UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment

No. )

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

| ☐ |

|

Preliminary Proxy Statement |

|

|

| ☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

| ☐ |

|

Definitive Proxy Statement |

|

|

| ☒ |

|

Definitive Additional Materials |

|

|

| ☐ |

|

Soliciting Material under §240.14a-12 |

Air Lease Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

|

|

| ☒ |

|

No fee required. |

|

|

| ☐ |

|

Fee paid previously with preliminary materials. |

|

|

| ☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Air Lease Corporation Spring 2023

Stockholder Engagement

Forward Looking Statements Statements in

this presentation that are not historical facts are hereby identified as “forward-looking statements,” including any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or

performance. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,”

“potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words

or phrases. Accordingly, these statements are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual results to differ materially from those expressed in them. We wish to caution you

that our actual results could differ materially from those anticipated in such forward-looking statements as a result of several factors, including, but not limited to, the following: our inability to obtain additional capital on favorable

terms, or at all, to acquire aircraft, service our debt obligations and refinance maturing debt obligations; increases in our cost of borrowing or changes in interest rates; our inability to generate sufficient returns on our aircraft investments

through strategic acquisition and profitable leasing; the failure of an aircraft or engine manufacturer to meet its delivery obligations to us, including or as a result of technical or other difficulties with aircraft before or after delivery; our

ability to pursue insurance claims to recover losses related to aircraft detained in Russia; the extent to which the COVID-19 pandemic impacts our business; obsolescence of, or changes in overall demand for, our aircraft; changes in the value of,

and lease rates for, our aircraft, including as a result of aircraft oversupply, manufacturer production levels, our lessees’ failure to maintain our aircraft, rising inflation, appreciation of the U.S. Dollar, and other factors outside of our

control; impaired financial condition and liquidity of our lessees, including due to lessee defaults and reorganizations, bankruptcies or similar proceedings; increased competition from other aircraft lessors; the failure by our lessees to

adequately insure our aircraft or fulfill their contractual indemnity obligations to us; increased tariffs and other restrictions on trade; changes in the regulatory environment, including changes in tax laws and environmental regulations; other

events affecting our business or the business of our lessees and aircraft manufacturers or their suppliers that are beyond our or their control, such as the threat or realization of epidemic diseases, natural disasters, terrorist attacks, war or

armed hostilities between countries or non-state actors; and any additional factors discussed under “Part I — Item 1A. Risk Factors,” in our Annual Report on Form 10-K for the year ended December 31, 2022 and other SEC filings,

including future SEC filings. We also refer you to the documents the Company files from time to time with the Securities and Exchange Commission (“SEC”), specifically the Company’s Annual Report on Form 10-K for ended

December 31, 2022, which contains and identifies important factors that could cause the actual results for the Company on a consolidated basis to differ materially from expectations and any subsequent documents the Company files with the SEC. All

forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such

statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we do not intend and undertake no obligation to update any forward-looking information to reflect actual results or events or circumstances after

the date on which the statement is made or to reflect the occurrence of unanticipated events. If any such risks or uncertainties develop, our business, results of operation and financial condition could be adversely affected. The Company has an

effective registration statement (including a prospectus) with the SEC. Before you invest in any offering of the Company’s securities, you should read the prospectus in that registration statement and other documents the Company has filed with

the SEC for more complete information about the Company and any such offering. You may obtain copies of the Company’s most recent Annual Report on Form 10-K and the other documents it files with the SEC for free by visiting EDGAR on the SEC

website at www.sec.gov. Alternatively, the Company will arrange to send such information if you request it by contacting Air Lease Corporation, General Counsel and Secretary, 2000 Avenue of the Stars, Suite 1000N, Los Angeles, California 90067,

(310) 553-0555. The Company routinely posts information that may be important to investors in the “Investors” section of the Company’s website at www.airleasecorp.com. Investors and potential investors are encouraged to consult the

Company’s website regularly for important information about the Company. The information contained on, or that may be accessed through, the Company’s website is not incorporated by reference into, and is not a part of, this presentation.

