Current Report Filing (8-k)

03 November 2022 - 9:39PM

Edgar (US Regulatory)

false000175982400017598242022-11-012022-11-010001759824us-gaap:PreferredStockMember2022-11-012022-11-010001759824altg:CommonStocksClassUndefinedMember2022-11-012022-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 1, 2022

ALTA EQUIPMENT GROUP INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-38864 |

|

83-2583782 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

13211 Merriman Road

Livonia, Michigan 48150

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (248) 449-6700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, $0.0001 par value per share |

|

ALTG |

|

The New York Stock Exchange |

Depositary Shares representing a 1/1000th fractional interest in a share of 10% Series A Cumulative Perpetual Preferred Stock, $0.0001 par value per share |

|

ALTG PRA |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events. *

On November 1, 2022, Alta Equipment Group Inc. (“Alta” or the “Company”) closed its acquisition of Ecoverse Industries, LTD (“Ecoverse”). Ecoverse is a full line distributor of industry-leading environmental processing equipment headquartered in Avon, Ohio, with 15 sub dealers throughout North America. The acquisition was completed pursuant to the agreement announced on October 18, 2022. The purchase price consisted of $42.5 million in cash paid at closing, subject to certain adjustments based upon Ecoverse's net working capital at closing. Additionally, the Company issued 212,400 shares of its common stock in connection with the purchase agreement. Ecoverse generated approximately $64.3 million in revenue, $10.0 million in net income, $10.1 million in Adjusted EBITDA* and $9.7 million of Adjusted pre-tax net income* for the trailing twelve months through July 2022.

*Use of Non-GAAP Financial Measures

We disclose non-GAAP financial measures Adjusted EBITDA and Adjusted pre-tax net income in this filing because we believe they are useful performance measures that assist in an effective evaluation of the acquisition and its expected impact on our operating performance when compared to our peers, without regard to financing methods or capital structure. We believe such measures are useful for investors and others in understanding and evaluating the acquisition and its expected impact on our operating results in the same manner as our management. However, such measures are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for, or in isolation from, net income (loss), revenue, operating profit, or any other operating performance measures calculated in accordance with GAAP.

We define Adjusted EBITDA as net income (loss) before interest expense (not including floorplan interest paid on new equipment), income taxes, depreciation and amortization, adjustments for certain one-time or non-recurring items and other adjustments. We exclude these items from net income (loss) in arriving at Adjusted EBITDA because these amounts are either non-recurring or can vary substantially within the industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted pre-tax net income is defined as net income (loss) before income taxes adjusted to reflect certain one-time or non-recurring items and other adjustments. Certain items excluded from Adjusted EBITDA and Adjusted pre-tax net income are significant components in understanding and assessing a company’s financial performance. For example, items such as a company’s cost of capital and tax structure as well as certain one-time or non-recurring items, are not reflected in Adjusted EBITDA or Adjusted pre-tax net income. Our presentation of Adjusted EBITDA, EBITA and Adjusted pre-tax net income should not be construed as an indication that results will be unaffected by the items excluded from these metrics. Our computation of Adjusted EBITDA, and other non-GAAP measures, may not be identical to other similarly titled measures of other companies. Ecoverse’s financial information has not been audited by Alta or its auditors and is subject to change. For a reconciliation of non-GAAP measures to their most comparable measures under GAAP, please see the table entitled “Reconciliation of Non-GAAP Financial Measures” below.

|

|

|

|

|

Reconciliation of Non-GAAP Financial Measures |

|

|

|

Twelve Months Ended July 31, 2022 |

|

(amounts in millions) |

|

|

|

Net income |

|

$ |

10.0 |

|

Income tax provision |

|

|

— |

|

Other adjustments (2) |

|

|

(0.3 |

) |

Adjusted pre-tax net income (1) |

|

$ |

9.7 |

|

Depreciation and amortization |

|

|

0.3 |

|

Interest expense |

|

|

0.1 |

|

Adjusted EBITDA (1) |

|

$ |

10.1 |

|

(1) Represents Non-GAAP measure

(2) Other adjustments primarily related to expected incremental expenses post-close

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

Exhibit No. |

|

Description |

|

|

|

Ex-104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

The information furnished under Item 8.01 of this Current Report on Form 8-K is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth

by specific reference in such a filing. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any information included in Item 8.01.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

ALTA EQUIPMENT GROUP INC. |

|

|

Dated: November 3, 2022 |

By: |

|

/s/ Ryan Greenawalt |

|

|

|

Name: Ryan Greenawalt |

|

|

|

Title: Chief Executive Officer |

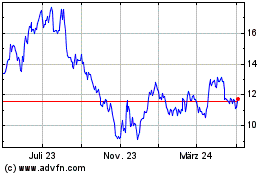

Alta Equipment (NYSE:ALTG)

Historical Stock Chart

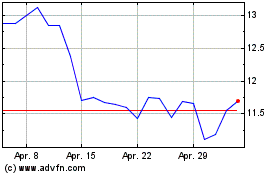

Von Mär 2024 bis Apr 2024

Alta Equipment (NYSE:ALTG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024