Financial results are solid across operating segments proving

the strength of Algoma's focused diversification strategy

Algoma Central Corporation (TSX: ALC) today reported its results

for the three and six months ended June 30, 2022. Revenues

increased 9% during the 2022 second quarter to $183,463 compared to

$167,687 for the same period in 2021 while net earnings increased

46% in the same period. The Company reported 2022 second quarter

EBITDA(1) of $61,412 compared to $61,860 for the same period in

2021. All amounts reported below are in thousands of Canadian

dollars, except for per share data and where the context dictates

otherwise.

"I have a different perspective this quarter, as I write this

from onboard the Captain Henry Jackman while she transports a load

of iron ore pellets from Port Cartier to Hamilton" said Gregg Ruhl,

President and CEO of Algoma Central Corporation. "I am impressed by

the hard work of our crews in these ever-changing times and with

the performance of the newest ship in our fleet which entered into

service just a year ago. Algoma continued to deliver strong results

in the second quarter, largely driven by the efforts of our

dedicated teams, our strategic long-term investments, and our

valued partnerships. Our international fleets generated excellent

results, our Domestic Dry-Bulk fleet held up well under the shadow

of a 46% decrease in Canadian grain exports for the crop

year-to-date and demand for our product tankers is beginning to

gain momentum. As we look into the second half of 2022, I am

confident in our ability to continue to generate strong results by

flexing our fleets to meet our customers' needs as economic

conditions evolve," concluded Mr. Ruhl.

Financial Highlights: Second Quarter 2022 Compared to

2021

- Net earnings increased 46% to $47,045 compared to $32,315 last

year. Basic earnings per share were $1.24 compared to $0.85.

- Global Short Sea Shipping segment equity earnings increased

108% to $9,454 compared to $4,544 for the prior year. Earnings

include a $4,782 gain on the sale of two vessels; excluding this

gain, earnings increased 37%.

- Ocean Self-Unloader segment revenue increased 26% to $50,292

compared to $40,006 driven by higher freight rates and fuel cost

recoveries. Operating earnings increased 188% to $11,139 compared

to $3,865. During the 2021 second quarter, a one-time compensation

payment of $5,513 related to the retirement of two older vessels

owned by our partner in the Pool was expensed.

- Domestic Dry-Bulk segment revenue increased 3% to $99,288

compared to $96,855, reflecting increased fuel recoveries and

modestly improved base freight rates across several sectors,

partially offset by lower volumes. Operating earnings decreased 36%

to $21,504 compared to $33,554 driven by higher operating costs and

by the timing of winter lay-up spending this year compared to

2021.

- Revenue for Product Tankers increased 11% to $31,923 compared

to $28,688. This was mainly driven by higher fuel cost recoveries,

partially offset by unplanned outages on two vessels. Operating

earnings decreased 24% to $3,683 compared to $4,821 driven by

higher operating costs.

- The Sault Ste. Marie shopping centre that was held for sale in

the Investment Properties segment sold at the end of June and a

pre-tax gain of $14,372 was recorded in the second quarter.

Consolidated Statement of Earnings

Three Months Ended

Six Months Ended

For the periods ended June 30

2022

2021

2022

2021

(unaudited, in thousands of dollars,

except per share data)

Revenue

$

183,463

$

167,687

$

268,566

$

245,286

Operating expenses

(125,615

)

(101,311

)

(212,173

)

(182,601

)

Selling, general and administrative

(8,767

)

(7,306

)

(17,178

)

(15,816

)

Other operating item

—

(2,783

)

—

(2,482

)

Depreciation and amortization

(17,000

)

(16,992

)

(33,745

)

(34,485

)

Operating earnings

32,081

39,295

5,470

9,902

Interest expense

(5,048

)

(4,931

)

(10,033

)

(10,248

)

Interest income

28

15

39

42

Gain on sale of property

14,372

1,586

14,372

1,586

Foreign currency gain

2,097

527

1,490

580

43,530

36,492

11,338

1,862

Income tax (expense) recovery

(8,947

)