In addition to financial results prepared in accordance with U.S. generally accepted accounting principles, or GAAP, this presentation contains certain non-GAAP financial measures. Management believes that in addition to using GAAP results in

evaluating our business, it can also be useful to measure results using certain non-GAAP financial measures. Investors and potential investors are encouraged to review the reconciliation of non-GAAP financial measures with their most direct

comparable GAAP financial results set forth in the Appendix section.

Air Lease Overview Assets ($ in billions)

Revenues ($ in billions) All information per ALC public filings. Air Lease Corporation (“ALC”; ticker: AL) is a leading global commercial aircraft leasing company Founded in 2010 with our IPO on the NYSE in 2011, we are one of the

world’s largest commercial aircraft leasing companies, and largest customers for new commercial jet aircraft We purchase the most modern, fuel-efficent, new technology commercial aircraft directly from aircraft manufacturers and lease those

aircraft to airlines throughout the world We have a diversified, global customer base with 117 customers across 62 countries as of December 31, 2022

A Leader in Aircraft Leasing Air Lease is a

~$55 billion aircraft leasing platform $28 Billion Total Assets 398 Aircraft On order1 $31.4 Billion Committed Rentals2 $6.9 Billion Liquidity3 (3%) Pre-Tax ROE 11.0% Adjusted Pre-tax ROE4 99.6% Aircraft Utilization Rate in 2022 96% revenues from

rentals associated with long-term lease agreements5 99% Unsecured debt 91% Fixed rate debt 90% order book positions through 2024 on long-term leases 502 Aircraft Owned & Managed Stable Stable Stable Stable Stable Stable All information per ALC

public filings as of December 31, 2022. Note: ~$55 billion leasing platform consists of $28.4 billion in assets, $25.5 billion in commitments to acquire aircraft, in addition to managed aircraft. 1As of December 31, 2022 we had commitments to

purchase 398 aircraft from Boeing and Airbus for delivery through 2029, with an estimated aggregate commitment of $25.5 billion. 2Includes $15.6 billion in contracted minimum rental payments on the aircraft in our existing fleet and $15.8 billion in

minimum future rental payments related to aircraft which will deliver between 2023 through 2028. 3Available liquidity of $6.9 billion is comprised of unrestricted cash of $0.8 billion and an available borrowing capacity under our committed unsecured

revolving credit facility of $6.1 billion as of December 31, 2022. 4Adjusted Pre-Tax Return on Common Equity is calculated as trailing twelve month Adjusted Net Income Before Income Taxes divided by average common shareholders’ equity.

Adjusted Pre-Tax Return on Common Equity and Adjusted Net Income Before Income Taxes are non-GAAP financial measures. See Appendix for a reconciliation to their most directly comparable GAAP measure. 5Revenue for the year ended December 31, 2022.

S&P BBB Fitch BBB Kroll A-

ALC key 2021 achievements despite ongoing

industry challenges 2022 ALC Milestones and Achievements ALC executed successfully in 2022 following industry headwinds 99.6% Aircraft Utilization Rate in 2022 Placed 90% of orderbook through 2024 on long-term leases Record $2.3 billion Total

Revenue in 2022 Continued Strong Aircraft Placement Activity $6.9 Billion in Total Available Liquidity 96% Cash Collection Rate YTD in 2022 Diversified Customer Base; 117 Airlines in 62 Countries Maintained Three Investment Grade Ratings

Impact of Russia-Ukraine Conflict In

response to sanctions imposed on Russia by various entities, in March 2022 we terminated all of our leasing activities in that country, consisting of 24 aircraft in our owned fleet, eight aircraft in our managed fleet and the leasing activity

relating to 29 aircraft that had not yet delivered from our orderbook, all of which have been subsequently placed. While we or the respective managed platform maintain title to the aircraft, we determined that it is unlikely we or they will regain

possession of the aircraft that are detained in Russia. As a result, we recorded a write-off of our interests in our owned and managed aircraft that are detained in Russia, totaling approximately $802.4 million for the three months ended March 31,

