Files Investor Presentation Highlighting Highly

Qualified Director Nominees, Successful Track Record and Corporate

Governance Enhancements

Annual Meeting to Be Held on December 16

Apartment Investment and Management Company (NYSE: AIV) (“Aimco”

or the “Company”) today issued a statement in connection with its

Annual Meeting of Stockholders (“Annual Meeting”) to be held on

December 16, 2022. The Company’s statement addresses Aimco’s

efforts to negotiate a mutually agreeable settlement with Land

& Buildings. Aimco also announced that today it filed an

investor presentation with the U.S. Securities and Exchange

Commission. The presentation is available on the investor relations

section of the Company’s website.

Dear Fellow Stockholder,

Aimco’s Annual Meeting is just days away.

We urge you to act TODAY. Protect the value of your investment

by voting “FOR” Aimco’s three highly qualified, independent

director nominees – Jay Leupp, Michael Stein and Dary

Stone– on the Universal WHITE Proxy Card.

The New Aimco Board is successfully executing

a clearly defined strategy, as exemplified by Aimco’s outstanding

total stockholder returns since the spin-off of Apartment Income

REIT Corp. (“AIR”) in December 2020. The New Aimco Board has made

tremendous progress and will continue to act as a change agent for

the benefit of all Aimco stockholders.

As you consider your vote, we ask you to

consider the following:

1. The New Aimco Board is independent and

has been purpose-built to include directors with specific skills

and expertise.

- The Board has appointed six new independent directors since the

spin-off of AIR in December 2020. Of the Board’s five committees,

four are chaired by new, independent directors with no ties to

pre-spin Aimco.

- Jay Leupp brings important stockholder perspectives

gained through real estate and REIT experience spanning investment,

sell-side research and board positions. As Audit Committee Chair,

he works closely with Aimco’s finance team and is leveraging his

expertise to help oversee the ongoing enhancement of Aimco’s

investor relations program.

- Michael Stein brings deep institutional knowledge of

Aimco and significant experience executing strategic transactions

to maximize stockholder value. His skills, experience and

leadership as Chairman of Aimco’s Investment Committee are critical

to Aimco’s value maximization efforts, particularly in light of the

Company’s ongoing review.

- Dary Stone’s leadership as the Chair of the Nominating,

Environmental, Social, and Governance Committee was instrumental in

Aimco’s recent governance enhancement efforts. He brings expertise

in corporate governance and significant experience gained leading

several real estate development companies.

2. The New Aimco Board and Management Team

have driven outperformance and will continue to explore all options

to maximize stockholder value.

- Leading proxy advisory firm ISS stated in its December 5th

report1: “AIV outperformed the median of the company's peers by

35.8 percent, the dissident peer median by 37.1 percent, and the

FTSE NAREIT Apartment Index by 30.8 percent in the twelve months

prior to the unaffected date. Since the spin-off through the

unaffected date, AIV has outperformed the company's peer median by

49.9 percentage points, the dissident's peer median by 52.4

percentage points, and the FTSE NAREIT Apartment Index by 32.0

percentage points.”

- Aimco has eliminated the relative valuation gap versus its peer

group on an estimated NAV basis – moving from a 20% relative

discount to peers in 2021 to an approximately 2% premium relative

to peers as of October 2022.

- The Board is not content with performance that is only

‘in-line’ with peers and is actively considering all opportunities

available to Aimco to further enhance and unlock stockholder value

and will leave no stone unturned.

3. We have enhanced Aimco’s corporate

governance profile and embraced emerging best practices.

- Aimco is accelerating the declassification of the Board to be

effective at the 2023 annual meeting, when all directors will be

elected to annual terms.

- Aimco has committed to opt out of the Maryland Unsolicited

Takeover Act, or MUTA, prior to the 2023 annual meeting.

- Aimco is transitioning the timing of the Company’s annual

meeting date so the 2023 annual meeting will be held by the end of

the third quarter of 2023 and the 2024 annual meeting will be held

by the end of the second quarter of 2024.

- Aimco is asking stockholders to approve amendments to the

Company’s charter at the 2023 annual meeting to eliminate

super-majority requirements to amend the Bylaws and remove

directors, allow directors to be removed by stockholders without

cause, and expand stockholder rights to replace directors.

- Effective as of the 2023 annual meeting, Aimco is amending the

Company’s Bylaws to lower the threshold for stockholders to call a

special meeting to a simple majority of shares outstanding.

4. We have a proven track record of active

stockholder engagement and have steadily enhanced our Investor

Relations efforts.

- The New Aimco Board and management team have met with

stockholders representing more than 80% of Aimco’s outstanding

shares of common stock over the past 13 months.

- The New Aimco Board and management team took seriously the

outreach from Jonathan Litt of Land & Buildings following his

September 2022 letter to the Board, quickly engaging with Mr. Litt

to hear his views directly.

- Within fewer than 90 days of Mr. Litt’s writing, and in

response to a broad survey of stockholders, Aimco committed to

implementing significant governance enhancements.

