million shares of its issued and outstanding shares of common stock. Purchases may be made from time to time, at management's discretion, in the open market or in privately negotiated transactions, including through the use of trading plans under Rule 10b5-1 of the Securities Exchange Act of 1934, as amended, as well as pursuant to one or more accelerated share repurchase programs or other share repurchase strategies that may include derivatives or forward contracts. This additional authorization, combined with the remaining shares available for purchase under the Company’s January 2021 program, provides for a total of 5.1 million shares available for repurchase under the Company’s share repurchase programs, which do not expire.

A copy of the press release is furnished as Exhibit 99.1 hereto, except for such portions which are filed, as noted below under Item 9.01.

| | | | | |

| ITEM 9.01 | Financial Statements and Exhibits. |

(d)Exhibits.

The financial highlights table set forth on page 1 and the financial tables set forth on pages 3 through 8 in Exhibit 99.1 hereto are “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall be deemed incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended. The remaining information in Exhibit 99.1 is being “furnished” to the Securities and Exchange Commission as provided pursuant to General Instruction B.2 of Form 8-K.

| | | | | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (the cover page tags are embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | AFFILIATED MANAGERS GROUP, INC. |

| | | |

| Date: February 7, 2022 | | | | By: | | /s/ David M. Billings |

| | | | | | Name: | | David M. Billings |

| | | | | | Title: | | General Counsel and Secretary |

| | | | | | | | | | | | | | |

| | Exhibit 99.1 |

| Investor Relations: Media Relations: | | Anjali Aggarwal

Ann Imes

+1 (617) 747-3300

ir@amg.com

pr@amg.com

|

| | |

AMG Reports Financial and Operating Results for

the Fourth Quarter and Full Year 2021

Company reports EPS of $4.17, Economic EPS of $6.10 in fourth quarter

EPS of $13.05, Economic EPS of $18.28 for the full year 2021

| | | | | |

| |

| Closed additional investment in Systematica Investments, one of the leading systematic managers in the world* |

| Closed investment in new Affiliate Abacus Capital Group, a real estate investment firm and AMG's sixth private markets Affiliate |

| Full-year Net Income (controlling interest) of $566 million, Economic Net Income of $780 million |

| Full-year Adjusted EBITDA and EEPS of $1,059 million and $18.28 increased 33% and 37% year-over-year, respectively, driven by Affiliate investment performance, new Affiliate investments, and share repurchases |

| |

| |

WEST PALM BEACH, FL, February 7, 2022 — Affiliated Managers Group, Inc. (NYSE: AMG) today reported its financial and operating results for the fourth quarter and full year 2021.

Jay C. Horgen, President and Chief Executive Officer of AMG, said:

“AMG generated excellent results in 2021, including year-over-year growth of 33% in Adjusted EBITDA and 37% in Economic Earnings per Share, given strong Affiliate investment performance, and the positive impact of new investments and share repurchases. Client cash flows were positive for the quarter and full year, excluding certain quantitative strategies. Liquid and illiquid alternative strategies generated $12 billion in net inflows during the quarter, reflecting AMG's strategic business evolution toward secular growth areas. As we continue to increase AMG's participation in growth areas — including private markets, specialty fixed income, wealth management, Asia, and ESG — we are well-positioned for future growth.

“In 2021, we successfully executed on our growth strategy, in partnering with new Affiliates, accelerating growth at our existing Affiliates, and enhancing our strategic capabilities. We were pleased to welcome four high-quality Affiliates over the last 12 months, including private real estate manager Abacus, ESG-dedicated managers Parnassus Investments and Boston Common Asset Management, and private credit manager OCP Asia. In addition, we recently increased our investment in Systematica, one of the industry's largest woman-owned and -led alternative firms. Our recent new investment activity reflects increasing demand for AMG's proven range of partnership solutions, which today includes growth capital, distribution, and succession planning — and looking ahead, AMG's unique approach will continue to attract independent managers seeking a strategic partner that can enhance their long-term growth and competitive positioning.

“Given our strong execution in 2021 and resulting significant business momentum, the quality and diversity of our Affiliates, and our disciplined approach to capital deployment, we entered 2022 with increased earnings power, a strong and flexible balance sheet, and an outstanding opportunity to drive further earnings growth and generate significant long-term value for our shareholders."