2022. The 21 aircraft that remained in Russia were removed from our fleet as of March 31, 2022. In June 2022, we submitted insurance claims to our insurers to recover our losses relating to aircraft detained in Russia. In December 2022, we filed

suit in the Los Angeles County Superior Court of the State of California against our insurers in connection with our previously submitted insurance claims and will continue to vigorously pursue all available insurance claims. Collection, timing and

amounts of any insurance recoveries and the outcome of the ongoing insurance litigation remain uncertain at this time. In October 2022, one Boeing 737-8 MAX aircraft that was not operating and had been in storage in Russia since the 737 MAX

grounding was returned to us. As a result, during the fourth quarter of 2022, we added the aircraft back to our owned fleet, recording it at fair value to Flight equipment subject to operating lease in our consolidated balance sheet with a

corresponding offset to the write-off line item in our statement of operations of $30.9 million. We do not currently anticipate the return of any other aircraft that are detained in Russia.

Extensive Stockholder Engagement and

Demonstrated Responsiveness. After issuing our proxy statement in March 2022, we engaged with holders of over 60% of outstanding shares of our Class A Common Stock (none of whom were our employees or directors). We continued our outreach during 2022

and early 2023, focusing conversations on investor feedback on our compensation practices and ESG disclosures. Based on this engagement, we took the following actions in 2022 and 2023: Returned to our Historical Long-Term Incentive Award Structure.

We structured our 2022 long-term incentive awards to return to our historical long-term incentive award structure which we had modified in 2021 due to the impact of the COVID-19 pandemic. As a result, the relative split between performance and

time-based awards for 2022 consisted of 50% Book Value RSUs, 25% TSR RSUs and 25% time-based RSUs. Time-based RSUs vest ratably each year over three years, while Book Value RSUs and TSR RSUs cliff vest at the end of three years Added First ESG

Metrics to our Strategic Performance Metrics for our Annual Bonus Opportunity. For our 2022 annual bonus program, our leadership development and compensation committee added new ESG and leadership development metrics to our strategic performance

objectives. Added Disclosure of the Strategic Objective Performance Goals Included in our Annual Bonus Opportunity. We provided additional disclosure in our 2023 proxy statement of the performance goals underlying the strategic objectives included

in our annual bonus opportunity in response to stakeholder feedback. Air Lease 2022 Executive Compensation Program 2022 Executive Compensation Program Actions

All Performance-Based Awards Forfeited for

the 3-Year Performance Period Ending in 2022. 100% of the outstanding Book Value RSUs and TSR RSUs that were eligible to vest at the end of the 3-year performance period ending on December 31, 2022 were forfeited by our NEOs. Despite the headwinds

created during the performance period by the COVID-19 pandemic and Russia’s invasion of Ukraine, our leadership and development committee determined not to make any adjustments to the original performance targets, and our 3-year performance

resulted in a 0% payout for the outstanding performance-based awards eligible to vest at the end of 2022. Reduced Company Performance Factor Given 2022 Challenges: Despite the solid financial performance in 2022, the Leadership Development and

Compensation Committee exercised its discretion to reduce the total company performance factor for awards under the annual cash bonus plan from 142% to 130% to reflect the challenges associated with 2022. Air Lease 2022 Executive Compensation

Program 2022 Executive Compensation Program Outcomes

Small, Talented Team Responsible for

Managing Complex Business Company/Industry Revenue / Employee (in millions) Total Assets / Employee (in millions) Net Income / Employee (in millions) Adjusted Net Income / Employee (in millions)3 Air Lease Corporation1 $15.3 $188.1 $(0.9) $4.4 2022

Custom Benchmark2 $4.1 $45.3 $(0.2) N/A 1 As of December 31, 2022. At year-end 2022, Air Lease had 151 employees. 2 Source: Bloomberg. Reflects average of the Company’s 2022 custom benchmark group as disclosed in our definitive proxy statement

filed with the SEC on March 17, 2023. 3 Adjusted Net Income Before Income Taxes is a non-GAAP financial measure. See Appendix for reconciliation to its most directly comparable GAAP measure. Compared to other capital intensive businesses similar to

