Apartment Investment and Management Company (NYSE: AIV) (“Aimco”

or the “Company”) today announced that, based on the preliminary

vote results provided by its proxy solicitor following the

Company’s 2022 Annual Meeting of Stockholders (the “Annual

Meeting”), Aimco stockholders have voted to elect Aimco nominees

and existing directors Jay Leupp and Dary Stone, as well as Jim

Sullivan.

Aimco issued the following statement:

We thank Aimco stockholders for their

constructive feedback and engagement since the spin-off of

Apartment Income REIT Corp. (“AIR”) in December 2020 and more

recently during the lead up to this year’s annual meeting.

Over the past 24 months, Aimco’s Board has

established a clearly defined value-creation strategy and has

overseen its successful execution, resulting in peer leading Total

Shareholder Returns.

Today, Aimco benefits from an experienced and

dedicated team of real estate investment professionals, a

significantly fortified balance sheet, a track record of effective

investment management and capital allocation, and a portfolio

containing significant opportunities for growth that are separate

and apart from AIR. While the efforts of the Aimco Board and

management team have positioned the company for continued success,

we remain committed to considering all options to further enhance

shareholder value.

In addition, we welcome Mr. Sullivan to the

Aimco Board and look forward to working with him constructively and

benefiting from his perspectives and experiences.

We also thank Michael Stein for his

dedication and service to Aimco. Mr. Stein played an integral role

and added invaluable expertise to the Board. We sincerely

appreciate his efforts in driving Aimco’s strategic evolution and

we wish him all the best.

The election results announced today are considered preliminary

until final results are tabulated and certified by the independent

Inspector of Elections. Final results will be reported on a Form

8-K that will be filed with the Securities and Exchange

Commission.

About Aimco

Aimco is a diversified real estate company primarily focused on

value add, opportunistic, and alternative investments, targeting

the U.S. multifamily sector. Aimco’s mission is to make real estate

investments where outcomes are enhanced through its human capital

so that substantial value is created for investors, teammates, and

the communities in which we operate. Aimco is traded on the New

York Stock Exchange as AIV. For more information about Aimco,

please visit its website www.aimco.com.

Forward-Looking Statements

This document contains forward-looking statements within the

meaning of the federal securities laws. Forward-looking statements

include all statements that are not historical statements of fact

and those regarding our intent, belief, or expectations, including,

but not limited to, the statements in this document regarding

future financing plans, including the Company’s expected leverage

and capital structure; business strategies, prospects, and

projected operating and financial results (including earnings),

including facts related thereto, such as expected costs; future

share repurchases; expected investment opportunities; and our 2022

pipeline investments and projects. We caution investors not to

place undue reliance on any such forward-looking statements.

Words such as “anticipate(s),” “expect(s),” “intend(s),”

“plan(s),” “believe(s),” “plan(s),” “may,” “will,” “would,”

“could,” “should,” “seek(s),” “forecast(s),” and similar

expressions, or the negative of these terms, are intended to

identify such forward-looking statements. These statements are not

guarantees of future performance, condition or results, and involve

a number of known and unknown risks, uncertainties, assumptions and

other important factors, among others, that may affect actual

results or outcomes include, but are not limited to: (i) the risk

that the 2023 preliminary plans and goals may not be completed in a

timely manner or at all, (ii) the inability to recognize the

anticipated benefits of pipeline investments and projects, (iii)

changes in general economic conditions, including as a result of

the COVID-19 pandemic. Although we believe that the assumptions

underlying the forward-looking statements, which are based on

management’s expectations and estimates, are reasonable, we can

give no assurance that our expectations will be attained.