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FINANCIAL HIGHLIGHTS | | | Three Months Ended | | | | Year Ended | |

| (in millions, except as noted and per share data) | | | 12/31/2020 | | 12/31/2021 | | | | 12/31/2020 | | 12/31/2021 | |

| | | | | | | | | | | | |

| Operating Performance Measures | | | | | | | | | | | | |

| AUM (at period end, in billions) | | | $ | 716.2 | | | $ | 813.8 | | | | | $ | 716.2 | | | $ | 813.8 | | |

| Average AUM (in billions) | | | 700.9 | | | 809.7 | | | | | 664.4 | | | 761.7 | | |

| Net client cash flows (in billions) | | | (15.8) | | | (6.2) | | | | | (61.8) | | | (18.5) | | |

| Aggregate fees | | | 1,450.7 | | | 1,935.3 | | | | | 4,626.4 | | | 5,611.4 | | |

| | | | | | | | | | | | |

| Financial Performance Measures | | | | | | | | | | | | |

| Net income (controlling interest) | | | $ | 115.9 | | | $ | 178.5 | | | | | $ | 202.2 | | | $ | 565.7 | | |

Earnings per share (diluted) (1) | | | 2.54 | | | 4.17 | | | | | 4.33 | | | 13.05 | | |

| | | | | | | | | | | | |

Supplemental Performance Measures (2) | | | | | | | | | | | | |

| Adjusted EBITDA (controlling interest) | | | $ | 255.2 | | | $ | 356.8 | | | | | $ | 798.8 | | | $ | 1,058.6 | | |

| Economic net income (controlling interest) | | | 191.4 | | | 255.3 | | | | | 624.4 | | | 779.8 | | |

| Economic earnings per share | | | 4.22 | | | 6.10 | | | | | 13.36 | | | 18.28 | | |

For additional information on our Supplemental Performance Measures, including reconciliations to GAAP, see the Financial Tables and Notes.

*Incremental investment in Systematica closed on January 14, 2022, and is not included in presentation of fourth quarter or full-year financial results.

Capital Management

During the fourth quarter of 2021, the Company repurchased approximately $120 million in common stock bringing total share repurchases to $510 million for the full year 2021, and announced a fourth-quarter cash dividend of $0.01 per share of common stock, payable March 3, 2022 to stockholders of record as of the close of business on February 17, 2022. In addition, AMG’s Board of Directors increased the Company’s share repurchase authorization to a total of 5.1 million shares.

About AMG

AMG is a leading partner to independent active investment management firms globally. AMG’s strategy is to generate long‐term value by investing in a diverse array of high-quality partner-owned investment firms through a proven partnership approach, and allocating resources across the Company's unique opportunity set to the areas of highest growth and return. AMG’s innovative partnership approach enables each Affiliate’s management team to own significant equity in their firm while maintaining operational and investment autonomy. In addition, AMG offers its Affiliates growth capital, global distribution, and other strategic value-added capabilities, which enhance the long-term growth of these independent businesses and enable them to align equity incentives across generations of principals to build enduring franchises. As of December 31, 2021, AMG’s aggregate assets under management were approximately $814 billion across a broad range of return-oriented strategies. For more information, please visit the Company’s website at www.amg.com.

Conference Call, Replay and Presentation Information

A conference call will be held with AMG’s management at 8:30 a.m. Eastern time today. Parties interested in listening to the conference call should dial 1-877-407-8291 (U.S. calls) or 1-201-689-8345 (non-U.S. calls) shortly before the call begins.

The conference call will also be available for replay beginning approximately one hour after the conclusion of the call. To hear a replay of the call, please dial 1-877-660-6853 (U.S. calls) or 1-201-612-7415 (non-U.S. calls) and provide conference ID 13726515. The live call and replay of the session and a presentation highlighting the Company's performance can also be accessed via AMG’s website at https://ir.amg.com/.