ALC, our employees are responsible for significantly more revenue, income and assets

2022 Long-Term Equity Incentives Equity

Mix Key Elements Performance Link Book Value RSUs (50%) Book value is a key value driver of our stockholder value Cliff vest at the end of a 3-year performance period Book value must increase by more than 6.25% over the 3-year performance period for

any RSUs to vest Book value must increase by 8.25% over the three-year performance period for target RSU awards to vest Book value must increase by 20.25% over the three-year performance period for maximum RSU awards to vest Book Value Appreciation

Relative TSR RSUs (25%) Focuses executives on actions that will generate sustainable value creation 3-year performance measurement period TSR measured against S&P 400 MidCap Index Time-based RSUs provide a retention incentive Vests in three

equal annual installments Total Shareholder Return Time-based RSUs (25%) Share Price Appreciation Time-based RSUs (25%) 2022 Long-Term Incentives Heavily Weighted Toward Achievements 75% of CEO’s and Named Executive Officers’ long-term

annual equity awards consist of performance-based shares 25% of CEO’s and Named Executive Officers’ LTI is time-based

Say on Pay Shareholder Support Given a

decline in advisory vote support in 2022, we engaged with over 60% of shareholders to better understand shareholder concerns. Actions taken during 2022 in response to shareholder feedback: We reduced the weighting of time-based awards in favor of

higher performance-based awards, increased disclosure of performance goals for strategic metrics in our 2023 proxy statement, and our Leadership Development and Compensation Committee exercised its discretionary authority to reduce the Company

performance factor in our annual cash bonus plan to reflect the challenges associated with 2022. Advisory Vote on Named Executive Officer Compensation – Last Five Years

Our 2023 executive compensation plan

retains our historical approach of measuring performance on an annual basis for our annual bonus program and returns the relative splits of long-term equity awards to our historical split of: 50% Book Value RSUs 25% TSR RSUs 25% Time-based RSUs

Increased the Weighting of the Financial Metrics in our Annual Bonus Opportunity. For our 2023 annual bonus program, our Leadership Development and Compensation Committee increased the weighting of the financial metrics from 60% to 70%, while

simultaneously reducing the weighting of the strategic objectives from 40% to 30%. Air Lease 2023 Executive Compensation Program 2023 Executive Compensation Program Actions

Environmental Social Governance The

aircraft in our fleet and orderbook are the most modern technology, fuel efficent commercial aircraft available today – our aircraft delivering today are 20-25% more efficient than prior generations The airline industry is now, more than ever,

focused on reducing its environmental impact in response to increasingly stringent environmental laws/regulations concerning air emissions and other impacts to the environment. We believe this will result in our airline customers accelerating their

transition to the aircraft we own and have on order In 2022, we added Scope 1 and 2 emissions disclosures to our ESG Report – we continue to evaluate reporting frameworks/standards and further enhancements to our ESG disclosures We are

dedicated to the continued enhancement of our ESG disclosures including additional information related to any required SEC climate disclosures We strive to cultivate an environment where all employees can succeed and have efforts in place focused on

diversity, equity and inclusion, including appropriate policies and required trainings We seek business partners that uphold ethical standards, and this commitment is outlined in codes/policies including our Supplier Code of Conduct,

Anti-Corruption, and Human Rights Policies We support the communities in which we do business as well as educational and charitable causes, and plan community service employee engagement events, which in 2022 focused on environmental restoration We

maintain governance practices that establish meaningful accountability for our Company and Board of Directors (the “Board”) which provides oversight of the risks related to ESG practices Board remains committed to identifying candidates

with gender, ethnic and geographic diversity, and has adopted a “Rooney Rule” to include minority and female candidates in the pool of potential director nominees Outreach to our Stakeholders continues through informal ongoing

conversations and more targeted dialogue related to our proxy and ESG efforts ALC ESG Strategy & Commitment ESG Strategy & Commitment