- In 2021, Aimco launched an all-new website and produced a

webcast and 73-page strategic overview presentation.

- Aimco attends major industry conferences, including BTIG and

NAREIT in 2022, and is committed to ongoing engagement with

investors.

- Aimco has reached out to no less than a dozen sell-side equity

research analysis and are in continuous discussions.

- Aimco has provided in-depth quarterly disclosures on

development and redevelopment projects and components necessary to

calculate NAV.

5. Land & Buildings’ nominees are not

additive to the Aimco Board and there is no case for change

- We acknowledge that James Sullivan is an experienced real

estate analyst, but he has no public company board or executive

management experience and does not provide any expertise that is

not currently represented on the New Aimco Board.

- The election of either James Sullivan or Michelle Applebaum

would displace a current Aimco Board Committee Chair with

significant public REIT board and corporate real estate experience

as well as extensive experience overseeing value-enhancing M&A

transactions.

- The removal of Michael Stein from the Board is unwarranted,

given New Aimco’s strong results, and would impair Aimco’s ongoing

strategic review.

- Leading proxy advisor firm Glass Lewis stated in its December

1st report1: “…we do not believe board change is warranted at this

time."

6. Settlement discussions with Land &

Buildings have not been constructive - its demands have been

unreasonable and not in stockholders’ best interest

- Aimco recently held discussions with Land & Buildings and

offered to appoint Mr. Sullivan to the Aimco Board. Under Aimco’s

proposal, Mr. Sullivan was invited to serve on the Investment

Committee as well as the Audit, Compensation and Human Resources,

and Nominating, Environmental, Social, and Governance Committees.

Aimco also offered to appoint the highly qualified Pat Gibson as

Chair of the Investment Committee. Ms. Gibson is an experienced

real estate investor and a new independent director on the Aimco

Board (who Mr. Litt has approved of previously). Mr. Litt rejected

the proposal.

- Land & Buildings has unreasonably refused to entertain any

settlement proposal that does not result in the removal of Michael

Stein, a vital member of the Aimco Board given his experience

overseeing strategic corporate transactions and unlocking

stockholder value.

- Land & Buildings demanded that Mr. Sullivan be appointed

Chairman of the Board’s Investment committee and that four of

Aimco’s other independent directors resign from the Committee.

- While we recognize Mr. Sullivan’s experience as a research

analyst, the Board does not believe he has the experience to chair

a committee of a public company Board of Directors given his lack

of previous public board experience, corporate capital allocation

and investment, real estate management and / or development

experience, and his non-existent track record of value creation at

a public company.

_______________ 1 Permission to use quotes neither sought nor

obtained

It is extremely important that Aimco

stockholders vote as soon as possible. Aimco’s Board unanimously

recommends that you use the Universal WHITE proxy card to vote today “FOR” Aimco’s three

director nominees – Jay Leupp, Michael Stein and Dary

Stone.

To ensure your shares are timely represented

at the Annual Meeting on December 16, stockholders are encouraged

to vote online or by telephone by following the easy instructions

on the Universal WHITE proxy

card.

We appreciate your support.

Sincerely,

The New Aimco Board of Directors

PROTECT THE VALUE OF YOUR INVESTMENT AND

AIMCO’S FUTURE GROWTH PROSPECTS. USE THE UNIVERSAL WHITE PROXY CARD TODAY TO VOTE FOR ALL THREE

OF AIMCO’S QUALIFIED AND EXPERIENCED DIRECTORS

If you have questions or require any assistance

with voting your shares, please contact the Company’s proxy

solicitor listed below:

MacKenzie Partners

1407 Broadway, 27th Floor New York, New York

10018 Call Collect: (212) 929-5500 or Toll-Free (800)

322-2885 Email: proxy@mackenziepartners.com

About Aimco

Aimco is a diversified real estate company primarily focused on

value add, opportunistic, and alternative investments, targeting

the U.S. multifamily sector. Aimco’s mission is to make real estate

investments where outcomes are enhanced through its human capital

so that substantial value is created for investors, teammates, and

the communities in which we operate. Aimco is traded on the New

York Stock Exchange as AIV. For more information about Aimco,

please visit its website www.aimco.com.

Forward-Looking Statements

This document contains forward-looking statements within the

meaning of the federal securities laws. Forward-looking statements

include all statements that are not historical statements of fact

and those regarding our intent, belief, or expectations, including,

but not limited to, the statements in this document regarding

future financing plans, including the Company’s expected leverage

and capital structure; business strategies, prospects, and

projected operating and financial results (including earnings),

including facts related thereto, such as expected costs; future

share repurchases; expected investment opportunities; and our 2022

pipeline investments and projects. We caution investors not to

place undue reliance on any such forward-looking statements.