Financial Tables Follow

| | | | | | | | | | | | | | |

ASSETS UNDER MANAGEMENT - STATEMENT OF CHANGES (in billions) |

| | | | | | | | | | | | | | | | | |

| BY STRATEGY - QUARTER TO DATE | Alternatives | Global Equities | U.S. Equities | Multi-Asset &

Fixed Income | Total |

| | | | | |

| AUM, September 30, 2021 | $ | 230.0 | | $ | 279.7 | | $ | 112.1 | | $ | 126.0 | | $ | 747.8 | |

| Client cash inflows and commitments | 17.0 | | 8.6 | | 7.8 | | 7.1 | | 40.5 | |

| Client cash outflows | (10.0) | | (20.3) | | (10.3) | | (6.1) | | (46.7) | |

| Net client cash flows | 7.0 | | (11.7) | | (2.5) | | 1.0 | | (6.2) | |

| New investments | 1.4 | | — | | 50.6 | | 0.4 | | 52.4 | |

| Market changes | 1.5 | | 9.6 | | 10.7 | | 2.8 | | 24.6 | |

| Foreign exchange | 0.1 | | 0.2 | | 0.1 | | (0.1) | | 0.3 | |

| Realizations and distributions (net) | (1.8) | | (0.3) | | (0.3) | | — | | (2.4) | |

| | | | | |

| Other | — | | — | | — | | (2.7) | | (2.7) | |

| AUM, December 31, 2021 | $ | 238.2 | | $ | 277.5 | | $ | 170.7 | | $ | 127.4 | | $ | 813.8 | |

| | | | | | | | | | | | | | | | | |

| BY STRATEGY - YEAR TO DATE | Alternatives | Global Equities | U.S. Equities | Multi-Asset &

Fixed Income | Total |

| | | | | |

| AUM, December 31, 2020 | $ | 216.5 | | $ | 278.5 | | $ | 103.5 | | $ | 117.7 | | $ | 716.2 | |

| Client cash inflows and commitments | 46.5 | | 38.3 | | 25.7 | | 25.7 | | 136.2 | |

| Client cash outflows | (25.2) | | (72.3) | | (33.0) | | (24.2) | | (154.7) | |

| Net client cash flows | 21.3 | | (34.0) | | (7.3) | | 1.5 | | (18.5) | |

| New investments | 4.0 | | 2.9 | | 51.7 | | 0.4 | | 59.0 | |

| Market changes | 11.3 | | 31.3 | | 23.0 | | 10.7 | | 76.3 | |

| Foreign exchange | (0.5) | | (0.7) | | (0.1) | | (0.1) | | (1.4) | |

| Realizations and distributions (net) | (12.4) | | (0.4) | | (0.2) | | (0.2) | | (13.2) | |

| | | | | |

| Other | (2.0) | | (0.1) | | 0.1 | | (2.6) | | (4.6) | |

| AUM, December 31, 2021 | $ | 238.2 | | $ | 277.5 | | $ | 170.7 | | $ | 127.4 | | $ | 813.8 | |

| | | | | | | | | | | | | | |

| BY CLIENT TYPE - QUARTER TO DATE | Institutional | Retail | High Net

Worth | Total |

| | | | |

| AUM, September 30, 2021 | $ | 406.5 | | $ | 200.8 | | $ | 140.5 | | $ | 747.8 | |

| Client cash inflows and commitments | 19.8 | | 12.6 | | 8.1 | | 40.5 | |

| Client cash outflows | (21.3) | | (19.5) | | (5.9) | | (46.7) | |

| Net client cash flows | (1.5) | | (6.9) | | 2.2 | | (6.2) | |

| New investments | 3.7 | | 48.7 | | — | | 52.4 | |

| Market changes | 7.6 | | 11.9 | | 5.1 | | 24.6 | |

| Foreign exchange | 0.2 | | — | | 0.1 | | 0.3 | |

| Realizations and distributions (net) | (1.6) | | (0.6) | | (0.2) | | (2.4) | |

| | | | |

| Other | (1.1) | | (1.4) | | (0.2) | | (2.7) | |

| AUM, December 31, 2021 | $ | 413.8 | | $ | 252.5 | | $ | 147.5 | | $ | 813.8 | |

| | | | | | | | | | | | | | |

| BY CLIENT TYPE - YEAR TO DATE | Institutional | Retail | High Net

Worth | Total |

| | | | |

| AUM, December 31, 2020 | $ | 401.0 | | $ | 189.3 | | $ | 125.9 | | $ | 716.2 | |