Environmental Highlights Our core

strategy is to work with our airline customers to replace their older aircraft with the most modern, fuel-efficient aircraft available. The aviation industry is committed to reducing its environmental impact and we believe our new aircraft are vital

to helping our industry achieve its sustainability goals over time. As of December 31, 2022, our owned fleet of 417 aircraft had a weighted average age of 4.5 years (~7 years younger than the average of the world’s fleet of commercial

passenger aircraft) Our order book is comprised of roughly 400 of the most environmentally friendly commercial passenger aircraft available The new aircraft we have on order from the manufacturers are generally 20% to 25% more fuel-efficient than

those they will replace and have a significantly smaller noise footprint Our headquarters in Los Angeles is in a LEED GOLD certified building Source: Boeing & Airbus 2022. 1Aircraft comparisons: A220-300 compared to A319ceo. A320neo compared to

A320ceo. A321neo compared to A321ceo. A330-900neo compared to B767-300ER. A350-900 compared to B777-200ER. A350-1000 compared to B777-300ER. 737-8 compared to 737NG (no winglet). 787 compared to 767-300ER. 737-8 is 20% lower and 737-9 is 21% lower.

787-9 and 787-10 are both 25% lower. A320neo is 20% lower, A321neo is 22% lower. A350-900 and A350-1000 are both 25% lower. Approximate improvement in fuel burn vs. previous generation aircraft Approx. fuel burn improvement per seat compared to

previous generation aircraft Aircraft Type1

ALC’s Orderbook Contains Modern,

Environmentally Friendly Aircraft Aircraft on order A330-900neo A320/321neo A350-900/1000 B787-9/10 B737-7/8/9 MAX A220-100/300 72 13 178 19 7 102 A350F 7 398 As of December 31, 2022.

Social Highlights We are committed to

operating with the highest standard for social responsibility. As such, we strive to cultivate an environment where all our employees can succeed. We seek out partners that uphold these ethical standards and we aim to support the communities in

which we do business and educational and charitable organizations within the aviation industry. We provide a comprehensive benefits package benchmarked in the 90th percentile of coverage for similarly sized companies. Our benefits package includes

various employee assistance programs that provide wellness benefits. We offer competitive compensation to our employees worldwide. U.S. employees, and, to the extent permissible, those outside the U.S., are eligible to participate in our long-term

stock-based incentive plan. We are building a diverse organization that respects different backgrounds and experiences; more than 30% of our employees were multicultural and over 50% were female as of December 31, 2022. We have codes and policies in

place which outline expectations for our employees and the companies with which we do business, such as a Code of Business Conduct and Ethics, Supplier Code of Conduct, Anti-Corruption Policy, and Human Rights Policy. We support and pay for training

and education programs that provide continual improvement for our employees, including continuing education, leasing seminars, and conferences related to the employee’s role in the Company. We require all employees to participate in our

training programs, including anti-harassment, compliance and cybersecurity. We require all employees to participate in training focused on promoting equity in the workplace. We support various charitable causes with both financial and human

resources to advance aviation, education and humanitarian assistance As of December 31, 2022, we had aircraft in our owned fleet leased to customers across 29 countries considered emerging markets and developing economies

Corporate Citizenship We are committed

to giving back as a corporation through community service, charitable donations and specialized mentorship programs

All Directors except Executive Chairman

and Chief Executive Officer are Independent All Standing Board Committees Comprised Entirely of Independent Directors Independent Lead Director with Clearly Defined Role and Responsibilities Commitment to Board Refreshment with Two New Directors in

Last Four Years Commitment to Board Diversity with Three Female Directors, One of Whom is from an Underrepresented Community Requirement to Actively Include Women and Individuals From Minority Groups in the Pool of Potential Director Candidates

Majority Vote Standard for Director Elections With Mandatory Director Resignation if Not Elected All Directors Elected on an Annual Basis Annual Board and Committee Evaluations All Audit Committee Members are Financial Experts Focus on Critical Risk

Oversight Role Ongoing Board Succession Planning—Management and Board Dialogue to Ensure Successful Oversight of Succession Planning Active Board Oversight of the Company’s Governance Robust Director and Executive Officer Stock Ownership

Guidelines Prohibition on Short Sales, Transactions in Derivatives and Hedging of Company Stock by Directors and all Employees Prohibition on Pledging of Company Stock by Directors and Executive Officers Clawback Policy for Executive Compensation

All Independent Directors are Invited to Attend Meetings of Committees they are not Members of and Regularly Attend those Meetings Governance Highlights We maintain governance practices that we believe establish meaningful accountability for our

Company and our Board, including:

Steven F. Udvar-Házy Exec.