(8,752

)

1,210

1,990

Net earnings from investments in joint

ventures

12,462

4,575

14,926

6,047

Net earnings

$

47,045

$

32,315

$

27,474

$

9,899

Basic earnings per share

$

1.24

$

0.85

$

0.73

$

0.26

Diluted earnings per share

$

1.12

$

0.78

$

0.69

$

0.26

EBITDA(1)

The Company uses EBITDA as a measure of the cash generating

capacity of its businesses. The following table provides a

reconciliation of net earnings in accordance with GAAP to the

non-GAAP EBITDA measure for the three and six months ended June 30,

2022 and 2021 and presented herein:

EBITDA(1)

Three Months Ended

Six Months Ended

For the periods ended June 30

2022

2021

2022

2021

Net loss

$

47,045

$

32,315

$

27,474

$

9,899

Depreciation and amortization

22,993

21,118

44,548

42,388

Impairment reversal

(2,783

)

—

(2,783

)

—

Interest and taxes

15,126

14,489

10,498

9,702

Foreign exchange loss (gain)

(1,815

)

(607

)

(1,293

)

(817

)

Other operating item

—

(2,730

)

—

(3,031

)

Gain on sale of property

(14,372

)

(1,586

)

(14,372

)

(1,586

)

Gain on sale of vessels

(4,782

)

(1,139

)

(4,780

)

(1,347

)

EBITDA

$

61,412

$

61,860

$

59,292

$

55,208

Select Financial Performance by Business Segment

Three Months Ended

Six Months Ended

For the periods ended June 30

2022

2021

2022

2021

Domestic Dry-Bulk

Revenue

$

99,288

$

96,855

$

123,876

$

121,408

Operating earnings (loss)

21,504

33,554

(5,715

)

3,871

Product Tankers

Revenue

31,923

28,688

49,959

46,905

Operating earnings

3,683

4,821

2,125

5,044

Ocean Self-Unloaders

Revenue

50,292

40,006

90,613

72,501

Operating earnings

11,139

3,865

17,246

8,233

Corporate and Other

Revenue

1,960

2,138

4,118

4,472

Operating loss

(4,245

)

(2,945

)

(8,186

)

(7,246

)

The MD&A for the three and six months ended June 30, 2022

and 2021 includes further details. Full results for the three and

six months ended June 30, 2022 and 2021 can be found on the

Company’s website at www.algonet.com/investor-relations and on SEDAR at

www.sedar.com.

2022 Business Outlook(2)

Dry-bulk cargo volumes for the second half of the year are

expected to be strong across all commodities, driving increased

domestic fleet utilization for the remainder of the year. The war

in Ukraine will likely continue to impact grain trading patterns

and the current outlook for the Western Canadian grain crop in the

fall is for a return to normal harvest levels. Product Tanker

demand remains steady and we expect the fleet to be well utilized

for the balance of the year.

Customer demand and vessel capacity for the Ocean segment is

well balanced for the remainder of the year. Revenues days for the

third quarter will be impacted by a vessel dry-docking.

We are anticipating the continuation of the strong charter rates

earned by the global short-sea mini-bulker fleet over the first

half of 2022 with the potential for a gradual normalization in

rates during the second half of the year. This outlook could change

if global markets slow appreciably. The cement sector is expected

to remain steady throughout the 2022 season and the two additional

handy-size bulk carriers, which entered the handy-size fleet in May

2022, are expected to make strong contributions for the remainder

of the year.

Normal Course Issuer Bid

Effective March 21, 2022, the Company renewed its normal course

issuer bid with the intention to purchase, through the facilities

of the TSX, up to 1,890,457 of its Common Shares ("Shares")

representing approximately 5% of the 37,800,943 Shares which were

issued and outstanding as at the close of business on March 9, 2022

(the “NCIB”). Under the current NCIB, no common shares have been

purchased or cancelled for the period ended June 30, 2022.