| Client cash inflows and commitments | 58.4 | | 50.9 | | 26.9 | | 136.2 | |

| Client cash outflows | (70.7) | | (63.3) | | (20.7) | | (154.7) | |

| Net client cash flows | (12.3) | | (12.4) | | 6.2 | | (18.5) | |

| New investments | 8.3 | | 49.6 | | 1.1 | | 59.0 | |

| Market changes | 32.7 | | 28.7 | | 14.9 | | 76.3 | |

| Foreign exchange | (0.5) | | (0.9) | | — | | (1.4) | |

| Realizations and distributions (net) | (11.8) | | (0.9) | | (0.5) | | (13.2) | |

| Other | (3.6) | | (0.9) | | (0.1) | | (4.6) | |

| AUM, December 31, 2021 | $ | 413.8 | | $ | 252.5 | | $ | 147.5 | | $ | 813.8 | |

| | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF INCOME |

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| (in millions, except per share data) | | 12/31/2020 | | 12/31/2021 | | |

| | | | | | |

| Consolidated revenue | | $ | 554.4 | | | $ | 691.8 | | | |

| | | | | | |

| Consolidated expenses: | | | | | | |

| Compensation and related expenses | | 246.8 | | | 295.0 | | | |

| Selling, general and administrative | | 83.5 | | | 96.8 | | | |

| Intangible amortization and impairments | | 7.1 | | | 10.4 | | | |

| Interest expense | | 26.8 | | | 28.6 | | | |

| Depreciation and other amortization | | 4.4 | | | 4.1 | | | |

| Other expenses (net) | | 18.1 | | | 32.8 | | | |

| Total consolidated expenses | | 386.7 | | | 467.7 | | | |

| | | | | | |

Equity method income (net)(3) | | 35.4 | | | 117.4 | | | |

| | | | | | |

| Investment and other income | | 31.1 | | | 26.5 | | | |

| Income before income taxes | | 234.2 | | | 368.0 | | | |

| | | | | | |

| Income tax expense | | 38.4 | | | 84.6 | | | |

| Net income | | 195.8 | | | 283.4 | | | |

| | | | | | |

| Net income (non-controlling interests) | | (79.9) | | | (104.9) | | | |

| Net income (controlling interest) | | $ | 115.9 | | | $ | 178.5 | | | |

| | | | | | |

| Average shares outstanding (basic) | | 44.9 | | | 40.6 | | | |

| Average shares outstanding (diluted) | | 47.5 | | | 43.9 | | | |

| | | | | | |

| Earnings per share (basic) | | $ | 2.58 | | | $ | 4.40 | | | |

Earnings per share (diluted)(1) | | $ | 2.54 | | | $ | 4.17 | | | |

| | | | | | | | | | | | | | |

RECONCILIATIONS OF SUPPLEMENTAL PERFORMANCE MEASURES(2) |

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| (in millions, except per share data) | | 12/31/2020 | | 12/31/2021 | | |

| | | | | | |

| Net income (controlling interest) | | $ | 115.9 | | | $ | 178.5 | | | |

| Intangible amortization and impairments | | 86.5 | | | 88.2 | | | |

| Intangible-related deferred taxes | | (2.8) | | | 0.6 | | | |

| Other economic items | | (8.2) | | | (12.0) | | | |

| | | | | | |

| Economic net income (controlling interest) | | $ | 191.4 | | | $ | 255.3 | | | |

| | | | | | |

| Average shares outstanding (adjusted diluted) | | 45.3 | | | 41.8 | | | |

| Economic earnings per share | | $ | 4.22 | | | $ | 6.10 | | | |

| | | | | | |

| Net income (controlling interest) | | $ | 115.9 | | | $ | 178.5 | | | |

| Interest expense | | 26.8 | | | 28.6 | | | |

| Income taxes | | 35.8 | | | 76.4 | | | |

| Intangible amortization and impairments | | 86.5 | | | 88.2 | | | |

| Other items | | (9.8) | | | (14.9) | | | |

| Adjusted EBITDA (controlling interest) | | $ | 255.2 | | | $ | 356.8 | | | |

See Notes for additional information.

| | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF INCOME |

| | | | | | | | | | | | | | | | | | |

| | Year Ended | | |

| (in millions, except per share data) | | 12/31/2020 | | 12/31/2021 | | |

| | | | | | |

| Consolidated revenue | | $ | 2,027.5 | | | $ | 2,412.4 | | | |

| | | | | | |

| Consolidated expenses: | | | | | | |

| Compensation and related expenses | | 883.7 | | | 1,047.1 | | | |

| Selling, general and administrative | | 321.4 | | | 347.1 | | | |

| Intangible amortization and impairments | | 140.5 | | | 35.7 | | | |

| Interest expense | | 92.3 | | | 111.4 | | | |

| Depreciation and other amortization | | 19.1 | | | 16.6 | | | |

| Other expenses (net) | | 52.8 | | | 73.5 | | | |

| Total consolidated expenses | | 1,509.8 | | | 1,631.4 | | | |

| | | | | | |

Equity method income (loss) (net)(3) | | (43.4) | | | 242.5 | | | |

| | | | | | |

| Investment and other income | | 34.1 | | | 117.6 | | | |

| Income before income taxes | | 508.4 | | | 1,141.1 | | | |

| | | | | | |

| Income tax expense | | 81.4 | | | 251.0 | | | |

| Net income | | 427.0 | | | 890.1 | | | |

| | | | | | |

| Net income (non-controlling interests) | | (224.8) | | | (324.4) | | | |

| Net income (controlling interest) | | $ | 202.2 | | | $ | 565.7 | | | |

| | | | | | |

| Average shares outstanding (basic) | | 46.5 | | | 41.5 | | | |

| Average shares outstanding (diluted) | | 46.7 | | | 44.8 | | | |

| | | | | | |

| Earnings per share (basic) | | $ | 4.34 | | | $ | 13.65 | | | |

Earnings per share (diluted)(1) | | $ | 4.33 | | | $ | 13.05 | | | |

| | | | | | | | | | | | | | |

RECONCILIATIONS OF SUPPLEMENTAL PERFORMANCE MEASURES(2) |

| | | | | | | | | | | | | | | | | | |

| | Year Ended | | |

| (in millions, except per share data) | | 12/31/2020 | | 12/31/2021 | | |

| | | | | | |

| Net income (controlling interest) | | $ | 202.2 | | | $ | 565.7 | | | |

| Intangible amortization and impairments | | 427.7 | | | 199.9 | | | |

| Intangible-related deferred taxes | | (9.9) | | | 52.5 | | | |

| Other economic items | | 4.4 | | | (38.3) | | | |

| | | | | | |

| Economic net income (controlling interest) | | $ | 624.4 | | | $ | 779.8 | | | |

| | | | | | |

| Average shares outstanding (adjusted diluted) | | 46.7 | | | 42.7 | | | |

| Economic earnings per share | | $ | 13.36 | | | $ | 18.28 | | | |

| | | | | | |

| Net income (controlling interest) | | $ | 202.2 | | | $ | 565.7 | | | |

| Interest expense | | 92.3 | | | 111.4 | | | |

| Income taxes | | 69.5 | | | 229.6 | | | |

| Intangible amortization and impairments | | 427.7 | | | 199.9 | | | |

| Other items | | 7.1 | | | (48.0) | | | |

| Adjusted EBITDA (controlling interest) | | $ | 798.8 | | | $ | 1,058.6 | | | |

See Notes for additional information

| | | | | | | | | | | | | | |

| CONSOLIDATED BALANCE SHEET |

| | | | | | | | | | | | | | | | | | |

| | Year Ended | | |

| (in millions) | | 12/31/2020 | | 12/31/2021 | | |

| | | | | | |

| Assets | | | | | | |

| Cash and cash equivalents | | $ | 1,039.7 | | | $ | 908.5 | | | |

| Receivables | | 421.6 | | | 419.2 | | | |

| Investments in marketable securities | | 74.9 | | | 78.5 | | | |

| Goodwill | | 2,661.4 | | | 2,689.2 | | | |

| Acquired client relationships (net) | | 1,048.8 | | | 1,966.4 | | | |

| Equity method investments in Affiliates (net) | | 2,074.8 | | | 2,134.4 | | | |

| Fixed assets (net) | | 79.6 | | | 73.9 | | | |

| | | | | | |

| Other investments | | 257.2 | | | 375.2 | | | |

| Other assets | | 230.9 | | | 231.1 | | | |

| Total assets | | $ | 7,888.9 | | | $ | 8,876.4 | | | |

| | | | | | |

| Liabilities and Equity | | | | | | |

| Payables and accrued liabilities | | $ | 712.4 | | | $ | 789.1 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Debt | | 2,312.1 | | | 2,490.4 | | | |