Chairman John L. Plueger CEO Robert Milton LID Matthew J. Hart Cheryl Gordon Krongard Yvette Hollingsworth Clark Marshall O. Larsen Susan McCaw Ian M. Saines Former Chairman & CEO, Ace Aviation Holdings* Retired President & COO,

Hilton Hotels Corporation Retired Senior Partner, Apollo Management Global Chief Compliance Officer, State Street Corporation Retired Chairman, President & CEO, Goodrich Corporation President, SRM Investments Former Chief Executive, Funds

Management Challenger Limited Joined Board 2010 2010 2010 2010 2013 2021 2014 2019 2010 Executive Leadership Experience ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ Airline Industry / Aviation ✔

✔ ✔ ✔ ✔ ✔ Financial / Capital Allocation Expertise ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ International Experience ✔ ✔ ✔ ✔ ✔ ✔

✔ ✔ ✔ Risk Management / Oversight Expertise ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ Public Company Board Experience / Current Public Company Directorship ✔ Spirit AeroSystems

Holdings ✔ American Airlines Group, Inc. American Homes 4 Rent ✔ Becton, Dickinson and Company Lionsgate Entertainment Corp. Macquarie Bank Limited *A holding company for Air Canada Highly Engaged Board with Extensive Industry

Relevant Experience Strong Board evaluation and succession processes ensure the Board is comprised of directors with the necessary skills and balance of perspectives to oversee our unique business Denotes independent directors

Board Composition All Directors except

Executive Chairman and Chief Executive Officer are Independent All Standing Board Committees Comprised Entirely of Independent Directors Independent Lead Director with Clearly Defined Role and Responsibilities Commitment to Board Refreshment with

Two New Directors in Last Four Years Commitment to Board Diversity with Three Female Directors, One of Whom is from an Underrepresented Community Requirement to Actively Include Women and Individuals From Minority Groups in the Pool of Potential

Director Candidates 33% Female Commitment to Expanding Racial Diversity

Appendix Non-GAAP reconciliations

1Adjusted pre-tax return on common equity is adjusted net income before income taxes divided by average common shareholders’ equity. Air Lease Corporation and Subsidiaries QUARTERLY CONSOLIDATED STATEMENTS OF INCOME (In thousands, except share

amounts) Year Ended December 31, (in thousands, except percentage data) 2022 Reconciliation of net income available to common stockholders to adjusted net income before income taxes: Net (loss)/income available to common stockholders $-,138,724

Amortization of debt discounts and issuance costs 53,254 Write-off Russian fleet, net of recoveries ,771,476 Stock-based compensation 15,603 Income tax (benefit)/expense ,-41,741 Adjusted net income before income taxes $,659,868 Year-end employees

151 Adjusted net-income before income taxes per employee $4,369.986754966887 Reconciliation of denominator of adjusted pre-tax return on common equity: Beginning common shareholders' equity $6,158,568 Ending common shareholders' equity $5,796,363

Average common shareholders' equity $5,977,465.5 Adjusted pre-tax return on common equity1 0.11039260703386745

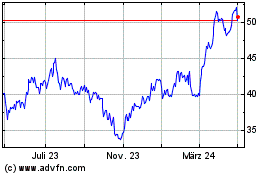

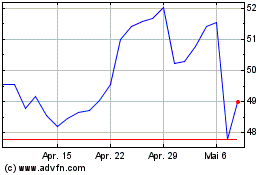

Air Lease (NYSE:AL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Air Lease (NYSE:AL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024