Risks and uncertainties that could cause actual results to

differ materially from our expectations include, but are not

limited to: the effects of the coronavirus pandemic on the

Company’s business and on the global and U.S. economies generally;

real estate and operating risks, including fluctuations in real

estate values and the general economic climate in the markets in

which we operate and competition for residents in such markets;

national and local economic conditions, including the pace of job

growth and the level of unemployment; the amount, location and

quality of competitive new housing supply; the timing and effects

of acquisitions, dispositions, redevelopments and developments;

changes in operating costs, including energy costs; negative

economic conditions in our geographies of operation; loss of key

personnel; the Company’s ability to maintain current or meet

projected occupancy, rental rate and property operating results;

the Company’s ability to meet budgeted costs and timelines, and, if

applicable, achieve budgeted rental rates related to redevelopment

and development investments; expectations regarding sales of

apartment communities and the use of proceeds thereof; insurance

risks, including the cost of insurance, and natural disasters and

severe weather such as hurricanes; financing risks, including the

availability and cost of financing; the risk that cash flows from

operations may be insufficient to meet required payments of

principal and interest; the risk that earnings may not be

sufficient to maintain compliance with debt covenants, including

financial coverage ratios; legal and regulatory risks, including

costs associated with prosecuting or defending claims and any

adverse outcomes; the terms of laws and governmental regulations

that affect us and interpretations of those laws and regulations;

possible environmental liabilities, including costs, fines or

penalties that may be incurred due to necessary remediation of

contamination of apartment communities presently or previously

owned by the Company; activities by stockholder activists,

including a proxy contest; the risk of the timing of our

stockholder value enhancement review and the risk that we will not

identify any value enhancing options or that we will not

successfully execute or achieve the potential benefits of any such

options.

In addition, the Company’s current and continuing qualification

as a real estate investment trust involves the application of

highly technical and complex provisions of the Internal Revenue

Code and depends on the Company’s ability to meet the various

requirements imposed by the Internal Revenue Code, through actual

operating results, distribution levels and diversity of stock

ownership. Readers should carefully review the Company’s financial

statements and the notes thereto, as well as the section entitled

“Risk Factors” in Item 1A of the Company’s Annual Report on Form

10-K for the year ended December 31, 2021 and in Item 1A of the

Company’s Quarterly Reports on Form 10-Q for the quarterly periods

ended March 31, 2022, June 30, 2022, and September 30, 2022, and

the other documents the Company files from time to time with the

SEC. These filings identify and address important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking

statements.

These forward-looking statements reflect management’s judgment

as of this date, and the Company assumes no (and disclaims any)

obligation to revise or update them to reflect future events or

circumstances.

We make no representations or warranties as to the accuracy of

any projections, estimates, targets, statements or information

contained in this document. It is understood and agreed that any

such projections, estimates, targets, statements and information

are not to be viewed as facts and are subject to significant

business, financial, economic, operating, competitive and other

risks, uncertainties and contingencies many of which are beyond our

control, that no assurance can be given that any particular

financial projections or targets will be realized, that actual

results may differ from projected results and that such differences

may be material. While all financial projections, estimates and

targets are necessarily speculative, we believe that the

preparation of prospective financial information involves

increasingly higher levels of uncertainty the further out the

projection, estimate or target extends from the date of

preparation. The assumptions and estimates underlying the

projected, expected or target results are inherently uncertain and

are subject to a wide variety of significant business, economic and

competitive risks and uncertainties that could cause actual results

to differ materially from those contained in the financial

projections, estimates and targets. The inclusion of financial

projections, estimates and targets in this presentation should not

be regarded as an indication that we or our representatives,

considered or consider the financial projections, estimates and

targets to be a reliable prediction of future events.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221215006105/en/

Matt Foster Sr. Director, Capital Markets and Investor Relations

(303) 793-4661 investor@aimco.com

MacKenzie Partners, Inc. Dan Burch (212) 929-5748

Dburch@mackenziepartners.com

Andrew Siegel / Greg Klassen / Adam Pollack Joele Frank,

Wilkinson Brimmer Katcher (212) 355-4449

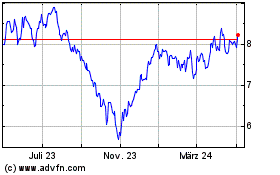

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

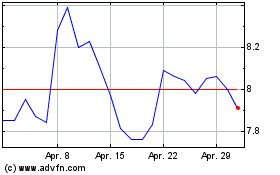

Von Mär 2024 bis Apr 2024

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024