| Deferred income tax liability (net) | | 423.4 | | | 503.2 | | | |

| Other liabilities | | 452.2 | | | 709.2 | | | |

| Total liabilities | | 3,900.1 | | | 4,491.9 | | | |

| | | | | | |

| Redeemable non-controlling interests | | 671.5 | | | 673.9 | | | |

| Equity: | | | | | | |

| Common stock | | 0.6 | | | 0.6 | | | |

| Additional paid-in capital | | 728.9 | | | 651.6 | | | |

| Accumulated other comprehensive loss | | (98.3) | | | (87.9) | | | |

| Retained earnings | | 4,005.5 | | | 4,569.5 | | | |

| | 4,636.7 | | | 5,133.8 | | | |

| Less: treasury stock, at cost | | (1,857.0) | | | (2,347.4) | | | |

| Total stockholders’ equity | | 2,779.7 | | | 2,786.4 | | | |

| Non-controlling interests | | 537.6 | | | 924.2 | | | |

| Total equity | | 3,317.3 | | | 3,710.6 | | | |

| Total liabilities and equity | | $ | 7,888.9 | | | $ | 8,876.4 | | | |

Notes

(1) Earnings per share (diluted) adjusts for the dilutive effect of the potential issuance of incremental shares of our common stock. We had junior convertible securities outstanding during the periods presented and are required to apply the if-converted method to these securities in our calculation of Earnings per share (diluted). Under the if-converted method, shares that are issuable upon conversion are deemed outstanding, regardless of whether the securities are contractually convertible into our common stock at that time. For this calculation, the interest expense (net of tax) attributable to these dilutive securities is added back to Net income (controlling interest), reflecting the assumption that the securities have been converted. Issuable shares for these securities and related interest expense are excluded from the calculation if an assumed conversion would be anti-dilutive to diluted earnings per share.

The following table provides a reconciliation of the numerator and denominator used in the calculation of basic and diluted earnings per share:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| (in millions) | | 12/31/2020 | | 12/31/2021 | | 12/31/2020 | | 12/31/2021 |

| Numerator | | | | | | | | |

| Net income (controlling interest) | | $ | 115.9 | | | $ | 178.5 | | | $ | 202.2 | | | $ | 565.7 | |

| Interest expense on junior convertible securities, net of taxes | | 4.8 | | | 4.5 | | | — | | | 18.5 | |

| Net income (controlling interest), as adjusted | | $ | 120.7 | | | $ | 183.0 | | | $ | 202.2 | | | $ | 584.2 | |

| Denominator | | | | | | | | |

| Average shares outstanding (basic) | | 44.9 | | | 40.6 | | | 46.5 | | | 41.5 | |

| Effect of dilutive instruments: | | | | | | | | |

| Stock options and restricted stock units | | 0.4 | | | 1.2 | | | 0.2 | | | 1.2 | |

| Junior convertible securities | | 2.2 | | | 2.1 | | | — | | | 2.1 | |

| Average shares outstanding (diluted) | | 47.5 | | | 43.9 | | | 46.7 | | | 44.8 | |

(2) As supplemental information, we provide non-GAAP performance measures of Adjusted EBITDA (controlling interest), Economic net income (controlling interest), and Economic earnings per share. Management utilizes these non-GAAP performance measures to assess our performance before our share of certain non-cash expenses and to improve comparability between periods.

Adjusted EBITDA (controlling interest) represents our performance before our share of interest expense, income taxes, depreciation, amortization, impairments, certain Affiliate equity expenses, certain gains and losses, including on general partner and seed capital investments, and adjustments to our contingent payment obligations. We believe that many investors use this non-GAAP measure when assessing the financial performance of companies in the investment management industry.

Under our Economic net income (controlling interest) definition, we add to Net income (controlling interest) our share of pre-tax intangible amortization and impairments (including the portion attributable to equity method investments in Affiliates), deferred taxes related to intangible assets, and other economic items which include non-cash imputed interest (principally related to the accounting for convertible securities and contingent payment obligations), certain Affiliate equity expenses, and certain gains and losses, including on general partner and seed capital investments. Economic net income (controlling interest) is used by management and our Board of Directors as our principal performance benchmark, including as one of the measures for aligning executive compensation with stockholder value.