Words such as “anticipate(s),” “expect(s),” “intend(s),”

“plan(s),” “believe(s),” “plan(s),” “may,” “will,” “would,”

“could,” “should,” “seek(s),” “forecast(s),” and similar

expressions, or the negative of these terms, are intended to

identify such forward-looking statements. These statements are not

guarantees of future performance, condition or results, and involve

a number of known and unknown risks, uncertainties, assumptions and

other important factors, among others, that may affect actual

results or outcomes include, but are not limited to: (i) the risk

that the 2023 preliminary plans and goals may not be completed in a

timely manner or at all, (ii) the inability to recognize the

anticipated benefits of pipeline investments and projects, (iii)

changes in general economic conditions, including as a result of

the COVID-19 pandemic. Although we believe that the assumptions

underlying the forward-looking statements, which are based on

management’s expectations and estimates, are reasonable, we can

give no assurance that our expectations will be attained.

Risks and uncertainties that could cause actual results to

differ materially from our expectations include, but are not

limited to: the effects of the coronavirus pandemic on the

Company’s business and on the global and U.S. economies generally;

real estate and operating risks, including fluctuations in real

estate values and the general economic climate in the markets in

which we operate and competition for residents in such markets;

national and local economic conditions, including the pace of job

growth and the level of unemployment; the amount, location and

quality of competitive new housing supply; the timing and effects

of acquisitions, dispositions, redevelopments and developments;

changes in operating costs, including energy costs; negative

economic conditions in our geographies of operation; loss of key

personnel; the Company’s ability to maintain current or meet

projected occupancy, rental rate and property operating results;

the Company’s ability to meet budgeted costs and timelines, and, if

applicable, achieve budgeted rental rates related to redevelopment

and development investments; expectations regarding sales of

apartment communities and the use of proceeds thereof; insurance

risks, including the cost of insurance, and natural disasters and

severe weather such as hurricanes; financing risks, including the

availability and cost of financing; the risk that cash flows from

operations may be insufficient to meet required payments of

principal and interest; the risk that earnings may not be

sufficient to maintain compliance with debt covenants, including

financial coverage ratios; legal and regulatory risks, including

costs associated with prosecuting or defending claims and any

adverse outcomes; the terms of laws and governmental regulations

that affect us and interpretations of those laws and regulations;

possible environmental liabilities, including costs, fines or

penalties that may be incurred due to necessary remediation of

contamination of apartment communities presently or previously

owned by the Company; activities by stockholder activists,

including a proxy contest; the risk of the timing of our

stockholder value enhancement review and the risk that we will not

identify any value enhancing options or that we will not

successfully execute or achieve the potential benefits of any such

options.

In addition, the Company’s current and continuing qualification

as a real estate investment trust involves the application of

highly technical and complex provisions of the Internal Revenue

Code and depends on the Company’s ability to meet the various

requirements imposed by the Internal Revenue Code, through actual

operating results, distribution levels and diversity of stock

ownership. Readers should carefully review the Company’s financial

statements and the notes thereto, as well as the section entitled

“Risk Factors” in Item 1A of the Company’s Annual Report on Form

10-K for the year ended December 31, 2021 and in Item 1A of the

Company’s Quarterly Reports on Form 10-Q for the quarterly periods

ended March 31, 2022, June 30, 2022, and September 30, 2022, and

the other documents the Company files from time to time with the

SEC. These filings identify and address important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking

statements.

These forward-looking statements reflect management’s judgment

as of this date, and the Company assumes no (and disclaims any)

obligation to revise or update them to reflect future events or

circumstances.

We make no representations or warranties as to the accuracy of

any projections, estimates, targets, statements or information

contained in this document. It is understood and agreed that any

such projections, estimates, targets, statements and information

are not to be viewed as facts and are subject to significant

business, financial, economic, operating, competitive and other

risks, uncertainties and contingencies many of which are beyond our

control, that no assurance can be given that any particular

financial projections or targets will be realized, that actual

results may differ from projected results and that such differences

may be material. While all financial projections, estimates and

targets are necessarily speculative, we believe that the

preparation of prospective financial information involves

increasingly higher levels of uncertainty the further out the

projection, estimate or target extends from the date of

preparation. The assumptions and estimates underlying the

projected, expected or target results are inherently uncertain and

are subject to a wide variety of significant business, economic and

competitive risks and uncertainties that could cause actual results

to differ materially from those contained in the financial

projections, estimates and targets. The inclusion of financial

projections, estimates and targets in this presentation should not

be regarded as an indication that we or our representatives,

considered or consider the financial projections, estimates and

targets to be a reliable prediction of future events.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221212005833/en/

Matt Foster Sr. Director, Capital Markets and Investor Relations

(303) 793-4661 investor@aimco.com

MacKenzie Partners, Inc. Dan Burch (212) 929-5748

Dburch@mackenziepartners.com

Andrew Siegel / Greg Klassen / Adam Pollack Joele Frank,

Wilkinson Brimmer Katcher (212) 355-4449

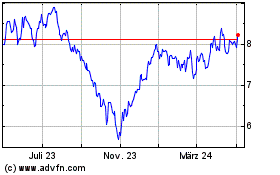

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

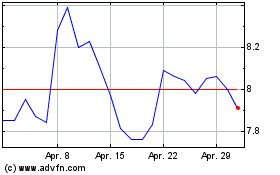

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024