Cash Dividends

The Company's Board of Directors have authorized payment of a

quarterly dividend to shareholders of $0.17 per common share. The

dividend will be paid on September 1, 2022 to shareholders of

record on August 18, 2022.

Notes

(1) Use of Non-GAAP Measures

The Company uses several financial measures to assess its

performance including earnings before interest, income taxes,

depreciation, and amortization (EBITDA), free cash flow, return on

equity, and adjusted performance measures. Some of these measures

are not calculated in accordance with Generally Accepted Accounting

Principles (GAAP), which are based on International Financial

Reporting Standards (IFRS) as issued by the International

Accounting Standards Board (IASB), are not defined by GAAP, and do

not have standardized meanings that would ensure consistency and

comparability among companies using these measures. From

Management’s perspective, these non-GAAP measures are useful

measures of performance as they provide readers with a better

understanding of how management assesses performance. Further

information on Non-GAAP measures please refer to page 2 in the

Company's Management's Discussion and Analysis for the three and

six months ended June 30, 2022.

(2) Forward Looking Statements

Algoma Central Corporation’s public communications often include

written or oral forward-looking statements. Statements of this type

are included in this document and may be included in other filings

with Canadian securities regulators or in other communications. All

such statements are made pursuant to the safe harbour provisions of

any applicable Canadian securities legislation. Forward-looking

statements may involve, but are not limited to, comments with

respect to our objectives and priorities for 2023 and beyond, our

strategies or future actions, our targets, expectations for our

financial condition or share price and the results of or outlook

for our operations or for the Canadian, U.S. and global economies.

The words "may", "will", "would", "should", "could", "expects",

"plans", "intends", "trends", "indications", "anticipates",

"believes", "estimates", "predicts", "likely" or "potential" or the

negative or other variations of these words or other comparable

words or phrases, are intended to identify forward-looking

statements.

By their nature, forward-looking statements require us to make

assumptions and are subject to inherent risks and uncertainties.

There is significant risk that predictions, forecasts, conclusions

or projections will not prove to be accurate, that our assumptions

may not be correct and that actual results may differ materially

from such predictions, forecasts, conclusions or projections. We

caution readers of this document not to place undue reliance on our

forward-looking statements as a number of factors could cause

actual future results, conditions, actions or events to differ

materially from the targets, expectations, estimates or intentions

expressed in the forward-looking statements.

Algoma owns and operates the largest fleet of dry and liquid

bulk carriers operating on the Great Lakes - St. Lawrence Seaway,

including self-unloading dry-bulk carriers, gearless dry-bulk

carriers and product tankers. Since 2010 we have introduced 10 new

build vessels to our domestic dry-bulk fleet, with one under

construction and expected to arrive in 2024, making us the

youngest, most efficient and environmentally sustainable fleet on

the Great Lakes. Each new vessel reduces carbon emissions on

average by 40% versus the ship replaced. Algoma also owns ocean

self-unloading dry-bulk vessels operating in international markets

and a 50% interest in NovaAlgoma, which owns and operates the

world's largest fleet of pneumatic cement carriers and a global

fleet of mini-bulk vessels serving regional markets. Algoma truly

is Your Marine Carrier of Choice™. For more information about

Algoma, visit the Company's website at www.algonet.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220805005450/en/

Gregg A. Ruhl President & CEO 905-687-7890

Peter D. Winkley E.V.P. & Chief Financial Officer

905-687-7897

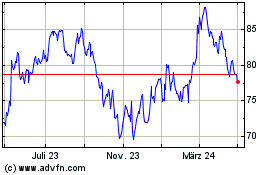

Alcon (NYSE:ALC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

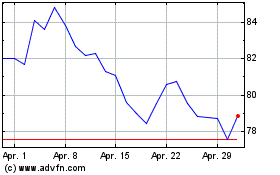

Alcon (NYSE:ALC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024