Economic earnings per share represents Economic net income (controlling interest) divided by the Average shares outstanding (adjusted diluted). In this calculation, the potential share issuance in connection with our junior convertible securities is measured using a “treasury stock” method. Under this method, only the net number of shares of common stock equal to the value of the junior convertible securities in excess of par, if any, are deemed to be outstanding. We believe the inclusion of net shares under a treasury stock method best reflects the benefit of the increase in available capital resources (which could be used to repurchase shares of common stock) that occurs when these securities are converted and we are relieved of our debt obligation.

The following table provides a reconciliation of Average shares outstanding (adjusted diluted):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| (in millions) | | 12/31/2020 | | 12/31/2021 | | 12/31/2020 | | 12/31/2021 |

| Average shares outstanding (diluted) | | 47.5 | | | 43.9 | | | 46.7 | | | 44.8 | |

| | | | | | | | |

| Junior convertible securities | | (2.2) | | | (2.1) | | | — | | | (2.1) | |

| Average shares outstanding (adjusted diluted) | | 45.3 | | | 41.8 | | | 46.7 | | | 42.7 | |

These non-GAAP performance measures are provided in addition to, but not as a substitute for, Net income (controlling interest), Earnings per share or other GAAP performance measures. For additional information on our non-GAAP measures, see our Annual and Quarterly Reports on Form 10-K and 10-Q, respectively, which are accessible on the SEC’s website at www.sec.gov.

Notes (continued)

(3) The following table presents equity method earnings and equity method intangible amortization and impairments, which in aggregate form Equity method income (loss) (net):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| (in millions) | | 12/31/2020 | | 12/31/2021 | | 12/31/2020 | | 12/31/2021 |

| Equity method earnings | | $ | 116.9 | | | $ | 198.6 | | | $ | 288.6 | | | $ | 417.5 | |

| Equity method intangible amortization and impairments | | (81.5) | | | (81.2) | | | (332.0) | | | (175.0) | |

| Equity method income (loss) (net) | | $ | 35.4 | | | $ | 117.4 | | | $ | (43.4) | | | $ | 242.5 | |

Forward Looking Statements and Other Matters

Certain matters discussed in this press release may constitute forward-looking statements within the meaning of the federal securities laws. These statements include, but are not limited to, statements related to our expectations regarding the performance of our business, our financial results, our liquidity and capital resources, and other non-historical statements. You can identify these forward-looking statements by the use of words such as “outlook,” “guidance,” “believes,” “expects,” “potential,” "preliminary," “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “projects,” “positioned,” “prospects,” “intends,” “plans,” “estimates,” “pending investments,” “anticipates,” or the negative version of these words or other comparable words. Actual results and the timing of certain events could differ materially from those projected in or contemplated by the forward-looking statements due to a number of factors, including changes in the securities or financial markets or in general economic conditions, pandemics (including COVID-19) and related changes in the global economy, capital markets and the asset management industry, the availability of equity and debt financing, competition for acquisitions of interests in investment management firms, the ability to close pending investments, the investment performance and growth rates of our Affiliates and their ability to effectively market their investment strategies, the mix of Affiliate contributions to our earnings, and other risks, uncertainties, and assumptions, including those described under the section entitled “Risk Factors” in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Such factors may be updated from time to time in our periodic filings with the SEC. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in our filings with the SEC. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments, or otherwise, except as required by applicable law.

From time to time, AMG may use its website as a distribution channel of material Company information. AMG routinely posts financial and other important information regarding the Company in the Investor Relations section of its website at www.amg.com and encourages investors to consult that section regularly.

v3.22.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation 12B

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amg_FivePointEightSeventyFiveJuniorSubordinatedNotesDue2059Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amg_FourPointSeventyFiveJuniorSubordinatedNotesDue2060Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amg_FourPointTwoJuniorSubordinatedNotesDue2061Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

This regulatory filing also includes additional resources:

courtesy.pdf

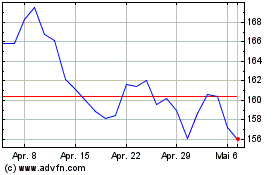

Affiliated Managers (NYSE:AMG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Affiliated Managers (NYSE:AMG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024